Side View Camera System Market Overview

The global side view camera system market reached USD 372.58 million in 2022 and is projected to witness lucrative growth by reaching up to USD 1,128.51 million by 2030. The market is expected to exhibit a CAGR of 17.7% during the forecast period (2024-2031). The side-view camera system consists of a camera, ECU, and display to offer the motorist view from the side of the vehicle to improve the motorist's perception and situational awareness while driving.

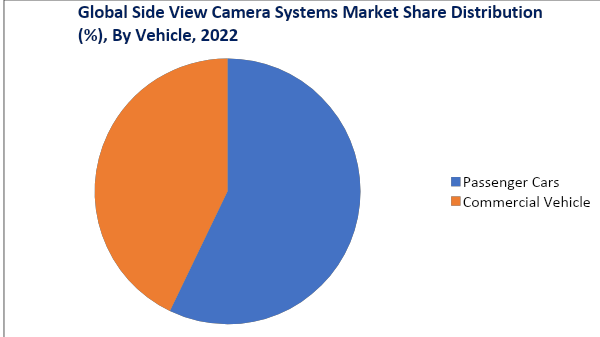

Passenger and commercial vehicles utilize a side-view camera system for safety and situational awareness during driving. The respective factor boosts the global side view camera system market shares.

The growing demand to decrease the rising rates of accidents due to blind spots offer growth opportunities for the global side view camera system market. Moreover, despite the high cost hindering the side view camera system market opportunities, growth in modern technologies and developments are cutting prices, thereby allowing the side view camera market shares to grow exponentially.

Market Scope

| Metrics | Details |

| CAGR | 17.7% |

| Size Available for Years | 2021-2030 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) and Volume (Tons) |

| Segments Covered | Type, Component, Vehicle, Sales Channel and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

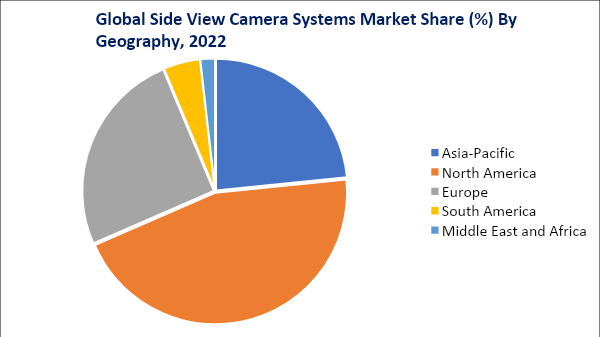

| Fastest Growing Region | Asia-Pacific |

| Largest Region | Asia-Pacific |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To Know more insights - Download Sample

Side View Camera System Market Dynamics

Rising accident cases due to blind spots

In the last two decades, rapid industrialization and economic expansion in major emerging regions have resulted in huge urbanization, and motor traffic growth. Moreover, the rising income, the availability of low-cost vehicles, and easy borrowing have all contributed to an increase in demand for passenger vehicles. Commercial vehicle adoption has been aided by increased trade, logistics, and investment in urban transportation infrastructure. The growth in motor traffic has resulted in a significant increase in road accidents worldwide.

Though accidents can be caused by poor road conditions and a lack of vehicle maintenance, a human mistake is the leading cause of traffic accidents. Lack of judgment, intoxicated driving, and inexperienced drivers are all key factors in the rise in traffic accidents. According to the WHO, road traffic accidents kill more than 1.3 million people globally each year. According to research conducted by the National Highway Traffic Safety Administration (NHTSA), 840,000 blind spot accidents occur in the United States each year, resulting in more than 300 deaths.

A modern passenger car or commercial vehicle has several blind spots, especially on the sides. A side-view camera system can accurately monitor blind spots on the vehicle's sides and alert the driver to nearby traffic, allowing the driver to take action accordingly. Passenger and commercial vehicle owners are increasingly investing in side-view cameras to increase situational awareness and as an important safety measure while driving. Therefore, the rising rates of accidents due to blind spots is a key driver for the side view camera system market.

High cost of side view camera systems

A side view camera system is high-tech equipment made up of hundreds of precision components. As a result, there is rising worry about the system's exorbitant costs, despite the fact that the use of side view camera systems has grown in recent years. Also, years are spent on research and development activities, which include extensive prototyping and field testing. These factors boost the price of side view camera systems.

Moreover, as the use of side view cameras is not mandated in most countries, passenger and commercial vehicle operators avoid them due to the high costs and additional expenditures necessary. Thus, the high cost of side view camera systems could hamper the sales and demand for side view camera systems in the global market.

Side View Camera System Market Segment Analysis

The global side view camera system market is segmented based on type, component, vehicle, sales channel and region.

Economic growth, industrialization and growth of trade and logistics

Economic growth, industrialization and growth of trade and logistics have increased the adoption of commercial vehicles such as trucks, earthmovers and trailers. Growing government investment in public transportation has increased the adoption of buses. However, the growth in vehicular traffic and multiple factors such as bad road conditions and inexperienced drivers is causing a massive increase in the frequency and rate of road accidents. Due to their bigger size, commercial vehicles have major blind spots on their sides, leading to accidents. Accidents involving commercial vehicles cause massive damage to human lives and property.

Furthermore, accidents involving some commercial vehicles such as tankers carrying hazardous chemicals and fuel can impact a much greater area. Various safety measures are being undertaken to reduce the rate of accidents for commercial vehicles and the ensuing damage. Therefore, commercial vehicles are increasingly being fitted with side-view camera systems to increase situational awareness, eliminate blind spots, and allow the driver to adapt quickly to dangerous driving situations. Although most side-view camera systems are fitted in the aftermarket, many commercial vehicle manufacturers now offer them as a standard safety feature.

Side View Camera System Market Geographical Share

A well-developed network of interstate highways, dense vehicular traffic and neglected state of road infrastructure

North America is a high-income developed region that is a major international hub of commerce. The U.S. is the world's largest economy and is a major hub of international trade and logistics. North American countries such as the U.S., Canada and Mexico have signed the North America Free Trade Agreement (NAFTA), which has led to a massive increase in regional trade. All three countries, especially the U.S., have a well-developed network of interstate highways. Almost all major goods traded in North America occurs through roadways. Refrigerated trucks, dumpsters and truck trailers are common commercial vehicles used to transport goods in North America.

The dense vehicular traffic, neglected state of road infrastructure and overworked drivers, has led to frequent road accidents across the region. It has caused major economic losses and damage to life and property. Trucking and logistic companies have installed side-view camera systems to increase safety during driving.

Premium and luxury passenger vehicles come installed with side-view camera systems. Many passenger vehicle owners install these systems in the aftermarket due to increased awareness. Commercial vehicle manufacturers have also started offering side-view camera systems as standard in many new models.

Side View Camera System Market Major Players

The major global players include Continental AG, Valeo, BMW, Hyundai Mobis, Lexus, Samvardhana Motherson, Robert Bosch GmBH, Magna International, Stoneridge, and Denso Corporation.

Key Developments

- On April 28, 2022, Robert Bosch GmbH launched a new innovative warning system for forklifts at LogiMAT. It is a new multi-camera system that minimizes the risk of accidents. It reduces stress for drivers by enhancing the panoramic view around the entire vehicle and consistently warning the driver of impending danger or collisions.

- In 2022, the National Highway Traffic Safety Administration (NHTSA), a key department of U.S. government’s Department of Transportation (DoT), issued a request for comment on new policy changes mandating the use of camera-based systems to improve rear and side visibility. The NHTSA has sought feedback from the general public and the automotive industry before implementing policy changes.

- Aston Martin, a leading vehicle manufacturer, announced the launch of a revolutionary system that projects views from rear and side view mirrors into a customizable three-screen LCD display using three cameras installed on the outside of the car on January 2, 2020. The driver is shown perspectives to the rear and sides as three portions in a LED screen.

Why Purchase the Report?

- To visualize the global side view camera system market segmentation based on type, component, vehicle, sales channel and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of side view camera system market-level with all segments.

- The PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping is available as Excel consisting of key products of all the major players.

The global side view camera system market report would provide approximately 69 tables, 63 figures and 207 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies