Overview

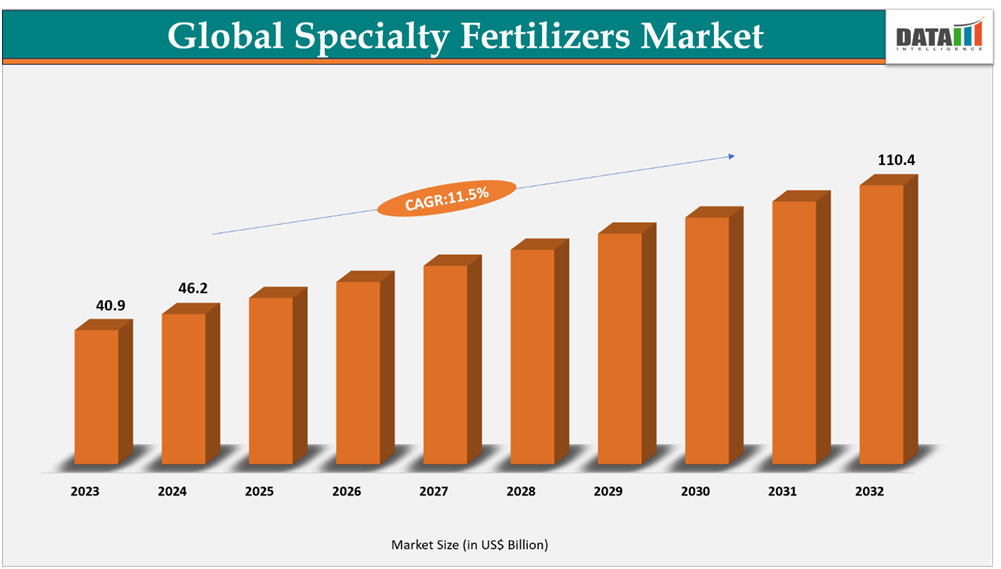

The global specialty fertilizers market reached US$40.9 billion in 2023, rising to US$46.2 billion in 2024 and is expected to reach US$110.4 billion by 2032, growing at a CAGR of 11.5% from 2025 to 2032.

The global specialty fertilizers market is witnessing stable growth, fueled by the rising need for efficient and sustainable nutrient management in modern agriculture. Increasing awareness of soil health, growing adoption of precision farming techniques, and the demand for higher crop yields are key factors driving market expansion. Specialty fertilizers, formulated for controlled and targeted nutrient release, help enhance productivity while minimizing environmental impact.

Advancements in agricultural technologies, along with supportive government initiatives promoting balanced fertilization and eco-friendly farming, are further strengthening market growth. The expanding use of specialty fertilizers across high-value crops such as fruits, vegetables, and ornamentals also contributes to their growing popularity. As the focus on sustainable and resource-efficient agriculture intensifies, the global specialty fertilizers market is expected to continue its upward trajectory in the coming years.

Specialty Fertilizers Market Industry Trends and Strategic Insights

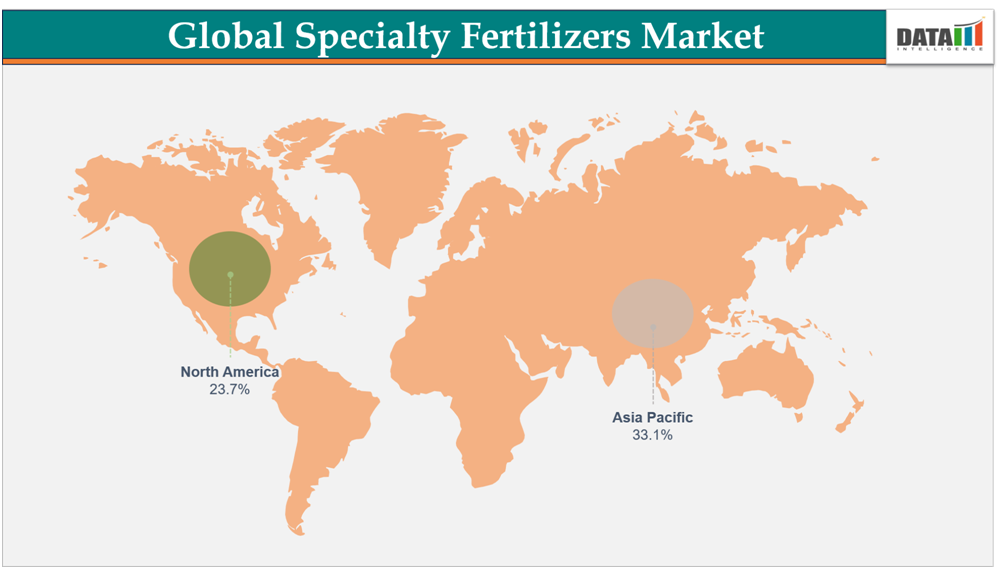

- Asia-Pacific leads the global specialty fertilizers market, capturing the largest revenue share of 33.1% in 2024.

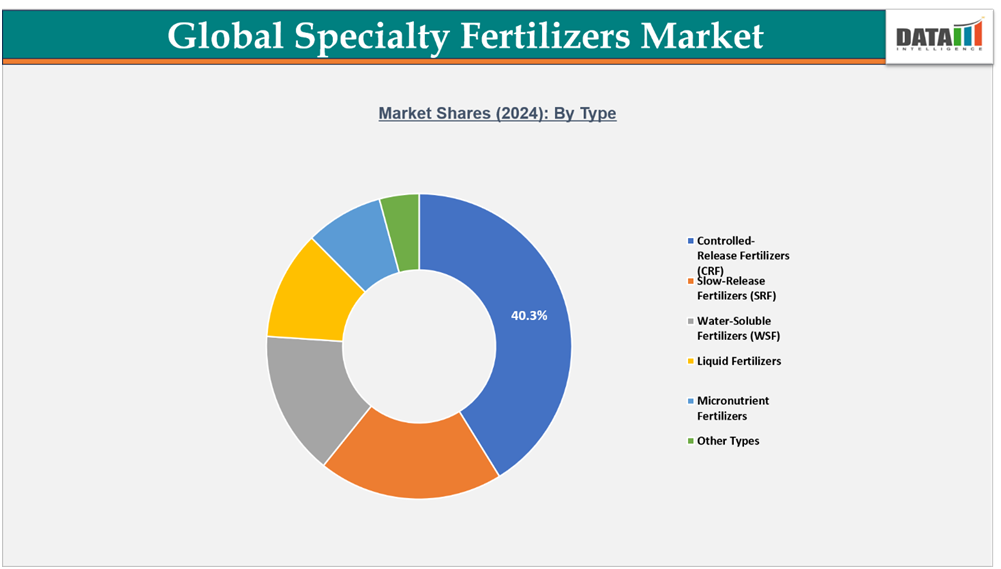

- By type form segment, Controlled-Release Fertilizers (CRF) lead the global specialty fertilizers market, capturing the largest revenue share of 40.3% in 2024.

Global Specialty Fertilizers Market Size and Future Outlook

- 2024 Market Size: US$46.2 billion

- 2032 Projected Market Size: US$40.9 billion

- CAGR (2025–2032): 11.5%

- Dominating Market: Asia-Pacific

Fastest Growing Market: North America

source : Datam intelligence Email: [email protected]

Market Scope

| Metrics | Details |

| By Type | Controlled-Release Fertilizers (CRF), Slow-Release Fertilizers (SRF), Water-Soluble Fertilizers (WSF), Liquid Fertilizers, Micronutrient Fertilizers, Other Types |

| By Form | Dry, Liquid, Powder |

| By Application | Soil, Fertigation, Foliar |

| By Crop Type | Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Turf & Ornamentals, Greenhouse & Protected Agriculture, Others crop type |

| By Distribution Channel | B2B, B2C |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Need for higher nutrient-use efficiency

The growing need to enhance nutrient-use efficiency (NUE) is a key driver of the global specialty fertilizers market. Traditional fertilizers often result in nutrient losses through leaching, volatilization, and runoff, leading to reduced effectiveness and environmental harm. To address these challenges, farmers are increasingly adopting specialty fertilizers that allow precise, controlled, and targeted nutrient delivery to crops. These advanced formulations ensure that plants absorb nutrients more effectively, leading to higher yields and improved soil health while minimizing waste.

In July 2024, for instance, ICL acquired Custom Ag Formulators (CAF), a North American company specializing in customized agricultural formulations and nutrient solutions, for approximately US$60 million. This acquisition reflects a broader industry trend toward developing tailored and efficient fertilizer products that meet specific crop and soil needs. By leveraging such innovations, fertilizer manufacturers aim to help growers achieve optimal productivity while promoting sustainability and resource conservation.

Moreover, the rising global focus on climate-smart agriculture and sustainable farming practices is further strengthening the demand for nutrient-efficient fertilizers. Governments and agricultural agencies are actively encouraging the use of advanced fertilizers that reduce carbon emissions and nutrient losses. Increasing pressure on arable land and the need to maximize crop output per hectare are also compelling farmers to adopt specialty fertilizers. As a result, the pursuit of higher nutrient-use efficiency is becoming a critical element in modern agricultural strategies worldwide.

Segmentation Analysis

The global specialty fertilizers market is segmented based on type, form, application, crop type, distribution channel and region.

Controlled-Release Fertilizers (CRF) Lead the Market Owing to Efficiency and Sustainable Nutrient Management

The controlled-release fertilizers (CRF) segment holds a major share of the global specialty fertilizers market, driven by growing demand for sustainable and efficient nutrient management. CRFs gradually release nutrients in sync with crop growth cycles, reducing losses from leaching or runoff and improving soil fertility.

Adoption is increasing across both developed and emerging economies, especially for high-value crops such as fruits, vegetables, and ornamentals. Technological advances in polymer coatings and sulfur encapsulation have further improved their efficiency and adaptability.

Asia-Pacific leads the CRF market, supported by rapid agricultural modernization and government programs promoting sustainable fertilizer use, followed by North America and Europe, where precision farming and strict environmental standards encourage adoption. Overall, CRFs are emerging as a key solution for modern, sustainable agriculture worldwide.

Slow-Release Fertilizers (SRF) Gain Momentum with Cost-Effectiveness and Long-Lasting Nutrient Supply

The slow-release fertilizers (SRF) segment is growing steadily, driven by its affordability, long nutrient-release period, and ease of use across diverse crop types. Unlike CRFs, SRFs rely on chemical or biological mechanisms to gradually release nutrients, reducing the frequency of application and enhancing soil nutrient balance over time.

SRFs are gaining traction among small and medium-scale farmers, especially in developing regions, due to their lower cost and reduced risk of nutrient runoff. Manufacturers are introducing advanced formulations using natural materials and microbial additives to extend nutrient availability and support soil health. The increasing adoption of SRFs for cereals, grains, and plantation crops highlights their value in improving efficiency and sustainability.

Overall, the growing focus on sustainable nutrient management and productivity enhancement continues to drive the demand for both CRF and SRF segments, with CRFs leading in technological advancement and SRFs expanding through accessible, cost-efficient solutions.

Geographical Penetration

DOMINATING MARKET:

Asia-Pacific Leads the Global Specialty Fertilizers Market Driven by Sustainable Farming and Crop Nutrition Innovation

The global specialty fertilizers market is witnessing strong growth, led by Asia-Pacific, driven by sustainable agriculture practices, precision farming adoption, and the need for high-efficiency fertilizers to enhance crop yield and soil health. The demand for specialty fertilizers such as controlled-release, water-soluble, and micronutrient-enriched variants is rising as farmers increasingly prioritize productivity, environmental sustainability, and balanced nutrient application.

India Specialty Fertilizers Market Insights

India is emerging as one of the fastest-growing markets in Asia-Pacific, supported by government initiatives promoting balanced fertilizer use and advanced nutrient management. However, the country is preparing for higher fertilizer prices ahead of the crucial rabi (winter) crop season after China suspended exports of urea and specialty fertilizers from October 15, 2025. This move is expected to tighten supply and push domestic producers to ramp up production. Growing awareness of soil health, water-efficient crop systems, and precision farming techniques continues to drive adoption of specialty fertilizers such as slow-release and bio-based formulations.

China Specialty Fertilizers Market Growth

China remains a leading producer and consumer of specialty fertilizers, with strong emphasis on controlled-release and water-soluble formulations for high-value crops. The country’s focus on sustainable agricultural practices, combined with technological advancements in fertilizer coating and nutrient management, continues to strengthen its market position. Government-led initiatives supporting eco-friendly fertilizer use are fostering growth despite export restrictions.

FASTEST GROWING MARKET:

North America Emerges as the Fastest-Growing Region Driven by Sustainable Agriculture and Advanced Nutrient Solutions

The global specialty fertilizers market is experiencing steady growth, driven by the global shift toward sustainable farming practices, precision agriculture, and demand for high-efficiency fertilizers that enhance crop yield and soil health. Rising environmental consciousness and advancements in agricultural technologies are accelerating the transition from conventional fertilizers to specialty variants such as controlled-release, water-soluble, and micronutrient-enriched fertilizers.

US Specialty Fertilizers Market Outlook

The United States remains one of the most progressive markets, supported by strong adoption of precision farming, technological innovation, and growing awareness of nutrient efficiency. Farmers are increasingly turning to specialty fertilizers to boost productivity while meeting environmental sustainability goals. Government initiatives and collaborations with agri-tech firms continue to encourage the use of customized and eco-friendly formulations across key crop segments.

Canada Specialty Fertilizers Market Trends

Canada’s specialty fertilizers market is expanding steadily, supported by the country’s strong emphasis on sustainable agriculture, efficient nutrient management, and environmental protection. Farmers are increasingly adopting controlled-release, water-soluble, and micronutrient-enriched fertilizers to enhance crop performance and reduce nutrient runoff. Government incentives promoting eco-friendly practices and precision farming technologies are accelerating this transition. Additionally, growing demand for high-value crops such as fruits, vegetables, and pulses is driving the use of customized nutrient solutions tailored to regional soil and climate conditions. Collaboration between agri-tech firms and fertilizer manufacturers is further advancing innovation and ensuring long-term soil health across Canada’s agricultural landscape.

Sustainability and ESG Analysis

Sustainability has become a key focus in the global specialty fertilizers market, shaping production practices, regulatory compliance, and stakeholder perception. Companies are increasingly embedding environmental, social, and governance (ESG) principles into their operations to enhance transparency, minimize ecological impact, and ensure responsible growth. The industry is witnessing a strong shift toward eco-friendly formulations, biodegradable coatings, and precision nutrient delivery methods aimed at supporting sustainable agriculture.

Reducing carbon emissions, minimizing nutrient losses, and improving water and energy efficiency remain critical priorities. To achieve these goals, manufacturers are investing in renewable energy sources, waste recovery systems, and carbon-neutral production facilities. Partnerships with farmers to promote precision and regenerative farming are also helping optimize nutrient use and preserve soil fertility.

Furthermore, growing ESG commitments are accelerating innovation in bio-based and low-emission fertilizers, aligning the industry with global climate targets. By integrating sustainability across sourcing, production, and supply chains, companies are strengthening brand reputation, regulatory readiness, and long-term market competitiveness.

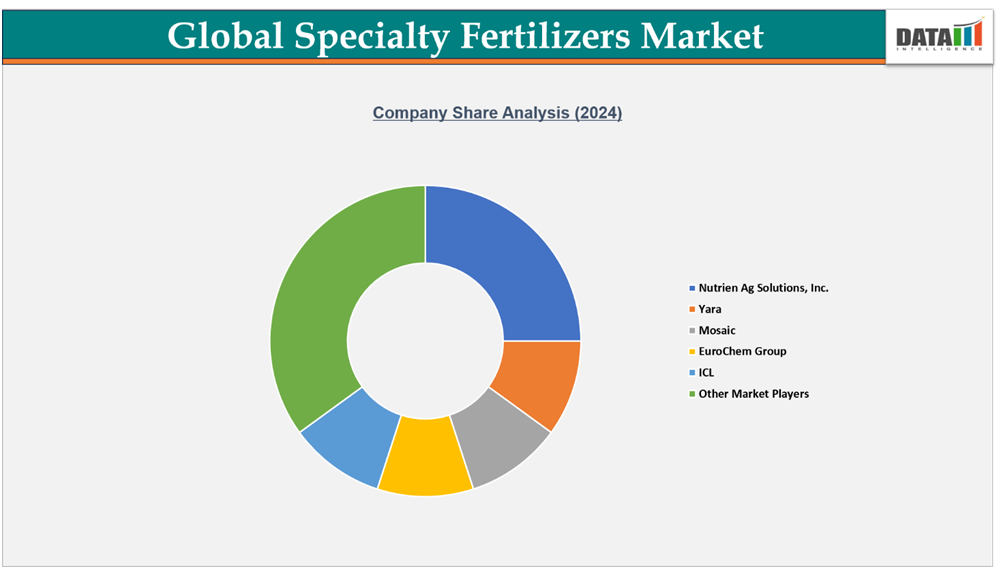

Competitive Landscape

- The global specialty fertilizers market is highly competitive, featuring a mix of established multinational corporations and strong regional manufacturers. Leading players such as Nutrien Ltd., Yara International ASA, The Mosaic Company, ICL Group Ltd., OCP Group, and Haifa Chemicals dominate the market through extensive production capacities, diversified fertilizer portfolios, and continuous investment in advanced nutrient technologies and R&D.

- Many companies are expanding their presence across emerging markets through strategic partnerships, mergers, and distribution networks. For instance, collaborations with agri-tech firms and digital platforms are helping manufacturers enhance nutrient efficiency and reach small and medium-scale farmers globally.

- The competitive landscape is driven by sustainability initiatives, innovation in slow- and controlled-release fertilizers, and tailored nutrient solutions for high-value crops. Regulatory compliance, product differentiation, and precision agriculture integration remain key factors shaping market leadership and long-term growth in the global specialty fertilizers industry.

Key Developments

- In July 2025, Kan Biosys, a leading Indian agri-biotech company, introduced two new product lines aimed at promoting sustainable farming in India. The first, ROFA (Real Optimized Fertilizer Application), is a range of imported specialty fertilizers developed in partnership with De Sangosse, France. The second includes a series of indigenously developed neem-based formulations designed to enhance soil health and support eco-friendly agricultural practices.

Investment & Funding Landscape

The global specialty fertilizers market is witnessing robust investment activity and strategic alliances, underscoring strong industry confidence in sustainable and high-performance agricultural solutions. In May 2025, Matix Fertilizers announced an investment of Rs 2,600 crore (approx. 29.3 US$) to venture into specialty chemicals, signaling a major step toward diversification and value-added fertilizer production. This move aligns with India’s ongoing efforts to promote sustainable farming and reduce dependency on conventional fertilizers.

Meanwhile, In 2024, ICL, a leading global specialty minerals company, entered into a five-year agreement with AMP Holdings Group Co. Ltd., one of China’s largest agricultural distributors. The deal, worth around $170 million, will run until 2028 and aims to expand ICL’s Growing Solutions portfolio, strengthening its presence across key agricultural markets.

These developments reflect the accelerating global shift toward innovation, sustainability, and strategic partnerships in the specialty fertilizers industry, as leading players work to enhance efficiency, resilience, and long-term growth potential.

| Company | Investment/Funding | Year | Details | |

| Matix Fertilizers | Investment | 2025 | Matix Fertilizers announced an investment of Rs 2,600 crore (approx. 29.3 US$) to venture into specialty chemicals, signaling a major step toward diversification and value-added fertilizer production. This move aligns with India’s ongoing efforts to promote sustainable farming and reduce dependency on conventional fertilizers. | |

| ICL | Investment | 2024 | ICL, a leading global specialty minerals company, entered into a five-year agreement with AMP Holdings Group Co. Ltd., one of China’s largest agricultural distributors. The deal, worth around $170 million, will run until 2028 and aims to expand ICL’s Growing Solutions portfolio, strengthening its presence across key agricultural markets. | |

What Sets This Global Specialty Fertilizers Market Intelligence Report Apart

- Latest Data & Forecasts – Comprehensive, up-to-date insights and projections through 2032. Coverage includes global value by product type, stage, form, and distribution channel segments. Scenario forecasts with region-level splits (North America, Europe, Asia-Pacific, South America, Middle East and Africa) and sensitivity to factors such as regulatory reclassification and raw-material costs.

- Regulatory Intelligence – Actionable analysis of regulatory frameworks that materially affect specialty fertilizers commercialization, revenue by country, allowable label claims, permitted doses, import/export controls and advertising restrictions.

- Competitive Benchmarking – Standardized profiling and benchmarking of leading pharma and nutraceutical players, contract manufacturers and e-commerce specialists active in the market.

- Geographic & Emerging Market Coverage – Region-by-region market sizing, growth drivers, reimbursement dynamics, cultural/consumer behavior and market access considerations. Focus on high-growth or regulatory-uncertain markets.

- Actionable Strategies – Identify opportunities for launching innovative products, while leveraging strategic partnerships and supply chain integration for maximum ROI.

- Pricing & Cost Analysis – In-depth assessment of price trends, raw material costs and sustainability-driven cost efficiencies across regional markets.

- Expert Analysis – Insights from industry experts such as clinical sleep specialists, regulatory affairs professionals and key manufacturing companies.