1. Disease Overview:

- ALS is age-related; symptoms most commonly develop between the ages of 55 and 75

- Amyotrophic lateral sclerosis (ALS) is a progressive and fatal neuromuscular disease with no cure.

- It is estimated that 5-10% of all ALS cases are inherited (familial disease) while the remaining 90-95% are sporadic, with unknown etiology and risk factors.

- The median survival of people with ALS is limited to 3 years after disease onset, mostly due to respiratory failure.

2. Epidemiology Analysis (Current & Forecast)

- The number of estimated ALS cases in 2022 was 32,893. By 2030, the projected cases increase more than 10%, to 36,308.

- The largest increase occurs for the population ages 66 years and older, with a 25% increase (from 16,349 cases in 2022 to 20,438 cases in 2030).

- It is the most common adult MND, with an incidence reported between 2.1 to 3.8 per 100,000 person/year

Prevalence is at 4.1–8.4 per 100,000 persons/year in Europe

- The number of patients in Japan is estimated to be approximately 10,000.

- The average number of new patients with this disease per year is 2.2 per 100,000.

3. Approved Drugs (Current SoC) - Sales & Forecast

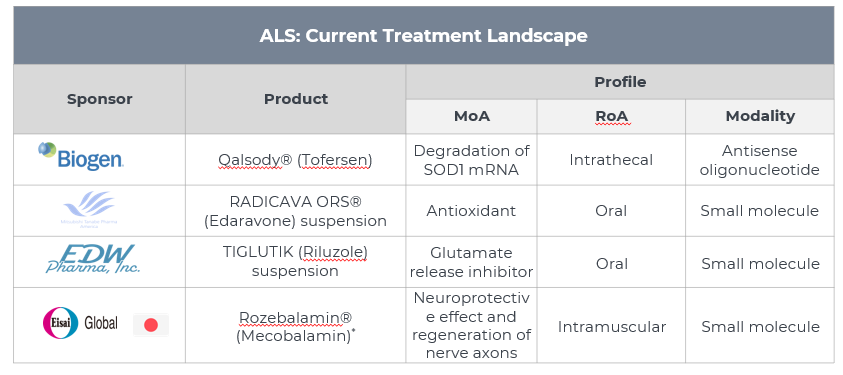

- Currently, clinical ALS treatments have focused primarily on relieving symptoms to improve the quality of life.

- QALSODY is the first approved treatment to target a genetic cause of ALS. It is used to treat amyotrophic lateral sclerosis (ALS) in adults with a superoxide dismutase 1 (SOD1) gene mutation.

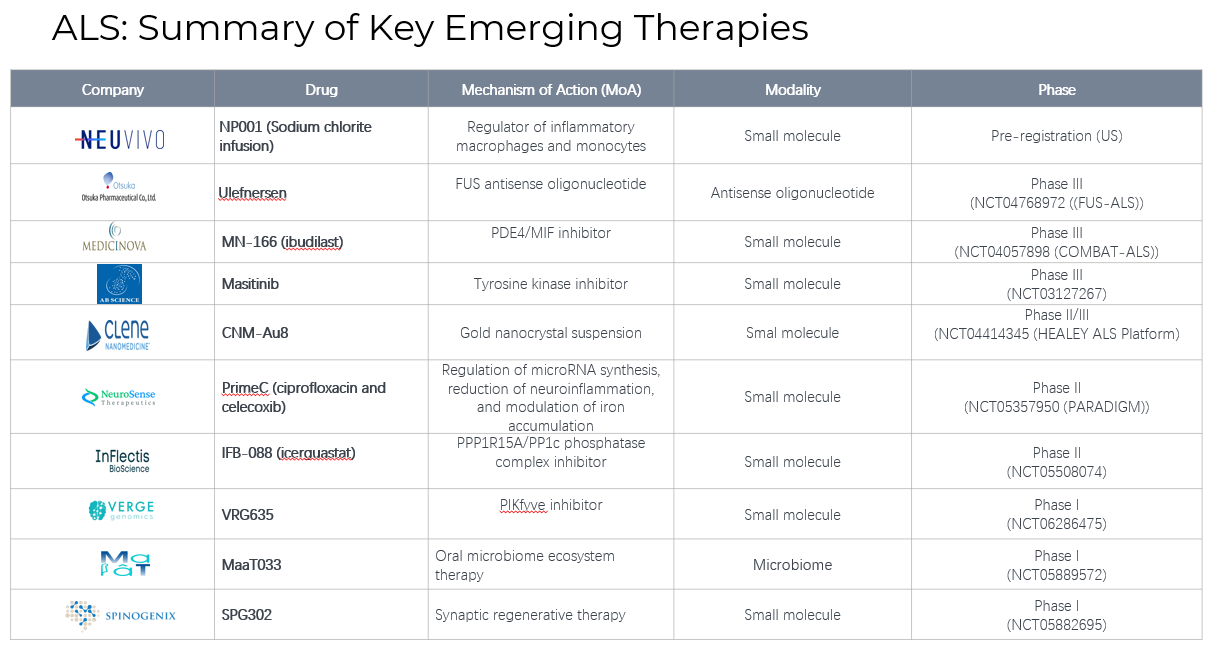

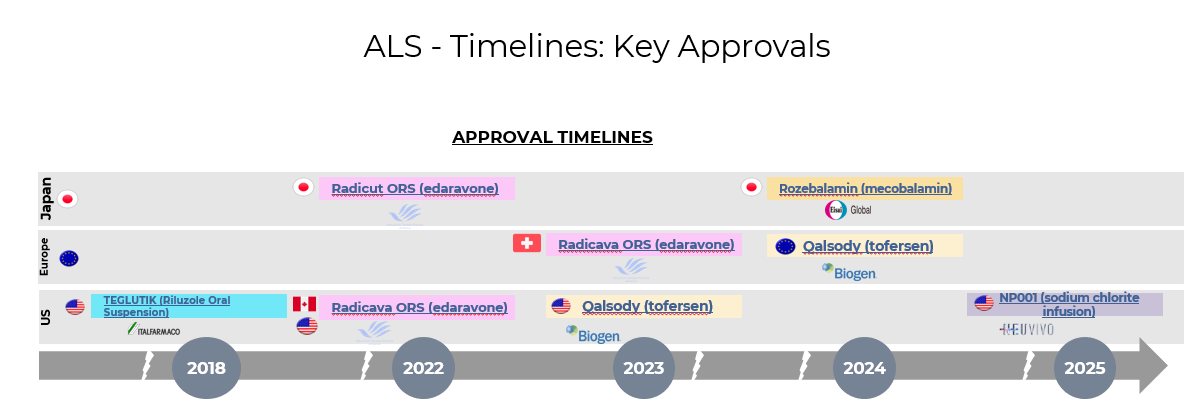

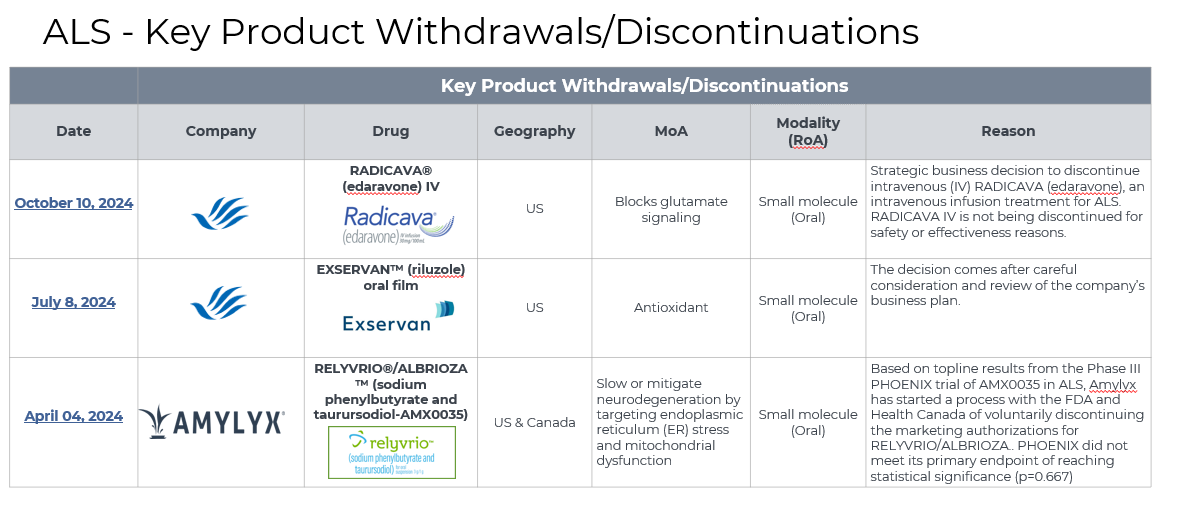

4. Pipeline Analysis and Expected Approval Timelines

Amyotrophic Lateral Sclerosis (ALS) remains a challenging neurodegenerative disease with limited treatment options. Recent advancements have introduced new therapies, and several promising candidates are in the pipeline.:

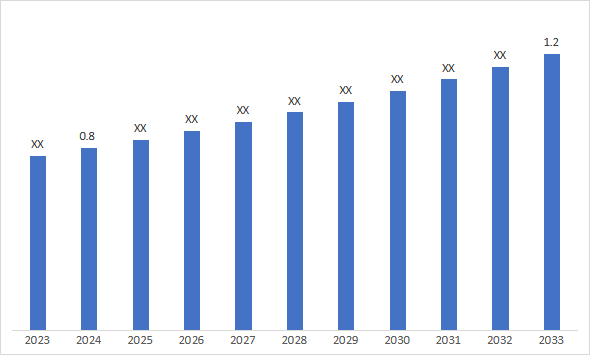

5. Market Size & Forecasting

The global amyotrophic lateral sclerosis market size is valued at USD 0.8 billion in 2024 and is estimated to reach USD 1.2 billion by 2033, representing a CAGR of ~5% during the forecast period.

Unmet Needs

Unmet needs in ALS remain significant despite advancements in treatment. Key challenges include:

| Key Unmet Needs |

|

|

|

6. Competitive Landscape and Market Positioning

Here is the competitive landscape of the Amyotrophic Lateral Sclerosis (ALS) treatment:

| Company | Key Product(s) | Market Position | Competitive Edge |

| Biogen Inc. | QALSODY (tofersen) | Market leader in genetic ALS therapy | First FDA-approved gene therapy for SOD1-ALS |

Mitsubishi Tanabe Pharma Corp. | RADICAVA ORS® (Edaravone) suspension | Leading in symptomatic ALS treatment | First-to-market intravenous & oral edaravone |

BrainStorm Cell Therapeutics | NurOwn (stem cell therapy – trials) | Innovator in cell-based therapy | Potential disease-modifying treatment |

| Otsuka | Ulefnersen | Emerging leader in ASO therapies for ALS | Expertise in antisense technology (In-license from IONIS) |

Key Companies

7. Target Opportunity Profile (TOP) & Benchmarking

Indication & Patient Population

| Company | Drug |

| Indication | Treatment of Amyotrophic Lateral Sclerosis (ALS), including both sporadic (sALS) and familial (fALS) forms. |

| Target Population | Patients diagnosed with ALS at early to moderate stages. It may include specific genetic subtypes (e.g., SOD1, C9orf72 ALS). |

| Market Subgroups | - Sporadic ALS (90-95% of cases) - Genetic ALS (5-10% of cases) - Fast vs. slow progressors |

Efficacy & Primary Clinical Endpoints

| Attribute | Target Profile |

| Primary Endpoint | ALSFRS-R Score: ≥ 3-point improvement vs. placebo over 24 weeks. |

| Survival Benefit | Increase median survival by ≥ 12 months compared to standard of care. |

| Disease Progression | Reduce neurofilament light chain (NfL) levels by ≥ 40% (biomarker-based efficacy). |

| Respiratory Function | Delay need for non-invasive ventilation (NIV) by at least 6 months. |

| Muscle Strength & Mobility | ≥ 30% slower decline in grip strength & walking ability compared to placebo. |

| Cognitive Function | Maintain or improve executive function in ALS patients with ALS-FTD overlap. |

Market Differentiation & Competitive Advantage

| Attribute | Target Profile |

| First-in-Class or Best-in-Class | Superior to Relyvrio, Radicava, QALSODY in efficacy and survival. |

| Combination Therapy Potential | Compatible with riluzole, edaravone, and investigational agents. |

| Biomarker Integration | Includes companion diagnostics (NfL, inflammatory markers, genetic testing). |

| Reimbursement & Pricing | Cost-effective vs. current ALS drugs ($100K-$150K/year range). |

Strategic Takeaways

- Biomarker-driven & neuroprotective drugs will lead the next wave of ALS therapies.

- Combination approaches (gene therapy + neuroprotection) will be key to maximizing survival benefits.

- Non-invasive, easy-to-administer therapies will improve adoption & patient compliance.

- Prolonging ALSFRS-R function & survival (>12 months) will be a key differentiator in the market

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

2. Make Data-Driven Decisions

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

3. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

4. Optimize R&D and Clinical Development

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

5. Enhance Market Access & Pricing Strategy

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

- Ensure smooth market entry and optimize pricing strategies for better adoption. your needs!

6. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

7. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.