Urban Air Mobility Market Size

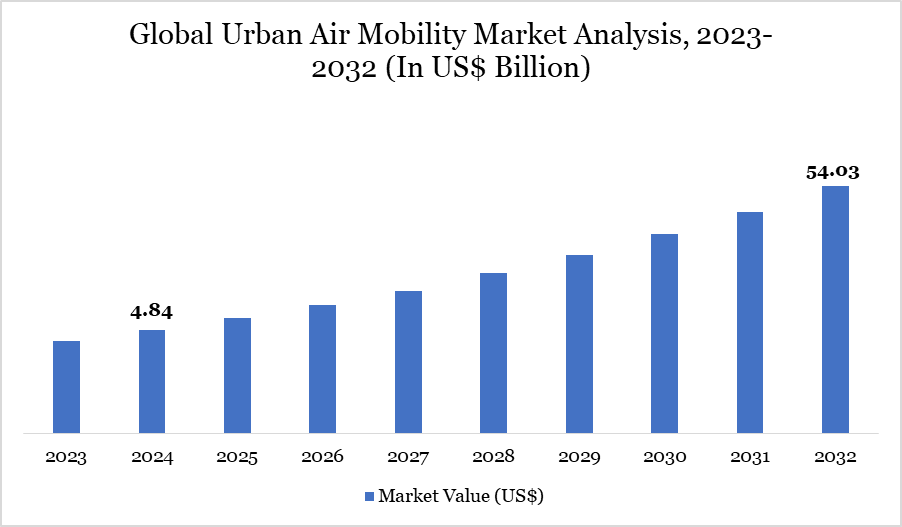

Global Urban Air Mobility Market Size reached US$ 4.84 billion in 2024 and is expected to reach US$ 54.03 billion by 2032, growing with a CAGR of 35.20% during the forecast period 2025-2032.

Rapid urbanization and overloaded road infrastructure are forcing governments and commercial stakeholders to look for creative transportation options, which is causing the Urban Air Mobility (UAM) sector to undergo a revolutionary development. According to UAM, in the future, electric Vertical Take-Off and Landing (eVTOL) aircraft will offer more rapid, clean and effective travel options in crowded cities.

With almost US$ 1.00 billion raised in 2020, including US$ 590.0 million from Toyota's investment in Joby Aviation and US$ 650.0 million from EHang's first public offering, the market attracted significant investor attention. This spike in investment shows how popular UAM is becoming as a next-generation mobility solution.

The growth of UAM is being fueled by the incorporation of artificial intelligence (AI) into autonomous aerial navigation, the rise of ride-sharing air taxis and the installation of vertiports in underutilized city locations. UAM is therefore quickly moving from experimental technology to a commercially feasible part of the city infrastructure of the future.

Urban Air Mobility Market Trend

The UAM market's trajectory is being defined by a number of noteworthy trends. First, artificial intelligence (AI) is essential because it makes it possible for aerial vehicles to navigate through intricate urban areas on their own, guaranteeing both operational effectiveness and safety. These aircraft are becoming autonomous transit systems thanks to the combination of AI and UAM.

Second, there is a noticeable trend toward eVTOL aircraft, which are being tailored for last-mile delivery and urban transportation. By avoiding surface traffic, these cars significantly cut down on trip times by taking advantage of vacant roofs and urban air corridors. The adoption of ride-share business models for air taxis is another development that draws comparisons to services like Uber but in the air.

Public-private collaborations are being formed by tech giants and startups to test UAM solutions, particularly in cities with persistent traffic. Lastly, the UAM ecosystem is increasingly focusing on environmental sustainability, which is aided by electric propulsion and zero-emission activities.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details |

| By Component | Hardware, Software |

| By Type | Air Taxis, Air Metros & Air Shuttles, Personal Air Vehicles, Cargo Air Vehicles, Air Ambulances & Medical Emergency Vehicles, Last-Mile Delivery Vehicles, Others |

| By Maximum Take-off Weight | <100 Kg, 100 – 300 Kg, >300 Kg |

| By Propulsion | Gasoline, Electric, Hybrid |

| By Operation | Remotely Piloted, Fully Autonomous, Hybrid |

| By Application | Passenger Transport (Air Taxis), Cargo Transport / Last-Mile Delivery, Emergency & Medical Services, Inspection & Surveillance, Private/Corporate Transport, Airport Shuttle Services, Tourism & Sightseeing Flights, Others |

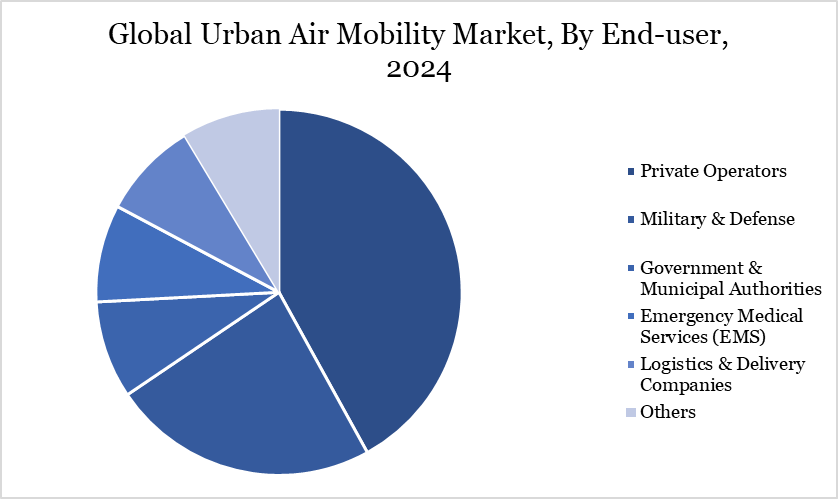

| By End-user | Private Operators, Military & Defense, Government & Municipal Authorities, Emergency Medical Services (EMS), Logistics & Delivery Companies, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Global Urban Air Mobility Market Dynamics

Growing Urban Congestion Encourages the Use of UAM

The growing urban congestion, which is made worse by the fast population increase and the proliferation of on-road cars, is a major factor propelling the UAM industry. Existing transportation infrastructure finds it difficult to meet peak-hour needs as cities grow. Germany, the US, France and the UK spent a total of US$ 200 billion in 2013 to manage traffic congestion; by 2030, that amount is expected to rise to US$ 293 billion.

By using vertical take-off and landing technology, UAM overcomes these difficulties and does away with the limitations of terrestrial roads. UAM improves access to underserved metropolitan areas and drastically cuts down on journey times by providing direct point-to-point aerial mobility.

Vertiports can be built on top of buildings or in underutilized urban spaces, increasing operational efficiency without the need for substantial land-based infrastructure. Businesses like Joby Aviation are prime examples of this change, developing planes designed to reduce traffic and increase accessibility, particularly in places with little access to public transit.

High Initial Investment

The UAM market has a major obstacle in the form of expensive initial investment requirements, despite its disruptive potential. It takes significant financial resources to develop eVTOL aircraft, build vertiports and obtain airworthiness certifications. Smaller businesses and new entrants may find these costs excessive, which would hinder competition and innovation.

For example, Joby Aviation had to look for more money in 2023 to move closer to commercialization after running into regulatory and scale issues despite having secured a sizable amount of funding. Long-term financial planning and public-private cooperation are also necessary for infrastructure investments like charging stations and safety-compliant takeoff and landing zones.

The development burden is further increased by the price of sophisticated composite materials and AI-based flight control systems. These financial obstacles could postpone broad UAM adoption and impede market expansion in the absence of expedited finance and government assistance channels.

Urban Air Mobility Market Segment Analysis

The global urban air mobility market is segmented based on component, type, maximum take-off weight, propulsion, operation, application, end-user and region.

Private Operators Enhancing Logistics and Travel with UAM

The private operators’ sector of the Urban Air Mobility (UAM) market emerged as a major contributor, with a sizeable revenue share. The main factor driving this rise is how useful UAM vehicles are for businesses, especially when it comes to cutting down on staff commute times. For employees going between offices, workplaces or meetings in cities, these cars provide a quicker and more effective form of transportation.

Additionally, UAM vehicles improve logistics efficiency and lessen dependency on traditional ground transportation methods, making them perfect for high-priority, urgent delivery. By enabling speedier on-site visits for maintenance, inspections or client meetings, UAM can be especially helpful to companies with geographically scattered businesses.

Because UAMs help enterprises streamline their operations and remove time-consuming travel constraints, this operational advantage not only increases productivity but also creates profitable prospects for private operators. As UAM is increasingly incorporated into urban business models, the segment is expected to grow even more.

Urban Air Mobility Market Geographical Share

Europe Leads the Global Urban Air Mobility Market by Progressing Toward Sustainable Air Travel

Due to its strict emissions regulations and dedication to sustainable urban development, Europe is positioned as a pivotal region in the development of the UAM market. In an effort to reduce pollution and traffic, nations including the UK, France and Germany are giving electric vehicles more importance. Europe made a substantial contribution to the $200 billion spent on congestion worldwide in 2013, underscoring the need for alternate modes of transportation.

With a focus on environmental sustainability, European companies like Vertical Aerospace are driving eVTOL development, supported by financing from American Airlines in 2021. In order to support pilot projects and commercial testing, regulatory bodies throughout Europe are developing standardized frameworks for UAM certification and integration. Furthermore, the regional UAM perspective is further strengthened by the European public's adoption of green transport technologies. UAM is probably going to play a major role in Europe's future mobility infrastructure as the continent attempts to decarbonize urban transit.

Sustainability Analysis

UAM offers a potential remedy for the environmental problems caused by traditional modes of transportation. With its emphasis on electric and fuel-cell-powered airplanes, UAM provides a zero-emission alternative to the ongoing pollution emissions from road cars and the energy inefficiencies caused by traffic. This change aligns with both local sustainability agendas and global climate goals.

Because UAM systems do not rely on fossil fuels for short-distance urban transit, they can significantly reduce air pollution. For example, compared to helicopters or cars with combustion engines, eVTOLs used for air taxis or freight operations are made to be quieter, cleaner and more energy-efficient.

Initiatives like American Airlines' investment in Vertical Aerospace demonstrate the company's dedication to sustainability and highlight the rising demand for green aviation solutions. In addition to improving the enjoyment of urban life, UAM significantly lowers the carbon footprint of contemporary cities by lowering surface traffic and providing faster commutes.

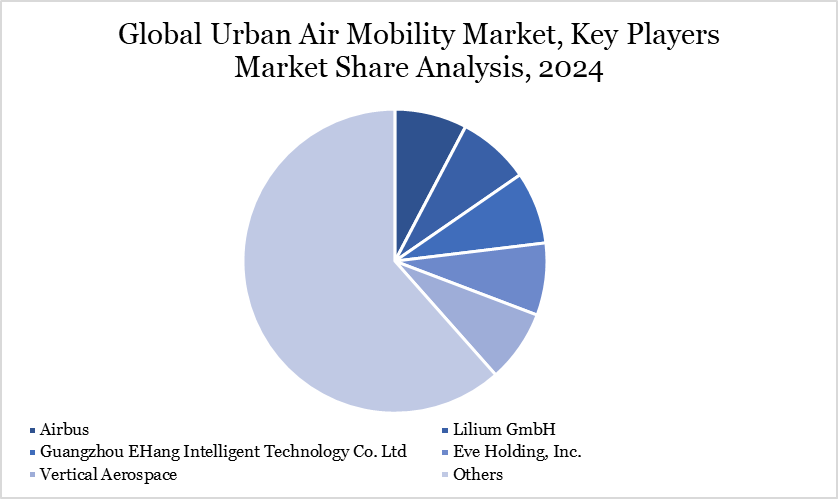

Urban Air Mobility Market Major Players

The major global players in the market include Airbus, Lilium GmbH, Guangzhou EHang Intelligent Technology Co. Ltd, Eve Holding, Inc., Vertical Aerospace, Textron Inc., Joby Aero, Inc., Embraer Group, Hyundai Motor Company, Archer Aviation Inc.

Key Developments

- In June 2024, Lilium GmbH collaborated with Bao’an District in China with an aim to establish itself as an active and contributing industry player with the support of local infrastructure partners, customers and regulatory authorities. The district offers extensive regional knowledge required to build the foundation for high-end eVTOL operations in the Greater Bay Area. The company intends to expand across the country and the Asia-Pacific region in the future.

- In June 2024, Guangzhou EHang Intelligent Technology Co. Ltd. announced the first autonomous air taxi flight of EH216-S, its pilotless electric vertical takeoff and landing (eVTOL) aircraft in Mecca, Saudi Arabia. The company has partnered with Front End Limited Company, a domestic advanced solutions provider for various industries, implying transformative potential of pilotless eVTOL aircraft for the regional transportation system.

- In April 2024, Joby Aero, Inc. signed a Memorandum of Understanding (MoU) with the Abu Dhabi Department of Economic Development (DED), the Department of Municipalities and Transport - Abu Dhabi (DMT) and the Department of Culture and Tourism - Abu Dhabi (DCT Abu Dhabi) with an aim to establish air taxi services in Abu Dhabi.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2025

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies