Overview

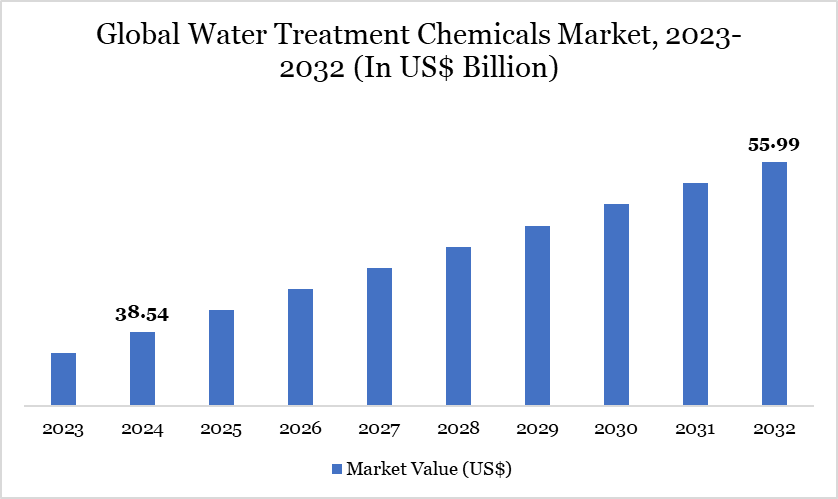

Global water treatment chemicals market reached US$38.54 billion in 2024 and is expected to reach US$55.99 billion by 2032, growing with a CAGR of 4.78% during the forecast period 2025-2032, according to DataM Intelligence report.

The global market for water treatment chemicals is seeing continuous expansion, propelled by the growing dependence on chemically treated water in various sectors, such as power generation, oil and gas, food and beverage, and pharmaceuticals. These sectors require high-performance chemicals to guarantee operating efficiency, uphold product quality, and comply with stringent environmental regulations.

In recent years, the power generation industry comprised over 18% of global water withdrawals, highlighting the essential function of water treatment in sustaining energy infrastructure. Furthermore, the oil and gas industry, in which produced water accounts for around 75% of all extracted fluids, relies significantly on chemical treatments for both recycling and safe disposal.

The increasing utilization of enhanced oil recovery (EOR) methods intensifies the demand for water treatment chemicals. The market is experiencing growth from developing countries like China, India, and Brazil, where industrial development and urbanization are driving investments in water infrastructure.

Market Trends

The global transition to sustainable water reuse is a significant development in the water treatment chemicals sector. In response to increasing pressure to conserve water, enterprises are investing in sophisticated treatment methods that facilitate water recycling and reuse. This is especially important in developing economies like Mexico, India, and China, where industrial expansion has heightened the necessity for water conservation.

Recent regional developments are influencing market dynamics. In October 2023, Solenis, a prominent specialty chemicals manufacturer, bought CedarChem LLC to augment its product portfolio in the southeastern US market. CedarChem's extensive range of wastewater treatment chemicals for industrial and municipal clients enhances Solenis' market approach.

The market is adjusting to technological developments in hydraulic fracturing, particularly in North Dakota and West Texas, which have increased water treatment requirements in upstream oil and gas activities. Collectively, these developments underscore a market-transforming, propelled by sustainability objectives and regional consolidation.

Market Scope

Metrics | Details |

By Type | Corrosion inhibitors, Scale inhibitors, Biocides & disinfectants, Coagulants & flocculants, Chelating agents, Anti-foaming agents, pH adjusters and stabilizers, Others |

By Application | Boiler water treatment, Cooling water treatment, Raw water treatment, Water Desalination, Others |

By Source | Synthetic, Bio-based |

By End-user | Residential, Commercial, Industrial |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Dynamics

The Increasing Dependence on Industrial Water Necessitates Chemical Treatment Solutions

A primary factor driving the water treatment chemicals market is the increasing reliance of industry on treated water for essential operations. In the power sector, chemically treated boiler feedwater and cooling tower systems are essential to prevent scaling and corrosion, therefore preserving thermal efficiency and extending equipment lifespan.

This issue has grown increasingly urgent as thermoelectric power facilities proliferate, notably in the US. Likewise, the oil and gas sector uses water treatment chemicals extensively in both upstream and downstream operations. Enhanced oil recovery techniques require high-quality treated water, hence expanding the market potential for specialty chemicals, including biocides, corrosion inhibitors, and scale removers.

In areas facing water scarcity, these compounds facilitate industrial water recycling, thereby enhancing sustainable practices. As industries expand, the water demand—and hence, the necessity for treatment—escalates, reinforcing the essential function of water treatment chemicals in contemporary industrial systems.

Elevated Operating Expenses Hinder Adoption of Chemical-Based Water Treatment

The water treatment chemicals market, despite its essential function, encounters a considerable limitation due to elevated operational expenses. The upkeep of treatment infrastructure, encompassing equipment enhancements, repairs, and inspections, can be excessively costly, particularly in antiquated plants.

The financial burden increases due to energy costs, as water treatment methods, including filtration, disinfection, and desalination, require significant energy use. These issues are exacerbated by the global shift towards sustainable energy consumption and increasing electricity costs. Moreover, the increasing accessibility of alternative water treatment technologies, such as membrane filtration, ultraviolet treatment, and electrochemical disinfection, offers economical, chemical-free solutions.

These advances attract enterprises pursuing environmentally sustainable solutions and may diminish dependence on conventional water treatment chemicals. Moreover, obstacles associated with patent infringement and the demand for sustainable chemical formulations pose additional impediments to market expansion, especially for smaller or mid-sized suppliers striving to maintain competitiveness in a swiftly changing business environment.

Segment Analysis

The global water treatment chemicals market is segmented based on type, application, source, end-user, and region.

Market Supremacy of Coagulants and Flocculants Based on Extensive Application Range

Coagulants and flocculants represent the predominant segment in the water treatment chemicals market, propelled by their unparalleled efficacy in eliminating suspended particles and pollutants from water. These compounds operate by consolidating tiny particles into bigger flocs, so facilitating their extraction during sedimentation or filtration. Their essential function in maintaining water clarity and safety has resulted in extensive implementation in municipal, industrial, and wastewater treatment facilities.

In potable water applications, they facilitate adherence to rigorous public health requirements, while in industrial contexts, they guarantee compliance with discharge laws. The chemicals are essential for the efficient and cost-effective treatment of substantial water volumes, hence reinforcing their predominant market position. With the increasing stringency of environmental regulations and heightened water quality standards, the need for high-performance coagulants and flocculants is anticipated to escalate, solidifying their role as a fundamental component of the water treatment chemical repertoire.

Geographical Penetration

North America's Infrastructure and Regulatory Emphasis Enhances Chemical Demand

North America is a pivotal growth region for the water treatment chemicals industry, predominantly driven by the US. In North America, over 95% of wastewater is collected, cleaned, and recycled, demonstrating the region's sophisticated infrastructure and rigorous water management practices.

This establishes a conducive environment for chemical providers as sectors including power generation, pharmaceuticals, and food and beverage escalate their demand for superior treated water. The US has established itself as a leader in energy production, consumption, and supply, resulting in increased water treatment demands, particularly in thermoelectric power facilities.

The rising output of shale gas and tight oil in regions such as North Dakota and West Texas, propelled by innovations in hydraulic fracturing, requires significant water treatment initiatives within the oil and gas industry. Regulatory monitoring and sustainability obligations guarantee ongoing investment in treatment infrastructure, with recent acquisitions such as CedarChem by Solenis improving chemical supply chains in the southeastern US.

Sustainability Analysis

Sustainability is emerging as a fundamental component of growth in the water treatment chemicals sector as industry and municipalities face difficulties related to water constraint and climate change. The growing implementation of water recycling and reuse technologies is propelling the demand for chemical solutions that facilitate closed-loop systems. Chemicals for water treatment are crucial for decreasing pollutant concentrations, facilitating water reuse in industrial operations, and reducing freshwater consumption.

In emerging economies like India, China, and Brazil, fast urbanization is exerting pressure on water supplies, prompting investment in chemical-based water treatment systems. Moreover, market actors are transitioning to environmentally sustainable formulations that minimize ecological impact while maintaining effectiveness.

The necessity for sustainable chemical advances that reconcile performance with environmental accountability is imperative. Industry stakeholders investing in green chemistry, energy-efficient processes, and biodegradable formulations are positioned to gain advantages in a market more aligned with global sustainability and environmental objectives.

Competitive Landscape

The major global players in the market include BASF SE, Ecolab, Kemira, Kurita Water Industries Ltd., Air Products and Chemicals, Inc., American Water Chemicals, Inc., Lenntech B.V., Thermax Limited, Hydrite Chemical, Dow and others

Key Developments

In January 2023, the full acquisition of SimAnalytics was finalized by Kemira, a chemical solutions provider catering to water-intensive sectors. Implementing this strategic decision strengthens Kemira's capacity to offer data-driven predictive services and machine learning solutions to efficiently assist its clients' enterprises.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies