Smart Thermometers Market Size

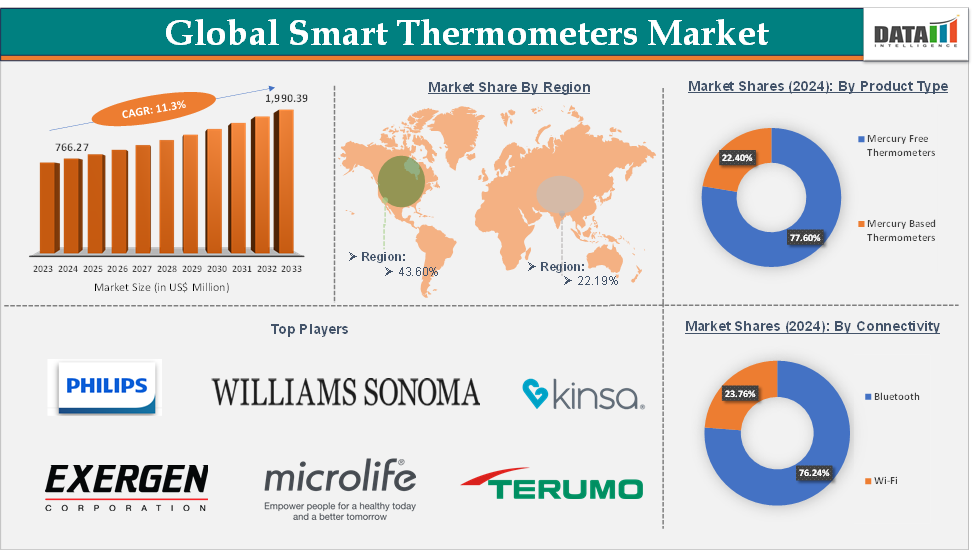

Smart Thermometers Market Size reached US$ 766.27 Million in 2024 and is expected to reach US$ 1,990.39 Million by 2033, growing at a CAGR of 11.3% during the forecast period 2025-2033.

Smart Thermometers Market Overview

A smart thermometer is an advanced temperature-measuring device that leverages digital technology to monitor and record temperature readings. Unlike traditional thermometers, smart thermometers are equipped with features such as wireless connectivity (Bluetooth, Wi-Fi) and are often integrated into larger digital ecosystems for enhanced functionality. These devices can transmit real-time data to smartphones, tablets, or cloud-based platforms, enabling users to track and analyze temperature trends over time. They play a crucial role in personal healthcare, public health initiatives, and compliance with food and industrial safety standards.

The smart thermometer market is characterized by intense competition, with several key players striving to gain a significant market share. Companies like Kinsa, Terumo, and Philips are leading the market with their innovative products and strong brand presence. The future of the smart thermometer market looks promising, with trends such as the increasing adoption of smart health monitoring devices, advancements in IoT technology, and the expansion of emerging markets expected to drive growth. Manufacturers will likely focus on enhancing user experience through improved connectivity, more intuitive interfaces, and integration with other smart health devices.

Executive Summary

For more details on this report – Request for Sample

Smart Thermometers Market Dynamics: Drivers & Restraints

Rising technological advancements are significantly driving the smart thermometers market growth

Many modern smart thermometers are equipped with Bluetooth or Wi-Fi capabilities, allowing users to easily sync data with mobile apps. This connectivity is particularly valuable for healthcare providers and consumers monitoring temperature over time, enhancing remote patient monitoring, and enabling real-time health tracking. For instance, devices like the Kinsa Smart Thermometer offer Bluetooth connectivity to smartphones, enabling users to track temperature trends and share data with healthcare professionals.

Non-contact infrared thermometers are gaining popularity due to their hygienic nature and accurate readings without the need for physical contact. This is especially critical in medical and public health applications, where reducing the risk of cross-contamination is paramount. For instance, Exergen and Withings have developed infrared thermometers that provide fast, accurate readings for both medical and home use.

Additionally, smart thermometers are increasingly being developed as wearables, enabling continuous temperature monitoring. This technology is particularly useful for patients with chronic conditions, children, or the elderly who require constant health tracking. TempTraq, a wearable patch thermometer, continuously monitors body temperature and sends alerts via a smartphone app if a fever is detected, making it ideal for parents monitoring children's health.

AI-based thermometers are gaining traction, which is boosting the market demand. For instance, in March 2025, Otiton Medical introduced its smart thermometer, Dr. In Home, into the European market. Dr. In Home is a smart thermometer that measures body temperature and captures real-time images of the ears, nose, and throat to assess health conditions. Equipped with AI-based analysis technology and mobile app integration, it is designed to determine potential illnesses swiftly. These technological advancements in smart thermometers are accelerating the market growth.

Data privacy concerns are hampering the market growth

Data privacy concerns associated with smart thermometers are expected to hamper the market growth over the forecast period. Smart thermometers collect personal health data, including body temperature, usage patterns, and in some cases, information about symptoms. This data can be seen as sensitive health information, and many consumers are cautious about sharing this data, especially in light of past privacy breaches in the health tech industry.

For instance, according to the HIPAA Journal, in March 2025, 1,754,097 individuals had their protected health information exposed, stolen, or impermissibly disclosed in a healthcare data breach, 2,277,555 individuals were affected in February 2025, and 3,121,358 individuals in January 2025.

The fear of data breaches in IoT-enabled devices, including smart thermometers, has led to skepticism among consumers. If a device is hacked or its data is sold to third parties, users’ health information could be exposed, leading to privacy violations. Many smart thermometers, like other IoT devices, lack robust encryption and data protection features, making them susceptible to cyberattacks. This lack of security can deter both consumers and healthcare providers from fully adopting these devices.

Smart Thermometers Market Segment Analysis

The global smart thermometers market is segmented based on product type, connectivity, application, and region.

The bluetooth from the connectivity segment is expected to hold 76.24% of the market share in 2024 in the smart thermometers market

The bluetooth segment holds a major portion of the smart thermometers market share and is expected to continue to hold a significant portion of the market share over the forecast period due to several key factors related to ease of use, compatibility, and growing consumer demand for connected devices. Bluetooth technology offers seamless integration with a wide range of devices, including smartphones, tablets, and computers, which are commonly used to track and monitor health data. Bluetooth-enabled thermometers can easily sync with mobile apps, making it convenient for users to store, access, and share their temperature readings.

Bluetooth-enabled smart thermometers are generally more affordable than those with Wi-Fi capabilities, which is a major factor driving the popularity of bluetooth models. This affordability has expanded the adoption of smart thermometers, particularly among price-sensitive consumers. For instance, brands like Withings and iHealth offer Bluetooth-enabled thermometers at a lower price point compared to more complex Wi-Fi models, making them accessible to a broader consumer base

Smart Thermometers Market Geographical Analysis

North America is expected to dominate the global smart thermometers market with a 43.60% share in 2024

The North America region is expected to hold the largest market share over the forecast period. The rapid adoption of telehealth services in North America, accelerated especially by the COVID-19 pandemic, has led to a surge in demand for smart health devices like thermometers. These devices play a critical role in remote patient monitoring (RPM), which is a growing healthcare trend.

For instance, according to ScienceDirect, a 30 USD Kinsa smart thermometer works with a cell phone app that records the users' temperature history and transmits the values to the company for public health forecasting of the spread of flu and flu-like illnesses, including COVID-19. Readings from the more than one million Kinsa thermometers in use have allowed Kinsa to establish baseline levels of fever across the United States.

Additionally, apart from healthcare, smart thermometers help in the food industry, and the market players are focusing on smart thermometers for the food industry, thus expanding the market growth in the region. For instance, in May 2024, Thermomix introduced the Thermomix Sensor, a groundbreaking smart thermometer that brings greater ease and precision to monitoring food’s core temperature. This cutting-edge smart thermometer is set to transform the way cooking enthusiasts approach cooking, grilling, and baking, ensuring precision and confidence in every dish.

Smart Thermometers Market Top Companies

Top companies in the smart thermometers market include Kinsa Health, LLC., Exergen Corporation, ThermoWorks, Testo SE & Co. KGaA, Microlife Corporation, Williams-Sonoma Inc., Koninklijke Philips N.V., Terumo Corporation, Radiant Innovation Inc., Tenergy Corporation, and among others.

Market Scope

| Metrics | Details | |

| CAGR | 11.3% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Product Type | Mercury Free Thermometers, Mercury-Based Thermometers |

| Connectivity | Bluetooth and Wi-Fi | |

| Application | Medical, Food Industry, Laboratory, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global smart thermometers market report delivers a detailed analysis with 62 key tables, more than 54 visually impactful figures, and 148 pages of expert insights, providing a complete view of the market landscape.