Uranium Market Size

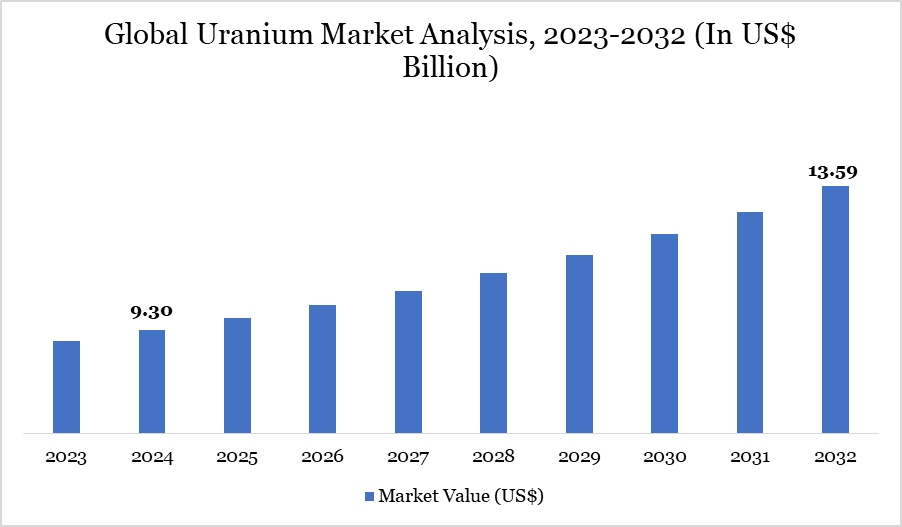

Global Uranium Market size reached US$ 9.30 billion in 2024 and is expected to reach US$ 13.59 billion by 2032, growing with a CAGR of 4.86% during the forecast period 2025-2032.

Over the past few decades, there have been significant changes in the global uranium market, mostly due to shifting energy policy, supply-demand imbalances, and geopolitical changes. Historically, almost 90% of the global energy demand has been met by uranium mining, with the remaining portion coming from secondary sources including military stocks and reprocessed materials.

Prices reached all-time high in the late 1970s and then had an extended decline in the 1980s and 1990s, demonstrating the market's normal cyclical nature. Weak spot prices that have lasted for more than ten years replaced a brief upswing that occurred between 2003 and 2009. Global attempts to lower carbon emissions, however, have sparked a fresh interest in nuclear energy in recent years.

Uranium demand is anticipated to be sustained by this revival, which is supported by calculated investments in new production and enrichment facilities located throughout Canada, the US, Brazil, and France. Early in 2024, the spot price hit US$ 106.75/lb before leveling down around US$ 80/lb, indicating mounting hope for a market rebound in 2025.

Uranium Market Trend

Current uranium market trends show a move away from conventional supply sources and toward multiple players and long-term strategic investments. In 2000, utilities and producers, the key market players, made about 95% of spot trading; however, after 2011, their proportion fell to about 30–40%, with traders and financial institutions increasingly taking their place.

Increasing market efficiency and liquidity have been brought about by this evolution. Once a negligible portion of trade, spot prices now account for around 25% of all uranium transactions and are frequently the foundation of long-term agreements. According to Sprott, the market experienced more volatility in 2024, reaching a top spot price of US$ 106.75/lb in February before settling at about US$ 77.08 by November.

Changes in nuclear legislation because of ongoing supply shortages, and climate-focused energy initiatives, long-term prospects are still optimistic despite short-term volatility. By mid-2025, experts predict that uranium prices will have recovered to US$ 90 to US$ 100/lb, pending investments in mining and enrichment facilities to satisfy the increasing demands of the energy transition.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details |

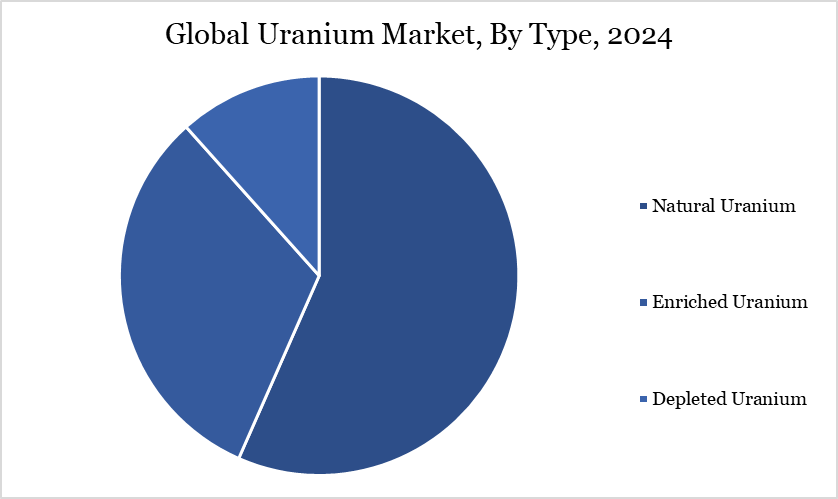

| By Type | Natural Uranium, Enriched Uranium, Depleted Uranium |

| By Application | Nuclear Power Generation, Medical Isotopes, Industrial, Military, Others |

| By End-user | Utilities, Government & Defense Agencies, Research Institutes, Others |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Global Uranium Market Dynamics

Uranium Demand Grows as Nuclear Energy Gains Global Support

One of the main causes of the rising demand for uranium is the increasing global push for decarbonization. Countries are reevaluating their nuclear strategy in order to fulfill aggressive climate targets, as nuclear energy is becoming more widely acknowledged as a reliable and low-carbon power source.

To improve domestic energy security, governments in North America, Europe, and Asia are updating energy policy and making investments in nuclear technologies. Initiatives like Brazil's resuscitation of domestic production, France's €300 million investment in Orano, and the US Nuclear Regulatory Commission's clearance of increased enrichment levels at Urenco USA are examples of this.

International organizations that promote safe and sustainable nuclear energy, such the NEA and IAEA, also encourage the change. Uranium, the main fuel for reactors, stands to gain a great deal as nuclear power becomes more popular in the world's energy mix. Despite short-term price swings, this long-term shift provides a solid basis for long-term market growth.

Supply Limitations and Infrastructure Gaps

The uranium market has significant limitations despite positive demand trends, mostly because of inadequate enrichment infrastructure and restricted mining capacity. The supply chain has been underinvested for decades during times of low prices, making it ill-equipped to react quickly to growing demand.

Even while mining provides 90% of today's utility needs, the remaining 80% comes from depleting secondary sources such recycled materials and military stocks, such as the 1999–2013 dilution of weapons-grade uranium. Financial, environmental, and legal barriers prevent new manufacturing projects from starting on time and limit their productivity.

Supply routes become more complicated due to geopolitical changes like China's expanding influence and Rosatom's withdrawal from Kazakhstan. For high-cost producers, the discrepancy between market prices and the true cost of mine operation persists even in the face of expected price recoveries. The market would find it difficult to effectively fulfill anticipated demand growth unless large investments are made in extraction, conversion, and enrichment facilities.

Segment Analysis

The global uranium market is segmented based on type, application, end-user and region.

Enriched Uranium Dominates the Market Driven by Technological Advancements and Strategic Enrichment Capacity

Enriched uranium dominates the uranium market because of its crucial role in the development of nuclear reactors and weapons. The primary distinction between U-235 and U-238 is their mass; U-235 is enriched by a procedure that raises its concentration for a variety of uses. Utilizing centrifuge technology or gas diffusion techniques, this enrichment procedure takes advantage of the slight mass difference between the isotopes and necessitates that uranium be in gaseous form.

Recent technological advancements have led to an overabundance of enrichment capacity, lowering enrichment prices and enabling underfeeding, in which enrichment plants run below capacity. The market is dominated by large producers like as Orano, Uranium One, and Paladin Energy, and the uranium enrichment industry is extremely capital-intensive. Enriched uranium continues to be essential for nuclear energy despite its high entry hurdles and technological complexity, solidifying its position as a key player in the global uranium market.

Market Geographical Share

North America Leads the Global Uranium Market with Strong Infrastructure and Policy Support

North America dominates the global uranium market due to strong nuclear infrastructure and government regulations. According to the American Nuclear Society, nuclear energy produced 2,602 terawatt-hours of electricity in the US in 2023, or 9% of the world's total electricity production.

Interest in uranium as a strategic resource has increased as a result of this expanding output. In an effort to lessen reliance on imports, the US government is aggressively promoting domestic production through programs like financial assistance for miners and strategic uranium reserves. At the same time, Canada is a major supplier of uranium because of its large reserves, top mining companies like Cameco Corp., and stable regulatory environment.

Canada intends to increase output at the Cigar Lake and McArthur River mines, strengthening North America's supply capacity. Together with growing awareness of energy security and climate change, these concerted efforts highlight the region's critical role in determining the direction of uranium production and consumption globally.

US Tariff Analysis

The Trump administration's erratic tariff policies and rising geopolitical tensions have increased uncertainty in the US uranium market. Recent taxes on imports from China, Canada, and Mexico have complicated the climate for utilities and investors and interfered with procurement strategy. Given that spot prices are currently at US$65 per pound, long-term investors may find that the current market slump presents a smart entry point.

Changes in US-Russian relations, such as rumors of loosening limits on Russian uranium and reviving disarmament negotiations, further complicate market dynamics. Due to the Prohibiting Russian Uranium Imports Act's uncertainties and frequent delays and modifications in tariff implementation, market participants are adopting a cautious "wait and see" approach.

Potential retaliatory tariffs from Canada, particularly on uranium, may increase procurement prices while favoring domestic producers. The sector's fundamentals, which are characterized by a chronic supply shortage and an increasing reliance on nuclear energy, continue to underpin a favorable long-term prognosis despite the policy noise.

Major Global Players

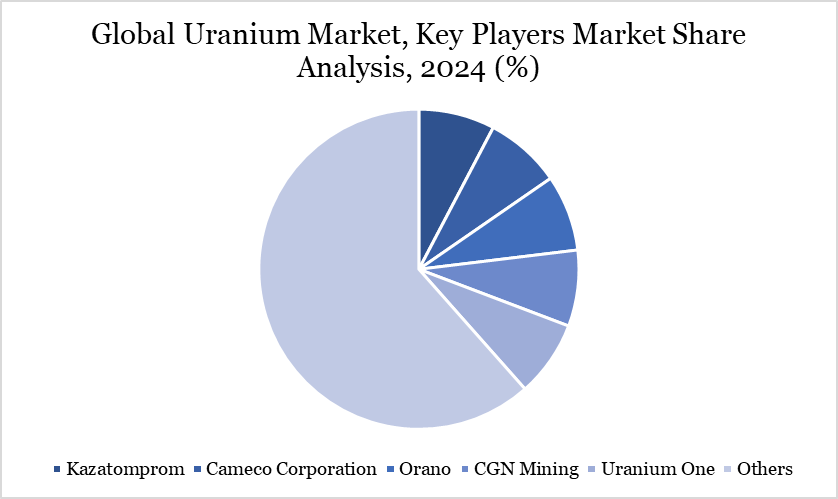

The major global players in the market include Kazatomprom, Cameco Corporation, Orano, CGN Mining, Uranium One, Paladin Energy, Energy Fuels Inc., Denison Mines Corp., Bannerman Energy, Berkeley Energia.

Key Developments

- On January 28, 2025, Sprott CEO John Ciampaglia expressed optimism regarding the uranium market, highlighting factors such as increasing utility interest, reactor life extensions, new builds, and geopolitical disruptions. Ciampaglia noted that while the spot market showed volatility, the long-term term market continued to grow, driven by future demand signals from reactors and geopolitical tensions. He expects uranium prices to strengthen as pent-up demand builds. Despite some short-term softness in the spot market, the overall outlook for 2025 remains bullish.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies