Global Protein Engineering Market – Industry Trends & Outlook

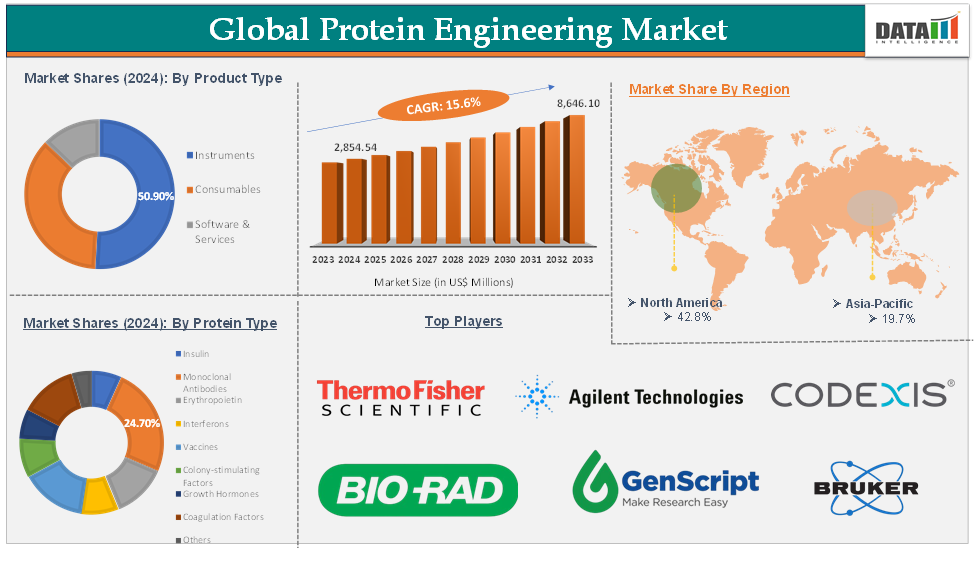

The global protein engineering market reached US$ 2,854.54 Million in 2024 and is expected to reach US$ 8,646.10 Million by 2033, growing at a CAGR of 15.6 % during the forecast period of 2025-2033.

The global protein engineering market is defined as the process of developing new proteins or modifying existing ones to enhance their performance, functionality, or characteristics. This is achieved through advanced techniques such as recombinant DNA technology, rational design, and directed evolution, allowing researchers to manipulate protein structures at the molecular level for improved stability, activity, specificity, or resistance to environmental conditions.

Key drivers of the protein engineering market include the rising prevalence of chronic diseases like cancer, diabetes, and autoimmune disorders. The market is further propelled by growing investments in biotechnology research and development, the shift toward personalized medicine, and advancements in biotechnological tools such as CRISPR and AI-based drug design.

Current trends in the market involve the integration of high-throughput screening, computational modeling, and synthetic biology to streamline the discovery and development of novel proteins. There is also an increasing application of protein engineering in industrial processes, agriculture, and the food and beverage industry, where engineered proteins are used to improve efficiency, sustainability, and product quality.

Opportunities for growth in the protein engineering market are expanding as technological innovations lower costs and improve the precision of protein modification. The growing popularity of protein therapies as alternatives to gene therapy, rising adoption in emerging economies, and increased government funding for research are expected to further boost market expansion.

Global Protein Engineering Market – Executive Summary

Global Protein Engineering Market Dynamics: Drivers

Advancements in biotechnology and protein engineering tools

Advancements in biotechnology and protein engineering tools, particularly AI, gene editing, automation, and synthetic biology, are dramatically enhancing the speed, precision, and scope of protein engineering. These innovations are expanding the market by enabling new applications, improving efficiency, reducing costs, and supporting the development of next-generation therapeutics and industrial solutions. AI-driven design and high-throughput tools enable rapid identification of therapeutic protein candidates, supporting the development of new biologics and personalized medicines.

For instance, in February 2025, Capgemini unveiled a groundbreaking generative AI-powered methodology for protein engineering, leveraging a proprietary protein large language model (pLLM) to accurately predict optimal protein variants. With a patent pending. This innovative approach is poised to accelerate the global bioeconomy and enable transformative scientific advancements across sectors such as healthcare, agriculture, and environmental science.

Global Protein Engineering Market Dynamics: Restraints

High maintenance costs are associated with protein engineering tools & instruments.

High maintenance costs associated with protein engineering tools and instruments are a significant challenge for the global protein engineering market. These costs stem from the need for sophisticated, high-precision equipment that requires regular servicing, calibration, and sometimes replacement of parts to ensure optimal performance.

The QuikChange HT Protein Engineering System is a specialized tool used for site-directed mutagenesis, a common technique in protein engineering to introduce specific mutations into DNA. These systems are expensive, with list prices ranging from approximately US$ 7,500 to over US$ 15,000 per unit.

Protein engineering tools like the QuikChange HT system are highly sophisticated and require regular calibration, servicing, and sometimes replacement of critical components. The precision needed for protein engineering means even minor malfunctions can lead to failed experiments and wasted resources. Thus, the above factors could be limiting the global protein engineering market's potential growth.

For more details on this report, Request for Sample

Global Protein Engineering Market - Segment Analysis

The global protein engineering market is segmented based on product type, protein type, technology, end-user, and region.

Product Type:

The instrument product type segment is expected to hold 50.9% of the global protein engineering market in 2024

Instruments are the specialized hardware and analytical devices used throughout the process of designing, modifying, producing, and characterizing proteins. These instruments are essential for enabling precise manipulation and detailed study of protein structure and function.

Instruments encompass a wide range of analytical, structural, automation, and detection devices. These tools are indispensable for enabling the precise engineering, analysis, and validation of proteins for research, therapeutic, and industrial purposes.

Devices such as spectrophotometers, fluorometers, and mass spectrometers are used to quantify protein concentration, assess purity, and analyze structural properties. Techniques like X-ray crystallography and cryo-electron microscopy (cryo-EM) are vital for determining the three-dimensional structure of proteins, which is crucial for rational protein design and engineering.

Robotic liquid handlers, automated synthesizers, and high-throughput screening platforms accelerate mutagenesis, cloning, and screening of protein variants, making large-scale protein engineering feasible. Instruments for ELISA, radioimmunoassay, and immunofluorescence are used to detect and quantify proteins, even at very low concentrations, supporting both research and diagnostic applications.

For instance, in June 2024, Syngene International, a leading contract research, development, and manufacturing organization (CRDMO), introduced a new platform designed for the rapid production of proteins. This platform leverages a special cell line and a transposon-based technology, which Syngene has licensed from ExcellGene, a Swiss company well-known for its expertise in developing mammalian cell lines. These factors have solidified the segment's position in the global protein engineering market.

Global Protein Engineering Market – Geographical Analysis

North America is expected to hold 42.8% of the global protein engineering market in 2024

North America, especially the U.S., hosts a high concentration of leading biopharmaceutical and biotechnology companies, as well as top academic and research institutes specializing in protein engineering.

Substantial government investment in research and development, particularly in biotechnology and life sciences, accelerates advancements in protein engineering. Federal funding, research grants, and favorable regulatory frameworks encourage academic and commercial research, supporting the development of new protein-based therapeutics and technologies.

For instance, in December 2024, Cradle Bio, an AI-driven protein engineering company based in Amsterdam, secured $73 million in Series B funding led by Institutional Venture Partners (IVP) from California, with continued support from existing investors Index Ventures and Kindred Capital. This new round brings Cradle’s total funding to over $100 million. Cradle Bio specializes in using generative AI to accelerate and improve protein engineering, a process crucial for developing new therapeutics, diagnostics, sustainable chemicals, and agricultural products.

Also, in May 2024, Bruker Corporation, a major player in scientific instruments and analytical solutions, has completed the acquisition of nearly all assets and rights of NanoString Technologies, Inc. NanoString, based in Seattle, is well-known for its innovative life science research tools, especially in the fields of spatial transcriptomics and gene expression analysis. Thus, the above factors are consolidating the region's position as a dominant force in the global protein engineering market.

Asia Pacific is expected to hold 19.7% of the global protein engineering market in 2024

The Asia-Pacific protein engineering market is expanding rapidly, driven by a combination of rising investments in biotechnology and pharmaceutical research and development, and strong support from favorable government policies. Countries such as China, India, Japan, and South Korea are at the forefront, with China currently dominating the regional market and India and Japan also showing impressive growth rates.

A significant driver is the increasing incidence of cancer and other chronic diseases in the region, which is fueling demand for engineered proteins in targeted therapies and precision medicine. This is complemented by the expansion of biopharmaceutical manufacturing capabilities, particularly in China, India, and South Korea, where local and multinational companies are boosting production capacity and efficiency.

Collaborations between global biotech firms and regional players are facilitating technology transfer and commercialization, while the availability of a skilled workforce at competitive costs strengthens the region’s market position. The expansion of contract development and manufacturing organizations (CDMOs), supportive regulatory frameworks, rising healthcare expenditure, and government-backed initiatives are further enhancing industry development.

For instance, in March 2025, Scientists in Shanghai have achieved a breakthrough in protein design by harnessing artificial intelligence. They have created the world’s largest protein sequence dataset and developed advanced models based on this extensive data. This innovation allows for the precise modification and selection of proteins with specific functions, opening up new possibilities for targeted applications in medicine, biotechnology, and beyond.

Additionally, the growing focus on monoclonal antibodies, biosimilars, and AI-driven drug discovery, along with investments in large-scale biomanufacturing infrastructure, ensures sustained growth. These drivers collectively position the Asia-Pacific region as the fastest-growing and an increasingly influential player in the global protein engineering market.

Global Protein Engineering Market – Competitive Landscape

The major global players in the protein engineering market include Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Bruker Corporation, Genscript Biotech Corporation, Codexis, Inc., Waters Corporation, New England Biolabs, Inc., Merck KGaA, PerkinElmer, Inc., Danaher Corp. (Cytiva), and Amgen, Inc., among others.

Global Protein Engineering Market – Key Developments

In May 2025, Creative BioMart, a prominent biotechnology solutions provider, announced enhancements to its protein engineering services. This update is designed to offer improved support to researchers working in diverse fields such as therapeutic drug development and industrial biotechnology.

In February 2025, Capgemini unveiled a groundbreaking generative AI-powered methodology for protein engineering, leveraging a proprietary protein large language model (pLLM) to accurately predict optimal protein variants. With a patent pending. This innovative approach is poised to accelerate the global bioeconomy and enable transformative scientific advancements across sectors such as healthcare, agriculture, and environmental science.

In January 2025, Bio-Techne, a prominent provider of life science tools and reagents, introduced a new line of "designer proteins" that have been created using advanced artificial intelligence (AI) design platforms and protein evolutionary workflows. Bio-Techne is using cutting-edge AI algorithms to engineer proteins with enhanced or novel properties, making them more effective for research and therapeutic applications.

In June 2024, Agilent Technologies launched the Agilent Seahorse XF Pro Analyzer, an advanced instrument designed for real-time analysis of cellular metabolism. This next-generation platform builds on Agilent’s established Seahorse technology, which is widely used by researchers to study how cells produce and use energy.

In May 2024, Bruker Corporation, a major player in scientific instruments and analytical solutions, has completed the acquisition of nearly all assets and rights of NanoString Technologies, Inc. NanoString, based in Seattle, is well-known for its innovative life science research tools, especially in the fields of spatial transcriptomics and gene expression analysis.

Global Protein Engineering Market – Scope

Metrics | Details | |

CAGR | 15.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Product Type | Instruments, Consumables, Software & Services |

Protein Type | Insulin, Monoclonal Antibodies, Erythropoietin, Interferons, Vaccines, Colony-stimulating Factors, Growth Hormones, Coagulation Factors, Others | |

Technology | Rational Protein Design, Irrational Protein Design, Others | |

End-User | Biopharmaceutical Companies, Contract Research Organizations, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global protein engineering market report delivers a detailed analysis with 76 key tables, more than 70 visually impactful figures, and 173 pages of expert insights, providing a complete view of the market landscape.