1. Introduction:

A biosimilar is a type of biologic medicine that closely resembles an already FDA-approved biologic, known as the reference product. While not identical, biosimilars demonstrate no significant clinical differences in terms of safety, efficacy, or quality compared to their reference counterparts. This ensures that patients can expect equivalent therapeutic benefits and outcomes when using a biosimilar in place of the original biologic.

An interchangeable biosimilar is a biosimilar that meets additional requirements outlined by the law that allows for the FDA to approve biosimilar and interchangeable biosimilar medications.

As per the US FDA, an interchangeable biosimilar product may be substituted for the original product without consulting the prescriber, much like how generic drugs are routinely substituted for brand drugs. This is commonly called pharmacy-level substitution and is subject to state pharmacy laws.

2. Key Trends & Advancements in Biosimilars

The biosimilars industry is rapidly evolving, driven by scientific innovations, regulatory advancements, and increasing market adoption. Below are some of the key trends and developments shaping the landscape.

| Trend | Description |

| Expanding Therapeutic Areas | Biosimilars are now being developed beyond oncology and autoimmune diseases, targeting areas such as ophthalmology, endocrinology, and rare diseases. |

| Increased Regulatory Approvals | Regulatory agencies, including the FDA and EMA, continue to streamline approval pathways, accelerating market entry for biosimilars. |

| Rise of Interchangeable Biosimilars | More biosimilars are receiving interchangeability designations, allowing automatic substitution at the pharmacy level without prescriber approval. |

| Price Reductions & Market Penetration | Increased competition is leading to significant cost reductions, improving patient access, and driving higher adoption rates. |

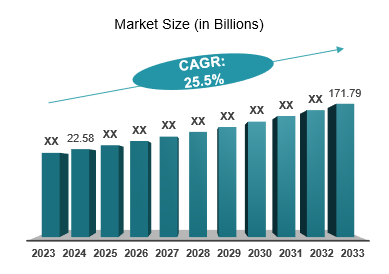

| Global Market Growth | The biosimilar market is projected to surpass $171 billion by 2033, fueled by patent expirations and demand for cost-effective alternatives. |

3. Approved Biosimilars - Sales & Forecast

- As of March 15, 2025, the U.S. Food and Drug Administration (FDA) has approved 71 biosimilars, including at least 15 classified as interchangeable products.

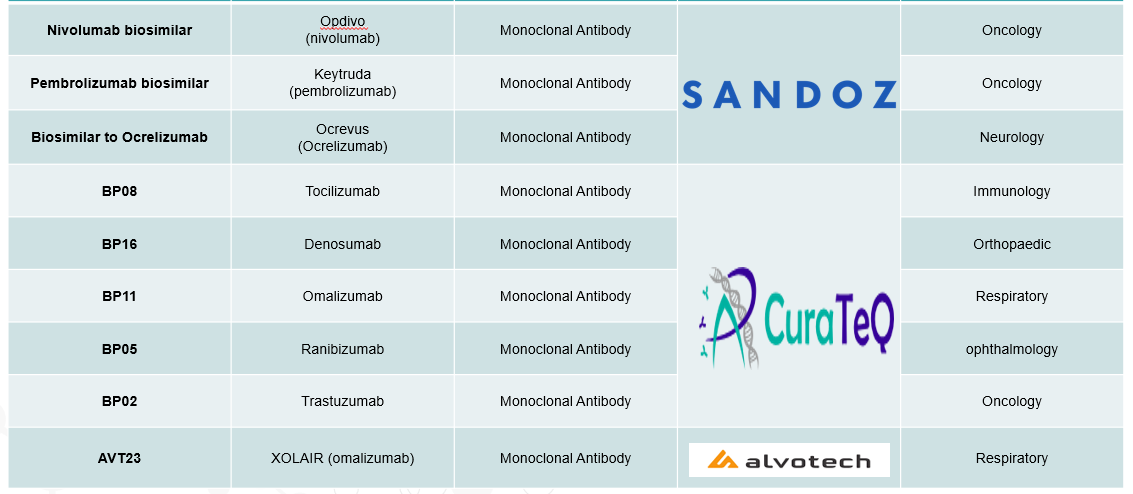

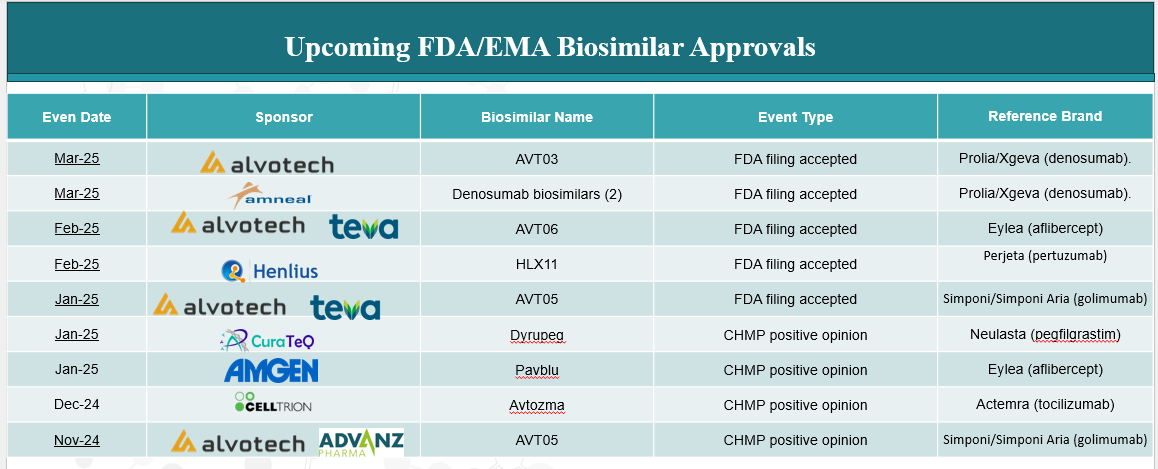

4. Pipeline Analysis and Expected Approval Timelines

The biosimilars landscape is experiencing significant expansion, with numerous products in development targeting a variety of therapeutic areas.

Below is an analysis of the current biosimilars pipeline, highlighting key products, their reference biologics, therapeutic areas, and anticipated approval timelines.

5. Market Size & Forecasting

The global biosimilars market was valued at $22.58 billion in 2024 and is anticipated to be valued at US$ 171.79 billion by 2033, registering a CAGR of 25.5% over the forecast period.

Unmet Needs

Despite the rapid growth and increasing adoption of biosimilars, several challenges and gaps remain in the market. Addressing these unmet needs is crucial for maximizing the potential of biosimilars in improving patient access and reducing healthcare costs.

| Category | Unmet Need | Impact |

| Regulatory & Approval Processes | Harmonization of global regulatory pathways | Variability in biosimilar approval standards across regions delays market entry. |

| Market Access & Adoption | Limited physician and patient awareness | Hesitancy in prescribing biosimilars due to misconceptions about efficacy and safety. |

| Pricing & Reimbursement | Complex reimbursement policies | Inconsistent coverage and reimbursement hinder biosimilar uptake. |

| Interchangeability & Substitution | Limited availability of interchangeable biosimilars | Many biosimilars lack interchangeability status, restricting automatic substitution at pharmacies. |

| Manufacturing & Supply Chain | High development and production costs | Biologic complexity results in high R&D and manufacturing expenses, limiting cost reductions. |

| Therapeutic Expansion | Need for biosimilars in new disease areas | Limited availability of biosimilars in neurology, endocrinology, and rare diseases. |

| Patient Confidence & Education | Misconceptions about biosimilar efficacy and safety | Resistance from patients and healthcare providers slows adoption. |

6. Competitive Landscape and Market Positioning

The biosimilars market is growing rapidly, with key players competing to capture market share through strategic positioning, pricing, and portfolio expansion.

Key Companies:

7. Target Opportunity Profile (TOP) & Benchmarking

The Target Opportunity Profile (TOP) assesses the potential of biosimilar candidates based on market demand, competitive landscape, and commercial viability. Benchmarking helps compare biosimilars against reference biologics and competitors to determine their market positioning.

Target Opportunity Profile (TOP) for Biosimilars

| Criteria | Description | Impact on Market Potential |

| Reference Biologic | Identifies the original biologic product (e.g., Humira, Herceptin, Eylea) | Determines target market size and demand |

| Therapeutic Area | Oncology, autoimmune diseases, ophthalmology, endocrinology, etc. | High-demand areas drive greater adoption |

| Patent Expiry Timeline | Expected loss of exclusivity (LOE) of the reference biologic | Earlier entry increases market advantage |

| Regulatory Pathway | FDA, EMA, and global biosimilar approval processes | Stringent regulations can impact speed to market |

| Interchangeability | FDA designation allowing pharmacy-level substitution | Enhances uptake and competitiveness |

| Pricing & Cost Advantage | Discount compared to reference biologic (typically 15–86% lower) | Greater affordability increases adoption |

| Manufacturing Complexity | Complexity of biologic structure and production scalability | Higher complexity can increase development costs |

| Market Access & Reimbursement | Insurance coverage and formulary inclusion | Strong payer support enhances market penetration |

| Competition & Differentiation | Number of biosimilars available for the same reference product | Higher competition may drive price erosion |

Strategic Insights from Benchmarking

- Interchangeability Matters: Biosimilars with FDA interchangeability status (e.g., HADLIMA, CIMERLI, SEMGLEE) gain a competitive edge, allowing pharmacy-level substitution and driving higher adoption.

- Pricing Strategy is Crucial: Biosimilar discounts range from 40% to 86%, with higher discounts leading to better market penetration.

- Market Share Growth Varies: Oncology biosimilars (e.g., OGIVRI, ZIRABEV) show 30–40% market share, whereas some autoimmune and insulin biosimilars are growing more gradually.

- Upcoming Neurology Biosimilars (e.g., Tysabri biosimilars) have low competition, making them attractive for early entrants.

- Manufacturing scalability and cost-efficient production play a key role in long-term success.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

2. Make Data-Driven Decisions

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

3. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

4. Optimize R&D and Clinical Development

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

5. Enhance Market Access & Pricing Strategy

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

- Ensure smooth market entry and optimize pricing strategies for better adoption. your needs!

6. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

7. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.