Type 2 Diabetes Market Size

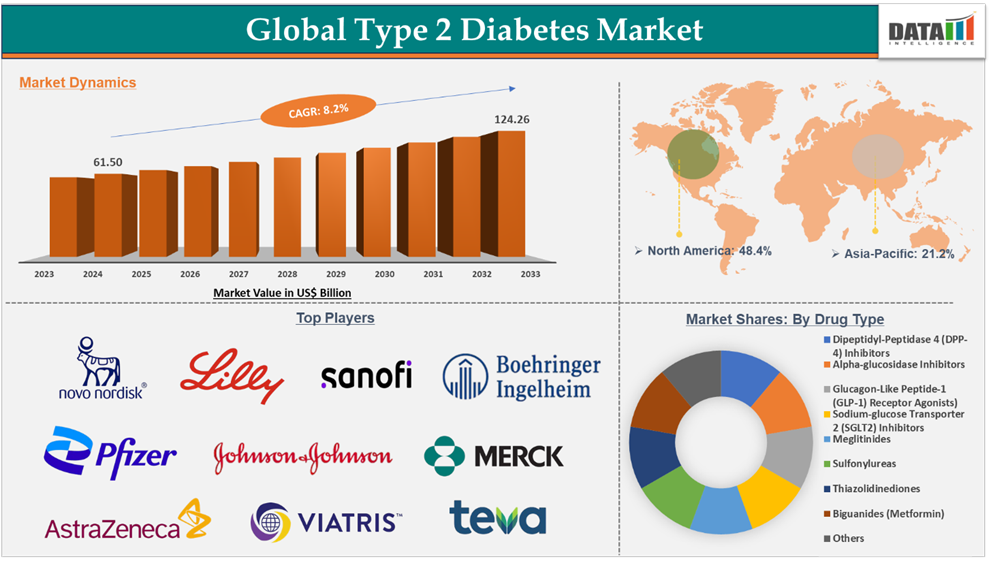

Type 2 Diabetes Market Size reached US$ 61.50 billion in 2024 and is expected to reach US$ 124.26 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025-2033.

The Type 2 Diabetes market is experiencing significant growth driven by the rising prevalence, increasing demand for advanced therapies, innovations by key market players, and new product approvals from regulatory bodies. The GLP-1 receptor agonists are dominating the market with the highest share of 47.2% in 2024. The top companies operating in the market with the highest share are Novo Nordisk A/S and Eli Lilly and Company. Nono Nordisk A/S has the market share of ~56% in the overall GLP-1 receptor agonists market.

Executive Summary

For more details on this report – Request for Sample

Type 2 Diabetes Market Dynamics: Drivers & Restraints

The rising prevalence of diabetes is driving the market growth

The market for type 2 diabetes is strongly driven by the rising prevalence of the condition. As the population with type 2 diabetes grows, the demand for advanced therapies and newer therapeutic categories is expected to rise, pushing the R&D activities, innovative product launches, thereby propelling the market growth.

For instance, according to the International Diabetes Federation, in 2024, globally, 588.71 million people are living with diabetes, and by 2050, this number is expected to reach 852.47 million. With this growing patient population, the overall treatment rate is expected to rise, with more and more patients opting for advanced therapies. The presence of key market players such as Novo Nordisk A/S and Eli Lilly and Company., who have gained popularity in the diabetes landscape, and their constant innovations to fulfill the high unmet needs, are expected to further boost the market growth.

High cost of branded drugs may restrain the market growth

Type 2 diabetes is a condition that needs lifelong treatment. Patients who are diagnosed with the condition are usually prescribed generic versions of type 2 diabetes drugs such as metformin. However, with the advancements in research and development, several newer agents like GLP-1 agonists, SGLT-2 inhibitors were launched. However, these newer agents are expensive and can financially drain the patient, who doesn’t have insurance coverage. For instance, Ozempic (semaglutide) a very popular GLP-1 agonist is sold at US$ 997.58 per one pen. This high cost can reduce the adoption, and hinder the market growth.

Type 2 Diabetes Market Segment Analysis

The global type 2 diabetes market is segmented based on drug type, gender, route of administration, distribution channel, and region.

Glucagon-like peptide-1 (GLP-1) receptor agonists in the drug type segment accounted for 47.2% of the market share in 2024 in the global type 2 diabetes market

Glucagon-like peptide-1 (GLP-1) is a physiological hormone that plays a crucial role in regulating blood glucose levels, lipid metabolism, and several other crucial biological functions by binding to GLP-1 receptors present on various cells across the body. GLP-1 receptor agonists are a class of medication that act by mimicking the GLP-1 hormone and bind to the GLP-1 receptor to exhibit the natural physiological function of regulating blood glucose levels. These GLP-1 receptor agonists include semaglutide (Ozempic, Rybelsus), liraglutide (Victoza), tirzepatide (Mounjaro), exenatide (Byetta, Bydureon), dulaglutide (Trulicity), lixisenatide (Lyxumia), etc. These drugs are currently the top-selling products among type-2 diabetes medications. Below are the revenues of top-selling GLP-1 receptor agonists, as stated in the respective company annual reports.

GLP-1 Receptor Agonist | Manufacturer | Sales (US$ Million) in 2024 |

Ozempic | Novo Nordisk A/S | 17,461.62 |

Mounjaro | Eli Lilly and Company. | 11,540.10 |

Trulicity | Eli Lilly and Company. | 5,253.50 |

Rybelsus | Novo Nordisk A/S | 3,380.98 |

Victoza | Novo Nordisk A/S | 795.44 |

Type 2 Diabetes Market Geographical Analysis

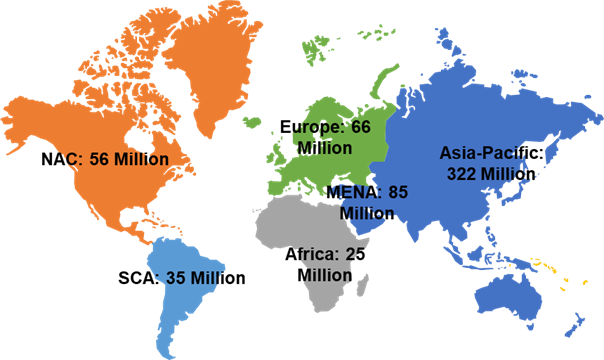

North America dominated the type 2 diabetes market with the highest share of 48.4% in 2024

The North America region, especially the United States, is well known for its innovations in the healthcare industry. In the type 2 diabetes market landscape, North America’s dominance is attributed to the high burden of the condition, which is driving the demand for advanced type 2 diabetes medication.

For instance, according to the International Diabetes Federation statistics, in the United States, there are approximately 38.53 million people (aged 20 to 79) with diabetes, and by 2050, the diabetes population is expected to reach 43.02 million.

With this alarming rise in prevalence, the demand for type 2 diabetes medication is expected to grow significantly in the forecast period.

With the higher demand for advanced therapies, the key market players are investing heavily in the region for research and development activities and are subsequently launching the products. Due to high disposable income, heavy spending on healthcare, these products are sold at high prices, and the manufacturers generate a major proportion of revenue from the region.

For instance, below are the top-selling diabetes drugs, i.e., GLP-1 receptor agonists, and their sales proportion from the United States.

GLP-1 Receptor Agonist | Manufacturer | Sales (US$ Million) in 2024 | U.S. Sales | U.S. Share |

Ozempic | Novo Nordisk A/S | 17,461.62 | 12,217.57 | 70.0% |

Mounjaro | Eli Lilly and Company. | 11,540.10 | 8,949.90 | 77.6% |

Trulicity | Eli Lilly and Company. | 5,253.50 | 3,693.80 | 70.3% |

Rybelsus | Novo Nordisk A/S | 3,380.98 | 1,566.35 | 46.3% |

Victoza | Novo Nordisk A/S | 795.44 | 246.52 | 31.0% |

This reflects the dominance of North America, especially the U.S., in the global type 2 diabetes market.

Type 2 Diabetes Market Major Players

The major players in the type 2 diabetes market are Novo Nordisk A/S, Eli Lilly and Company., Sanofi, Pfizer Inc., Johnson & Johnson Services, Inc., AstraZeneca, Boehringer Ingelheim Pharmaceuticals, Inc., Merck & Co., Inc., Viatris Inc., and Teva Pharmaceutical Industries Ltd., among others.

Key Development

In April 2025, Eli Lilly and Company announced that its investigational drug orforglipron has shown positive results in phase 3 clinical trials, which are evaluating safety and efficacy in type 2 diabetes patients. Orforglipron is the first oral glucagon-like peptide-1 (GLP-1) receptor agonist, which is taken once daily without any food or water restrictions. In the phase 3 trials, Orforglipron 12 mg has reduced 1.6% A1C from a baseline of 8.0%.

In April 2025, FDA Approves Generic Liraglutide for Type 2 Diabetes has announced that the U.S. Food and Drug Administration (FDA) has approved its generic version of Victoza (liraglutide) for Type 2 Diabetes.

Market Scope

Metrics | Details | |

CAGR | 8.2% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Drug Type | Dipeptidyl-Peptidase 4 (DPP-4) Inhibitors, Alpha-glucosidase Inhibitors, Glucagon-Like Peptide-1 (GLP-1) Receptor Agonists, Sodium-glucose Transporter 2 (SGLT2) Inhibitors, Meglitinides, Sulfonylureas, Thiazolidinediones, Biguanides (Metformin), and Others |

Gender | Male and Female | |

Route of Administration | Oral and Parenteral | |

By Distribution Channel | Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |