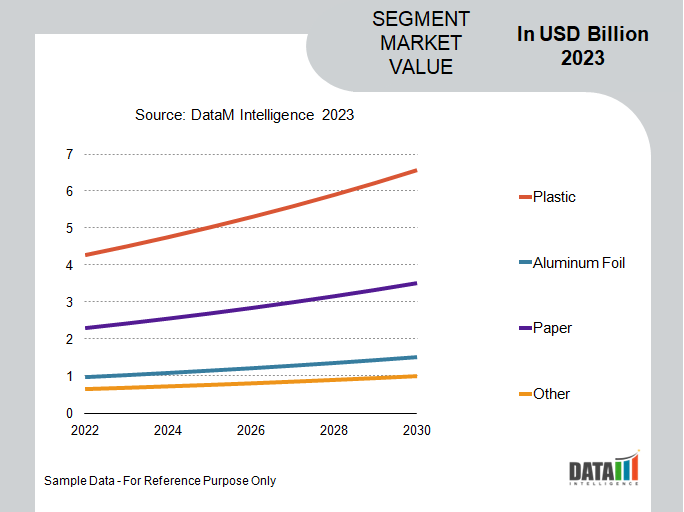

Global Sachet Packaging Market is segmented By Material (Plastic, Aluminum Foil, Paper and Other), By Size(1ml-10ml, 11-20ml, 21-30ml, 30 ml and Above), By Application(Food and Beverage, Personal Care and Cosmetics, Pharmaceuticals and Healthcare, Industrial and Commercial, Promotional and Sample Products, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2023-2030.

Sachet Packaging Market Overview

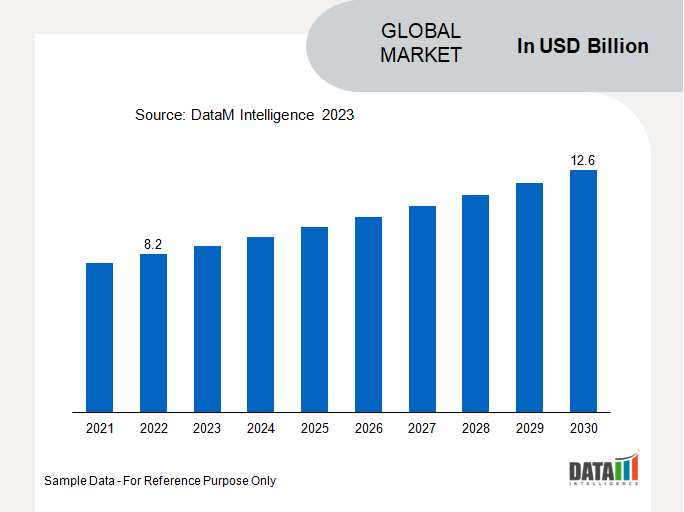

The Global Sachet Packaging Market reached US$ 8.2 billion in 2022 and is expected to reach US$ 12.6 billion by 2030, growing with a CAGR of 5.5% during the forecast period 2023-2030.

The recycle-ready sachet and stickpack solutions aim to provide options that align with recycling streams, particularly Polyolefin and paper. The solutions combine Polyolefin films or paper with a metalized barrier, ensuring both recyclability and machinability. Hapa and Volpak, two companies within the Coesia Group, are set to showcase a new line of Pharma sachets at Interpack 2023. The presentation is part of the larger initiative called GREENMATION, which is Coesia's response to the growing consumer demand for reusable and recyclable packaging solutions, as well as the challenges manufacturers face due to labor shortages and rising production costs.

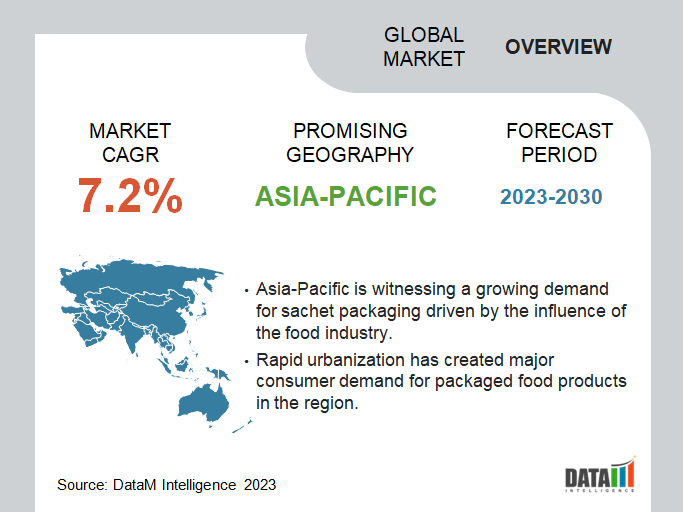

Asia-Pacific is witnessing a growing demand for sachet packaging driven by the influence of the food industry. The region has one of the highest burdens of foodborne illness in the world, making food safety a critical concern. With changing consumer preferences, climate challenges and a growing population, the food industry, including packaging, in the APAC region is evolving rapidly.

Japan is taking initiatives to increase the circularity of plastic packaging as a resource. The Ministry of the Environment introduced the Plastic Resource Circulation Act in April 2022 to encourage packaging firms to reduce single-use plastic usage and adopt circular systems. Companies conforming to the Act receive incentives for transitioning to more circular packaging models.

Sachet Packaging Market Scope and Summary

|

Metrics |

Details |

|

CAGR |

5.5% |

|

Size Available for Years |

2021-2030 |

|

Forecast Period |

2023-2030 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Material, Size, Application and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

Largest Region |

Asia-Pacific |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more details on this report - Request for Sample

Sachet Packaging Market Dynamics and Trends

Increasing Adoption of Sustainability in Sachet Packaging

The sachet packaging market is expected to witness major demand growth on account of the growing demand for sustainable packaging globally. Recyclable Polypropylene sachets exemplify this trend by offering dual advantages: recyclability and reduced environmental impact. PP sachets, which are conveniently recyclable alongside plastic bags, cater to consumers keen on waste reduction. Their lighter composition not only maintains print quality but also trims emissions, appealing to environmentally-conscious consumers and businesses striving to shrink their carbon footprint.

PET/ALU/PE sachets showcase a different facet of sustainability by significantly reducing plastic use—roughly 70% less than a plastic bottle. While traditionally considered non-recyclable, these laminates are finding new life through innovative recycling programs, aligning with the circular economy. Collaboration with recycling entities such as Terracycle and the opportunity for consumers to recycle at local supermarkets underscore the commitment to sustainability.

Food Industry's Influence Drives Sachet Packaging Innovation and Customization

The sachet packaging industry is expected to witness a heightened demand for innovative packaging solutions and sachet packaging is emerging as a preferred choice. Custom sachets, digitally printed using premium rollstock films, offer a sophisticated aesthetic that resonates with consumers seeking both uniqueness and convenience. The trend is driven by the diverse types of sachet packaging available, catering to various consumer preferences. Single-serve sachets are becoming a marketing tool of choice, enticing consumers with low-risk trials and boosting brand awareness.

Ferrero India has introduced a new pouch packaging for its Ferrero Rocher Moments confectionery brand. The packaging innovation aims to provide consumers with a premium yet affordable option for gifting purposes as well as self-consumption and sharing. The new packaging, available in sizes 8, 16 and 32 pieces, retains the premium essence and design codes of the original Ferrero Rocher through its gold-colored packaging and contemporary design patterns. The pouches are designed to be easily shareable, enhancing their appeal as a gifting choice for everyday occasions, not just festivals.

Environmental Challenges and Complexities in the Sachet Packaging Industry

The Sachet packaging industry is expected to become riddled with environmental concerns related to their small size, complex composition and low recyclable value. The packaging consists of multiple layers of various materials, including adhesives and dyes, which renders them nearly impossible to recycle efficiently.

Furthermore, the lightweight and low-value nature of sachets often leads to them being disregarded by garbage pickers and recyclers, exacerbating the problem. As a result, a considerable portion of sachets end up in landfills and water bodies, contributing to the already pervasive plastic pollution crisis.

Furthermore, although FMCG companies have recognized the environmental hazards posed by sachets and initiated efforts to address the issue, challenges persist. Some companies have attempted to promote the recycling of sachets through innovative methods like "chemical recycling."

However, instances like Unilever's experience in Indonesia reveal the complexities and limitations of these approaches. The company aimed to create a circular economy by recycling multilayer sachets into new packaging, but logistical, financial and technical challenges led to the failure of this endeavor. The recyclability of the resulting product remained unproven and a substantial portion of waste feedstock was lost during the process.

Sachet Packaging Market Segmentation Analysis

The global sachet packaging market is segmented based on material, size, application and region.

Plastic Dominance and Sustainable Innovations in Sachet Packaging

Plastic holds the largest segment in the sachet packaging market, plastic sachets are commonly used in sachet packaging for various products such as soup, sauces, hygiene items like shampoo and toothpaste and food. The flexible packaging material used in sachets and pouches is typically composed of layers of different types of plastic, each serving distinct functions. For instance, one layer prevents moisture and light from affecting the contents, another layer seals the packaging and another displays printed product information.

Furthermore, environmental concerns are pushing countries towards sustainable packaging innovations. For instance, Unilever is working on shifting to sachets made from a single type of plastic instead of multiple layers, making recycling easier. In Hanoi, Vietnam, Unilever initiated a trial for recyclable mono-material sachets for Clear shampoo. Unilever is part of the CEFLEX consortium, which aims to make flexible packaging in Europe circular by 2025. They are also working with governments to develop waste infrastructure and promote a circular economy for plastic.

Sachet Packaging Market Geographical Penetration

Asia-Pacific is Expected to be a Key Source of Global Growth

Asia-Pacific countries such as India and China are witnessing significant growth in the packaging industry, with a specific focus on the sachet packaging segment. India's packaging industry is projected to experience substantial expansion in the upcoming years, driven by factors such as increasing awareness of clean water, safe food, pharmaceuticals and the adoption of next-generation digital technologies. According to the "INVEST INDIA" report this growth aligns with global trends, as the packaging industry is already positioned as one of the fastest-growing sectors, worth over US$ 917 billion in 2019 and expected to reach US$ 1.05 trillion by 2024, growing at a CAGR of 2.8%.

The packaging industry in China is also experiencing significant growth and development, with a focus on intelligent packaging technology and sustainability. According to "Interpack" report analysis the Chinese packaging market is projected to have a market volume of 439.4 Million US$ by 2025, indicating a strong upward trajectory. The Chinese packaging market is also expanding with major growth opportunities in the e-commerce industry. With a thriving e-commerce industry, there's a substantial demand for packaging materials to accommodate the increasing volume of online orders which further increases the use of effective sachet transit packaging demand.

Sachet Packaging Market Competitive Landscape

The major global players in the market include Ampac Holdings LLC, GEA Group, Constantia Flexibles Group, Swiss Pac, Sealed Air Corporation, Huhtamaki Group, Glenroy, Inc., Paharpur 3P, Packman Industries and Printpack.

COVID-19 Impact on Sachet Packaging Market

COVID made a significant impact on the sachet packaging industry, demand for protective packaging increased significantly due to changes in consumer behavior. As people moved online for shopping and businesses adapted to remote operations, the need for protective packaging to safely ship goods and products rose. It includes sachet packaging, as products ordered online often require small, individual packaging units.

The disruption in supply chains affected the availability of materials for packaging, including plastics and cardboard used for sachet packaging. The recycling industry, which supplies materials for various types of packaging, was severely impacted, potentially affecting the production of sachet packaging materials. Packaging companies faced challenges in manufacturing and distribution due to business closures, lockdowns and the need for employees to self-isolate. The challenges had temporarily impacted the production and distribution of sachet packaging.

Russia-Ukraine War Impact Analysis

The ongoing Russia-Ukraine war made a significant impact on the sachet packaging industry, conflict in Ukraine has disrupted supply chains in the packaging industry. Businesses, including those reliant on Ukrainian materials, are experiencing side effects due to the conflict. This includes potential disruptions in the supply of materials used in sachet packaging. The conflict has caused an exodus of major Western companies from the region, including packaging companies.

The conflict has led to the closure of packaging and production facilities in both Ukraine and Russia. Major Western companies, including packaging companies, have closed facilities due to the conflict. It has led to decreased production capacity and might potential shortages of packaging materials in the short and medium term. The conflict has led to price fluctuations in commodities like aluminum and paper, which are essential packaging materials. Rising prices of materials such as aluminum and kraft paper could impact the cost of producing sachet packaging.

Key Developments

- In April 2022, Amcor, a global leader in responsible packaging solutions, introduced new, more sustainable High Shield laminates to its pharmaceutical packaging portfolio. These innovations are designed to provide high barrier and performance requirements for the pharmaceutical industry while supporting recyclability agendas. The new High Shield laminates include options for pharmaceutical sachet, stick pack and strippack packaging, using both paper-based and Polyolefin-based materials.

- In August 2023, sustainable packaging startup Notpla and vegan detergent company MACK joined forces to introduce a biodegradable packaging solution for laundry detergents. This initiative aims to contribute to the reduction of single-use plastics in the cleaning industry. MACK is launching laundry detergent refills that come in sachets made from Notpla's innovative seaweed and plant-derived biodegradable film.

- In January 2023, Seven Spring, a tea brand based in Gujarat, India, introduced the country's first 100% compostable tea bag sachets that are free from plastic and aluminum foils. This initiative aligns with the Government's G20 initiative, which focuses on making environmentally responsible and sustainable choices to contribute to a cleaner and greener future. The introduction of these compostable tea bag sachets is aimed at reducing plastic pollution and promoting environmental sustainability.

Why Purchase the Report?

- To visualize the global sachet packaging market segmentation based on material, size, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of cement market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global sachet packaging market report would provide approximately 61 tables, 62 figures and 190 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies