Overview

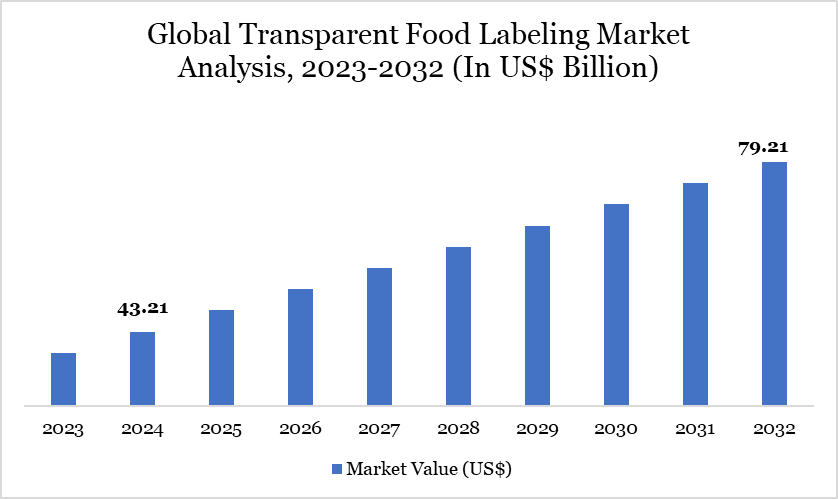

Global transparent food labeling market size reached US$ 43.21 billion in 2024 and is expected to reach US$ 79.21 billion by 2032, growing with a CAGR of 7.87% during the forecast period 2025-2032.

The transparent food labeling market is undergoing significant transformation, propelled by technological advancements and evolving regulatory landscapes. In the US, the Food and Drug Administration (FDA) has proposed new regulations mandating front-of-package (FOP) nutrition labels that categorize key nutrients like added sugars, saturated fats and sodium as "low," "medium," or "high." This initiative aims to assist consumers in making healthier dietary choices and encourage manufacturers to reformulate products to meet healthier standards.

In the UK, industry leaders are advocating for mandatory health ratings on food products. Stéfan Descheemaeker, CEO of Nomad Foods, has called on the government to enforce front-of-pack traffic light labels and require annual reports from companies on the nutritional profile of their sales. This push aims to aid consumers in making healthier dietary choices and drive manufacturers to improve product formulations.

Transparent Food Labeling Market Trend

A notable trend in the transparent food labeling market is the increasing adoption of digital tools to enhance consumer engagement. For instance, the SmartLabel initiative in the US allows consumers to access detailed product information by scanning QR codes on packaging. This approach caters to the growing demand for transparency and enables consumers to make informed choices based on comprehensive product data.

Market Scope

| Metrics | Details |

| By Label Type | Nutritional Labels, Allergen Labels, GMO Labels, Smart Labels and Others |

| By Technology | Sensing Labels, Radio-Frequency Identification (RFID), Dynamic Display Labels, QR Codes and NFC Tags and Others |

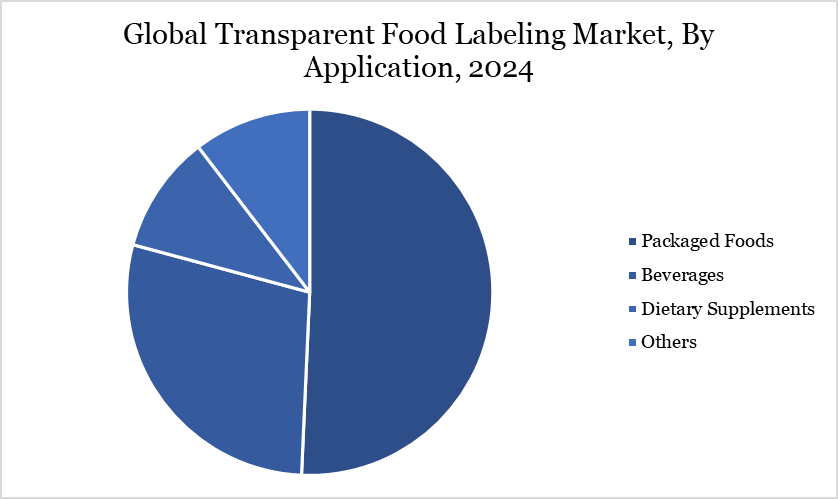

| By Application | Packaged Foods, Beverages, Dietary Supplements and Others |

| By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Dynamics

Integration of Augmented Reality (AR) in Food Packaging for Interactive Labeling

The integration of Augmented Reality (AR) in food packaging is emerging as a key driver in the transparent food labeling market by offering consumers interactive and immersive access to product information. AR-enabled labels allow users to scan packaging with their smartphones to view detailed content about sourcing, nutrition, sustainability practices and even recipe suggestions. This technology aligns with increasing demands for transparency and digital engagement, especially among tech-savvy consumers.

According to the US Department of Commerce's National Telecommunications and Information Administration (NTIA), over 85% of US households had smartphone internet access as of 2022, enabling widespread potential use of AR features. Additionally, pilot initiatives supported by the US Department of Agriculture (USDA) through its Smart Agriculture programs encourage digital innovations, including AR, to enhance traceability and consumer communication. As brands explore AR to differentiate products and foster trust, the transparent food labeling market is expected to benefit from this immersive, consumer-centric shift.

High Cost and Limited Standardization of Digital Labeling Infrastructure

The transparent food labeling market faces a significant restraint due to the high costs and lack of standardization in digital labeling infrastructure. Implementing advanced technologies such as QR codes, RFID tags and blockchain for traceability demands substantial investment in hardware, software and employee training—often challenging for small and medium food enterprises. According to a US Department of Agriculture (USDA) report, only 32% of small food processors in the US had adopted digital traceability solutions as of 2023, primarily due to financial and technical barriers.

Moreover, there is no unified global standard for digital food labeling, creating interoperability issues across markets. This fragmentation makes it difficult for exporters and multinational brands to implement a single labeling system, resulting in increased compliance costs and operational inefficiencies. Without broader government-supported infrastructure or harmonized regulatory frameworks, the widespread adoption of transparent digital labeling remains constrained, especially in developing markets.

Segment Analysis

The global transparent food labeling market is segmented based label type, technology, application and region.

Packaged Foods-Based Segment Driving Transparent Food Labeling Market

The demand for transparent food labeling in the packaged foods sector is experiencing significant growth, driven by increasing consumer awareness and evolving regulatory frameworks. In the US, the Food and Drug Administration (FDA) has proposed regulations requiring front-of-package (FOP) nutrition labels that indicate levels of key nutrients like added sugars, saturated fats and sodium. These labels aim to help consumers make healthier choices and encourage manufacturers to reformulate products to meet healthier standards.

Similarly, in India, the Food Safety and Standards Authority of India (FSSAI) has implemented guidelines mandating clear labeling of packaged foods, including information on nutritional content and allergens. These regulations are designed to enhance consumer awareness and ensure that individuals can make informed dietary choices.

Consumer demand is also influencing the market, with a growing preference for products that provide transparent and easily understandable nutritional information. This trend is particularly evident among younger demographics, such as Millennials and Generation Z, who prioritize health and wellness in their purchasing decisions. Manufacturers are responding by adopting clearer labeling practices and utilizing digital tools like QR codes to provide detailed product information.

Geographical Penetration

Rising Consumer Awareness and Regulatory Push in North America

The demand for transparent food labeling in North America is experiencing significant growth, driven by heightened consumer awareness and evolving regulatory frameworks. A 2023 survey by the International Food Information Council (IFIC) revealed that 63% of US consumers actively seek detailed nutritional information when shopping, underscoring a strong preference for clarity in food labeling.

In response to these consumer demands, the US Food and Drug Administration (FDA) has proposed regulations mandating front-of-package (FOP) nutrition labels. These labels aim to provide clear indicators of key nutrients like added sugars, saturated fats and sodium, categorized as "low," "medium," or "high." The initiative is part of a broader effort to combat diet-related health issues, including obesity and heart disease.

Generational shifts further influence the market dynamics. Millennials and Generation Z consumers prioritize transparency and simplicity in food ingredients. A 2024 NielsenIQ study found that 72% of Gen Z shoppers are willing to pay more for products they perceive as healthier, with clear labeling playing a pivotal role in their purchasing decisions.

Technological Analysis

Technological innovations are reshaping the transparent food labeling market by enhancing data integrity, consumer trust and supply chain transparency. One of the leading advancements is the integration of blockchain technology, which enables secure and tamper-proof tracking of food products from origin to shelf. For instance, the US Food and Drug Administration (FDA) launched the “New Era of Smarter Food Safety” initiative, encouraging the use of blockchain for traceability. This ensures quick responses to contamination incidents and builds consumer confidence in food safety.

The deployment of Internet of Things (IoT) devices and smart sensors allows for real-time monitoring of storage conditions such as temperature and humidity. These tools help ensure product quality and reduce spoilage throughout the supply chain. According to the US Department of Agriculture (USDA), over 70% of large food producers in the US have adopted IoT for supply chain monitoring. This enhances transparency and supports compliance with food safety regulations.

Competitive Landscape

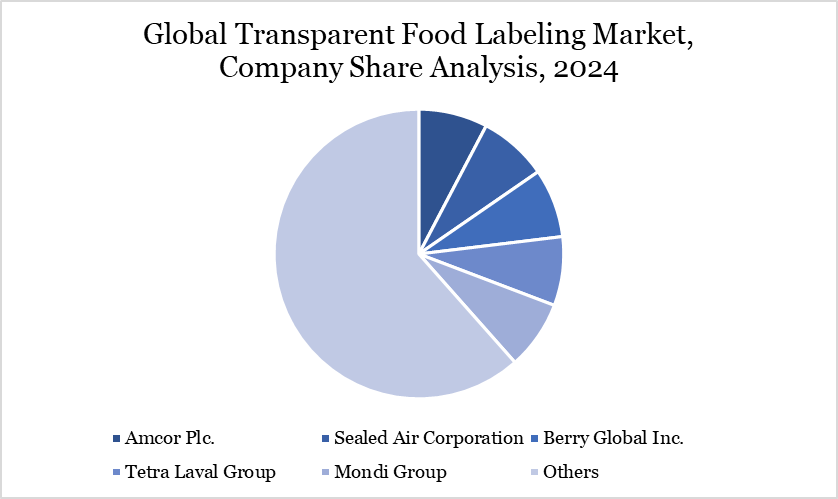

The major global players in the market include Amcor Plc., Sealed Air Corporation, Berry Global Inc., Tetra Laval Group, Mondi Group, Toyo Seikan Group Holdings, Ltd., Crown Holdings, Inc., 3M Company, Timestrip UK Ltd. and Mitsubishi Gas Chemical Company, Inc.

Key Developments

- In February 2023, Henry Dimbleby's National Food Strategy aimed to provide an independent review as to how to transform our food system and ensure it is fit for the future. The government has responded to one of its key recommendations with the formation of the Food Data Transparency Partnership (FDTP). This transformational, multi-year partnership between government, industry, academia and civil society, aims to improve the availability, accessibility and policy-use of data across key health, animal welfare and sustainability metrics.

- In September 2021, Label Insight, a NielsenIQ company and the leader in powering product-attribute-driven growth across the consumer-packaged goods (CPG) ecosystem and FARE, the largest private funder dedicated to food allergy research and education, announced a partnership to further empower people living with food allergies and intolerances by providing them with transparent food product information to gain additional control when shopping for food and beverages.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Suggestions for Related Report