Overview

Global Satellite Internet Market reached US$ 13.12 billion in 2024 and is expected to reach US$ 47.59 billion by 2032, growing with a CAGR of 17.67% during the forecast period 2025-2032.

As of early 2025, over 5 million users globally were connected to low-Earth orbit (LEO) satellite internet services, primarily driven by commercial rollouts and government-supported initiatives in rural broadband. The global satellite internet market is driven by large-scale deployments in Asia-Pacific, Africa, and parts of Latin America. North America currently accounts for close to 60% of global satellite broadband traffic, but major expansion plans across emerging regions are expected to shift that balance over the next decade. The European Union, for example, has committed over US$11.5 billion for its satellite broadband constellation, IRIS², which will include approximately 290 satellites by 2027, aimed at both civilian connectivity and secure communications.

Satellite Internet Market Trend

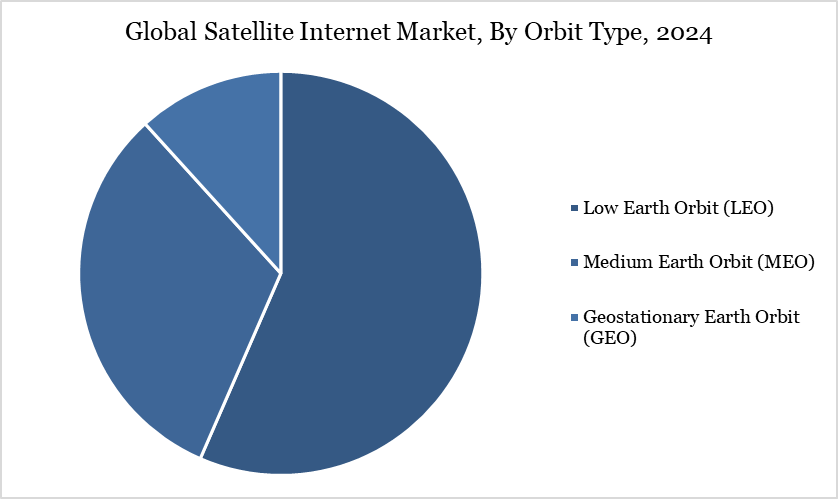

A defining trend in the market is the transition from geostationary satellites to LEO systems, which offer significantly reduced latency and higher data speeds. This shift is enabling real-time connectivity for remote communities, maritime operations, and in-motion applications like aviation and emergency response. Public-sector investment is playing a larger role than in past decades, with national governments including satellite solutions in their universal broadband frameworks.

Simultaneously, the cost of end-user terminals is falling, with average hardware pricing dropping below US$500 per unit in 2024, making adoption more accessible for households and small businesses. Satellite broadband is also gaining traction in climate-sensitive zones where terrestrial infrastructure is vulnerable to extreme weather.

Market Scope

Metrics | Details |

By Orbit Type | Low Earth Orbit (LEO), Medium Earth Orbit (MEO) |

By Frequency Band | C Band, L Band, Ku Band, Ka Band, X Band |

By Download Speed | Low Speed (<25 MBPS), Medium Speed (25-100 MBPS), High Speed (>100 MBPS) |

By End-User | Residential, Commercial, Others |

By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Expansion of Government-Funded Rural Connectivity Programs

India’s BharatNet initiative has made 166,088 Gram Panchayats “service-ready” via a mix of optical fiber and satellite links, covering around 4218 panchayats through satcom as of November 2021 .In its latest phase, NBM 2.0 (2025–30) seeks to extend broadband to 270,000 villages with 95 % uptime and boost rural internet subscribers from 45 to 60 per 100 population by 2030. Meanwhile, in the US, the USDA’s ReConnect Program has deployed over US$ 1 billion since 2018 in loans and grants to bring high‑speed broadband—including satellite—to unserved rural areas and tribal lands.

Orbital Congestion and Satellite Collision Risk

Orbital congestion is increasingly limiting the satellite internet market. As of April 2025, over 40,230 trackable objects orbit Earth—comprising around 11,000 functional satellites and the remainder space debris—cluttering key LEO bands. Starlink alone executed approximately 50,000 collision-avoidance maneuvers between December 2023 and May 2024, nearly doubling the prior six-month period, underscoring both operational strain and rising costs

Segment Analysis

The global satellite internet market is segmented based on orbit type, frequency band, download speed, end-user and region.

Low Earth Orbit (LEO) Segment Driving Satellite Internet Market

The Low Earth Orbit (LEO) segment is revolutionizing the satellite internet market with unprecedented scale and deployment speed. SpaceX's Starlink currently operates over 7,900 satellites in LEO, accounting for roughly 65% of all active spacecraft and serving more than 6 million global subscribers, with projected revenue of nearly US $11.8 billion in 2025.

Meanwhile, Amazon’s Project Kuiper has begun rolling out its own LEO network—deploying 54 satellites via two Atlas V launches by late June 2025—with plans for a total of 3,236 satellites, and must place at least half that by July 2026 under its FCC license. These massive LEO constellations are meeting urgent demand for low‑latency, high‑bandwidth internet in remote and under‑served regions, driving substantial public funding and regulatory support for LEO-fueled connectivity projects across North America and beyond.

Geographical Penetration

North America Drives the Global Satellite Internet Market

The demand for satellite internet in North America—particularly in the US and Canada—has surged sharply, driven by rural broadband needs and rising capacity from LEO constellations. As of Q1 2025, North America alone accounted for approximately 2.5 million Starlink users, representing about 47% of its global subscriber base. In the US, Starlink surpassed 1.4 million subscribers by early 2024, overtaking legacy providers like

This growth is underpinned by federal initiatives such as the FCC’s Rural Digital Opportunity Fund (RDOF), which offers substantial subsidies specifically for extending broadband to underconnected rural regions via satellite, spurring both household adoption and infrastructure investment.

Sustainability Analysis

The global satellite internet market is advancing sustainability through cleaner technologies and policy support. SpaceX reports a 60% reduction in launch emissions via reusable rockets (FCC filings). The US NTIA's US$42B BEAD program supports eco-conscious broadband including satellite systems. The EU’s IRIS² initiative promotes sustainable satellite constellations (European Commission, 2023). Viasat aims for net-zero emissions by 2040, per its 2023 ESG report.

Competitive Landscape

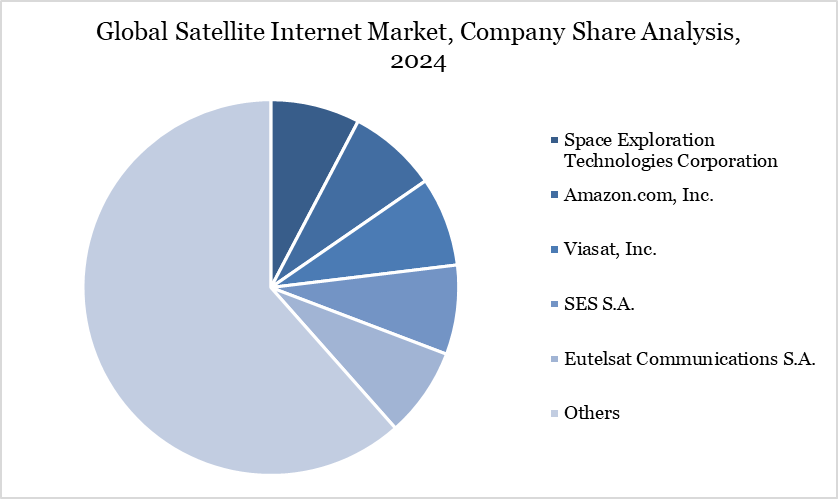

The major global players in the market include Space Exploration Technologies Corporation, Amazon.com, Inc., Viasat, Inc., SES S.A., Eutelsat Communications S.A., Intelsat S.A., Telesat Canada, Iridium Communications Inc., AST SpaceMobile, Inc., and Gilat Satellite Networks Ltd.

Key Developments

In March 2025, Airtel announced an agreement with SpaceX to bring Starlink’s high-speed internet services to its customers in India. This is the first agreement to be signed in India, which is subject to SpaceX receiving its authorizations to sell Starlink in India. It enables Airtel and SpaceX to further explore how Starlink can complement and expand Airtel’s offerings, and how Airtel’s expertise in the Indian market complements SpaceX’s direct offerings to consumers and businesses.

In June 2025, Kazakhstan has signed an agreement with Starlink to begin official satellite terminal sales starting Q3 2025, aiming to boost nationwide internet access. With its vast and remote regions, the country seeks to overcome persistent connectivity challenges.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Suggestions for Related Report

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies