US Corn Starch Market Size

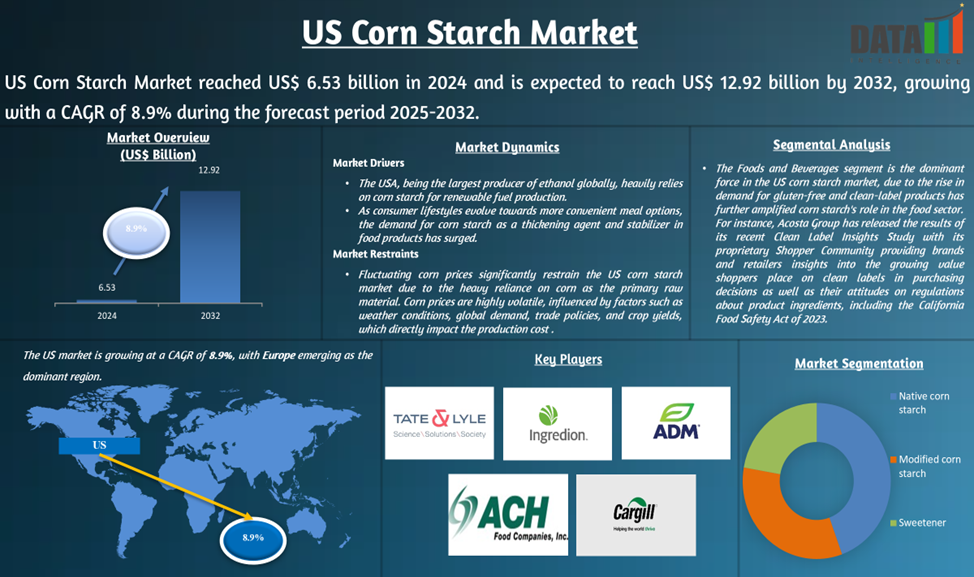

US Corn Starch Market reached US$ 6.53 billion in 2024 and is expected to reach US$ 12.92 billion by 2032, growing with a CAGR of 8.9% during the forecast period 2025-2032.

US corn starch market is a well-established segment, driven by its versatile applications across food, beverage, pharmaceutical, textile, paper and bioethanol industries. As one of the largest producers of corn globally, US benefits from abundant raw material availability, supporting a steady supply chain for corn starch production.

Additionally, in the food and beverage industry, corn starch is a thickening, stabilizing and binding agent, finding extensive use in processed foods, bakery products, snacks and beverages. For instance, it is a critical ingredient in soups, sauces, gravies and gluten-free baked goods, where it enhances texture and consistency. The growing trend of clean-label and non-GMO products is driving demand for non-GMO corn starch, particularly in organic food and infant nutrition segments.

Moreover, in the bioethanol industry, corn starch plays a pivotal role as the primary feedstock for ethanol production. US leads the global ethanol market, with government policies like the Renewable Fuel Standard (RFS) mandating ethanol blending in gasoline to reduce carbon emissions. This has significantly driven corn starch demand, with over 40% of US corn production diverted toward ethanol manufacturing.

Executive Summary

To Know More Insights - Download Sample

Market Scope

| Metrics | Details |

| CAGR | 8.9% |

| Size Available for Years | 2023-2032 |

| Forecast Period | 2025-2032 |

| Data Availability | Value (US$) |

| Segments Covered | Type, Application, Distribution Channel |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

Market Dynamics

Increasing Use in Industrial Applications

The increasing use ofcorn starch in industrial applications is a significant driver for the USA corn starch market, owing to its versatility and cost-effectiveness. One of the primary applications is in the bioethanol industry, where corn starch serves as a key feedstock for ethanol production. The USA, being the largest producer of ethanol globally, heavily relies on corn starch for renewable fuel production. For instance, US is the world's largest producer of ethanol, having produced over 15 billion gallons in 2021 and 2022. Together, US and Brazil produce 80% of the world's ethanol. The vast majority of U.S. ethanol is produced from corn, while Brazil primarily uses sugarcane.

Additionally, corn starch finds widespread usage in the paper and packaging industry as a binding and coating agent to improve paper strength, texture and printability. The rising demand for sustainable packaging solutions has driven the adoption of corn starch-based biodegradable plastics, particularly Polylactic Acid (PLA), as eco-friendly alternatives to conventional plastics. For instance, California’s SB 54 or the Plastic Pollution Prevention and Packaging Producer Responsibility Act, is the state’s EPR legislation. The law requires cutting single-use plastics by 25%, recycling 65% of single-use plastics and ensuring 100% of single-use packaging and plastic food ware are recyclable or compostable.

Rising Consumer Demand

The increasing consumption of processed and convenience foods is another crucial factor propelling market growth. As consumer lifestyles evolve towards more convenient meal options, the demand for corn starch as a thickening agent and stabilizer in food products has surged. Similarly, The economic landscape also plays a vital role in shaping the corn starch market. With rising disposable incomes and urbanization, consumers are increasingly seeking healthier snack options and innovative food products that incorporate corn starch.

Furthermore, Major players in the corn starch industry, such as Cargill and Archer Daniels Midland Company, are making substantial investments to enhance production capabilities and meet growing demand. For instance, Cargill announced a $150 million investment to upgrade its maize starch plants in the U.S., aiming to increase efficiency and expand its product offerings. Such strategic moves indicate a robust industry outlook bolstered by both domestic consumption trends and export opportunities.

Fluctuating Corn Prices and Supply Chain Issues

Fluctuating corn prices significantly restrain the US corn starch market due to the heavy reliance on corn as the primary raw material. Corn prices are highly volatile, influenced by factors such as weather conditions, global demand, trade policies and crop yields, which directly impact the production cost and profitability of corn starch manufacturers. For instance, North American corn starch prices showed a 3.84% quarterly decline due to the availability of corn starch from major exporting countries. Similarly, Asia-Pacific recorded an average quarterly decline of 1.05% as most countries rebounded with high-yield new corn season, impacting domestic corn starch prices.

Unfavorable weather conditions such as droughts or excessive amounts of rainfall impact corn crops, affecting the amount and quality of the raw material utilized to produce corn starch. For instance, the bad weather in Northeast, China caused the country’s recent market corn starch turmoil. Additionally, the disruptive snowfall delayed transportation routes and affected the whole supply chain, ultimately rousing corn starch prices.

Market Segment Analysis

The US corn starch market is segmented based on type, application and distribution channel.

Demand for Gluten-Free and Clean-Label Products in Food & Beverage Market

The foods and beverages segment is the dominant force in US corn starch market, due to the rise in demand for gluten-free and clean-label products has further amplified corn starch's role in the food sector. As consumers seek healthier, allergen-free alternatives, corn starch has become a preferred substitute in gluten-free baked goods, such as bread, cakes and cookies, where it provides structure and softness.

For instance, Acosta Group has released the results of its recent Clean Label Insights Study with its proprietary Shopper Community providing brands and retailers insights into the growing value shoppers place on clean labels in purchasing decisions as well as their attitudes on regulations about product ingredients, including the California Food Safety Act of 2023. Around, 83% of shoppers are already knowledgeable about clean-label products or have heard the term.

Additionally, major food brands in the US are increasingly turning to modified corn starch to enhance the shelf life, texture and flavor profile of their products while keeping labels simple and free from artificial additives. For instance, corn starch is used in plant-based beverages like almond milk and soy milk to stabilize the mixture and improve mouthfeel, ensuring consistency in the final product.Top of Form

Major US Players

The major US players in the market include Tate & Lyle PLC, Cargill Incorporated, Ach Food Companies Inc, Archer Daniels Midland Company, Ingredion Incorporated, Roquette Frères S.A., AGRANA Beteiligungs-AG, Sudzucker AG, Associated British Foods plc and Wacker Chemie AG.

Sustainability Analysis

Sustainability plays a crucial role in shaping the corn starch market. The growing awareness of environmental issues has led to a heightened demand for sustainable practices in agriculture and food production. The U.S. corn industry benefits from advanced agricultural techniques that enhance starch yields while minimizing environmental impact. Specifically, U.S. corn demonstrates superior starch extractability compared to other origins, which translates to higher profitability for industrial plants. Moreover, manufacturers are increasingly adopting eco-friendly practices, such as sourcing materials sustainably and investing in research and development for cleaner production methods.

Consumer Analysis

| Consumer Group | Consumer Pain Points | Consumer Needs |

| Gluten-Free Product Consumers | Limited availability of certified gluten-free corn starch. | Safe and reliable gluten-free alternatives to wheat-based starches. |

| Biofuel Producers | Fluctuating corn supply affects ethanol production. | Reliable supply of cost-effective corn starch for ethanol production. |

| Paper & Packaging Industry | Variability in starch properties affects product quality. | Strong and cost-effective starch adhesives to improve product strength. |

Why Purchase the Report?

- To visualize the US Corn Starch market segmentation based on type, application and distribution channel.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points at the corn starch market level for all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The US corn starch market report would provide approximately 39 tables, 29 figures and 192 pages.

Target Audience 2025

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies