Succinic Acid Market Size

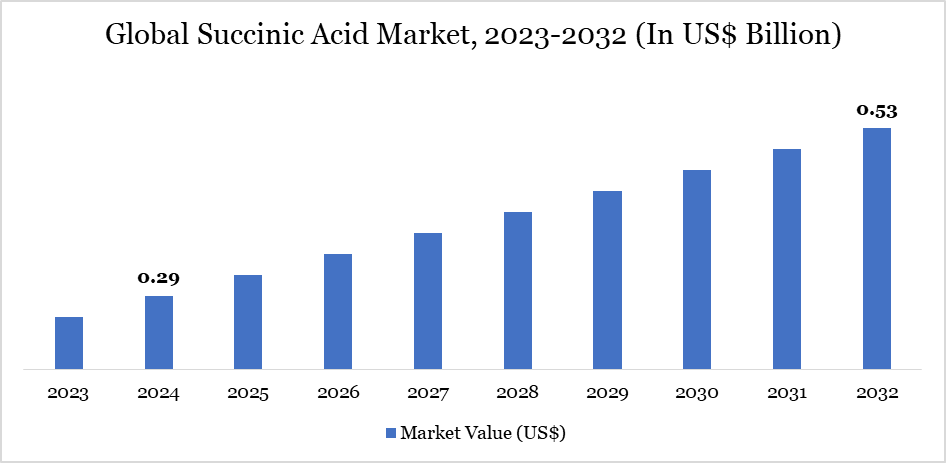

Global Succinic Acid Market reached US$ 0.29 billion in 2024 and is expected to reach US$ 0.53 billion by 2032, growing with a CAGR of 7.76% during the forecast period 2025-2032.

Succinic acid can be used as an acidifier and flavor enhancer in foods such as relishes, beverages and sausages. The potential use of succinic acid as a beginning feedstock for the synthesis of industrial chemicals and consumer items with vast markets sparked the development of bio-based succinic acid production technologies.

Due to its versatility in numerous chemical processes, this product's applications extend beyond products to include the human body. The acid can be applied to the skin to alleviate joint and arthritic discomfort. It greatly helps eliminate any skin scars and reduces the signs of age. Finding alternatives to dangerous chemicals for the environment and human health is becoming increasingly vital as public concern grows.

Succinic Acid Market Trend

A major trend in the worldwide succinic acid market is the growing preference for bio-based succinic acid as a more sustainable option to petroleum-derived succinic acid. Driven by rising environmental concerns and stricter carbon emission restrictions, industries such as packaging, plastics, agriculture and medicines are turning to bio-based succinic acid for its lower carbon footprint and renewable source.

In recent years, Chinese manufacturers and European startups have increased production capacity and invested in R&D to improve yield and cost efficiency. The development is consistent with the larger market drive toward green chemicals, establishing bio-based succinic acid as a critical component in the transition to a circular and sustainable economy.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

| By Type | Trackless Cleaning Robot, Railed Cleaning Robot | |

| By Grade | Dry Cleaning, Wet Cleaning, Others | |

| By End-User | Commercial Places, Power Plants & Industrial, Others | |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Growing Demand from the Bioplastics and Biodegradable Polymers

One of the primary drivers of the global succinic acid market is the growing need for bioplastics and biodegradable polymers. Succinic acid is an important intermediary in the synthesis of polybutylene succinate (PBS), a biodegradable polymer that is commonly used in packaging, agricultural films, disposable items and consumer products. As worldwide restrictions tighten around single-use plastics and environmental sustainability gains popularity, the market for bio-based, compostable alternatives like PBS has experienced a substantial rise.

Countries in the European Union, for example, have imposed tight limits on single-use plastic products, putting pressure on producers to choose environmentally friendly alternatives. This, in turn, emphasizes the importance of bio-based succinic acid as a sustainable building component. Companies investing in PBS manufacturing, such as Showa Denko and Mitsubishi Chemical, are boosting the upstream demand for succinic acid, confirming its position in the future of environmentally friendly material innovation.

High Production Costs

One major constraint is the relatively high manufacturing cost of bio-based succinic acid as compared to typical petrochemical-derived succinic acid. Although bio-based processes have environmental benefits, they frequently require sophisticated fermentation techniques, expensive feedstocks and lower yields, making the end product less cost-competitive at scale. Furthermore, capital expenditures for establishing bio-based production facilities can be much greater, creating a barrier for new market entrants and limiting general adoption.

Despite their initial success, companies such as BioAmber and Reverdia struggled to retain commercial viability due to operational costs and market pricing pressures. Until technical advances further optimize fermentation methods and lower input costs, the price difference between bio-based and petro-based succinic acid will continue to impede the rapid expansion of the industry, particularly in cost-sensitive countries.

Market Segment Analysis

The global succinic acid market is segmented based on type, grade, end-user and region.

Expanding Use of Succinic Acid as a Flavor Enhancer and pH Regulator in Food & Beverage

A significant driver for the food & beverage segment in the global succinic acid market is its increasing use as a flavor enhancer, acidity regulator and fermentation agent. Succinic acid is a naturally occurring organic acid that has a slight salty-sour flavor and is commonly utilized in processed foods, beverages and nutritional supplements. Its non-toxic and biodegradable properties, combined with the FDA's GRAS (Generally Recognized as Safe) designation, make it a popular component in the formulation of sauces, spices, dairy products and functional drinks.

In recent years, the rising demand for clean-label and natural food components has increased the use of bio-based additives such as succinic acid. For example, as the plant-based and functional beverage sectors grow, manufacturers are adding succinic acid to improve flavor balance and shelf life. It is projected to strengthen succinic acid's relevance in the food and beverage industry and boost overall market growth.

Market Geographical Share

Robust Regulatory Support and Sustainability Goals in Europe

In Europe, the succinic acid market is witnessing strong growth, largely driven by stringent environmental regulations, green chemistry initiatives and an increasing shift towards bio-based and sustainable chemicals. The European Union's emphasis on lowering carbon emissions and reliance on petrochemical-based inputs has boosted the use of bio-based succinic acid in a variety of industries, including packaging, agriculture, medicines and food and drinks.

Europe has been at the forefront of developing the circular economy and succinic acid, which is biodegradable and comes from renewable sources, fits nicely into this concept. Key regional players and research institutes have been actively involved in scaling up fermentation-based succinic acid production, with backing from EU-funded innovation programs such as Horizon Europe. Countries have seen significant investment in bio-refineries and sustainable polymer synthesis (e.g., polybutylene succinate), increasing demand for succinic acid as a core feedstock.

Sustainability Analysis

The global succinic acid market is progressively aligning with sustainability principles, owing to the growing adoption of bio-based production processes and their integration into environmentally friendly industrial applications. Succinic acid, which was previously generated from petroleum-based feedstocks, has evolved into an important component in the bio-economy as a result of advances in microbial fermentation technologies that use renewable resources such as corn, sugarcane and glucose.

The transition not only eliminates reliance on fossil fuels, but also dramatically reduces greenhouse gas emissions during manufacturing, making bio-based succinic acid a low-carbon alternative to petrochemical derivatives. With continued technology developments, increased legislative backing (particularly in the EU) and expanding consumer demand for green chemicals, the market is positioned to significantly contribute to a more sustainable global industrial framework in the next years.

Majro Global Players

The major global players in the market include RPI, Spectrum Chemical, Reverdia, NIPPON SHOKUBAI CO., LTD., Junsei Chemical Co.,Ltd, Anhui Sunsing Chemicals Co.,Ltd, Guangzhou ZIO Chemical Co., Merck KGaA, GFS Chemicals, Inc. and Allan Chemical Corporation.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies