Venous Stents Market Size

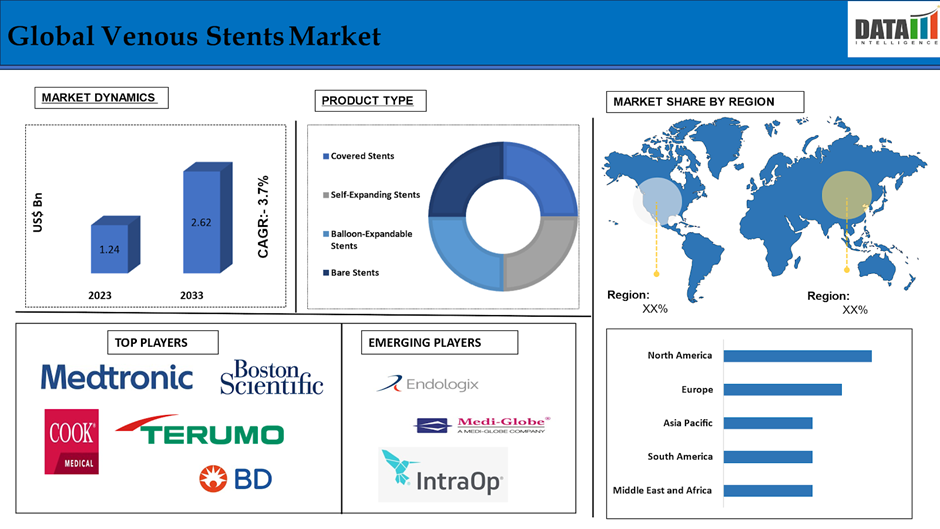

The Global Venous Stents Market reached US$ 1.24 billion in 2024 and is expected to reach US$ 2.62 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025-2033.

Venous stents are expandable metal mesh tubes which apply pressure to walls of blocked or narrowed veins and act as a scaffold to keep the veins open. They are usually placed in the bigger central veins located in the abdomen, chest, and legs. Venous stents are used to treat chronic deep vein thrombosis (DVT), hemodialysis/arteriovenous fistulae, May-Thurner syndrome, Nutcracker syndrome, and post-thrombotic syndrome. DVT is defined as the condition where a blood clot develops in one of the large, deep veins, which brings back blood from the leg to the heart and lungs.

Executive Summary

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Rise in the Technological Advancements

Technological advancements are driving the global venous stents market growth by improving the effectiveness, safety, and longevity of stenting procedures. Biocompatible alloys like nitinol enhance flexibility and durability, reducing complications. Drug-eluting stents release medication to prevent restenosis, reducing the need for repeat procedures. Self-expanding and balloon-expandable stents provide ease of use during minimally invasive surgeries, allowing quicker recovery times and better patient experiences.

Moreover, technological advancements in stent design are inevitable and likely to outpace data collection. Current stents are mainly laser-cut nitinol designs, with some open and hybrid designs. Future designs may incorporate drug coating and alternative designs to influence factors like the Poisson effect or flow. Understanding factors driving patency loss and the biological mechanism of stent thrombosis and occlusion is crucial for stent failure prevention.

Risk of Complications and Restenosis

The global venous stents market is facing some complications due to the risk of complications and restenosis, which instigate questions regarding the long-term effectiveness and safety of venous stenting procedures. Even though there has been technological advancement in stents, barriers such as stent thrombosis, infection, or re-narrowing of the vein still exist and might lead to further procedures, prolonged recovery, or some surgical intervention. This fear sometimes turns out towards the patient or even the healthcare provider and sometimes does not consider venous stents as an option. Hence, it has a rather slow adoption rate and limits overall market potential. This stems the emergence and acceptance of venous stests in the healthcare industry.

Market Segment Analysis

The global venous stents market is segmented based on product type, material, application end user and region.

Product Type:

Covered Stents from the device segment is expected to dominate the Venous Stents market share

The covered stents segment holds a major portion of the venous stents market share and is expected to continue to hold a significant portion of the venous stents market share during the forecast period.

Covered stents are a vital segment in the global market for venous stents, by offering further protection from restenosis and other complications. Covered stents differ from bare metal stents in that their luminal surfaces are lined with a synthetic material to physically restrict tissue ingrowth, thereby reducing the risk of thrombosis, preventing re-narrowing of a vein. Thus they can be ideal for use in complicated situations, such as stenosis of large veins, or those susceptible to occlusion. In fact, covered stents are often preferred in high-risk patients due to the better long-term patency and likelihood of re-treatment.

For instance, in October 2023, Getinge has launched its iCast covered stent system for treating iliac arterial occlusive disease in the US, having received FDA premarket approval in March 2023. The balloon expandable polytetrafluoroethylene-covered stent is marketed outside the US as Advanta V12, according to Getinge.

End User:-

Hospitals segment is the fastest-growing segment in Venous Stents market share

The oncology segment is the fastest-growing segment in the venous stents market share and is expected to hold the market share over the forecast period.

Hospitals are the major healthcare providers in the global venous stents market by offering interventional radiology, vascular surgery, and cardiology in specialty services. Hospitals provide infrastructure and medical expertise for safe stent implantation by proper patient selection and post-procedural care. The increasing number of patients diagnosed with venous conditions has become a demand driver for venous stenting procedures, such as chronic venous insufficiency and deep vein thrombosis. Hospitals also train patients and physicians on the advantages and disadvantages of stenting. With the adoption of advanced stenting technologies, it can contribute to the market growth and acceptance of such forms of treatment.

Market Geographical Share

North America is expected to hold a significant position in the Venous Stents market share

North America holds a substantial position in the venous stents market and is expected to hold most of the market share due to advanced healthcare infrastructure accompanied by increasing prevalence of venous diseases such as DVT and CVI. Moreover, product launches, ongoing studies, demand for advanced treatment solutions is complemented by the geriatric population and alarming obesity statistics helps in the region growth. The sophisticated reimbursement mechanisms and the forceful active market players are conducive to a stimulating atmosphere for the development of innovative stent technologies while increased awareness channels between minimally invasive treatment options.

For instance, in March 2023, W. L. Gore & Associates has enrolled the first U.S. patient in a prospective, non-randomized, multicenter, single-arm study to evaluate the GORE VIAFORT Vascular Stent for treating symptomatic inferior Vena Cava obstruction with or without combined Iliofemoral Obstruction.

Hence, W. L. Gore & Associates is ongoing clinical trials on the GORE VIAFORT Vascular Stent, aiming to improve treatment options for venous obstructions and stimulate market growth by validating new therapeutic approaches and improving patient care outcomes.

Europe is growing at the fastest pace in the Venous Stents market

Europe holds the fastest pace in the venous stents market and is expected to hold most of the market share due to launches of significant products, healthcare expenditures, and development in the medical technology field. Hence, these factors drive the venous market for stents in Europe. Other factors that will drive the market include an aging population, government programs for chronic diseases, and the progress of clinical trials. A highly systematized and organized health structure provides timely diagnosis and treatment, thus increasing the venous stent uptake in Europe.

For instance, in June 2024 Philips has successfully implanted the Duo Venous Stent System, an implantable medical device designed to treat symptomatic venous outflow obstruction in patients with chronic venous insufficiency, following premarket approval from the U.S. FDA.

Competitive Landscape

The major global players in the venous stents market include Medtronic Plc, Boston Scientific Corporation, Cook Medical, Terumo Corporation, Becton, Dickinson and Company (BD), Abbott Laboratories, Cordis Corporation(Cardinal Health), Vesper Medical, Bentley, Optimed Medizinische Instrumente GmbH and among others.

Key Developments

- In April 2024, Getinge has received EU MDR certification for its Advanta V12 covered stent system, which is used for patients with aortoiliac occlusive disease, including aortic bifurcation lesions. This certification confirms the system's compliance with EU regulations and reflects Getinge's commitment to quality and patient safety.

- In July 2023, Steven Abramowitz, MD, at MedStar Washington Hospital Center, completed the first deep venous stent thrombosis procedures using a minimally invasive thrombectomy catheter, RevCore, which received FDA clearance in March and was officially launched in June. The stent cleaner is a deep venous "stent cleaner."

| Metrics | Details | |

| CAGR | 8.5% | |

| Market Size Available for Years | 2018-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Volume (Units) | ||

| Segments Covered | Product Type | Covered Stents, Self-Expanding Stents, Balloon-Expandable Stents, Bare Stents |

| Material | Nitinol, Metal Stents, Stainless Steel, Polymers, Others | |

| Application | Deep Vein Thrombosis (DVT), Chronic Venous Insufficiency (CVI) Pulmonary Embolism (PE), Tumor Occlusion, Others | |

| Distribution Channel | Hospitals, Specialty Clinics, Ambulatory Surgical Centers | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global venous stents market report delivers a detailed analysis with 60+ key tables, more than 50 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2025

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Material Type & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.