Global Wing-Lift Enhancement Mountings Market is segmented By Mounting (Winglets, Slats and Flaps, Spoilers, Thrust Reversers, Wing Fences, Others), By Aircraft (Commercial, Military, Others), By Application (Take-off, Landing, Cruise, Low-speed Flight, Others), and By Region (North America, South America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2023-2030

Wing-Lift Enhancement Mountings Market Size

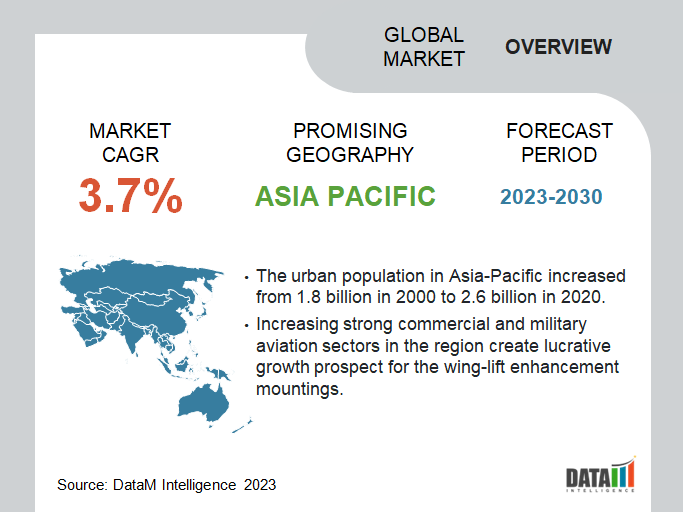

Global Wing-Lift Enhancement Mountings Market reached US$ 12.0 billion in 2022 and is expected to reach US$ 16.0 bllion by 2030, growing with a CAGR of 3.7% during the forecast period 2023-2030.

Wing-lift enhancement mounting revenues have increased significantly in recent years due to a number of factors. The need for such devices has increased as the aviation industry puts more and more attention on cost and fuel efficiency. Wing-lift enhancement mountings are a desirable solution since airlines and aircraft operators are continually looking for ways to cut operating costs and optimize fuel usage.

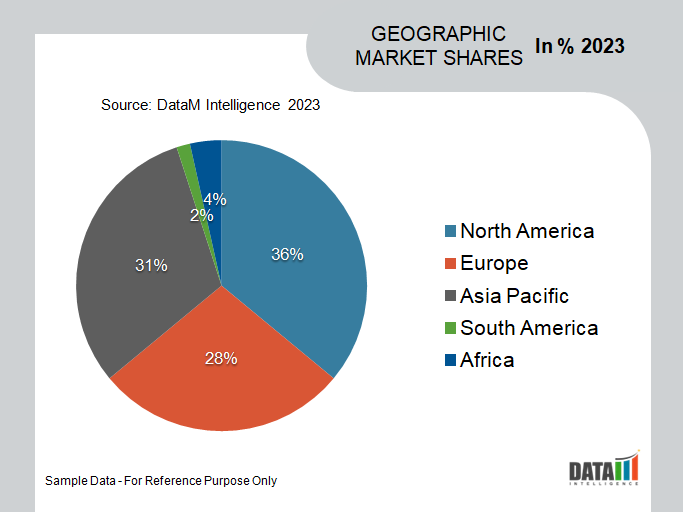

For instance, in July 2023, As the company tries to keep its advantage over US rival Boeing, Airbus is pushing on with plans to develop a lightweight wing in the UK for the next generation of its best-selling A320 airliners. The enormous Filton plant, which is close to Bristol and is where the Bristol Blenheim bombers and Concorde were made, has seen investment from the European aircraft manufacturer for a center dedicated to the development of wings. Therefore, Europe accounted for nearby 1/3rd of the global shares and is expected to grow at a significant CAGR during the forecasted period.

Wing-Lift Enhancement Mountings Market Scope

|

Metrics |

Details |

|

CAGR |

3.7% |

|

Size Available for Years |

2021-2030 |

|

Forecast Period |

2023-2030 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Mounting, Aircraft, Application and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

Largest Region |

North America |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Equipment Mounting Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more details on this report - Request for Sample

Wing-Lift Enhancement Mountings Market Dynamics

Effects of Rotor Placement Below and Behind a Wing

Companies that leverage the findings of this study to develop innovative and effective wing-lift enhancement mountings gain a competitive advantage in the market. By offering solutions that address the specific aerodynamic interactions between rotors and wings, these companies can differentiate themselves from competitors. This can attract customers looking for advanced wing-lift enhancement technologies, thus driving the growth of the global market.

For instance, in 2022, in a study by Rensselaer Polytechnic Institute, New York, lifting rotors that are positioned below and behind a wing are compared to conventional rotor-wing units. In order to understand the interference effects, the performance of the rotor-wing units is compared to that of isolated rotors and wings after being simulated using CFD.

AcuSolve, a commercial Navier Stokes solver, is used to run simulations using a delayed detached eddy simulation (DDES) model. Rotor-wing units with three different wing incidence angles (7°, 10° and 13°) and three different rotor disc loadings (6, 9 and 12 lb/ft2) are considered. It can be observed that the rotor introduces a low-pressure area that covers the upper surface of the wing by simulating the flow and comparing the pressure distribution around an isolated wing to one with the rotor installed. Therefore, above research studies contributes to the growthof the global market.

Regulatory Requirements

In order to lessen aviation's influence on the environment, regulatory authorities set restricted limits for fuel efficiency and emissions. Winglets and vortex generators are examples of mountings for wing-lift enhancements that increase aerodynamic efficiency and decrease drag for reduced fuel consumption and emissions.

Wing-lift enhancement mountings are becoming more popular since manufacturers may comply with these rules if they create and implement these technologies in their aircraft. For instance, the International Civil Aviation Organization (ICAO) establishes international emissions guidelines that encourage the use of technologies that save fuel.

In addition to ensuring regulatory compliance, aircraft manufacturers can obtain market acceptance and access to international markets by adhering to regulatory regulations. Airlines and operators are driven to invest in aircraft with wing-lift improvement mountings in order to comply with regulatory requirements. As a result, regulatory regulations spur technological breakthroughs and promote the implementation of these technologies throughout the industry, fueling the growth of the global market for wing-lift enhancement mountings.

High Initial Costs

Some aircraft manufacturers, especially companies with limited financial means, may find it difficult to finance wing-lift improvement mountings due to the large upfront costs connected with their development and integration. These manufacturers might be discouraged by higher costs from making investments in these technologies, which would delay market expansion and adoption.

Wing-lift enhancement mountings are carefully considered for integration by aircraft manufacturers. The initial outlay must be outweighed by the return on investment and possible cost savings from increased fuel efficiency, improved performance and operational advantages. Manufacturers may be hesitant to invest in these technologies if the payback period is thought to be too long or if the perceived cost-effectiveness does not reach their expectations.

Wing-Lift Enhancement Mountings Market Segmentation Analysis

The global wing-lift enhancement mountings market is segmented based on mounting, aircraft, application and region.

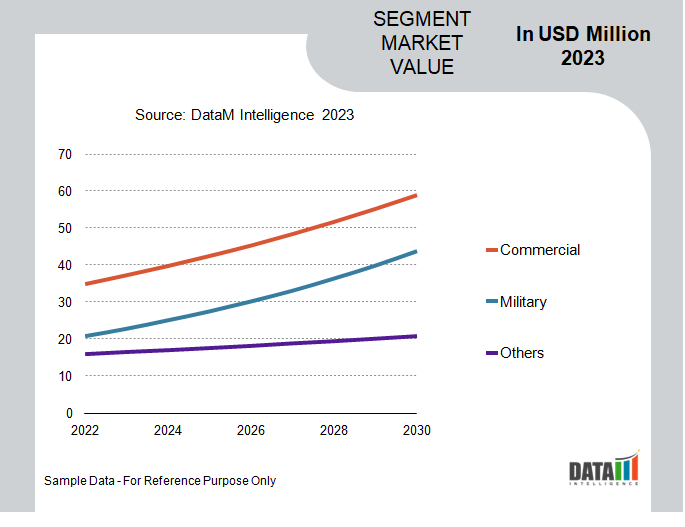

Owing to its Large Fleet Sizes, Commercial Aircraft Domiantes the Global Market

Due to a variety of factors, including the sheer volume of commercial airlines, the increasing demand for passenger and freight transportation and the ongoing expansion and modernization of airline fleets, the commercial aircraft segment leads the global market for wing-lift enhancement mountings.

Large aircraft fleets, ranging from narrow-body long-haul planes to small regional jets, are used by commercial airlines. These fleets frequently have a large number of aircraft, resulting in a significant need for wing-lift improvement mountings. To expand the range, decrease operating costs, improve overall performance and improve fuel efficiency, airlines invest in innovative wing-lift technologies. Therefore, commercial aircraft holds the nearly half of total segmental share.

Global Wing-Lift Enhancement Mountings Market Geographical Share

Large Aircraftr Market in U.S. Drives the Regional Market Growth

One of the world's biggest markets for commercial airplanes is in U.S. To be competitive, major U.S. airlines maintain sizable fleets and regularly modernize their aircraft. This fuels the North American market's demand for wing-lift improvement mountings.

In March 2023, U.S. Defense Security Cooperation Agency (DSCA) has informed Congress of a potential E-2D Advanced Hawkeye (AHE) aircraft foreign military sale (FMS) to Japan. It has already received State Department approval. Up to five E-2D AHE airborne early warning and control (AEW&C) aircraft and 12 T56-A-427A engines, of which two will be furnished as spares and ten will be delivered pre-installed, are included in the FMS, which is valued at around US$ 1.38 billion. Therefore, U.S. dominates the North America wing-lift enhancement mountings with more than 80.2% of the regional market share.

Wing-Lift Enhancement Mountings Market Companies

The major global players include United Technologies Corporation (UTC) Aerospace Systems, Safran Group, Boeing Company, Airbus Group, Bombardier Aerospace, General Electric Aviation, Spirit AeroSystems Holdings Inc., GKN Aerospace, FACC AG and RUAG Aerostructures.

COVID-19 Impact On Wing-Lift Enhancement Mountings Market

The COVID-19 epidemic has significantly impacted many international industries and economies. Lockdowns, travel restrictions, supply chain disruptions and a decline in consumer demand all caused many businesses to experience operational interruptions. The pandemic had a particularly negative impact on the aviation sector, with airlines reporting a significant reduction in passenger traffic.

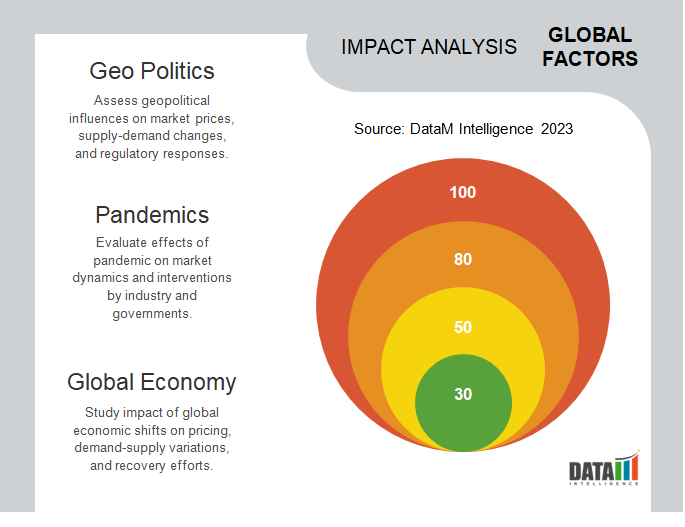

Russia- Ukraine War Impact

If the conflict between Russia and Ukraine worsens or persists for for a long time, it could affect several worldwide supply chains, including those involved in the manufacture and delivery of wing-lift improvement mountings. Order fulfilment issues may arise for manufacturers and suppliers in the impacted areas, causing delays or interruptions in the supply of these products.

Geopolitical tensions can also have an effect on trade and diplomatic ties, possibly leading to trade sanctions, import/export regulatory modifications or trade restrictions. Such actions can exacerbate the dynamics of the wing-lift enhancement mountings supply chain, potentially influencing both distribution and production.

Scope

By Mounting

- Winglets

- Slats and Flaps

- Spoilers

- Thrust Reversers

- Wing Fences

- Others

By Aircraft

- Commercial

- Military

- Others

By Application

- Take-off

- Landing

- Cruise

- Low-speed Flight

- Others

Others By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In July 2023, As the company seeks to preserve its advantage over US rival Boeing, Airbus is continuing on with plans to develop a lightweight wing in UK for the next generation of its best-selling A320 airliners.

- In March 2023, U.S. Defense Security Cooperation Agency (DSCA) has informed Congress of a potential E-2D Advanced Hawkeye (AHE) aircraft foreign military sale (FMS) to Japan. It has already received State Department approval. Up to five E-2D AHE airborne early warning and control (AEW&C) aircraft and 12 T56-A-427A engines, of which two will be furnished as spares and ten will be delivered pre-installed, are included in the FMS, which is valued at around US$ 1.38 billion.

- In July 2022, On June 30, 2022, it was revealed that France, Germany and Sweden had decided to construct a new fixed-wing medium-lift transport aircraft. The three nations inaugurated the Future Mid-Size Tactical Cargo (FMTC) programme during the European Wings event, which was sponsored by the French Presidency of the Council of the European Union (PFUE), according to a release by the French Ministry of Defense.

Why Purchase the Report?

- To visualize the global wing-lift enhancement mountings market segmentation based on mounting, aircraft, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of wing-lift enhancement mountings market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global wing-lift enhancement mountings market report would provide approximately 61 tables, 61 figures and 192 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies