Testosterone Replacement Therapy Market Size& Industry Outlook

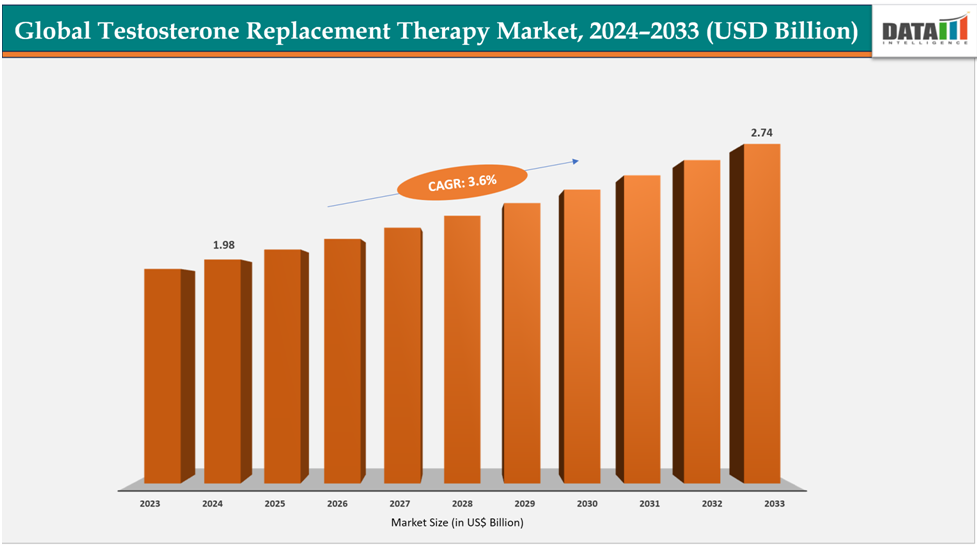

The global testosterone replacement therapy market size was US$1.98Billion in 2024 and is expected to reach US$2.74Billion by 2033, growing at a CAGR of3.6%during the forecast period 2025-2033.

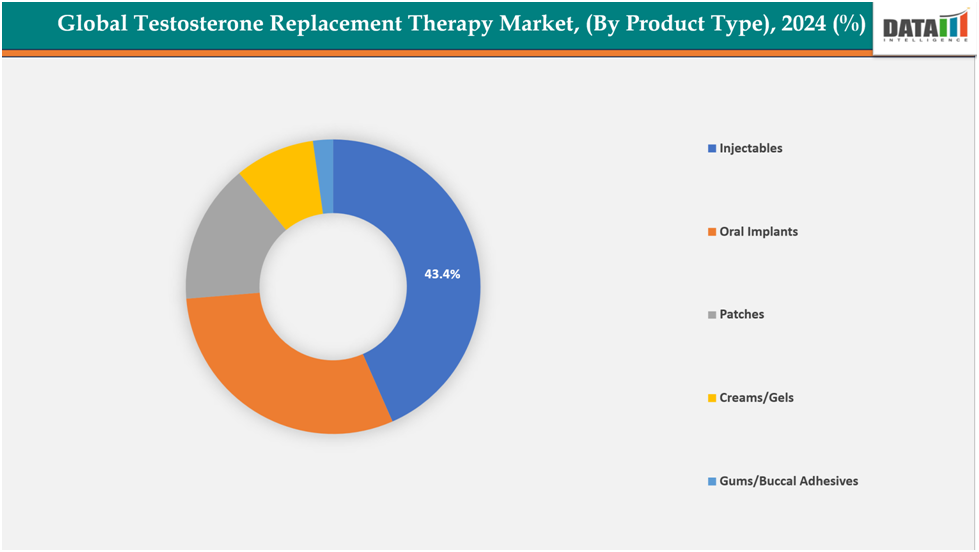

The expansion of the testosterone replacement therapy (TRT) market is being greatly boosted by the variety of product offerings and the approval of new formulations by regulatory agencies. Pharmaceutical companies are launching various delivery methods, such as injectables, gels, patches, and oral options, to cater to patient preferences and improve adherence. The approvals given by regulatory organizations like the FDA and EMA for innovative and long-acting testosterone formulations have also contributed to market growth. These developments improve treatment effectiveness, minimize side effects, and provide more convenient dosing alternatives.

Key Highlights

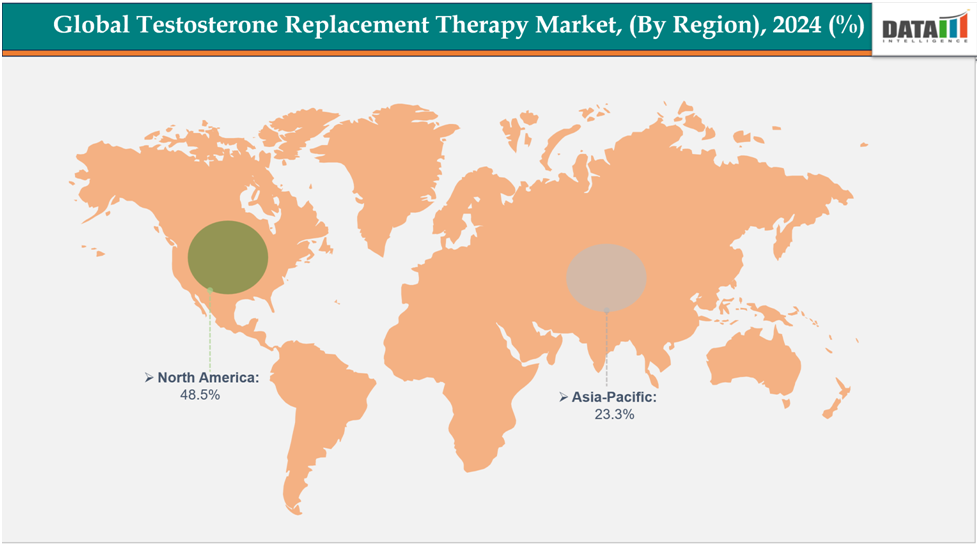

- North America is dominating the global testosterone replacement therapy market with the largest revenue share of 48.5% in 2024.

- The Asia Pacific region is the fastest-growing region in the global testosterone replacement therapy market, with a CAGR of 7.7% in 2024.

- The injectables segment is dominating the testosterone replacement therapy market with a 43.4% share in 2024

- The testosterone cypionate segment is dominating the testosterone replacement therapy market with a 40.2% share in 2024

- Top companies in the testosterone replacement therapy market include AbbVie Inc., Besins Healthcare, Inc., Endo Pharmaceuticals Inc., Pfizer Inc., Grünenthal, Tentamus, Antares Pharma, Inc., Tolmar, Inc., Verity Pharmaceuticals Inc., Marius, and Upsher-Smith Laboratories, LLC. among others.

Market Dynamics

Drivers:

An aging population and rising hypogonadism diagnosis are accelerating the growth of the testosterone replacement therapy market

As the world's population grows older, the prevalence of testosterone deficiency, especially in men over 40, is on the rise. Aging inherently decreases testosterone production, which can lead to issues such as fatigue, loss of muscle mass, and reduced sexual desire. Enhanced awareness and advanced diagnostic methods have contributed to the earlier and more precise identification of hypogonadism, leading to increased rates of treatment adoption. Healthcare professionals are more frequently recommending testosterone replacement therapy to address age-related hormonal decline and enhance overall quality of life.

Owing to the factors like prevalence, according to the World Health Organization, by 2030, one in six individuals globally will be aged 60 or older. At that time, the proportion of the population who are 60 years and above will rise from 1 billion in 2020 to 1.4 billion. By 2050, the global population of those aged 60 and older will increase to 2.1 billion. Additionally, the number of individuals aged 80 years and above is projected to triple from 2020 to 2050, reaching 426 million.

Misuse and off-label demand are hampering the growth of the testosterone replacement therapy market

The inappropriate and unapproved use of testosterone replacement therapy (TRT) is hindering market expansion by presenting regulatory, ethical, and safety issues. Numerous people utilize testosterone products for non-medical reasons, such as bodybuilding, enhancing athletic performance, or combating aging, often without adequate medical oversight.

Additionally, this improper use frequently results in negative health consequences and heightened attention from regulatory agencies such as the FDA and EMA. Consequently, more stringent prescribing protocols and monitoring obligations have been established, discouraging doctors from starting treatment for borderline or mild cases of hypogonadism. For instance, in February 2025, the FDA implemented class-wide labeling changes for testosterone products after reviewing TRAVERSE trial findings and postmarked ABPM studies, reinforcing safety updates and clarifying approved therapeutic use to minimize misuse and ensure evidence-based prescribing practices.

For more details on this report, see Request for Sample

Testosterone Replacement Therapy Market, Segmentation Analysis

The global testosterone replacement therapy market is segmented based on product type, active ingredient type, indication, distribution channel, and region

By Product Type:

The injectables segment is dominating the testosterone replacement therapy market with a 43.4% share in 2024

The injectable segment leads the testosterone replacement therapy (TRT) market due to its established effectiveness, extended action duration, and cost efficiency compared to other delivery methods. Injectable options like testosterone cypionate, enanthate, and undecanoate maintain stable hormone levels, which lessens the dosing frequency and enhances patient adherence. Doctors favor injectables due to their reliable pharmacokinetics and capacity to maintain steady serum testosterone levels.

Furthermore, ongoing research and development, along with the approval of new injectable drugs, enhance the prominence of this segment. For instance, in December 2024, Azurity Pharmaceuticals announced the launch of Azmiro, the first and only FDA-approved prefilled testosterone cypionate injection. The product was introduced as an androgen therapy for males with testosterone deficiency, enhancing treatment convenience and precision in testosterone replacement therapy administration.

By Active Ingredient Type:

The testosterone cypionate segment is dominating the testosterone replacement therapy market with a 40.2% share in 2024

The testosterone cypionate segment leads the global testosterone replacement therapy market due to its established effectiveness, long-lasting characteristics, and broad acceptance among physicians. This injectable option provides consistent testosterone levels with less frequent administration, which enhances patient adherence in contrast to short-acting alternatives.

Furthermore, its affordability and widespread availability in both branded and generic forms with necessary approvals contribute to its increased use in both developed and emerging markets. For instance, in April 2023, Xiromed LLC received FDA approval for its Abbreviated New Drug Application (ANDA) for Testosterone Cypionate Injection, USP, the generic equivalent of Depo-Testosterone, and subsequently launched the product, expanding access to affordable testosterone replacement therapy options.

Geographical Analysis

North America is dominating the global testosterone replacement therapy market with 48.5% in 2024

North America leads the global testosterone replacement therapy market owing to a significant incidence of hypogonadism, well-developed healthcare systems, and the strong presence of major companies like AbbVie, Pfizer, and Endo Pharmaceuticals. The region’s dominance is further bolstered by advantageous reimbursement policies and the swift acceptance of new formulations.

In the United States, the market for testosterone replacement therapy has grown due to recent FDA approvals, new formulations, and improved management of testosterone deficiency disorders. For instance, in October 2023, Eugia Pharma received FDA approval for its Testosterone Cypionate Injection, USP, in multiple and single-dose vial strengths, enhancing its injectable therapy portfolio for treating testosterone deficiency in adult males.

Europe is the second region after North America, which is expected to dominate the global testosterone replacement therapy market with34.5% in 2024

The market for testosterone replacement therapy in Europe has grown due to recent approvals from the EU and EMA, along with the introduction of new products, fueled by continuous clinical research, strategic partnerships, and technological progress. These advancements have improved treatment availability, expanded therapeutic choices, and hastened the implementation of innovative formulations within the region's sophisticated healthcare systems.

Owing to the factors like the recent EU and EMA approvals and new product launches. For instance, in September 2024, EVER Pharma received EU approval for its testosterone enantate formulation to treat male hypogonadism, a condition affecting up to 10% of men globally and nearly 40% of men over 45.

The Asia-Pacific region is the fastest-growing region in the global testosterone replacement therapy market, with a CAGR of 7.7% in 2024

The testosterone replacement therapy market in the Asia-Pacific area is growing rapidly, fueled by the increasing occurrence of hypogonadism, heightened awareness of men's health issues, enhancements in healthcare infrastructure, and favourable government measures. The rising use of advanced formulations in nations such as China, Japan, South Korea, and India also propels the expansion of the market.

Market Competitive Landscape

Top companies in the testosterone replacement therapy market include AbbVie Inc., Besins Healthcare, Inc., Endo Pharmaceuticals Inc., Pfizer Inc., Grünenthal, Tentamus, Antares Pharma, Inc., Tolmar, Inc., Verity Pharmaceuticals Inc., Marius, and Upsher-Smith Laboratories, LLC. among others.

AbbVie Inc.: AbbVie Inc. is a leading biopharmaceutical company recognized for its flagship testosterone replacement therapy product Andro Gel, a topical testosterone gel used to treat male hypogonadism. The company has played a pivotal role in shaping the TRT market through innovation, clinical research, and global commercialization, maintaining a strong market presence despite increasing generic competition and evolving regulatory environments.

Key Developments:

- In June 2025, ADVANZ PHARMA Holdco Limited completed the acquisition of commercial rights to Testoviron from Bayer for Europe and selected markets in Latin America, the Middle East & Africa, and Asia-Pacific, strengthening its global presence in testosterone replacement and specialty pharmaceutical segments.

- In March 2025, Marius Pharmaceuticals announced that the U.S. FDA approved major labeling changes for KYZATREX (testosterone undecanoate) capsules, removing the black box warning after results from the TRAVERSE trial and blood pressure studies, representing a landmark advancement in testosterone replacement therapy safety and regulation.

Market Scope

| Metrics | Details | |

| CAGR | 3.6% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Product Type | Injectables, Oral Implants, Patches, Creams/Gels, Gums/Buccal Adhesives |

| By Active Ingredient Type | Testosterone Cypionate, Testosterone, Methyl Testosterone, Testosterone Undecanoate, Testosterone Enanthate | |

| By Indication | Hypogonadism, Autoimmune Conditions, Genetic Disorders, and Others | |

| By Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global testosterone replacement therapy market report delivers a detailed analysis with 73 key tables, more than 68visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more Women's and Male Health-related reports, please click here