Overview

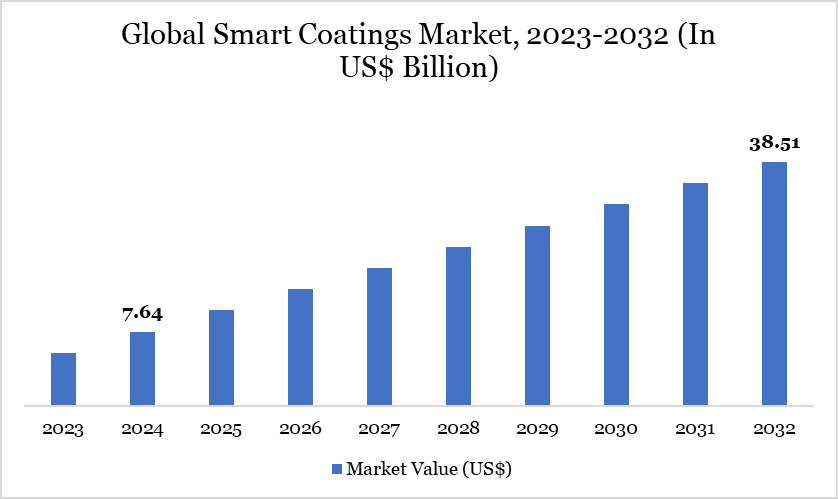

Global Smart Coatings market reached US$ 7.64 billion in 2024 and is expected to reach US$ 38.51 billion by 2032, growing with a CAGR of 22.41% during the forecast period 2025-2032.

The Ion Smart Coatings market is seeing a notable transformation, characterized by the incorporation of nanotechnology and a focus on sustainability. These coatings possess multifunctional features that react to environmental stimuli like temperature, pressure, light, and pH. Smart coatings are transforming surface protection and performance across various sectors, including aerospace and construction.

Nanofillers, both organic and inorganic, are employed to improve thermal and mechanical stability while imparting additional capabilities such as piezoelectric and thermoelectric properties. The aerospace industry significantly benefits from these improvements, especially considering the Boeing Commercial Outlook 2022–2041, which forecasts that commercial aviation services will yield US$ 3,615 billion by 2041.

Environmental awareness is influencing product development, with more than 160 countries participating in LEED-certified projects by 2022. Industry stakeholders are investing in self-healing, antimicrobial, and energy-efficient technologies, highlighting the increasing integration within electric vehicles, renewable energy infrastructure, and sophisticated construction methods.

Market Trends

Smart coatings represent a leading edge in material science innovation, undergoing significant transformations driven by sustainability, functionality, and digital integration. A prominent trend is the development of self-healing coatings that autonomously rectify minor flaws, thus prolonging product lifespan and minimizing maintenance requirements. These materials are very advantageous in aerospace and automotive applications.

A significant trend is the transition to environmentally sustainable coatings. There is a rising need for formulations that include low levels of volatile organic compounds (VOCs) and improve energy efficiency, including solar-reflective coatings that help decrease building energy use. There is increased interest in responsive coatings that modify their qualities in response to external stimuli, such as smart windows that darken with sunshine or coatings that adjust conductivity with temperature.

The integration of smart coatings with IoT ecosystems is facilitating the development of intelligent, adaptive surfaces. The Asia-Pacific region has strong demand driven by industrialization, whereas North America and Europe promote innovation through rigorous environmental regulations and research and development spending.

Market Scope

| Metrics | Details |

| By Layer | Single Layer, Multi-Layer |

| By Function | Anti-corrosion, Anti-icing, Anti-fouling, Anti-microbial, Self-cleaning, Others |

| By Technology | Nano-Coatings, Stimuli-Responsive Coatings, Microencapsulation, Others |

| By End-user | Building & Construction, Automotive, Electronics, Military, Medical, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Dynamics

Enhancing Engineering Performance via Multifunctionality

The growing need for multifunctional materials in end-use industries is a primary catalyst for the Ion Smart Coatings market. These coatings offer essential performance improvements in industries like construction, automotive, aerospace, textiles, and electronics. The US Census Bureau reported that construction investment attained a seasonally adjusted annual pace of US$ 1.677 trillion in early 2022, underscoring a robust basis for the integration of smart coatings.

These coatings are progressively utilized to safeguard architectural materials such as aluminum, glass, and steel from corrosion, ultraviolet degradation, and temperature-induced stress. Coatings with self-healing, anti-icing, and antibacterial qualities are improving safety and durability in transportation.

The swift proliferation of electric vehicles 6.75 million units produced worldwide in 2021 has created opportunities for thermal and corrosion management through advanced coatings. These factors collectively indicate an increasing inclination towards materials that enhance operational efficiency, lower lifecycle costs, and provide value-added features that align with both technological and environmental objectives.

Cost Barriers and Material Availability

he Ion Smart Coatings market encounters considerable limitations due to elevated production costs and material restrictions. These coatings frequently necessitate intricate formulae and specific manufacturing techniques, resulting in higher unit prices relative to conventional alternatives.

Adoption in price-sensitive areas remains constrained. The problem is exacerbated by the limited availability and price fluctuations of advanced raw materials, such as specific nanofillers and rare elements. The absence of economies of scale in the nascent sector further obstructs widespread adoption.

Variations in supply chains for specialist materials especially those utilized in piezoelectric or phase change coatings, introduce uncertainty in pricing and availability. These obstacles highlight the necessity for ongoing investigation into cost-effective formulations and scalable manufacturing methods. Confronting these issues will be crucial to realizing the complete potential of smart coatings in mass-market applications, especially in developing regions and intensely competitive sectors.

Segment Analysis

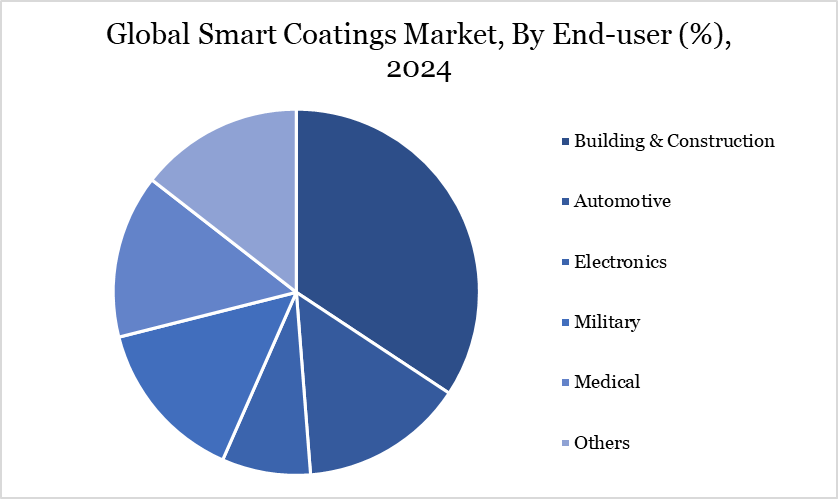

The global smart coatings market is segmented based on layer, function, technology, end-user and region.

Adoption Trends in Building and Construction End-users

The building and construction industry is becoming a fundamental component of the Ion Smart Coatings market, categorized as commercial, residential, industrial, healthcare, and institutional end-users. Commercial and industrial edifices mostly utilize anti-corrosion and solar-reflective smart coatings to enhance structural longevity and optimize energy efficiency.

Solar-reflective coatings diminish internal building temperatures, resulting in decreased electricity usage and operational expenses. Simultaneously, residential, hospital, and institutional structures are implementing anti-fouling, antimicrobial, and self-cleaning coatings to improve hygiene, safety, and maintenance efficacy.

The expansion in advanced building projects, illustrated by a 5.4% gain in construction orders in Japan in recent years, indicates the industry's increasing receptiveness to novel materials. High-rise and intelligent structures particularly benefit from coatings with self-healing, anti-icing, and hydrophobic properties. This segmentation illustrates a varied demand landscape, with each sub-segment corresponding to distinct performance characteristics, thereby facilitating focused product creation and strategic market positioning.

Geographical Penetration

North America’s Sustainability and R&D Propel Market Expansion

The Ion Smart Coatings market in North America is witnessing significant expansion due to a combination of sustainability requirements and technological advancements. The US spearheads the region with a robust focus on sustainable construction, evidenced by its involvement in LEED-certified building initiatives throughout more than 160 countries as of 2022. This dedication to sustainable infrastructure is driving the utilization of low VOC and high-energy-efficiency coatings.

North America serves as a center for advanced research and development, where partnerships between coating producers and technology companies are producing innovative applications, including self-healing surfaces and light-emitting coatings. Moreover, the robustness of the construction sector, evidenced by US expenditures totaling US$ 1.677 trillion in early 2022, creates an advantageous environment for market entry.

The aerospace industry, supported by anticipated aviation services valued at US$ 3,615 billion by 2041, is increasingly implementing smart coatings to improve performance and safety. North America's legislative framework and innovation ecosystem foster an atmosphere conducive to market expansion.

Sustainability Analysis

Sustainability has transitioned from an optional attribute to a crucial factor influencing the future of the Ion Smart Coatings market. Motivated by international climate objectives and rigorous environmental requirements, manufacturers are progressively developing coatings that are low in volatile organic compounds and biodegradable.

The increase of LEED-certified projects in over 160 countries highlights the demand for sustainable construction solutions. Innovations such as solar-reflective and energy-efficient coatings are diminishing operational emissions in buildings, while anti-corrosion coatings enhance infrastructure durability, hence reducing the necessity for resource-intensive maintenance. In the textile and electronics industries, bio-based coatings that preserve breathability and durability are becoming increasingly prevalent.

The incorporation of intelligent coatings into renewable energy infrastructure such as wind turbines and solar panels corresponds with clean energy transitions. As collaborations between technology companies and chemical producers expand, the sector is prepared to provide scalable, sustainable technologies. These initiatives establish smart coatings as a pivotal facilitator in the worldwide transition to sustainable and intelligent materials.

Competitive Landscape

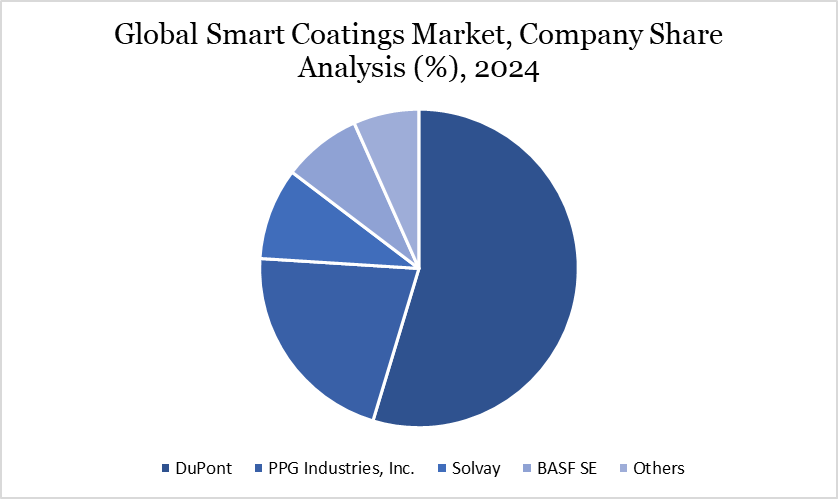

The major global players in the market include DuPont, PPG Industries, Inc., Solvay, BASF SE, The Dow Chemical Co., 3M, Akzo Nobel N.V., RPM International Inc., The Sherwin-Williams Company, Honeywell International Inc. and among others.

Key Developments

In December 2023, Axcentive, a leader in innovative coatings technology, announced a merger with Materia Nova, a company renowned for its expertise in advanced surface coatings. This strategic alliance aims to propel advancements in nanotechnology, marking a significant milestone in the smart and functional coatings market. The collaboration is expected to enhance Axcentive's expansion efforts, combining the strengths of both firms to drive innovation and development in this rapidly evolving industry.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies