Semiconductor Sensors Market is segmented By Type (Temperature Sensor, Pressure Sensor, Motion Sensor, Image Sensor and Others), By Material(Carbon Nanotubes, Graphene), By Technology(CMOS, MCMOS, Nanotechnology), By Application (Industrial Automation, Household Appliance, Aerospace & Defense, Medical, Automobile and Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031.

Market Overview

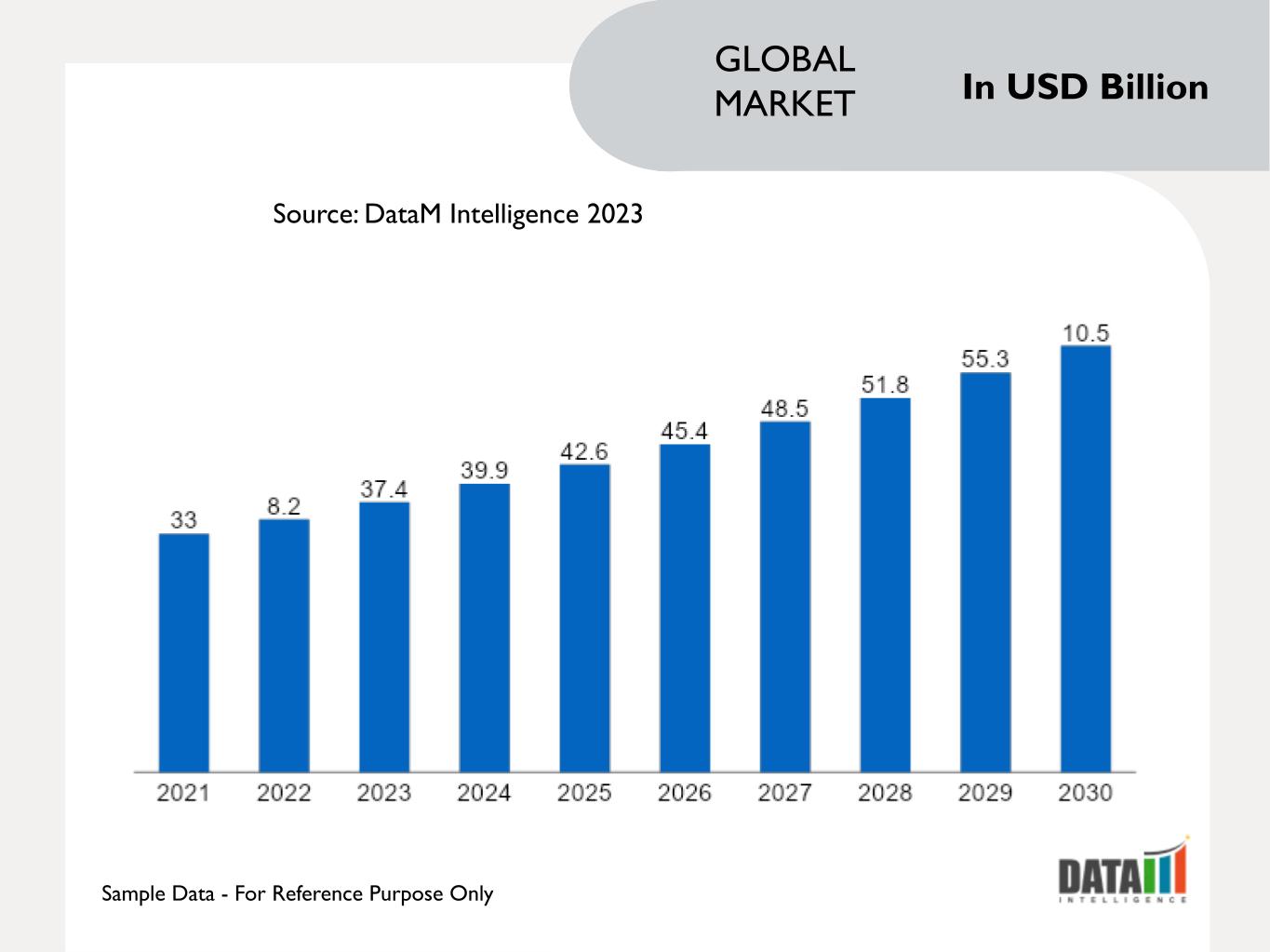

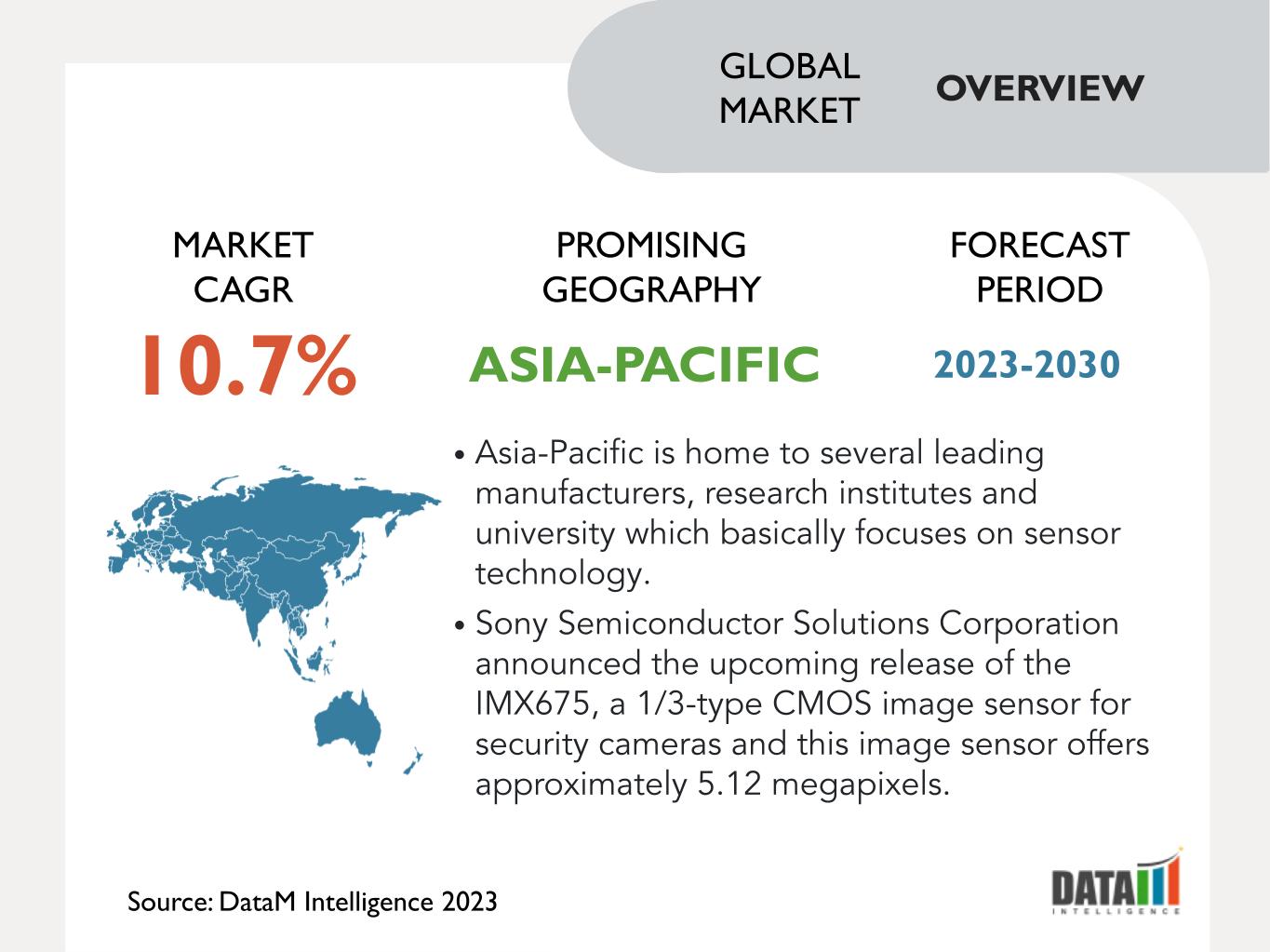

The Global Semiconductor Sensors Market reached US$ 8.2 billion in 2022 and is expected to reach US$ 10.5 billion by 2031, growing with a CAGR of 8.4% during the forecast period 2024-2031.

Continuous advancement in semiconductor sensor technology allowed for the development of efficient and cost-effective sensors. As there is a wider adoption of semiconductor sensors in various fields. The small sensor miniaturization has enabled their usage in smartphones, IoT devices and wearable devices. As there is mass production of sensors which leads to reduced manufacturing costs.

For instance, on 26 January 2023, Allegro MicroSystems, Inc. announced that Polar Semiconductor, a company jointly owned by Allegro and Sanken Electric Co., Ltd., will receive a US$ 150 million equity investment from an affiliate of One Equity Partners and this investment is intended to expand Polar's capacity for 200-millimeter sensor and high voltage power wafers at its fabrication facility in Bloomington, Minnesota.

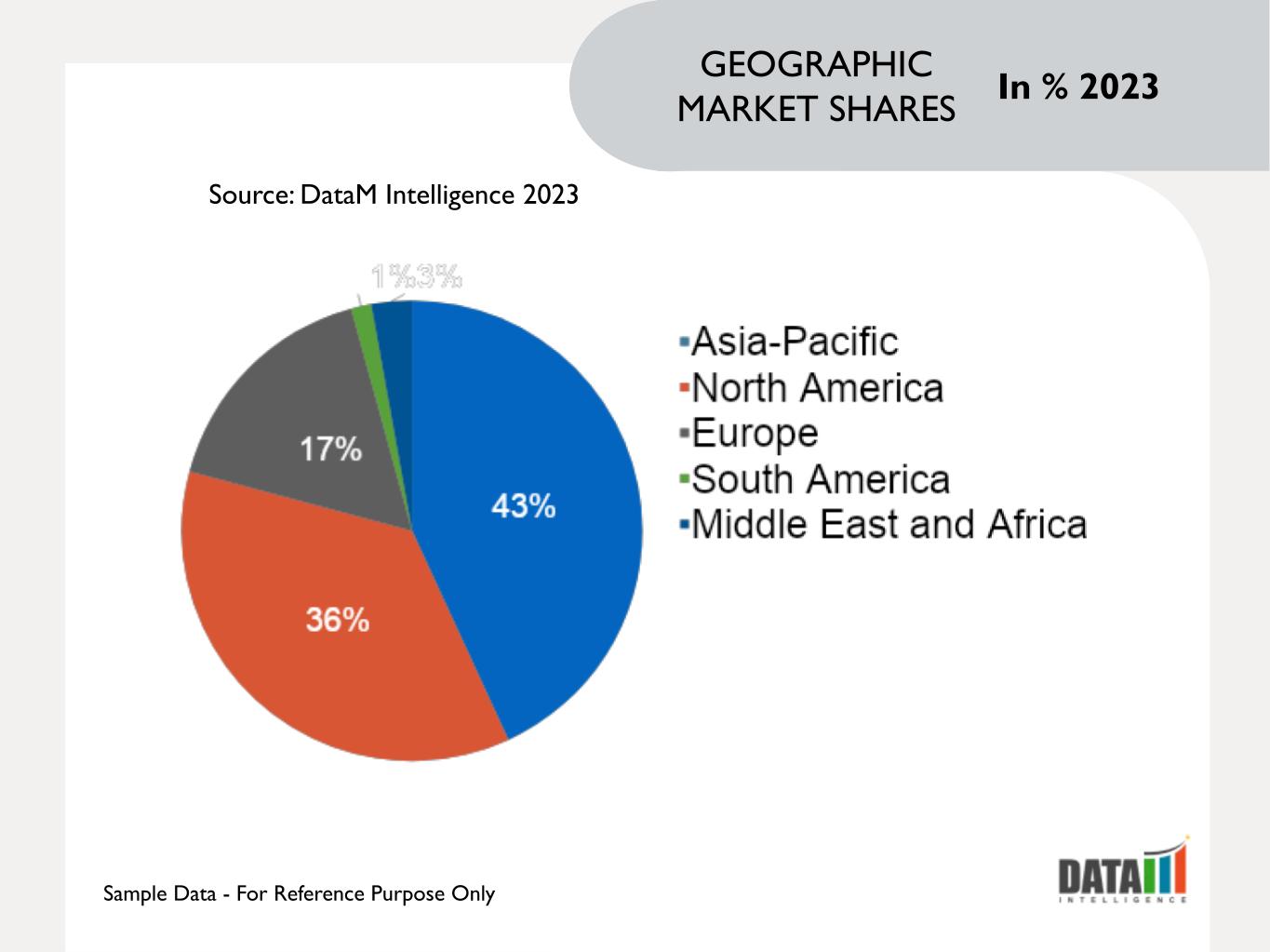

In 2022, North America is expected to cover more than 1/4th of the global market. North America has major consumers in electronics such as laptops, smartphones, tablets and wearable devices. As consumer electronics continuously grow and evolve into more advanced features the demand for semiconductor sensors grows. The adoption of IIoT and Industry 4.0 technologies is growing in North America.

Market Summary

| Metrics | Details |

| CAGR | 8.4% |

| Size Available for Years | 2022-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Type, Material, Technology, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | Asia-Pacific |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis, and Other key Insights. |

To know more insights - Request for Sample

Market Dynamics

Adoption of Industry4.0

Industry 4.0 represents the fourth industrial revolution, characterized by the integration of digital technologies into various industries. Semiconductor sensors play a pivotal role in this transformation by enabling data collection, monitoring and control in real time. As more industries embrace Industry 4.0 practices, the demand for semiconductor sensors increases. Semiconductor sensors provide the necessary data for monitoring equipment, ensuring product quality, and optimizing manufacturing processes.

For instance, on 3 February 2022, the Indian government, led by Prime Minister Narendra Modi, wanted to make India a center for the design and production of electronic systems on a worldwide scale. The approach requires a number of activities to produce crucial parts, like chipsets and to foster a competitive environment for the electronics sector globally.

However, the manufacturing of these components involves complex processes, requires significant capital investments, carries high risks, and features long gestation and payback periods. Additionally, the semiconductor and display technologies evolve rapidly, making it a dynamic field.

Rising Government Initiatives

Governments may actively promote the export of semiconductor sensors by providing support for international marketing, participating in trade agreements and offering export incentives and this can significantly expand market reach and revenue. Governments establish regulatory frameworks and standards for semiconductor sensors to ensure product quality and safety. Clear regulations can boost consumer confidence and global market acceptance.

For instance, on 31 May 2023, The initiative is set to commence on June 1, 2023, and aims to attract investments in the semiconductor and display manufacturing ecosystem in India. The India Semiconductor Mission will oversee and manage this initiative, serving as the designated nodal agency responsible for its implementation. The Modified Programme, eligible companies, consortia, and joint ventures can benefit from a fiscal incentive equivalent to 50% of the project cost for establishing Semiconductor Fabs and Display Fabs in India and this incentive is open to projects at any node, including mature nodes.

Adoption of IoT Technology

By enabling the ability to sense and gather data from the real environment, semiconductor sensors play a critical role in enabling IoT. As IoT networks expand, the security and privacy of sensor data become critical. Semiconductor sensors designed with security features, encryption and authentication mechanisms help protect data integrity and user privacy. As it is cost-effective sensor solution and in IoT, the devices majorly focus on large scale deployments.

For instance, on 30 May 2023, A new line of temperature and humidity sensors was unveiled by iMatrix Systems, a U.S.-based developer of Internet of Things solutions, for use in a variety of industries, including agricultural, food storage, pharmaceuticals and transportation monitoring. The NEO Series sensors can measure temperatures between -40°C and 125°C and relative humidity levels between 0 and 100 percent.

Drift OverTime and Potential Errors

Semiconductor sensors can be sensitive to temperature variations, which may affect their accuracy. Calibration and compensation techniques are often required to mitigate this limitation. Some semiconductor sensors may not be acceptable for measurements outside their designated range or under harsh conditions because they have a limited functioning range. The output measurements of semiconductor sensors may gradually change due to drift over time.

Ionizing radiation is harsh on semiconductor sensors, which has an impact on the way they work in radiation-exposed situations. Although semiconductor sensors can be made to consume little power, some applications can still call for more energy-efficient options, particularly in battery-powered devices. Some semiconductor sensors may exhibit cross-sensitivity to environmental factors other than the target parameter, leading to potential measurement errors.

Market Segment Analysis

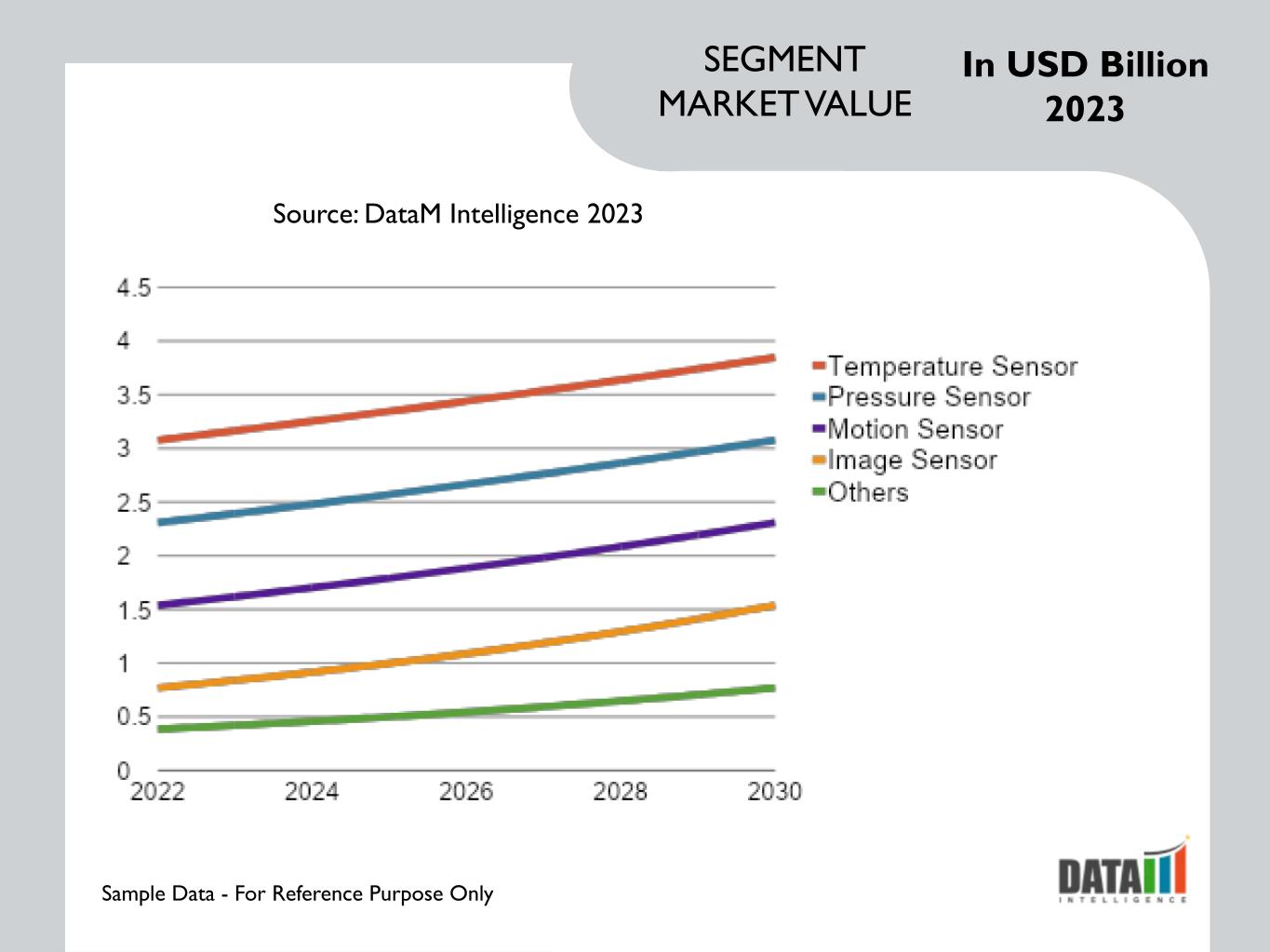

The global semiconductor sensors market is segmented based on type, material, technology, application and region.

Manufacturing of Temperature Semiconductor Sensors

In 2022, temperature sensor is expected to be the dominant segment in the global market holding around 1/3rd of the market. The process of manufacturing temperature semiconductor sensors requires and reliability of devices. As semiconductor devices become smaller and more compact, the need for miniaturized temperature sensors that can fit into tight spaces within semiconductor equipment and devices has increased. The overall growth of the market leads to increased demand for various semiconductor-related components.

For instance, on 27 September 2023, Accelovant introduced its Vacuum Series of fiber-optic temperature sensors designed for use inside semiconductor process chambers under vacuum conditions and these sensors are capable of precise and stable temperature measurements ranging from -95°C to 450°C and are resistant to RF, vacuum and various process conditions. Utilizing the company's patented Kristonium material, these sensors offer improved measurement precision compared to traditional devices.

Market Geographical Share

Rising Demand for Appliances in Asia-Pacific

Asia-Pacific is the dominant region in the global semiconductor sensors market covering more than 1/3rd of the market. It is home to several leading manufacturers, research institutes, and university which basically focuses on sensor technology. Governments in the region launched various initiatives for supporting semiconductor sensors and encourage R&D in sensor technologies. The consumer devices such as smartphones, wearable technology, and appliances, are in high demand throughout the region.

For instance, on 20 July 2022, Sony Semiconductor Solutions Corporation announced the upcoming release of the IMX675, a 1/3-type CMOS image sensor for security cameras and this image sensor offers approximately 5.12 megapixels and provides both full-pixel output of the entire captured image and high-speed output of specific regions of interest simultaneously.

Market Companies

The major global players in the market include Texas Instruments Inc., Analog Devices, Inc., STMicroelectronics, Infineon Technologies AG, Broadcom Inc., Bosch Sensortec GmbH, Sensirion AG, Omron Corporation, NXP Semiconductor N.V. and Honeywell International Inc.

COVID-19 Impact on Market

The pandemic disrupted global supply chains, leading to shortages of critical semiconductor components, including sensors. Factory closures, lockdowns and transportation disruptions affected sensor production and delivery. The pandemic drove increased demand for sensors used in health monitoring devices. For example, temperature sensors, pulse oximeters and respiratory rate sensors became crucial for monitoring COVID-19 symptoms and ensuring patient safety.

The need for remote monitoring solutions surged during the pandemic. Sensors in IoT devices enabled remote monitoring of equipment, infrastructure and environments, reducing the need for physical presence. The automotive industry faced challenges due to the pandemic. Automotive sensor production was affected as vehicle sales declined temporarily. However, the pandemic accelerated interest in autonomous vehicles and smart transportation solutions, driving demand for certain types of sensors.

AI Impact

AI algorithms can process sensor data more efficiently and accurately and they can filter out noise, detect patterns and identify anomalies in sensor readings, leading to improved data quality and reliability. AI can analyze sensor data to predict when equipment or devices may require maintenance. By monitoring sensor outputs for signs of wear or malfunction, AI can schedule maintenance proactively, reducing downtime and maintenance costs.

AI can detect sensor faults or failures by analyzing data trends. If a sensor starts producing abnormal readings, AI can trigger alerts or switch to backup sensors to maintain system functionality. AI can integrate data from multiple sensors, enabling more comprehensive environmental monitoring or context-aware decision-making. Sensor fusion can enhance applications such as autonomous vehicles, robotics and smart cities.

For instance, on 29 September 2023, Syntiant Corp. and GlobalSense introduced cloud-free, always-on deep learning solutions designed to enhance vehicle safety and security in the automotive industry, these solutions use audio event detection (AED) and predictive maintenance and these solutions aim to provide highly accurate event detection without relying on cloud services, reducing power consumption and cost.

Russia- Ukraine War Impact

Ukraine is home to several semiconductor manufacturers and suppliers. The conflict has disrupted supply chains, potentially affecting the availability of critical components, including semiconductor sensors. Companies that rely on Ukrainian suppliers may experience delays or shortages. Uncertainty in the world economy might result from geopolitical tensions like the conflict between Russia and Ukraine.

Business decisions to invest in and conduct R&D could become more conservative, which could have an effect on the advancement and use of sensor technology. Ukraine plays a significant role in the energy supply chain, particularly for natural gas transit. Energy-related disruptions could affect the operation of semiconductor manufacturing facilities, potentially impacting sensor production. Geopolitical conflicts can lead to commodity price volatility and can affect the cost of producing sensors and may lead to price fluctuations in the market.

Key Developments

- In March 2022, Sensorix's expansion of its sensor range for hydrides and hydrogen chloride is aimed at improving safety and monitoring in the semiconductor manufacturing industry, where the use of hazardous gases poses potential risks to both employees and businesses. The addition of these sensors allows for the detection of low concentrations of toxic and dangerous gases with high sensitivity, fast response times and good selectivity.

- In July 2023, the Semiconductor Education Alliance, initiated by Arm and supported by various partners including Arduino, Cadence, Cornell University and others, aims to address the growing challenges in the semiconductor industry's workforce and this initiative focuses on finding talent and upskilling the existing workforce through collaboration between industry, academia and government stakeholders.

- In May 2023, rFpro is collaborating with Sony Semiconductor Solutions Corporation to develop high-fidelity sensor models integrated into rFpro software for the rapid development of perception systems in ADAS and autonomous vehicles. By integrating Sony's sensor models into their simulation technology, they aim to reduce the need for collecting physical data during the sensor development cycle.

Why Purchase the Report?

- To visualize the global semiconductor sensors market segmentation based on type, material, technology, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of semiconductor sensors market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global semiconductor sensors market report would provide approximately 69 tables, 71 figures, and 202 pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies