Global Real Estate Market is segmented By Property(Residential, Commercial, Industrial), By Type(Land, Buildings), By Business(Sales, Rental, Lease), By Mode(Online, Offline), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2023 - 2030

Real Estate Market Overview

Global Real Estate Market reached USD 28,901.4 billion in 2022 and is expected to reach USD 48,912.1 billion by 2030, growing with a CAGR of 4.1% during the forecast period 2023-2030. The incorporation of artificial intelligence (AI) and Internet of Things (IoT) technology, which provides a centralized platform for automating numerous building activities such as lighting, security systems and energy management, is positively impacting market growth.

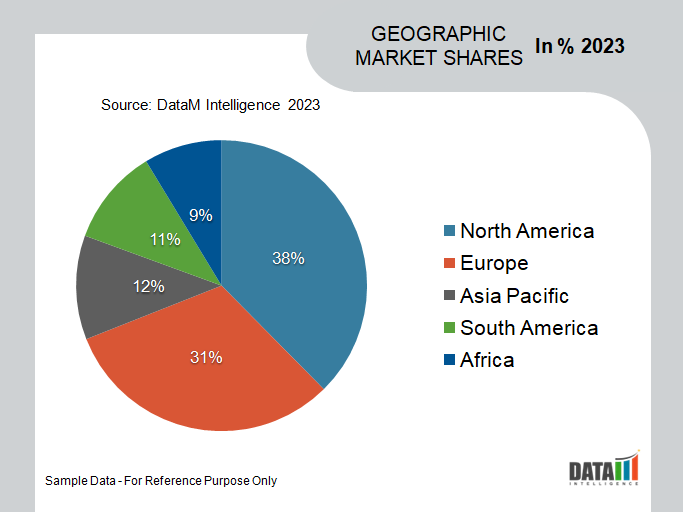

Furthermore, increased demand for contemporary and trendy office spaces, as well as a growing trend of urban and semi-urban lodging, are driving market expansion. In 2022, North America is expected to account for over 40% of the global real estate market. Several developing firms are establishing themselves in the real estate market in U.S.

For example, Facilio, a New York-based property technology enterprise, has raised USD 35 million in its most recent fundraising round in order to expand and improve its technology. The investment allow the company to extend its sales and marketing efforts, allowing more businesses to achieve success through a predictive, connected real estate operations model.

Real Estate Market Scope

|

Metrics |

Details |

|

CAGR |

4.1% |

|

Size Available for Years |

2021-2030 |

|

Forecast Period |

2023-2030 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Property, Type, Business, Mode and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

Largest Region |

Asia-Pacific |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Property Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

Real Estate Market Dynamics

The Rising Government Investments

Various government measures in various nations are likely to assist the growth of the global real estate sector. Several initiatives have been made by the Government of India, in partnership with the governments of several states, to promote development in the sector. The Smart City Project, which aspires to build 100 smart cities, provides an opportunity for real estate.

The Reserve Bank of India (RBI) announced in October 2021 that the benchmark rate of interest would remain at 4%, providing a significant boost to the country's real estate sector. Low mortgage interest rates are expected to increase housing demand and raise sales by 35-40% over the 2021 holiday season. The measures taken will have a positive effect on market growth.

The Rising Search for Homes and Online Real Estate Services

Potential clients began to increase their house search and purchase activity, encouraging the real estate market's growth. According to the National Association of Realtors, waiting sales in U.S. metro regions were up about 30% by August 2020, after falling more than 30% in April 2020. Furthermore, the internet's effect has raised customer awareness of online real estate services.

Online real estate services allow buyers and renters to explore houses from the comfort of their own homes in an easy and time-efficient approach. To acquire market share, key firms are providing various services such as live-streaming rooms. According to Alibaba, more than 5,000 real estate brokers from over 100 cities in China have embraced the live-streaming rooms method, allowing homebuyers to view homes and make deals of their own homes.

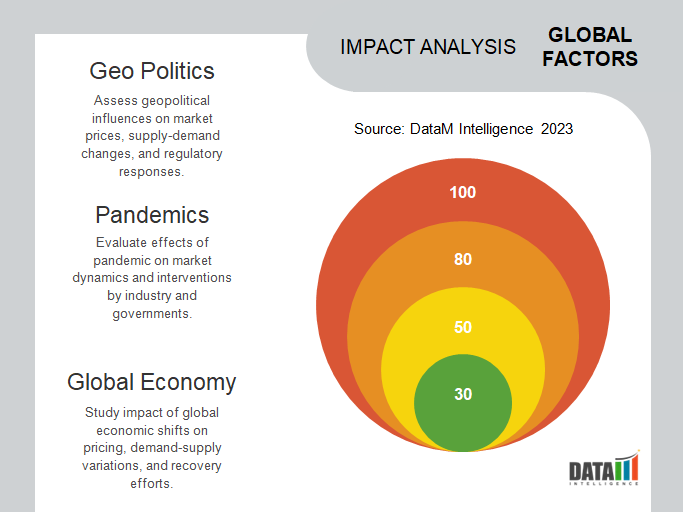

Economic Uncertainty and Fluctuations in Interest Rate

Economic risks, such as recessions, changes in GDP growth and international trade conflicts, can all have an impact on the real estate market. During uncertain economic times, consumer confidence and expenditure declined, resulting in lower property demand and investment. Interest rate changes can have a big impact on the real estate market.

The price of monthly mortgage payments is affected by interest rates. A period of high interest rates will raise the cost of mortgage payments and reduce demand for home purchases. Renting is more attractive than owning due to high interest rates. If homeowners with large variable mortgages, interest rates have a greater impact. Extremely low interest rates, on the other hand, can cause asset bubbles and instability in the housing market.

Real Estate Market Segment Analysis

The global real estate market is segmented based on property, type, business, mode and region.

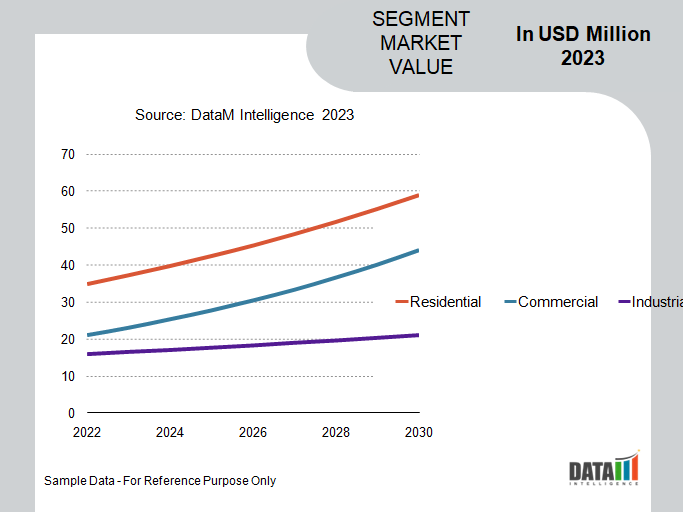

The Inclination Towards Homeownership drives Residential Property Growth

During the forecast period, residential property is expected to hold around 33.4% of the global real estate market. The millennial generation has been driving the growth, as they have been more interested in homeownership in recent years. According to Apartment List's Homeownership Study, the homeownership percentage among millennials has risen from 40% in 2020 to 47.9% in 2021.

Residential real estate has remained an appealing financial commodity for both domestic and international investors. The chance for capital appreciation and rental income, particularly in premium locations, buyers' enthusiasm. There was a growing interest in environmentally friendly and sustainable residential properties. Buyers were becoming more interested in residences with energy-efficient features and green certifications.

Global Real Estate Market Geographical Penetration

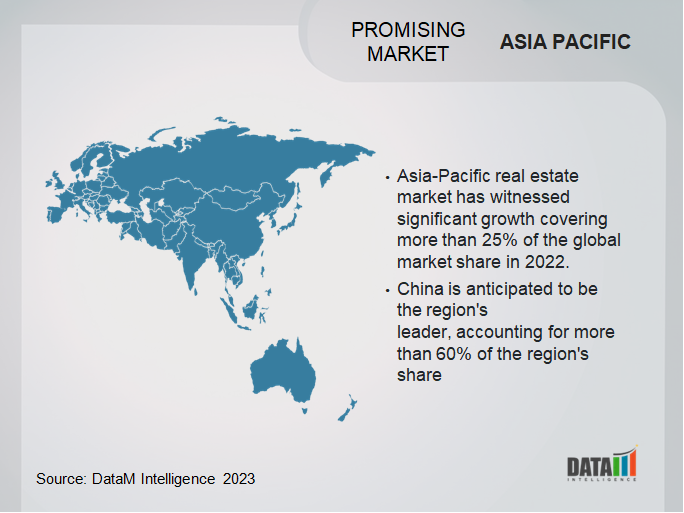

The Rising Investments in Asia-Pacific

Asia-Pacific real estate market has witnessed significant growth covering more than 25% of the global market share in 2022. China is anticipated to be the region's leader, accounting for more than 60% of the region's share. Shanghai is actively promoting technology sectors, which is driving the high need for Business Parks. Landlords should actively pursue tenant rebalancing, with a concentration on industries with long-term development prospects.

The growing number of tourists in developing nations such as India, the Philippines, Indonesia, Thailand and Vietnam is expected to promote regional market growth. In Australia, landlords in regional malls are devoting up to 40% of Gross Lettable Area to experiential retail, childcare and innovative facilities in order to capitalize on localised shopping, reflecting the future of retail as an enhanced community role.

Furthermore, according to a Colliers analysis, investments in the commercial office sector in India increased 53% from the same time last year between January-September 2022. Overall, overall investments in Indian real estate reached US$3.6 billion from January to September 2022, an increase of 18% over the same period previous year. Office sector investments accounted for nearly half of total investments.

Major Key Players

The major global players include American Tower Corporation, Aston Pearl Real Estate Broker, Ayala Land Inc. (Ayala Corporation), Cbre Group Inc., Colliers International, Gecina Inc., Jones Lang Lasalle Incorporated, Prologis Inc., Reliance Relocation Services and Simon Property Group Inc..

COVID-19 Impact

The ongoing risk of COVID-19 took the real estate sector into a crisis, which is still unfolding. To prevent the risk posed by pandemics, much of the activity has shifted to digitization and internet business. It resolves various segments of the real estate market without physical interaction, transactions, visits, inspection or access.

While the difficulty during the financial crisis was a shortage of money or liquidity, the problem during COVID19 is with the actual sector, where money may be available but many goods and services may not be due to restrictions placed as a precaution against pandemics. And it has an impact on the financial industry by lowering cash flow and returns, which is reflected across the value chain.

Russia- Ukraine War Impact

Property developers and investors are facing more uncertainty in their construction projects as the Ukraine crisis and economic sanctions imposed on Russia exacerbate already growing energy costs and a building material shortage. Executives attending Mipim, one of Europe's largest real estate events, held March 15-18 in Cannes, France, expressed concerns about the dangers of existing projects, notably in Central and Eastern Europe (CEE).

The rise in property costs is mostly due to an increase in the cost of raw materials and transportation, which is being driven by an increase in fuel prices. Russia has been one of the largest crude oil distributors; but, as a result of the worldwide sanctions imposed on the country as a result of the invasion, the cost of fuel has risen. It influenced the cost of manufacture and transportation of steel, iron and their alloys (which are must use materials used in the construction of houses).

Key Developments

- In May 2023, Simon announced the beginning of construction on a new Residence Inn® by Marriott® at Northgate Station, a global leader in top shopping, dining, entertainment and mixed-use destinations. The first hotel at Northgate Station is the most recent transformation in world-class, mixed-use building in the heart of Northgate Station and it will be a valuable community asset.

- In December 2021, Coldwell Banker, an American real estate franchise, has created the "Franchise and Capitalize" program to aid in the development of Egypt's real estate market. It enables Real Estate marketing investors and entrepreneurs to build profitable projects, extend current ones and obtain the maximum Return on Investment (ROI) while also complying with the framework of Egyptian Real Estate new market criteria.

- In November 2021, JLL, a global professional services firm specializing in real estate and investment management, announced the completion of its acquisition of Building Engines, the market-leading building operations platform. JLL paid about USD 300 million in cash to acquire Building Engines. The acquisition shows JLL's singular commitment to using technology to address real estate's greatest problems.

Why Purchase the Report?

- To visualize the global real estate market segmentation based on property, type, business, mode and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of real estate market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global real estate market report would provide approximately 69 tables, 65 figures and 201 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies