Swarm Drones System Market Size

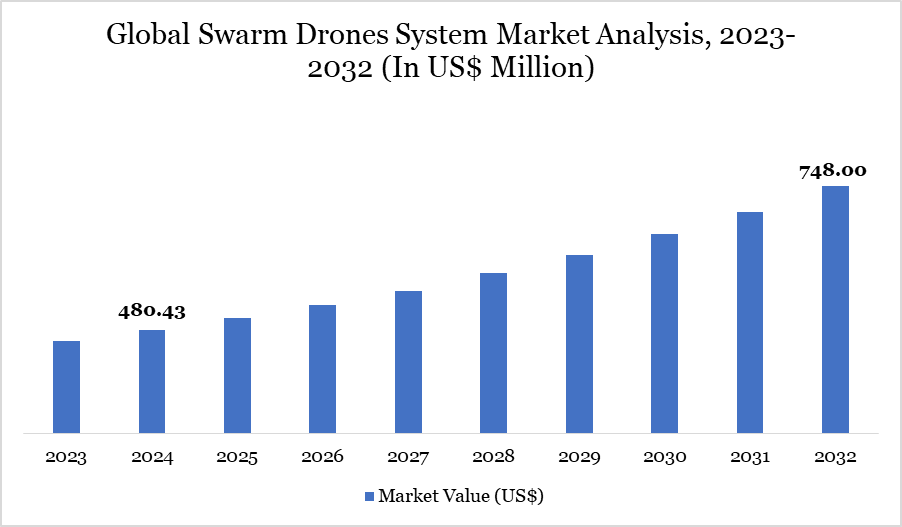

Global Swarm Drones System Market size reached US$ 480.43 million in 2024 and is expected to reach US$ 748.00 million by 2032, growing with a CAGR of 5.69 % during the forecast period 2025-2032.

Rising geopolitical tensions, the need for more affordable military capabilities and the quick development of AI-enabled automation are all driving significant changes in the swarm drone systems market. According to the US Government Accountability Office, swarm drones are coordinated networks of three or more uncrewed aerial systems (UAS) that use decentralized intelligence to function with little human supervision.

A significant milestone has been reached with the Swedish Armed Forces' 2025 introduction of Saab's software, which can control 100 drones. The Arctic Strike Exercise is scheduled for March 2025 for practical testing. Military giants around the world are making significant investments in swarm initiatives, including Germany's KITU 2 project, China's 10-ton Jiu Tian mothership UAV and the US Replicator initiative, which will get $500 million in FY 2024. The growing use of swarm intelligence, especially for defense, payload delivery and reconnaissance in high-threat situations, is expected to propel the market's growth and transform tactical and strategic military doctrines.

Swarm Drones System Market Trend

Swarm drones have become a key technology trend as the military and defense industries adopt low-cost, high-efficiency solutions. Swarms are now essential on contemporary battlefields due to their improved capacity to navigate intricate, GPS-denied settings thanks to the integration of artificial intelligence and machine learning.

The global competition for superiority in swarm drones is demonstrated by China's 2024 Jiu Tian UAV and the Pentagon's Replicator project. Notably, the UK's MMDS architectural trials and Germany's Quantum Systems both leverage AI-driven autonomous collaboration, indicating a paradigm shift towards multi-domain operational integration. Furthermore, military planning is changing as a result of drone swarms' use in reconnaissance, force multiplication and saturation attacks.

AI was named as the primary trend impacting swarm growth in 2024 and beyond in the Commercial UAV News study published in late 2023. These technology trends show a significant push toward dynamic, real-time swarm coordination with greater autonomy and decision-making accuracy, whether through suicide drones, combat intelligence fusion or autonomous load distribution.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

| By Type | Loitering Munitions, Reconnaissance Drones, Combat Drones, Others | |

| By Model | Fixed-Wing, Rotary-Wing, Hybrid | |

| By Capability | Autonomous, Semi-Autonomous, Remote Controlled | |

| By Application | Military and Defense, Commercial, Industrial, Emergency Services, Others | |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Global Swarm Drones System Market Dynamics

Tactical superiority at a fraction cost

The demand for swarm drone systems is primarily driven by their unmatched tactical superiority and cost-effectiveness. Each unit of conventional military hardware, such as Tomahawk missiles or HIMARS, costs millions of dollars. On the other hand, drone swarms provide a low-cost, scalable substitute that can carry out electronic warfare, surveillance and coordinated attacks for a fraction of the cost. Their expendability improves mission resilience, particularly in situations where attrition is significant.

For instance, the US has made a strategic shift by allocating US$ 500 million in its 2024 defense budget to the deployment of low-cost autonomous drones by August 2025. Because of its adaptability, the swarm can coordinate air, sea and land operations with little assistance from humans. Furthermore, single-operator supervision for numerous UAVs is made possible via real-time communication, adaptive AI and decentralized control systems, such as Germany's Fortion Joint C2 system.

Complex Interoperability and Counter-Swarm Threats

Swarm drone systems have significant limitations despite their benefits. The most significant of these is the technological complexity needed for cross-platform interoperability and real-time autonomous coordination. Swarm intelligence mimics biological systems, but it takes advanced AI, machine learning and resilient network topologies like the US ORIENT framework to adapt such behavior in unexpected combat contexts.

Communication in situations where GPS is blocked or where there is electronic jamming is still a major challenge. Furthermore, the necessity for efficient counter-swarm systems is highlighted by new dangers posed by hostile swarm technologies, such as Turkiye's Kargu-2 swarms and China's suicide drone formations. These have to eliminate numerous swifts, independent threats with no collateral damage.

Joint operational deployment is further hampered by ally forces' lack of a common architecture and communication standards. Furthermore, drone swarms may be vulnerable to cybersecurity threats due to their heavy reliance on cloud integration and data processing infrastructure, which makes safe control and resilience essential for market scalability.

Swarm Drones System Market Segment Analysis

The global swarm drones system market is segmented based on type, model, capability, application and region.

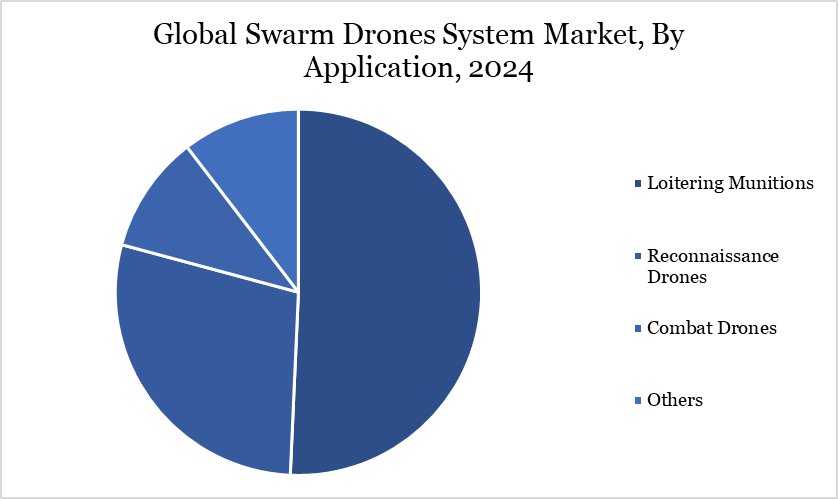

Loitering Munitions Driving Swarm Drone Market Growth Through AI Integration and Tactical Flexibility

Loitering munitions have become the market leader for swarm drone systems due to the growing demand for affordable and flexible defense solutions worldwide. These devices, sometimes known as "suicide drones," are perfect for handling contemporary warfare situations, including border skirmishes, asymmetric conflicts and counterterrorism, because they combine precision striking capabilities with real-time observation. Their unrivaled tactical versatility comes from their capacity to hover over a target region before striking.

Loitering munitions is being improved by technological developments, especially in the areas of artificial intelligence and sensor integration. Following international humanitarian norms, AI minimizes collateral harm and eliminates the need for direct human intervention by facilitating quick decision-making and precise target identification. In dynamic combat conditions, enhanced sensors also help to improve situational awareness.

Recent events, including AeroVironment's US$ 54.9 million deal with the US Army for its Switchblade systems, highlight the strategic importance of loitering bombs and demonstrate the market's strong military adoption and ongoing expansion.

Swarm Drones System Market Geographical Share

Growing Military Modernization and Strategic Preparedness in Asia-Pacific Is Driving the Market in the Region

The market for swarm drone systems is expected to grow at a faster rate in the Asia-Pacific area due to rising defense modernization initiatives, tensions across international borders and domestic technological developments. With its Jiu Tian mothership UAV, which was unveiled in November 2024 and can deploy swarms at 560 mph over 1,200 miles, China continues to have a dominant position in the region. This enormous UAV demonstrates China's quick advancement in swarm integration by surpassing the US MQ-9 Reaper in both scale and capability.

Since 2020, Turkiye, which is involved in geopolitics pertaining to Asia, has used the Kargu-2 drone in swarming formations of up to 20 units. India is aggressively investing in counter-swarm technology and developing domestic capabilities for future-proof defense in response to changing threats. Regional stakeholders are changing drone warfare doctrines with a significant emphasis on artificial intelligence and data fusion. Asia-Pacific will emerge as a key hub for the development of swarm drones worldwide as long as it keeps investing in swarm systems for tactical superiority and strategic deterrence.

Technological Analysis

The market for swarm drone systems is centered on technological improvement. Swarm intelligence decentralized, group decision-making based on biological systems like ant colonies or bird flocks is its fundamental component. Modern swarms can reroute missions, avoid obstacles and react to jamming and signal interference without human assistance thanks to advancements in AI and ML.

The operational maturity of such systems is demonstrated by the Perdix System in the US, which has had over 670 units deployed since 2016. Real-time data transmission and cooperative action are guaranteed by new frameworks such as ACT and ORIENT. Secure multi-domain coordination is also emphasized in the UK's MMDS program and Germany's AI-enhanced KITU 2.

Real-time advancements in single-operator design are reflected in Sweden's 2025 Saab system, which will allow for the management of 100 drones. The limits of autonomous warfare are being pushed by these technical advancements. In order to keep swarm drone systems flexible, reliable and mission-resilient in future battle zones, the emphasis has shifted to cloud integration, energy efficiency, miniaturization and cyber-secure networks.

Swarm Drones System Market Major Players

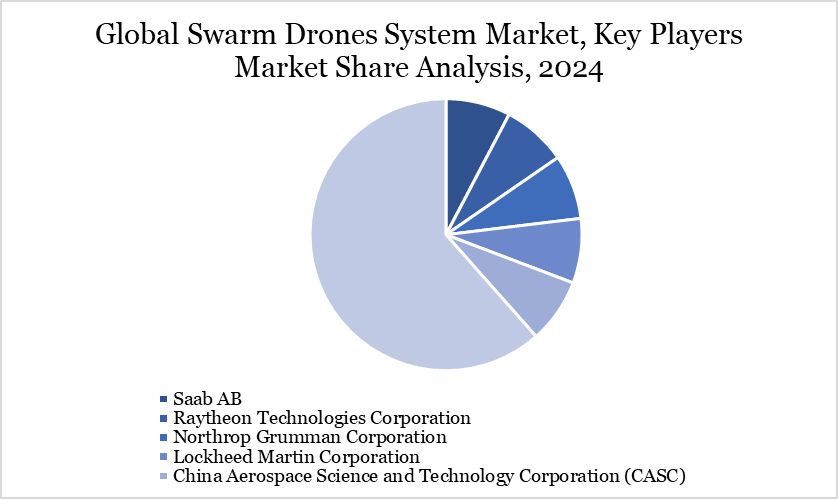

The major global players in the market include Saab AB, Raytheon Technologies Corporation, Northrop Grumman Corporation, Lockheed Martin Corporation, China Aerospace Science and Technology Corporation (CASC), STM Savunma Teknolojileri Mühendislik ve Ticaret A.Ş., Quantum Systems GmbH, Blue Bear Systems Research Ltd., AeroVironment, Inc., BAE Systems plc.

Key Developments

- In February 2023, Exyn Technologies announced they will collaborate with Easy Aerial to introduce their new flagship airframe, the ExynAero EA6, which is tailored for Exyn's various use cases and connected with ExynAI.

- On August 14, 2023, the IAF and Veda Aeronautical Pvt Ltd, a New Delhi-based startup, inked a historic Rs 300 crore deal to manufacture 200 long-range swarm drones for the IAF. The Mehar Baba Swarm Drone competition by the IAF may make this feasible. As part of its efforts to raise the standard of the local drone startup ecosystem, the IAF has demonstrated its steadfast dedication to supporting it with this order. Although these drones, often referred to as kamikaze drones, are intended to be launched in small groups, once in the air, they will band together to attack or defend the targets.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies