Torque Vectoring Market Size

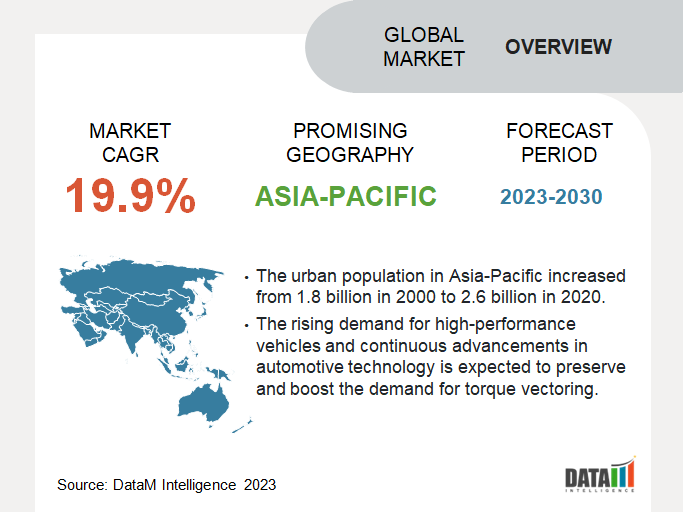

Global Torque Vectoring Market reached USD 8.9 billion in 2022 and is expected to reach USD 14.8 billion by 2030, growing with a CAGR of 19.9% during the forecast period 2023-2030. The global torque vectoring market is experiencing significant growth and transformation, driven by the increasing demand for enhanced vehicle performance, safety, and efficiency.

Torque vectoring technology enhances vehicle stability during cornering by mitigating understeer and oversteer tendencies. As automotive manufacturers continue to innovate and introduce advanced technologies, torque vectoring will play a vital role in shaping the future of the automotive industry. With its wide-ranging applications and potential for improving driving experiences, torque vectoring is set to become a key feature in the vehicles of tomorrow.

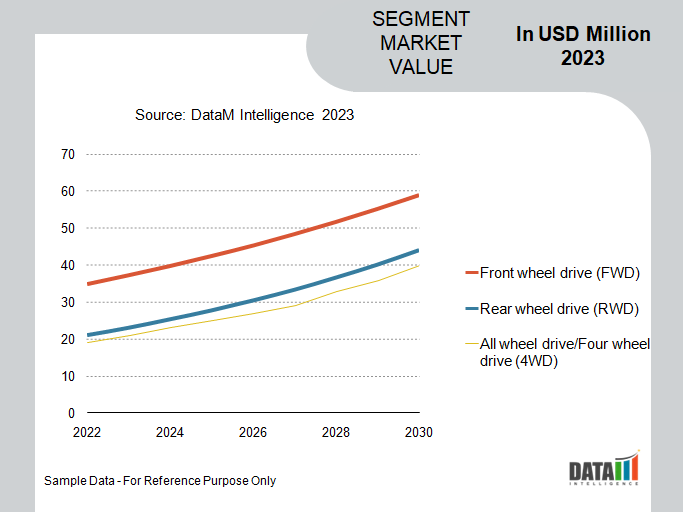

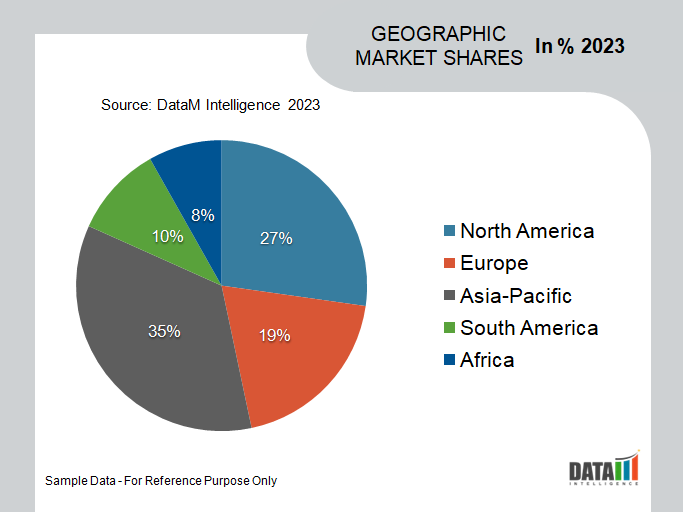

The front-wheel drive leads the vehicle type segment in the global torque vectoring market, accounting for more than half of the market share. The respective segment has experienced rapid growth due to the numerous benefits that torque vectoring technology brings, including improved handling, stability, and overall performance. Similarly, the Asia-Pacific region dominates the torque vectoring market, capturing the largest market share of over one-third. The region's dominance is attributed to the rising demand for high-performance vehicles and continuous advancements in automotive technology.

Torque Vectoring Market Scope

| Metrics | Details |

| CAGR | 19.9% |

| Size Available for Years | 2021-2030 |

| Forecast Period | 2023-2030 |

| Data Availability | Value (US$) |

| Segments Covered | Vehicle Type, Propulsion, Clutch Actuation, Technology and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | Asia-Pacific |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To Know More Insights - Download Sample

Torque Vectoring Market Dynamics

Growing Demand for Electric All-Wheel Drive (eAWD) Systems and Stringent Emission and Fuel Efficiency Regulations

Electric All-Wheel Drive (eAWD) systems are gaining popularity among consumers due to their ability to improve traction and stability on challenging terrains. Torque vectoring is a fundamental technology used in eAWD systems to optimize torque distribution among all wheels, providing enhanced off-road capabilities and superior performance.

According to the China Association of Automobile Manufacturers (CAAM), the number of electric vehicles equipped with eAWD systems in China increased by approximately 40% between 2018 and 2020. The respective fact indicates a growing market for torque vectoring technology in eAWD systems.

Government authorities around the world are actively implementing stringent emission and fuel efficiency regulations to address environmental concerns. Torque vectoring technology can significantly contribute to improving vehicle fuel efficiency by optimizing power distribution and minimizing energy wastage during cornering and acceleration.

The United Nations Framework Convention on Climate Change (UNFCCC) estimates that global greenhouse gas emissions from the transportation sector increased by 5% between 2018 and 2020. As governments intensify their efforts to combat climate change, automakers are under increased pressure to adopt technologies like torque vectoring to achieve higher fuel efficiency and reduce emissions.

Improving Vehicle Safety and Stability and Growing Interest in Autonomous Driving

Ensuring vehicle safety is a top priority for both consumers and regulatory bodies globally. Torque vectoring enhances vehicle stability and control, especially during challenging road conditions or emergency maneuvers. By adjusting the torque distribution between the wheels, the technology minimizes the risk of oversteering and understeering, thus improving vehicle stability and preventing accidents.

According to the National Highway Traffic Safety Administration (NHTSA), there was a 12% reduction in the number of traffic fatalities in U.S. from 2018 to 2020. The respective positive trend is attributed to the increasing implementation of advanced safety technologies like torque vectoring in modern vehicles.

Moreover, the global automotive industry is witnessing an increased interest in autonomous driving technologies. Torque vectoring systems can be integrated into advanced driver-assistance systems (ADAS) to enhance the capabilities of autonomous vehicles. By providing precise control over the power distribution to each wheel, torque vectoring technology ensures smooth and stable maneuvering, crucial for autonomous vehicles to navigate complex road scenarios.

The International Energy Agency (IEA) reports that the number of electric and autonomous vehicles is expected to increase by approximately 36% between 2020 and 2022. As the autonomous vehicle market expands, the demand for torque vectoring technology is also expected to grow.

Stringent Government Regulations and Technological Limitations

One of the significant restraints faced by the torque vectoring market is the stringent government regulations about emissions and fuel efficiency. Various governments worldwide have imposed strict emission standards to curb environmental pollution and promote sustainable practices. The respective fact has prompted automotive manufacturers to prioritize fuel efficiency, which might affect the adoption of torque vectoring systems due to their added weight and complexity. According to the United States Environmental Protection Agency (EPA), the average fuel economy standard for passenger cars in U.S. is set at 36.7 miles per gallon (mpg) for the year 2022, and this figure is expected to rise in subsequent years.

Similarly, the success of torque vectoring systems relies heavily on advanced sensors, software algorithms, and precise control mechanisms. Any limitations in these technologies could impact the efficiency and effectiveness of torque vectoring systems, creating a challenge for their widespread adoption. For instance, adverse weather conditions, such as heavy rain or snow, can affect the performance of sensors used in torque vectoring systems. If torque vectoring systems fail to function optimally under such conditions, it might raise safety concerns, hindering market growth.

Torque Vectoring Market Segment Analysis

The global torque vectoring market is segmented based on vehicle type, propulsion, clutch actuation, technology and region.

The Growing Focus on Reducing Carbon Emissions and Promoting Fuel Efficiency

The growing focus on reducing carbon emissions and promoting fuel efficiency has led governments around the globe to implement stringent regulations in the automotive sector. These regulations encourage the adoption of advanced technologies like torque vectoring to enhance vehicle efficiency and reduce environmental impact. The surge in the popularity of sports and performance vehicles has been a significant driver for the adoption of torque vectoring technology. As a result, manufacturers are equipping front-wheel drive sports cars and high-performance vehicles with torque vectoring systems to enhance agility and driving dynamics.

Front-wheel drive vehicles dominate the automotive market, comprising a substantial share of passenger cars and entry-level SUVs. As the popularity of torque vectoring grows, the front-wheel drive segment has seen a significant rise in adopting this technology. According to data from the National Highway Traffic Safety Administration (NHTSA), the front-wheel drive segment constitutes approximately 60% of the total passenger car market in U.S. As torque vectoring systems become more prevalent in the automotive industry, this segment is expected to experience substantial growth.

Global Torque Vectoring Market Geographical Share

Benefits of Torque Vectoring in Improving Vehicle Safety and Environmental Sustainability

Governments in the Asia-Pacific region have recognized the potential benefits of torque vectoring in improving vehicle safety and environmental sustainability. Government support and initiatives have played a pivotal role in promoting the adoption of torque vectoring systems, as countries across the region focus on enhancing road safety and reducing carbon emissions. With market statistics indicating robust growth rates in the adoption of torque vectoring technology, the Asia-Pacific region is poised to lead the global automotive industry's transformation. Collaborations and investments by automotive companies and technology providers further reinforce the region's potential in shaping the future of the torque vectoring market.

According to the Japan Automobile Manufacturers Association (JAMA), the number of vehicles equipped with torque vectoring systems in Japan increased by 18% in the past year. The surge can be attributed to the growing awareness and demand for enhanced vehicle performance and safety features among Japanese consumers. In China, the sales of electric vehicles with torque vectoring technology have tripled in the last two years. The significant growth reflects the country's commitment to promoting the adoption of advanced automotive technologies to address environmental concerns and improve road safety.

Torque Vectoring Market Companies

The major global players in the market include GKN and American Axle, Dana, BorgWarner, Eaton, ZF, JTEKT, Magna, Bosch and Univance.

COVID-19 Impact on Torque Vectoring Market

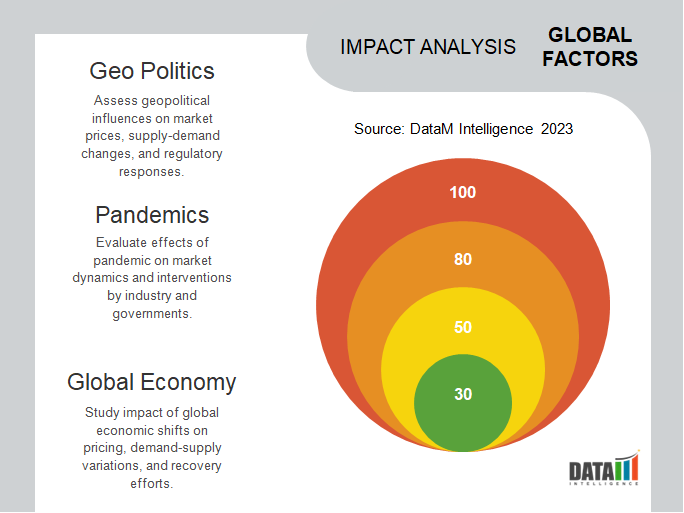

The COVID-19 pandemic has presented unprecedented challenges to the automotive industry, impacting the demand and growth of torque vectoring systems. As governments implemented lockdown measures and travel restrictions, automotive manufacturers faced reduced sales and temporary closures of production facilities. According to government statistics, global vehicle sales experienced a significant decline during the pandemic, with some regions reporting a year-on-year decrease of over 20%. While the market experienced setbacks during the pandemic, government support and the industry's resilience have paved the way for recovery.

As vaccination efforts intensified and COVID-19 cases started to decline, the automotive industry gradually began to recover. Governments' efforts to restore economic activities and lift travel restrictions contributed to the revival of vehicle sales. Amid the recovery, automotive manufacturers have continued their commitment to research and development, focusing on innovative technologies like torque vectoring to meet future emission standards and customer demands for enhanced driving experiences. By leveraging government support, investing in research and development, and embracing technological advancements, the global torque vectoring market can overcome the pandemic's impact and thrive in the post-COVID era.

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Propulsion

- Front-wheel drive (FWD)

- Rear-wheel drive (RWD)

- All-wheel drive/Four wheel drive (4WD)

By Clutch Actuation

- Hydraulic

- Electronic

By Technology

- Active Torque Vectoring System

- Passive Torque Vectoring System

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In 2021, Bosch introduced its new torque vectoring system, which incorporates advanced sensors and control units to precisely manage the distribution of torque between the wheels. The system is designed to optimize vehicle traction and stability, especially during challenging driving conditions and tight cornering. Bosch's torque vectoring system aims to improve vehicle dynamics and safety, making it an attractive choice for automakers seeking to enhance the performance of their vehicles.

- In 2020, ZF unveiled its Gen 3 eTB (Electric Twist Beam) system, which integrates an electric motor into the rear axle of electric and hybrid vehicles. The eTB system enables torque vectoring capabilities, allowing for precise control of each wheel's power output. ZF's innovative eTB system addresses the growing demand for eco-friendly and high-performance electric vehicles, contributing to the growth of the torque vectoring market in the electric vehicle segment.

- In 2021, GKN Automotive, a renowned driveline systems supplier, launched its Twinster torque vectoring technology in the market. The system is designed for all-wheel-drive applications and offers precise and instantaneous control of torque distribution between the front and rear axles. The Twinster technology enhances vehicle stability and cornering performance, providing drivers with a dynamic and engaging driving experience. GKN Automotive's Twinster torque vectoring system has garnered interest from various automakers and is anticipated to drive market growth in the all-wheel-drive vehicle segment.

Why Purchase the Report?

- To visualize the global torque vectoring market segmentation based on vehicle type, propulsion, clutch actuation, technology and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of torque vectoring market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global torque vectoring market report would provide approximately 64tables, 69figures and 192 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies