Disease Overview:

Achondroplasia is the most common form of skeletal dysplasia, affecting bones. This genetic condition is marked by distinct features, including an enlarged head (macrocephaly), shortened upper limbs, limited elbow extension, trident-shaped hands, bowed legs, and significantly reduced adult height, typically around 4 feet.

The disorder results from a mutation in the FGFR3 gene (fibroblast growth factor receptor 3), critical in regulating bone growth at the cartilage growth plates.

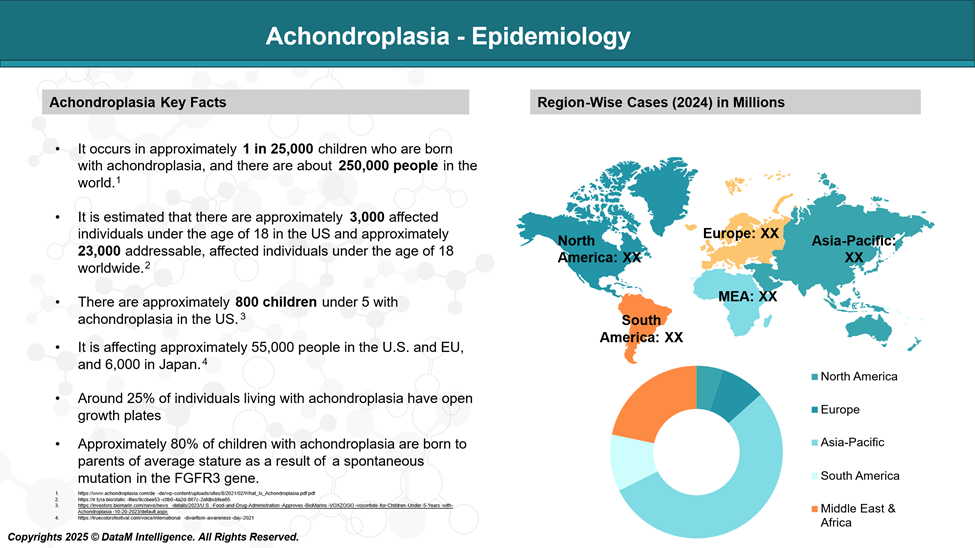

Epidemiology Analysis (Current & Forecast)

Achondroplasia is considered rare, affecting approximately 1 in 20,000-30,000 live births.

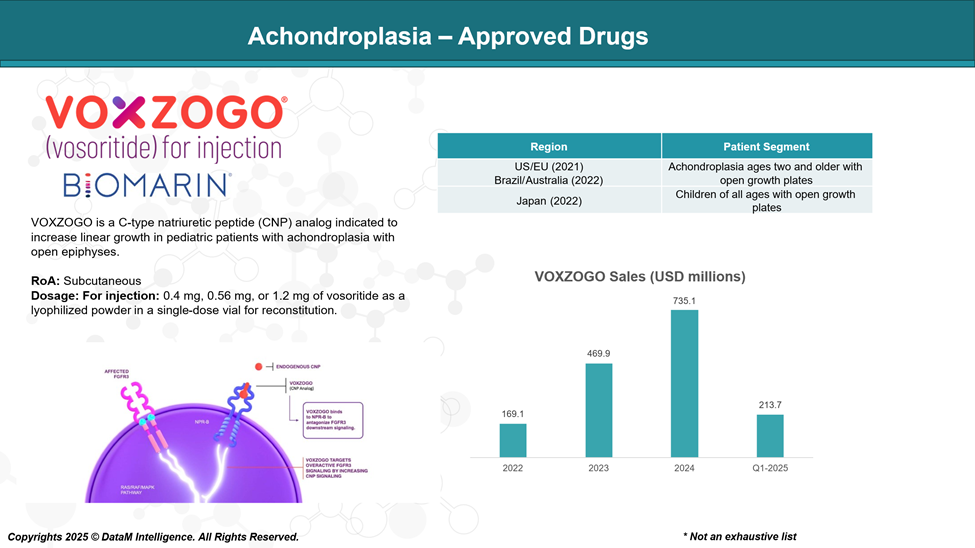

Approved Drugs (Current SoC) - Sales & Forecast

Currently, the only FDA-approved therapy for children with achondroplasia is Voxzogo (vosoritide), a daily injection.

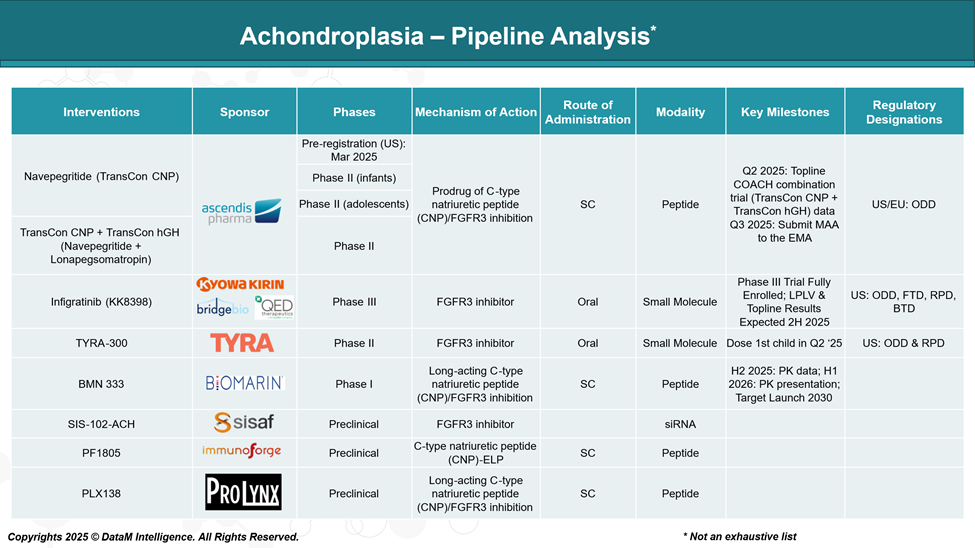

Pipeline Analysis and Expected Approval Timelines

While Voxzogo remains the only FDA-approved therapy for achondroplasia, recent advancements in therapeutic development have introduced several promising candidates targeting this pathway.

Competitive Landscape and Market Positioning

The therapeutic landscape for achondroplasia is evolving rapidly, with several biopharmaceutical companies advancing clinical and preclinical candidates aimed at targeting the fibroblast growth factor receptor 3 (FGFR3) pathway or modulating C-type natriuretic peptide (CNP) activity to improve bone growth.

Achondroplasia Competitive Landscape – Market Positioning & Benchmarking

| Company | Product | Stage | Mechanism of Action | Market Positioning / Benchmarking |

| BioMarin Pharmaceutical | Voxzogo (Vosoritide) | Approved (FDA) | CNP analog; FGFR3 inhibition | First and only approved therapy; market leader; sets efficacy and safety benchmarks; daily injection may affect long-term adherence. |

| BMN 333 | Phase I | Long-acting CNP analog; FGFR3 inhibition | Next-gen candidate from BioMarin; aims to improve dosing convenience and patient compliance over Voxzogo. | |

| Ascendis Pharma | Navepegritide (TransCon CNP) | Pre-registration (filed NDA with FDA in Mar 2025) | Prodrug of CNP; sustained FGFR3 inhibition | Key competitor to Voxzogo; designed for less frequent dosing (weekly); strong potential for better adherence and broader acceptance. |

| Navepegritide (TransCon CNP) | Phase II | Same as above | Ongoing evaluation to optimize dose and safety profile before launch. | |

| Navepegritide + Lonapegsomatropin | Phase II | CNP + hGH combination | Differentiated combo approach; targets dual mechanisms for enhanced growth outcomes; unique in class. | |

| Tyra Biosciences | TYRA-300 | Phase II | Oral FGFR3 inhibitor | First oral FGFR3-targeted small molecule in development; potential for superior convenience and compliance; early safety profile under evaluation. |

| Kyowa Kirin/QED Therapeutics | Infigratinib (KK8398) | Phase III | Oral FGFR3 inhibitor | Most advanced oral FGFR3 inhibitor; positioned as an alternative to peptides; may appeal to patients preferring non-injectables. |

| SiSaf Ltd | SIS-102-ACH | Preclinical | siRNA targeting FGFR3 | Novel RNA-based approach; high innovation potential, but early-stage and unproven in clinical trials. |

| ImmunoForge | PF1805 | Preclinical | CNP-ELP fusion peptide | Designed for enhanced half-life and less frequent injections; early development; competitive with long-acting CNP analogs. |

| ProLynx | PLX138 | Preclinical | Long-acting CNP analog; FGFR3 inhibition | Extended-release peptide; comparable to Ascendis’ TransCon platform; yet to demonstrate competitive differentiation. |

Key Market Insights:

- BioMarin holds the first-mover advantage with Voxzogo and is reinforcing its position with next-gen candidates.

- Ascendis Pharma is BioMarin’s closest competitor, leveraging its TransCon technology product Navepegritide to offer weekly dosing and potential combination therapies.

- Oral FGFR3 inhibitors TYRA-300 (Tyra) and Infigratinib (Kyowa Kirin) represent a major shift toward non-invasive therapies, which could reshape patient preference dynamics.

- Preclinical candidates (SiSaf, ImmunoForge, ProLynx) offer platform diversity and mechanistic innovation, though timelines to market are longer.

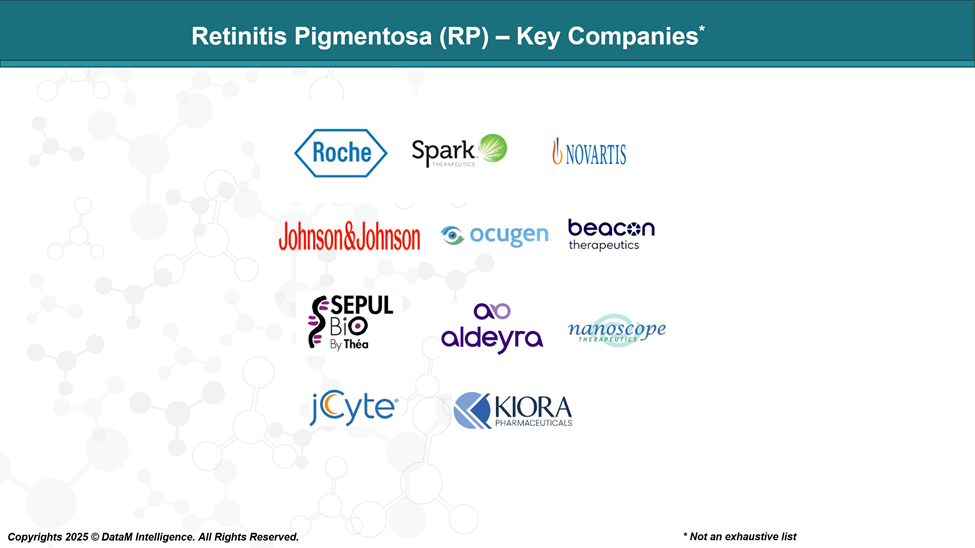

Key Companies:

Target Opportunity Profile (TOP)

Target Opportunity Profile (TOP) helps to highlight what emerging therapies need to demonstrate to surpass approved treatments like Voxzogo (vosoritide) in achondroplasia.

| Category | Details |

| Indication | Achondroplasia – the most common form of skeletal dysplasia, caused by activating mutations in the FGFR3 gene, resulting in impaired bone growth. |

| Patient Population | - Incidence: ~1 in 20,000–30,000 live births globally. - Prevalence (US): ~25,000 individuals. - Primarily pediatric focus. |

| Unmet Needs | - Limited to one approved therapy (Voxzogo). - Daily subcutaneous injections may affect compliance. - No oral therapies/long-acting injectables approved. - Need for earlier intervention (infant use) and broader age indication. |

| Current Standard of Care | - Voxzogo (Vosoritide, BioMarin): CNP analog for children ≥5 years old with open growth plates. - Growth hormone is used off-label in some regions, but not approved. |

| Key Differentiation Drivers | - Route of administration (oral vs injectable). - Dosing frequency (daily vs weekly/monthly). - Mechanism of action (FGFR3 inhibition vs CNP analog vs RNA therapy). - Age range approved (early childhood through adolescence). - Efficacy on height gain, safety, and functional outcomes (e.g., sleep apnea, mobility). |

| Target Product Profile (TPP) | - Indication: Pediatric achondroplasia with potential for adult extension. - MOA: FGFR3 pathway modulation. - Route: Oral or long-acting injectable preferred. - Dosing: Weekly or less frequent. - Efficacy Goal: ≥2 cm/year height velocity increase over baseline. - Safety: Minimal adverse effects; no impact on cognition or development. |

| Competitive Dynamics | - BioMarin: First-mover advantage; established physician and patient relationships. - Ascendis: Weekly dosing could offer strong positioning. - Kyowa Kirin & Tyra: oral FGFR3 inhibitors; may disrupt market with better compliance. |

| Market Potential | - Global peak sales estimated at approximately $1.5–2 billion. - Significant commercial opportunity in the US/EU and Japan. - Expansion potential into related FGFR3-driven skeletal disorders. |

| Reimbursement Outlook | - High due to orphan drug status and rare disease designation. - Health economic value justified through improved quality of life, reduced complications, and fewer surgeries. |

| Regulatory Designations | - Orphan Drug, Fast Track, and Breakthrough Therapy Designation may apply. - Early engagement with FDA/EMA is essential to optimize pediatric study design and endpoints. |

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: