Global Robot as a Service Market Overview

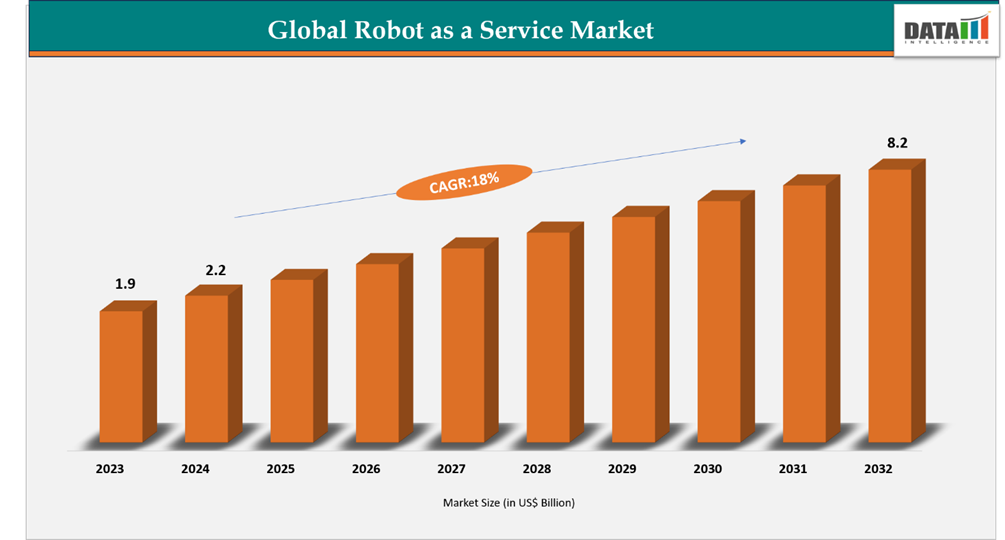

Global Robot as a service Market reached US$ 2.2 billion in 2024 and is expected to reach US$ 8.2 billion by 2032, growing with a CAGR of 18% during the forecast period 2025-2032. The global robot as a service market is experiencing strong growth, driven by rising adoption across sectors such as manufacturing, logistics, healthcare, and retail. Rapid digital transformation, industrial automation, and the integration of artificial intelligence and IoT technologies are key contributors to market expansion. Governments worldwide are promoting automation and smart manufacturing initiatives to enhance productivity and operational efficiency, with programs supporting technology adoption and digital infrastructure development. These industry and policy-driven efforts are expected to directly boost the deployment and utilization of robot as a service solutions, enabling businesses to scale automation with minimal upfront investment.

Robot as a Service Industry Trends and Strategic Insights

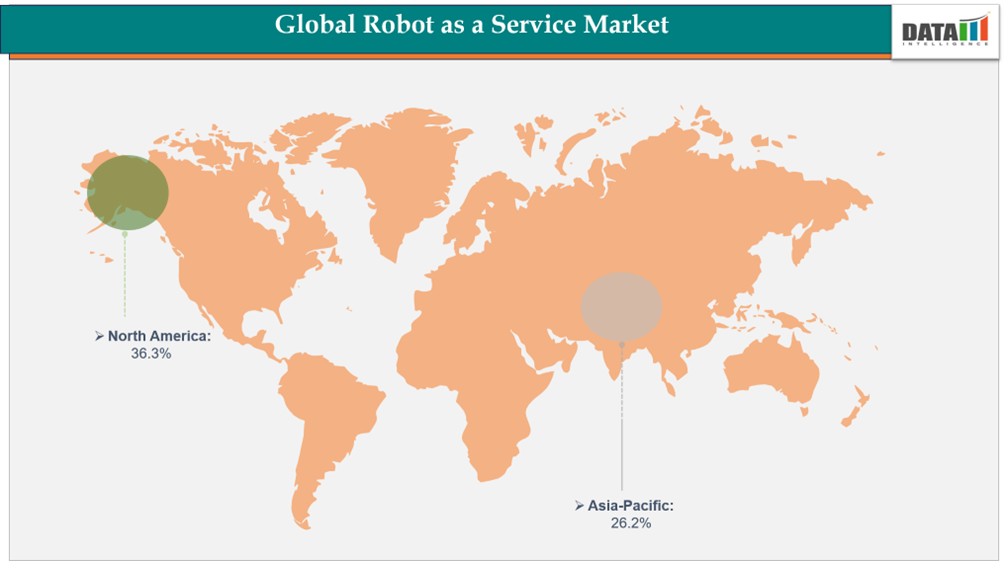

- North America dominates the robot as a service market, capturing the largest revenue share of 36.3% in 2024.

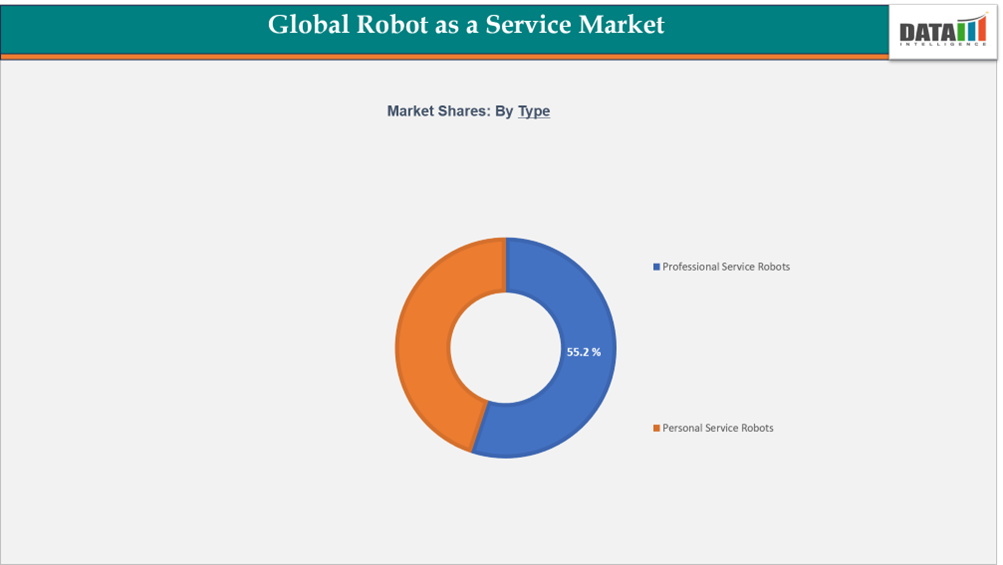

- By type, the professional service robots segment is projected to be the largest market, holding a significant share of 55.2% in 2024.

Market Size and Future Outlook

- 2024 Market Size: US$ 2.2Billion

- 2032 Projected Market Size: US$ 8.2 Billion

- CAGR (2025-2032): 18%

- Largest Market: North America

- Fastest Market: Asia-Pacific

Market Scope

| Metrics | Details |

| By Type | Professional Service Robots, Personal Service Robots |

| By Service Model | Pay-as-you-go (On-demand), Subscription/Leasing Model, Hybrid Model |

| By Deployment | Cloud-based, On-premises |

| By End-User | Automotive, E-commerce & Retail, Healthcare, Food & Beverage, Aerospace & Defense, Agriculture, Education, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For More Detail Information, Request for Free Sample

Market Dynamics

Rising Demand for Automation

The robot as a service market is experiencing rapid growth, driven by increasing adoption of automation across logistics, manufacturing, and service industries. Companies are turning to robotic solutions to improve operational efficiency, reduce reliance on manual labor, and optimize processes such as last-mile delivery, warehouse management, and material handling.

A strong example of this trend is Serve Robotics’ acquisition of Vayu Robotics in August 2025, a company specializing in AI foundation model-based navigation for robots. This strategic move enhances Serve Robotics’ autonomous delivery capabilities and enables the company to expand into new geographic markets, reflecting how businesses are leveraging AI-powered robotics to scale operations and meet growing demand for automated solutions.

Overall, the rising focus on efficiency, cost reduction, and advanced technology integration is pushing more organizations to adopt robot-as-a-service models, making automation a key driver of market growth.

High Initial Costs for Advanced Robotics

The robot as a service market faces a challenge from the high upfront costs of advanced robotic systems. Robots with AI, sensors, and connectivity capabilities often require significant investment, and additional expenses for installation, integration, and employee training can further limit adoption, particularly for small and medium-sized businesses. This barrier is being mitigated by subscription-based and pay-per-use models, which let companies access sophisticated robotics without major capital expenditure. Such flexible approaches allow organizations to incrementally implement automation, lower financial risk, and still benefit from improved efficiency and productivity offered by robot-as-a-service solutions.

Segmentation Analysis

The global Robot as a Service market is segmented based on type, service model, deployment, end-user and region.

Rising Demand for Automation in Professional Services Drives the Segment Growth

The professional service robots segment holds a major share of the global robot as a service market, driven by rising automation in manufacturing, logistics, healthcare, and hospitality. These robots perform tasks such as material handling, inspection, cleaning, and delivery—enhancing productivity, safety, and operational efficiency. The growing preference for subscription-based robotic solutions allows businesses to scale automation without high upfront costs.

For instance, In January 2024 joint venture between Accenture and Mujin, forming Accenture Alpha Automation to help companies automate manufacturing and logistics through data-driven robotics integration. This reflects the increasing collaboration between technology and robotics firms to accelerate the adoption of professional service robots globally.

Rising Demand for Convenience and Smart Living Fuels Personal Service Robots

The personal service robot segment is witnessing rapid growth, driven by rising demand for automation, convenience, and intelligent living solutions. These robots are used for home assistance, mobility, companionship, security, and education, leveraging AI, IoT, and cloud connectivity to provide seamless, adaptive, and personalized experiences.

For instance, in October 2025, when Robo.ai Inc. and Changer.ae unveiled “Roboy339,” the world’s first smart vehicle equipped with a digital wallet, at TOKEN2049. This innovation highlights the expanding capabilities of personal service robots, integrating mobility, finance, and AI-driven intelligence to enhance everyday life. With increasing affordability, smarter functionalities, and growing consumer adoption, this segment is poised to remain a key growth driver in the global robot as a service market.

Geographical Penetration

Rising Adoption of Automation and AI in North America

The North America robot as a service market holds a highest share of the global market in 2024, driven by strong demand from automotive, aerospace, logistics, and industrial sectors. Advanced industrial infrastructure, mature technology ecosystems, and widespread AI adoption support the deployment of autonomous and intelligent robotic solutions across multiple applications. Businesses increasingly use robots for delivery, material handling, inspection, and operational automation, reflecting the region’s focus on efficiency and innovation.

For instance, on August 18, 2025, Serve Robotics Inc., a leading autonomous sidewalk delivery company, acquired Vayu Robotics, Inc., a pioneer in urban robot navigation using large-scale AI models. This acquisition enhances Serve Robotics’ capabilities in intelligent navigation and autonomous delivery solutions, highlighting the growing adoption of AI-driven robotic services in North America and the importance of strategic partnerships and technology integration in driving market growth.

US Robot as a Service Market Outlook

The US robot as a service market is growing steadily, driven by strong demand from sectors such as logistics, healthcare, manufacturing, and retail. Increasing adoption of autonomous robotics, AI-enabled solutions, and smart automation is fueling market expansion as companies aim to improve productivity and operational efficiency. Innovations in digital platforms further support deployment across industries. For instance, in June 2025, SoftBank Robotics America launched SoftBank Robotics Connect for the U.S. market, a platform that streamlines the management of diverse autonomous robot fleets, enhancing operational transparency and efficiency. This highlights the rising focus on intelligent, connected robotic solutions in the US.

Canada Robot as a Service Market Trends

In Canada, the robot as a service market is smaller than in the US but continues to grow due to the country’s technology-focused industries, advanced manufacturing clusters, and logistics networks. Businesses are increasingly adopting autonomous solutions for material handling, healthcare, and industrial automation, supporting steady market growth. Collaborations between local technology providers and global robotics companies are facilitating the deployment of advanced robotic services, emphasizing Canada’s commitment to automation, operational efficiency, and technological advancement.

Presence of Advance Industrial Infrastructure in Asia Pacific

The Asia-Pacific region is anticipated to fastest growing region in the global robot as a service market in 2024, supported by rapid industrialization, expanding manufacturing capabilities, and the rising adoption of automation and AI-driven robotics across sectors such as automotive, logistics, and electronics. Countries like China, Japan, South Korea, and India are leading this transformation, backed by strong industrial frameworks and increasing investments in smart technologies. In a strategic development, In August 2025, Serve Robotics, a pioneer in autonomous sidewalk delivery, acquired Vayu Robotics, a company specializing in AI foundation model-based navigation for robots. This acquisition strengthens Serve’s technological capabilities and supports its expansion into new Asia-Pacific markets, underlining the region’s growing importance in global automation and AI integration. With its combination of advanced infrastructure, digital transformation initiatives, and government support for smart manufacturing, Asia-Pacific continues to emerge as a powerhouse for robot-as-a-service innovation and large-scale deployment.

India Robot as a Service Market Insights

India’s robot as a service market is expanding rapidly, driven by industrial automation, digital transformation, and government initiatives promoting local innovation. Growing adoption across manufacturing, logistics, and healthcare is accelerating demand for affordable and scalable robotic solutions. In a key development, In July 2025, Zoho Corporation acquired Kerala-based Asimov Robotics and opened a new campus in Kottarakkara, strengthening India’s domestic robotics ecosystem. With rising R&D investments and the push toward “Make in India,” the country is emerging as a fast-growing hub for service robotics.

China Robot as a Service Industry Growth

China holds a leading position in the robot as a service market, supported by large-scale automation, strong manufacturing capabilities, and continuous AI integration. The country’s service robotics adoption spans retail, logistics, and hospitality, backed by national innovation policies. Recently, In June 2025, Richtech Robotics Inc. signed a multi-Billion-dollar sales agreement with Beijing Tongchuang Technology Development Co., Ltd. through its joint venture Boyu Artificial Intelligence Technology Co., Ltd., reflecting China’s growing global influence and technological leadership in intelligent service robotics.

Technology Analysis

The robot as a service market is advancing rapidly thanks to innovations in AI, machine learning, IoT, and robotics, which enable smarter, more autonomous, and efficient solutions across various sectors. Integration of AI-driven software with robotic hardware is enhancing precision, productivity, and operational efficiency in industries such as manufacturing, logistics, healthcare, and personal services.

For instance, In September 2025 partnership between L&T Technology Services and Silicon Valley’s SiMa.ai, a leader in Physical AI. This collaboration focuses on delivering advanced AI-powered solutions for mobility, healthcare, industrial automation, and robotics, demonstrating how cutting-edge technology is shaping the future of robot-as-a-service deployments.

Competitive Landscape

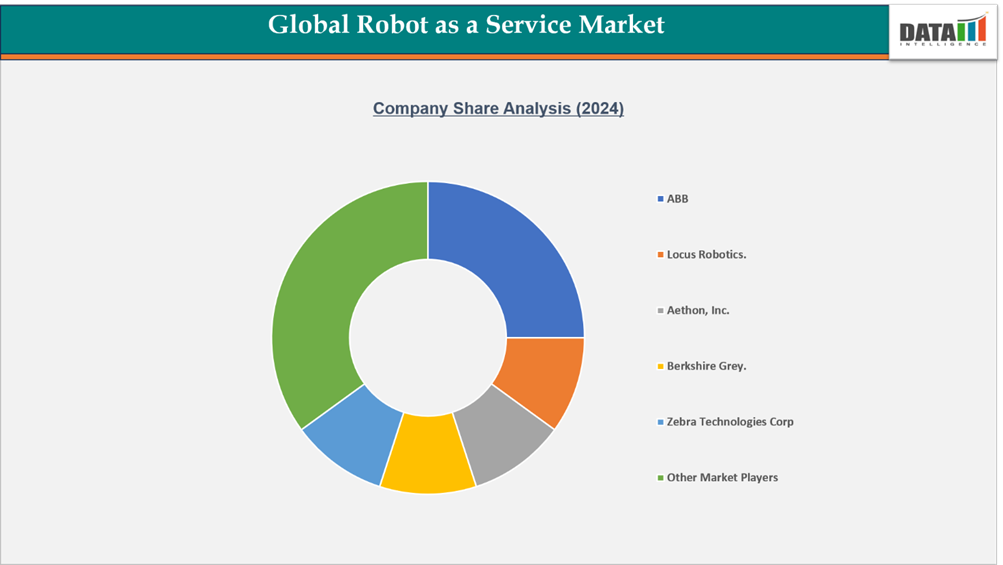

- The global robot as a service market is highly competitive, comprising both established robotics manufacturers and specialized service providers.

- Key players include ABB, Locus Robotics., Aethon, Inc., Berkshire Grey., Zebra Technologies Corp, Cobalt AI, Ademco Global, FANUC CORPORATION, Exotec, Vectis Automation LLC

- Companies focus on product differentiation by offering advanced robotic solutions with superior autonomy, AI integration, and operational efficiency tailored to industrial, logistics, healthcare, and personal applications.

- Strategic investments in R&D, AI and software development, sustainability, and service optimization are critical, as the market faces growing competition from alternative automation solutions and emerging technologies.

Key Developments

- In September 2025, RobCo, a Munich-based industrial automation robot-as-a-service company, has expanded into the United States by opening a new headquarters in San Francisco.

- In November 2024, ABB has acquired Sevensense, strengthening its position in next-generation AI-powered mobile robotics.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2025

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies