Sodium Nitrate Market Size

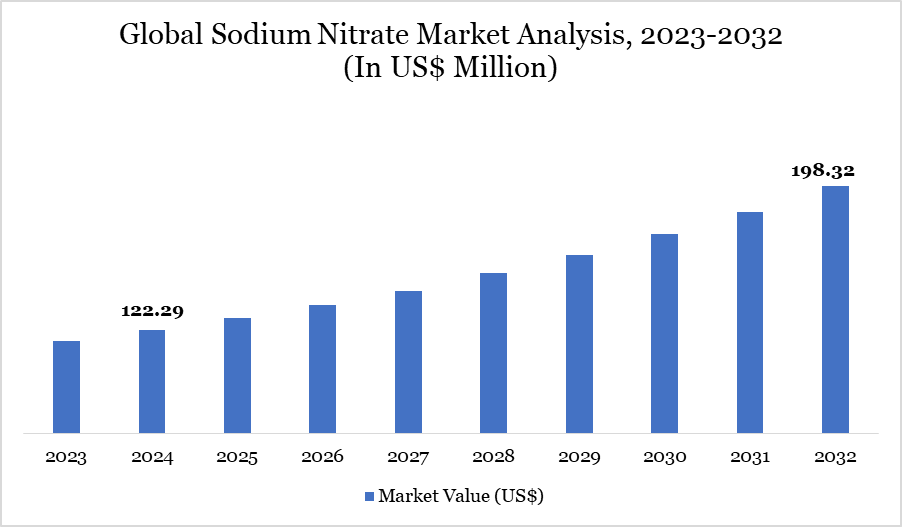

Sodium Nitrate market size reached US$ 122.29 million in 2024 and is expected to reach US$ 198.32 million by 2032, growing with a CAGR of 6.23% during the forecast period 2025-2032.

The expansion of the global sodium nitrate market is driven by its varied applications in agriculture, industrial manufacturing, and food processing. Sodium nitrate, as a vital basic ingredient, is essential in fertilizer formulations, facilitating increased crop yields in response to escalating food demands. The FAO asserts that accommodating an anticipated global population of 9.1 billion by 2050 will necessitate a 70% augmentation in food production, hence substantially increasing the demand for fertilizers.

Sodium nitrate's applications in explosives and glass production contribute to its strong industrial demand beyond agriculture. Its efficacy as an oxidizing agent in the mining and construction sectors further reinforces its market position. Sodium nitrate remains essential in both established and developing sectors due to advantageous regulatory conditions and heightened innovation in water treatment and chemical production.

Sodium Nitrate Market Trend

The sodium nitrate market is experiencing significant changes characterized by innovation and digital integration. Yara International is leading innovations in synthetic nitrate production, diminishing reliance on natural sources and stabilizing supply chains. As regulatory frameworks like the EPA in the US and EU REACH impose stricter environmental and safety standards, the industry is adopting safer and more sustainable methods.

Blockchain and digital technologies are progressively utilized to improve traceability throughout the supply chain, mitigating fraud and ensuring compliance. Applications are growing beyond conventional uses; sodium nitrate is being utilized in thermal energy storage, medicinal formulations, and sophisticated food preservation systems.

The increase in infrastructure initiatives and pyrotechnic uses, especially in developing economies, is reinforcing sodium nitrate's position in various industrial sectors. These continuous trends suggest a market ready for transformation, propelled by regulatory impetus and technical progress.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

| By Grade | Industrial, Pharmaceutical, Food, Others |

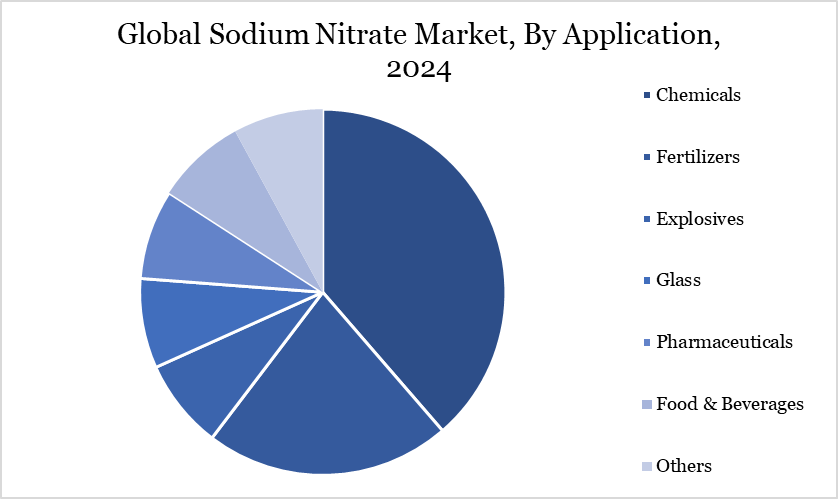

| By Application | Chemicals, Fertilizers, Explosives, Glass, Pharmaceuticals, Food & Beverages, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Sodium Nitrate Market Dynamics

Agricultural Expansion Fuels Escalating Fertilizer Demand

A primary driver for the expansion of the sodium nitrate market is the significant increase in global food production demands. According to the FAO, to accommodate a burgeoning population projected to reach 9.1 billion by 2050, cereal demand is anticipated to escalate to 3 billion tons, an increase from 2.1 billion tons in 2009.

The significant rise has heightened the demand for fertilizers, with sodium nitrate acting as a crucial element in improving agricultural output and soil fertility. In 2022, the fertilizer application category accounted for more than 69% of revenue, highlighting its critical importance. Farmers, especially in developing nations, are implementing high-efficiency fertilization methods to enhance productivity.

The great solubility of sodium nitrate and the prompt availability of nitrogen render it particularly efficient in this setting. The interplay of population expansion, food security issues, and contemporary agricultural methods is anticipated to perpetually enhance demand, solidifying sodium nitrate’s role as a crucial component in the global agricultural value chain.

Geopolitical Risks and Regulatory Obstacles Confront Market Expansion

The geographical restriction of natural sodium nitrate reserves, predominantly located in specific areas, renders the supply chain susceptible to geopolitical threats. Furthermore, sodium nitrate, being an oxidizing agent, presents considerable obstacles in storage and transportation, requiring stringent safety measures. This complexity increases operational expenses, especially in emerging economies with underdeveloped logistics infrastructure. Regulatory oversight presents an increasing difficulty.

Agencies such as the EPA and EU REACH impose rigorous compliance requirements regarding the management and ecological effects of sodium nitrate. These regulations augment administrative burdens and may impede small- and medium-sized manufacturers. The compound's designation as hazardous may impede its utilization in specific end-use sectors. The interplay of supply limitations, increasing compliance expenses, and logistical challenges constitutes a significant obstacle, especially in expanding the product in less industrialized areas.

Sodium Nitrate Market Segment Analysis

The global sodium nitrate market is segmented based on grade, application and region.

Fertilizers Predominate Applications Due to Increased Yield-Driven Demand

The fertilizer sector is the predominant application in the sodium nitrate market, propelled by the pressing global demand to improve agricultural output. In 2022, this sector constituted over 69% of the market's revenue, underscoring its essential significance in food production systems. The chemical makeup of sodium nitrate facilitates quick nitrogen availability, essential throughout vital growth phases of diverse crops. Its elevated solubility and compatibility with precision agriculture technologies further facilitate its adoption by large-scale farms and agribusinesses.

The anticipated demand for grains is expected to attain 3 billion tons by 2050, an increase from 2.1 billion in 2009, hence underscoring the continued necessity of sodium nitrate in fertilizers. Agricultural producers are progressively shifting from conventional fertilizers to high-efficiency alternatives such as sodium nitrate to achieve yield objectives sustainably. This transition supports sodium nitrate's continued supremacy in the application sector, particularly in developing countries with growing agricultural industries.

Sodium Nitrate Market Geographical Share

Asia Pacific Accelerates as Strategic Hub for Sodium Nitrate Demand Expansion

The Asia-Pacific region is poised to dominate the worldwide sodium nitrate market throughout the forecast period, largely owing to swift industrialization and agricultural growth. Prominent economies such China, India, and Japan are leading this expansion, utilizing sodium nitrate in fertilizers, explosives, glass manufacturing, and food preservation. India's robust dedication to agriculture is seen in the escalation of its agricultural budget from US$ 1,390.71 million (₹11,915.22 crore) in 2008-09 to US$ 1,430.122 billion (₹1,22,528.77 crore) in 2024-25, markedly enhancing fertilizer subsidies and infrastructure.

China leads the regional market, closely succeeded by Japan and South Korea, due to their strong industrial foundations. Concurrently, ASEAN countries such as Malaysia, Thailand, and Indonesia are investing in building and glass manufacturing, so stimulating further demand. The acceleration of urbanization and infrastructure development is increasing sodium nitrate consumption, establishing the Asia-Pacific area as the fastest-growing market of significant strategic importance.

Sodium Nitrate Market Major Players

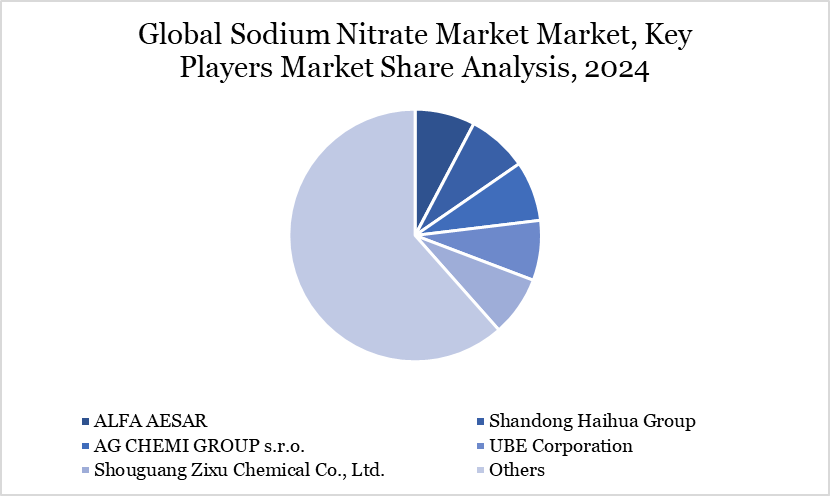

The major global players in the market include ALFA AESAR, Shandong Haihua Group, AG CHEMI GROUP s.r.o., UBE Corporation, Shouguang Zixu Chemical Co., Ltd., Pon Pure Chemicals Group, Santa Cruz Biotechnology, Inc., American Elements, Hach Company, Sumitomo Chemical.

Sustainability Analysis

The sodium nitrate industry is experiencing increased momentum in sustainability due to escalating environmental concerns and stricter regulations. Regulatory frameworks like EU REACH and the US EPA are compelling corporations to develop cleaner production techniques and safer handling practices. Prominent manufacturers such as CF Industries have used sustainable techniques that diminish emissions while simultaneously improving regulatory compliance and business reputation.

The sector is seeing a transition to synthetic nitrate alternatives, led by companies such as Yara International. These technologies diminish reliance on limited natural resources and contribute to supply chain stabilization. Moreover, technologies such as blockchain are utilized to enhance transparency, reduce fraud, and augment traceability in procurement and distribution.

The sodium nitrate market is aligning with global climate objectives by including sustainability throughout production, logistics, and end-use, so ensuring long-term survival. Such activities are essential for converting a traditionally resource-intensive business into a more resilient and environmentally sustainable one.

Key Developments

In July 2023, NovaAir Technologies unveiled plans to establish a medical and Sodium Nitrate plant in Karnataka, India. The initiative aims to address the rising demand for medical gases in the healthcare sector. This expansion reinforces the company's commitment to enhancing gas supply infrastructure.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies