Overview

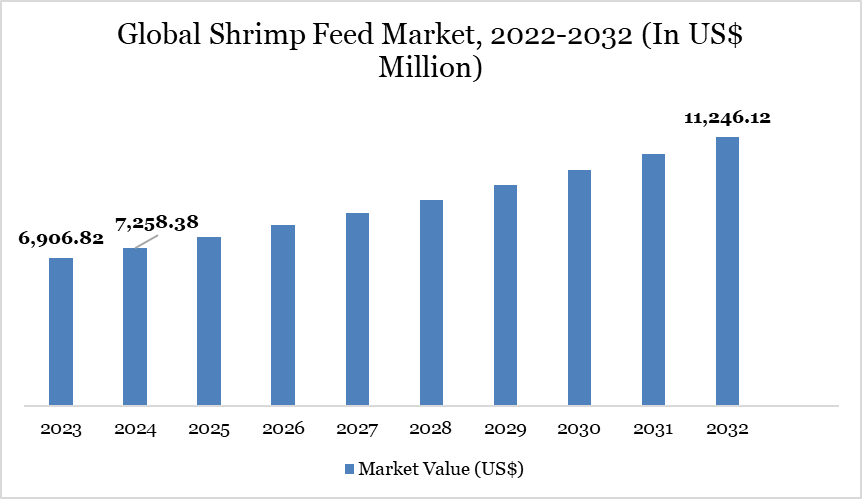

The global shrimp feed market was US$ 7,258.38 million in 2024 and is expected to reach US$ 11,246.12 million in 2032 growing at a CAGR of 5.7% during the forecast period (2025-2032).

The global shrimp feed market is experiencing growing demand driven by the need for efficient, sustainable feed formulations. As shrimp farming becomes more intensive, there is a greater focus on improving shrimp health and growth while ensuring economic and environmental sustainability. Cholesterol plays a critical role in enhancing feed conversion efficiency, supporting shrimp's growth, and improving disease resistance, making it an essential ingredient in feed formulations.

Cholesterol is required at 0.2%–0.5% in shrimp feed to support optimal growth, feed conversion, and survival rates. Studies indicate that shrimp fed with cholesterol-enriched diets gain 10%–18% more weight and achieve 12% better feed conversion efficiency (FCR) than cholesterol-deficient diets. This highlights cholesterol’s importance in maximizing shrimp yield and farm profitability.

According to ScienceDirect, A recent 8-week feeding trial on Pacific white shrimp (Litopenaeus vannamei) highlighted the benefits of cholesterol supplementation in low fishmeal diets. Shrimp fed cholesterol-enriched diets showed improved intestinal health, mitochondrial integrity, and better disease resistance, particularly against Vibrio parahaemolyticus. Additionally, cholesterol supplementation led to better feed conversion efficiency, underlining its cost-effectiveness and importance in enhancing farm productivity and sustainability.

Shrimp Feed Market Trend

The global shrimp feed market is increasingly focusing on reducing reliance on fishmeal due to its rising costs and limited availability. This shift creates an opportunity for the development of cost-effective and sustainable feed formulations using alternative protein sources, including plant-based ingredients and rendered animal by-products.

Krill meal is emerging as a valuable alternative to traditional fishmeal. It provides essential nutrients that enhance the nutritional value and palatability of shrimp feeds, overcoming the limitations of other alternative ingredients, such as lower feeding effectiveness and bioavailability of nutrients. Krill meal improves feed attractability and nutrient absorption.

Market Scope

Metrics | Details |

By Type | Finisher, Grower, Starter |

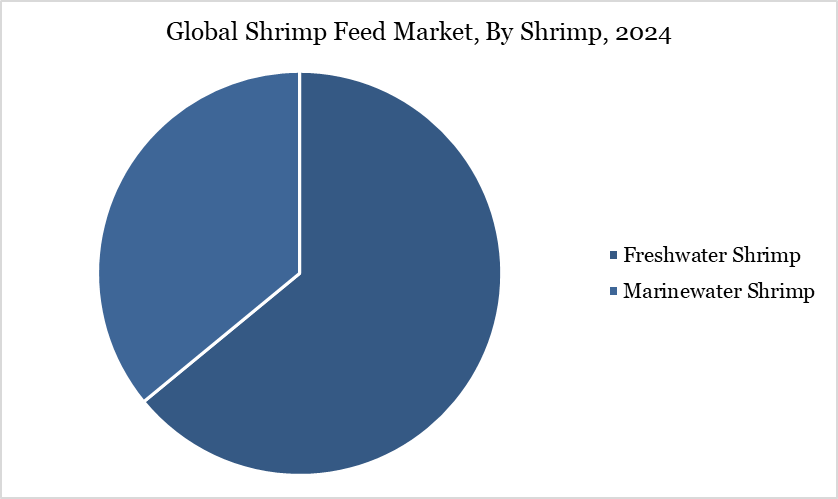

By Shrimp | Freshwater Shrimp, Marinewater Shrimp |

By Form | Pellets, Powders, Liquid, Others |

By Ingredient | Fish Meal, Soybean Meal, Wheat Flour, Fish Oil, Others |

By Additives | Vitamins and Proteins, Fatty Acids, Antioxidants, Cholesterol, Feed Enzymes, Antibiotics, Others |

By Functionality | Growth Promotion, Disease Prevention, Breeding and Reproduction, Digestive Health Support, Color Enhancement, Others |

By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Growing Demand for High-Performance Shrimp Feed

The growing demand for high-performance shrimp feed is a significant driver in the global shrimp feed market. As the global shrimp industry expands, there is increasing pressure to improve shrimp health, growth, and productivity. Cholesterol plays a vital role in achieving these objectives by supporting key functions such as molting, cellular function, and energy metabolism. By enhancing feed conversion efficiency (FCR) and survival rates, cholesterol supplementation contributes to better farm productivity and profitability.

The demand for cholesterol-enriched shrimp feeds is driven by the challenges associated with maintaining optimal shrimp health under the constraints of low fish meal availability and fluctuating feed costs. Cholesterol supplementation, especially in plant-based feed formulations, helps mitigate the limitations of alternative protein sources, ensuring the growth and development of shrimp are not compromised. Cholesterol’s role in molting and exoskeleton formation further supports the demand for high-performance feeds that reduce molting-related mortality and increase production efficiency.

For instance, studies have shown that diets with optimal cholesterol levels result in up to 18% better growth rates and 12% improved FCR compared to cholesterol-deficient diets. Additionally, the use of cholesterol in shrimp feed has been linked to higher survival rates, improved disease resistance, and better overall shrimp health. As the industry shifts towards more sustainable and cost-effective feed solutions, cholesterol supplementation remains a key factor in driving performance and profitability in shrimp farming.

High Cost and Supply Chain Variability of Cholesterol

The high cost and supply chain variability of cholesterol present significant challenges for the shrimp feed market. Cholesterol is essential for shrimp growth, immune function, and overall health, but its sourcing complexities lead to price fluctuations and inconsistent availability. This creates barriers for feed producers, particularly in cost-sensitive markets.

Cholesterol is primarily sourced from animal-based ingredients like fishmeal and meat industry by-products. The volatility of these raw materials, driven by global commodity markets and sustainability concerns, raises production costs. As demand for sustainable feed grows, regulatory pressures further add to sourcing expenses, impacting feed affordability.

Supply chain disruptions also contribute to cholesterol’s variability. Factors such as overfishing regulations, climate change, and geopolitical instability can affect fishmeal availability, leading to inconsistent cholesterol supply. This forces feed manufacturers to seek alternatives, which may not provide the same nutritional benefits for shrimp.

High cholesterol costs and supply issues can limit shrimp feed manufacturers' ability to develop cost-effective, high-performance feeds. Smaller producers, in particular, may struggle to absorb rising costs or secure stable supply contracts. This can impact overall industry competitiveness and profitability.

To address these challenges, leading companies like Cargill and Skretting are investing in research to identify sustainable cholesterol alternatives. Developing cost-effective formulations with optimized cholesterol levels will be essential for ensuring profitability and long-term sustainability in the shrimp feed industry.

Segment Analysis

The global shrimp feed market is segmented based on type, shrimp, form, ingredient, additive, functionality and region.

Freshwater Shrimp Segment Driving Shrimp Feed Market

Freshwater shrimp in the global shrimp feed market was valued at US$ 5,212.90 million in 2024 and is expected to reach US$ 8,492.07 million by 2032, growing with a CAGR of 6.3% between 2025 and 2032.

The freshwater shrimp segment, while smaller compared to the marine water shrimp segment, holds significant potential in specific regions and markets. Freshwater shrimp species, such as Macrobrachium rosenbergii (giant river prawn), are primarily farmed in regions with abundant freshwater resources. This segment caters to niche markets, particularly in Asia, where freshwater shrimp are a traditional delicacy.

Although it does not dominate the global market, the freshwater shrimp segment is growing steadily due to increasing demand in local and regional markets.

Unlike marine shrimp, which require coastal or brackish water for farming, freshwater shrimp can be raised in inland areas with accessible freshwater resources. This makes them an ideal alternative for countries or regions where access to coastal areas is limited or where land-based shrimp farming systems are more cost-effective.

For instance, Bangladesh has seen a surge in freshwater shrimp farming, with farmers opting for Macrobrachium rosenbergii due to its ability to thrive in the freshwater rivers and ponds found across the country. The expansion of inland shrimp farming has also been supported by government initiatives aimed at boosting shrimp production and export, which has further strengthened the dominance of freshwater shrimp in these regions.

Geographical Penetration

Asia-Pacific Drives the Global Shrimp Feed Market

Asia-Pacific’s shrimp feed market was valued at US$ 4,672.78 million in 2024 and is estimated to reach US$ 1,890.20 million by 7,374.29, growing at a CAGR of 5.9% % during the forecast period from 2025-2032.

The Asia-Pacific region holds a significant share of the global shrimp feed market due to its dominance in shrimp farming, which is the largest contributor to global shrimp production. Countries like China, India, Vietnam, Thailand and Indonesia are major shrimp producers, driving the demand for high-quality feed.

According to AQUA CULTURE Asia Pacific (AAP), in 2022, global farmed marine shrimp production was estimated at 5.5 million tonnes, with vannamei and black tiger shrimp leading the market. Asia accounted for over 3.5 million tonnes of this total production, dominating the global shrimp farming industry. Similarly, according to the USDA, China is the world's largest producer of aquaculture shrimp, specifically Penaeus vannamei, with production reaching nearly 2 million metric tonnes (MMT) in 2021, an increase from 1.9 MMT in 2020. This growth reflects China's leading role in the global shrimp aquaculture industry.

With the increasing adoption of aquaculture practices in the region, the need for specialized shrimp feeds that promote growth, health and disease resistance has escalated. Hence, companies are offering a range of products with various additives that help optimize feed efficiency and support sustainable aquaculture practices. For instance, Nippon Fine Chemical Co., Ltd., a Japan-based company offers Lanolin Cholesterol as an essential trace supplement for shrimp farming, where it enhances feed quality and supports shrimp health. While animal fats like fish meal are traditional sources of cholesterol, their availability is limited, making cholesterol an important additive for shrimp and fish feed.

Sustainability Analysis

Sustainability in the shrimp feed market is a major concern, with feed production accounting for 57% of total GHG emissions in global aquaculture. Producing one ton of shrimp feed emits around 2,031 kg CO₂e, driven by raw material sourcing and energy-intensive processing. Improving feed conversion ratios by just 10% could save over 100,000 hectares of land and 141 million m³ of water in Asia alone. However, replacing fishmeal with plant proteins may reduce marine impact but can increase land and water use by over 60%, creating trade-offs. Energy and feed together contribute up to 80% of total shrimp farm emissions, making feed innovation essential for sustainability.

Competitive Landscape

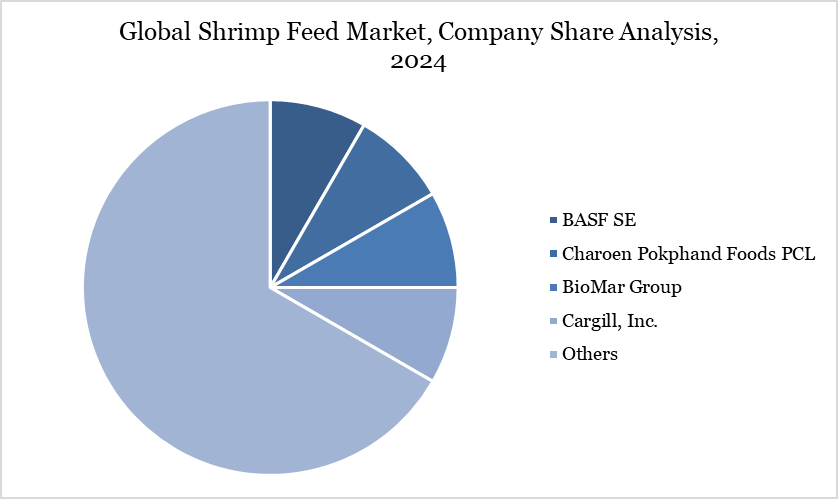

The global shrimp feed market is characterized by a highly competitive landscape, where a few dominant players hold significant market shares due to their established presence, strong distribution networks and ability to provide high-quality, innovative feed solutions.

Companies like Charoen Pokphand Foods PCL (18.96%), Cargill, Incorporated (16.53%) and Avanti Feeds Limited (8.85%) dominate the market due to their long-standing experience, large-scale production capacities and extensive customer bases across diverse regions.

Key Developments

In September 2024, Skretting, in collaboration with Zooca, has introduced a new copepod feed for marine fish and shrimp juveniles, providing hatcheries with access to fresh and canned Calanus finmarchicus. This high-quality natural feed is rich in essential nutrients, including omega-3 fatty acids, proteins and antioxidants, which are crucial for the early development and survival of marine larvae.

In May 2024, Skretting has launched Armis, a new functional feed designed to enhance shrimp resilience and maintain growth under challenging conditions, debuting in India. It offers a practical nutritional solution, particularly for farmers dealing with Enterocytozoon hepatopenai (EHP) and other parasites. Armis provides targeted support to shrimp, ensuring better resilience, improved digestion and sustainable farm performance in the face of disease threats.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies