Soy Sauce Market Size

Global Soy Sauce Market reached USD 35.1 billion in 2022 and is expected to reach USD 51.2 billion by 2030 growing with a CAGR of 5.5% during the forecast period 2024-2031. Consumers are becoming more health-conscious and are seeking healthier food options.

This has led to an increased demand for natural and organic soy sauce varieties with reduced sodium content and without artificial additives.

The sauces market is a well-established and varied industry globally, as it provides flavorful options that attract consumers to their everyday meals. From ancient times to the present, sauces and condiments have remained highly sought-after by consumers, and this trend continues to thrive in the worldwide market. Among the many oriental table sauces available, this particular one is immensely popular due to its ability to enhance the sensory experience of food.

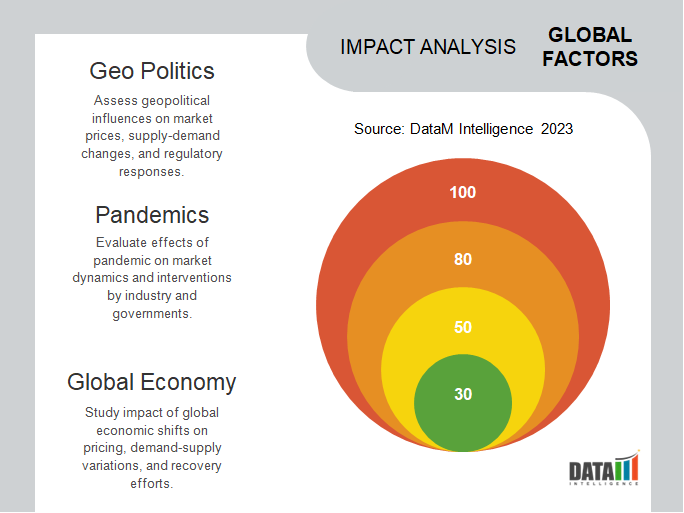

Nevertheless, the worldwide COVID-19 pandemic will have a direct adverse impact on the purchasing behavior and use of these products in international markets, particularly affecting the food service sector. The World Trade Organization projected a decline in global trade ranging from 13% to 32% for the year 2020. The prolonged lockdowns and disruptions in supply chains are expected to hinder the production and consumption of this sauce for the foreseeable future.

Market Scope

| Metrics | Details |

| CAGR | 5.5% |

| Size Available for Years | 2021-2030 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Process, Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa |

| Fastest Growing Region | North America |

| Largest Region | Asia Pacific |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis, and Other key Insights. |

For More Insights about the Market Request Free Sample

Market Dynamics

Increased Demand for Artificial Preservatives Free Sauces to Drive the Global Market Trends

The global organic food market has been experiencing significant growth over the years. According to the latest FiBL survey on organic agriculture worldwide, organic farmland increased by 1.1 million hectares, and organic retail sales continued to grow, as shown by the data from 187 countries. This indicates an increasing demand for natural and organic food products, including sauces.

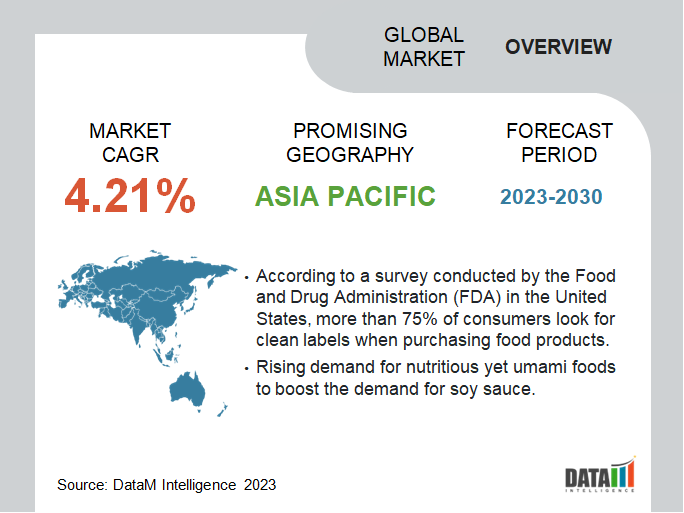

The clean label movement is gaining traction, and consumers are actively seeking products with transparent and easy-to-understand ingredient lists. According to a survey conducted by the Food and Drug Administration (FDA) in the United States, more than 75% of consumers look for clean labels when purchasing food products. Consumers are increasingly concerned about the potential health risks associated with artificial preservatives, such as sodium benzoate, potassium sorbate, and artificial colors.

Rising Demand for Nutritious Yet Umami Foods is Expected to Drive The Soy Sauce Market Growth

Umami is considered the fifth basic taste, alongside sweet, sour, bitter, and salty. Soy sauce is known for its rich umami flavor, which adds depth and savoriness to various dishes. As consumer palates evolve and seek more complex tastes, the demand for umami-rich foods, including those seasoned with soy sauce, is expected to rise.

The popularity of Asian cuisine, which often incorporates soy sauce as a key ingredient, is increasing globally. As people become more adventurous with their culinary choices, the demand for authentic Asian flavors and condiments like soy sauce is expected to rise. With the rise of plant-based diets and the increasing number of flexitarians, soy sauce's vegetarian and vegan-friendly nature makes it a sought-after condiment in these dietary lifestyles.

Misrepresentation and Counterfeit Products is Restraining the Soy Sauce Market

Misrepresentation and counterfeit products can erode consumer trust in the authenticity and safety of soy sauce products. When consumers encounter fraudulent or inferior quality soy sauce, they may become hesitant to purchase soy sauce in the future, leading to decreased demand. Counterfeit or mislabeled soy sauce may not meet safety standards or contain harmful substances, posing health risks to consumers.

Instances of foodborne illnesses or adverse reactions from consuming counterfeit products can lead to negative perceptions of soy sauce and impact market growth. Authentic soy sauce brands invest time and resources in building their reputation based on quality and taste. Counterfeit products can dilute the brand value and reputation of genuine soy sauce manufacturers, leading to a decline in sales and market share.

Market Segment Analysis

The global soy sauce market is segmented based on process, type, end-user, and region.

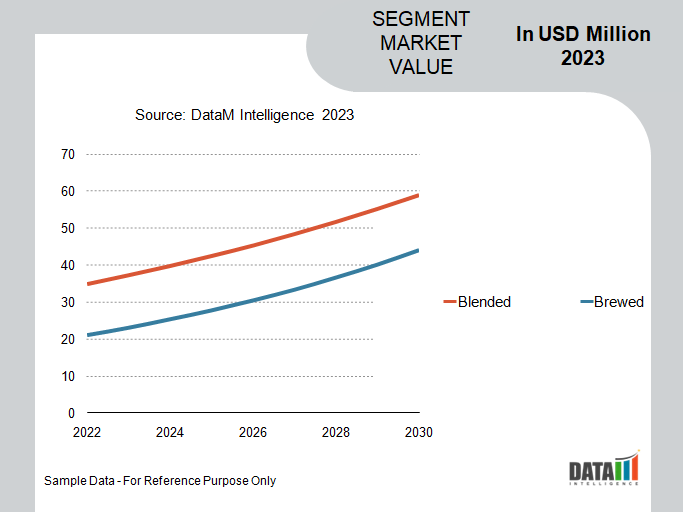

The Blended Soy Sauce Holds the Largest Market Share in the Soy Sauce Market

Blended soy sauce combines different types of soy sauce, such as light and dark soy sauce, to create a well-balanced flavor profile. The versatility of blended soy sauce makes it suitable for a wide range of dishes and cuisines, which appeals to consumers worldwide. Blended soy sauce is commonly used in various Asian cuisines, including Chinese, Japanese, Korean, and Thai dishes. The daily consumption of soy sauce in Japan is estimated at about 30 ml per person according to the data from the Japan Soy Sauce Brewers Association.

Blended soy sauce allows manufacturers to customize the flavor by adjusting the ratio of light and dark soy sauce. This ability to tailor the taste to different regional preferences or specific recipes makes it a favored choice among chefs and home cooks. Blended soy sauce offers consistency in flavor with each batch, ensuring that consumers get the same taste they have come to expect from the product.

Market Geographical Share

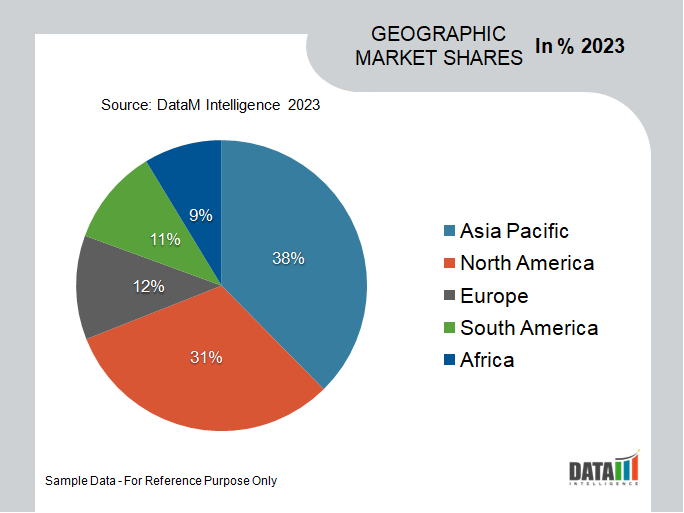

Asia Pacific is Dominating the Soy Sauce Market

Soy sauce is deeply ingrained in the culinary traditions of many Asian countries. It has been an essential condiment in various Asian cuisines, including Chinese, Japanese, Korean, Vietnamese, and Thai dishes, for centuries. This cultural significance contributes to its widespread consumption in the region.

The Asia Pacific region is home to a significant portion of the world's population, including countries with large populations such as China and India. The sheer size of the consumer base in this region drives the high demand for soy sauce. As urbanization continues to accelerate in many Asian countries, busy lifestyles and the growth of the foodservice industry have led to an increased demand for convenient and ready-to-use condiments like soy sauce.

Major Key Players

The major global players in the market include Nestle S.A., Cambell Soup Company, Shoda Sauces Europe Company Limited, Yamasa Corporation, Kraft Heinz Company, Haitian Group, MARUNAKA SHOYU, Kikkoman Corporation, McCormick & Co Inc., and Hormel Foods Corporation.

COVID-19 Impact

Global Recession/Ukraine-Russia War/COVID-19, and Artificial Intelligence Impact Analysis:

Covid-19 Impact:

During the early stages of the pandemic, many countries implemented lockdowns and restrictions, disrupting supply chains and logistics. This affected the transportation and distribution of soy sauce products, leading to potential delays and shortages. With lockdowns and social distancing measures in place, consumers' purchasing behavior shifted. There was an increased preference for pantry staples and essential goods, but a decline in discretionary spending.

Key Developments

- In April 2022, the world's leading producer of naturally brewed soy sauce, Kikkoman Corporation, announced the introduction of the first set of recipes co-created with several top chefs in India.

- In March 2023, Solenis and Diversey Holdings, Ltd. announced they have entered into a definitive merger agreement under which Solenis will acquire Diversey in an all-cash transaction valued at an enterprise value of approximately $4.6 billion. Upon completion of the merger, Diversey will become a private company.

- In July 2022, Vonage becomes wholly-owned subsidiary of Ericsson. With Vonage on board, Ericsson will create a market for easy-to-adopt global network Application Program Interfaces (API) this will drive the next wave of digitalization.

Why Purchase the Report?

- To visualize the global soy sauce market segmentation based on product type, flavor, application, distribution channel, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities in the market by analyzing trends and co-development.

- Excel data sheet with numerous data points of soy sauce market-level with all segments.

- The PDF report consists of cogently put-together market analysis after exhaustive qualitative interviews and in-depth market study.

- Product mapping is available as Excel consists of key products of all the major market players.

The global soy sauce market report would provide approximately 61 tables, 55 figures, and 190 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies