Red Mud (Bauxite Residue) Market Overview

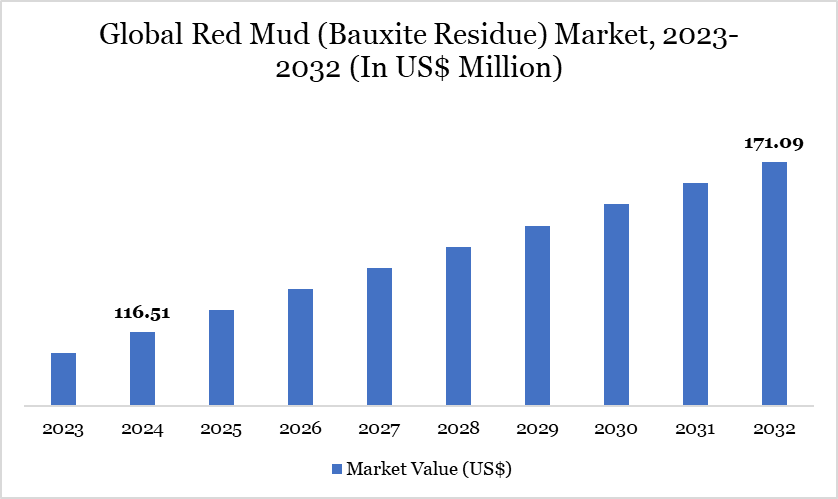

Red Mud (Bauxite Residue) Market reached US$ 116.51 million in 2024 and is expected to reach US$ 171.09 million by 2032, growing with a CAGR of 4.92% during the forecast period 2025-2032.

Red mud, also known as bauxite residue, is an industrial waste generated during the extraction of alumina from bauxite using the Bayer process. For every ton of alumina produced, approximately 1.5 tons of red mud is generated. Traditionally considered an environmental hazard due to its high alkalinity and heavy metal content, red mud is increasingly being viewed as a valuable secondary resource. This has led to a rise in red mud valorization projects, supported by advancements in separation technologies and a growing demand for sustainable raw materials in various downstream industries.

One of the primary driving factors is the increasing demand for sustainable construction materials. Red mud’s chemical properties make it a suitable raw material substitute in cement, bricks, and concrete production. For instance, in 2021, Alcoa has a goal to reduce bauxite residue land requirements per metric ton of alumina produced by 15 percent by 2030, from a 2015 baseline. Alcoa is a founding member of the four-year ReActiv project, which is seeking to transform bauxite residue into a reactive material suitable for new cement products that have a low carbon dioxide footprint.

Red Mud (Bauxite Residue) Market Trend

The red mud processing market is witnessing several emerging trends, driven by technological breakthroughs, regulatory shifts, and industry collaborations. One of the most prominent trends is the shift from disposal to resource recovery. Companies are increasingly treating red mud not as a waste, but as a potential Product of raw materials.

For instance, NALCO in India and Hydro's Alunorte refinery in Brazil are actively working on extracting valuable elements like iron, alumina, titanium, and rare earth elements (REEs) from red mud using acid leaching and other advanced processes. This trend is gaining traction as countries seek to secure their supply chains for critical minerals.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

| By Product | Low-Iron Red Mud, High-Iron Red Mud, Others |

| By Production Process | Bayer Process, Sintering Process, Others |

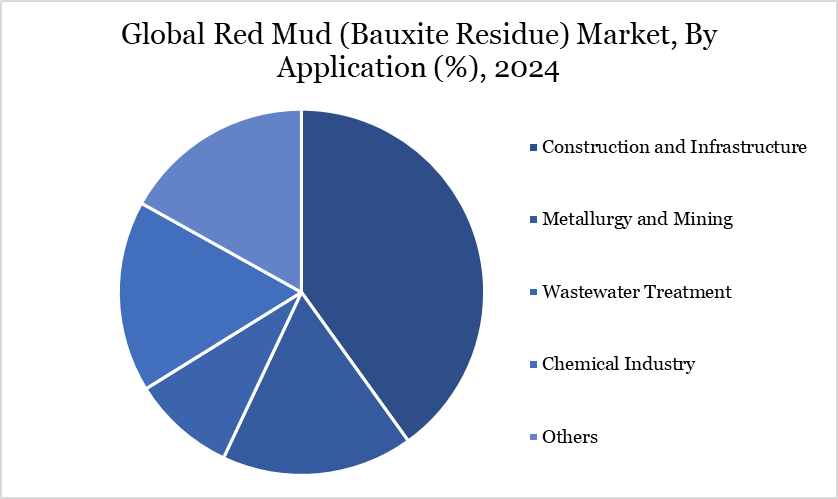

| By Application | Construction and Infrastructure, Metallurgy and Mining, Wastewater Treatment, Chemical Industry, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Red Mud (Bauxite Residue) Market Dynamics

Innovations and Research Collaborations

Technological innovations and research collaborations are transforming the red mud (bauxite residue) market, turning a hazardous waste into a valuable resource. Traditionally known for its high alkalinity and toxic metals, red mud is now being processed to extract iron, alumina, titanium, and rare earth elements. Partnerships like that of IIT Madras with Vedanta Aluminum—are developing commercial uses in cement, ceramics, pigments, and soil conditioners.

Innovations such as dry stacking, thermal treatments, and acid leaching have improved safety and efficiency. Notably, in February 2023, Wave Aluminum and Hydro’s Alunorte refinery launched a red mud processing project in Brazil. These advancements support circular economy goals, attract green investments, and create new revenue streams from industrial waste. As circular economy models take hold globally, the red mud valorization sector offers significant economic and environmental opportunities, paving the way for a more sustainable future in alumina and allied industries. Thus, above factors helps to boost the market growth.

High Cost and Complexity of Advanced Extraction Technologies

One of the most significant restraints in the red mud processing market is the high cost and complexity associated with advanced extraction technologies, particularly for recovering valuable elements like rare earth elements (REEs), titanium, and iron. While red mud contains these materials in trace amounts, their extraction involves multi-step processes such as acid leaching, solvent extraction, and high-temperature roasting, which require specialized infrastructure and chemicals.

Additionally, the technical challenges such as dealing with impurities, ensuring environmental safety, and managing post-extraction residues further deter investment. As a result, many companies hesitate to adopt these advanced processes, slowing down the broader market penetration of high-value red mud utilization technologies.

Red Mud (Bauxite Residue) Market Segment Analysis

The global red mud (bauxite residue) market is segmented based on product, production process, application, and region.

Rising Adoption of Red Mud in the Construction and Infrastructure Sector

The construction and infrastructure sector holds a significant share in the red mud (bauxite residue) market due to its ability to utilize large volumes of this industrial by-product as a raw material. In January 2025, Shailesh Kumar Agarwal, Executive Director of the Building Materials and Technology Promotion Council under MoHUA, India, stated that India's construction sector is experiencing rapid growth and is projected to reach a value of US$1.4 trillion by 2047.

This growing sector enhances the market potential for red mud by integrating it into high-demand infrastructure applications. The expansion of India's construction industry is, therefore, directly contributing to the increased use of red mud in building materials. Red mud is increasingly being used as a substitute for conventional materials like clay, sand and laterite in cement and brick manufacturing. Its high content of iron oxide, alumina and silica makes it suitable for producing construction-grade materials, helping reduce reliance on natural resources.

Cement manufacturers, especially in regions like India and China, are integrating red mud into clinker production, contributing to cost efficiency and lower carbon emissions. For instance, red mud can replace up to 20% of cement in concrete mixes, enhancing sustainability without compromising structural integrity.

Red Mud (Bauxite Residue) Market Geographical Share

APAC Dominates the Red Mud (Bauxite Residue) Market with Robust Infrastructure and Industrial Demand

The Asia-Pacific region holds a significant share in the Red Mud (Bauxite Residue) Market due to its dominant role in global bauxite production, with countries like China, India and Australia being major players in the mining and refining industries. These countries produce a substantial volume of bauxite, a key raw material for aluminum production, resulting in a considerable amount of red mud as a byproduct.

In August 2020, Hindalco Industries signed a Memorandum of Understanding (MoU) with UltraTech Cement to deliver 1.2 million metric tonnes of red mud annually to UltraTech’s 14 plants across seven states. This initiative marks a significant step in sustainability, as red mud, a byproduct of alumina manufacturing, will be used as a replacement for mined minerals in cement production.

China, as the largest aluminum producer in the world, generates vast quantities of red mud, contributing significantly to the regional market. India, with its rapidly growing aluminum industry, also plays a pivotal role in the market's expansion. Moreover, Australia, a leading bauxite exporter, adds to the growing production of red mud.

Sustainability Analysis

The utilization of red mud (bauxite residue) aligns strongly with global sustainability goals, particularly in promoting circular economy practices, reducing industrial waste, and conserving natural resources. Traditionally regarded as an environmental burden due to its high alkalinity and potential toxicity, red mud is now being reclassified as a valuable secondary raw material.

Its integration into sectors like construction, cement, and ceramics helps reduce dependence on non-renewable materials such as clay, limestone, and sand, which are heavily extracted and energy-intensive. For instance, using red mud in cement production can lower carbon emissions by reducing clinker content, which is a significant source of CO₂ in the cement industry. Furthermore, red mud’s reuse prevents the long-term environmental risks associated with its landfilling, such as groundwater contamination and land degradation.

Red Mud (Bauxite Residue) Market Major Players

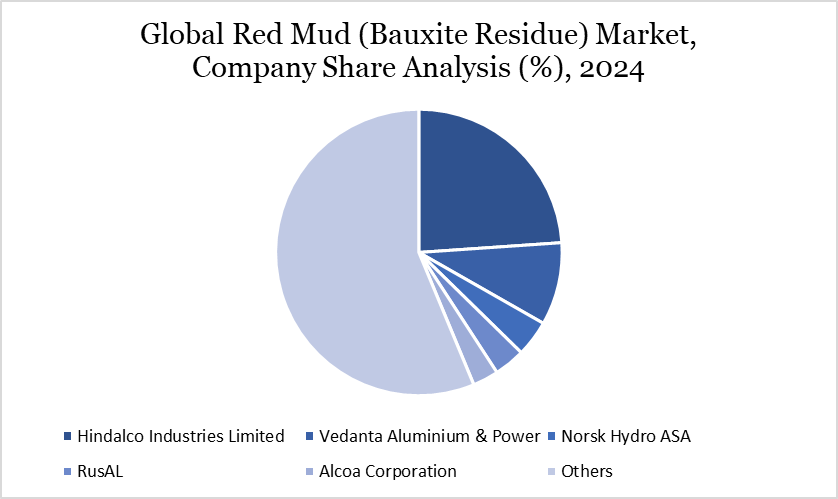

The major global players in the market include Hindalco Industries Limited, Vedanta Aluminium & Power, Norsk Hydro ASA, RusAL, Alcoa Corporation, Alum Tulcea, Rio Tinto Group, National Aluminium Company Limited (NALCO), South32 Limited, Enervoxa and among others.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies