Preventive Vaccine Market Size& Industry Outlook

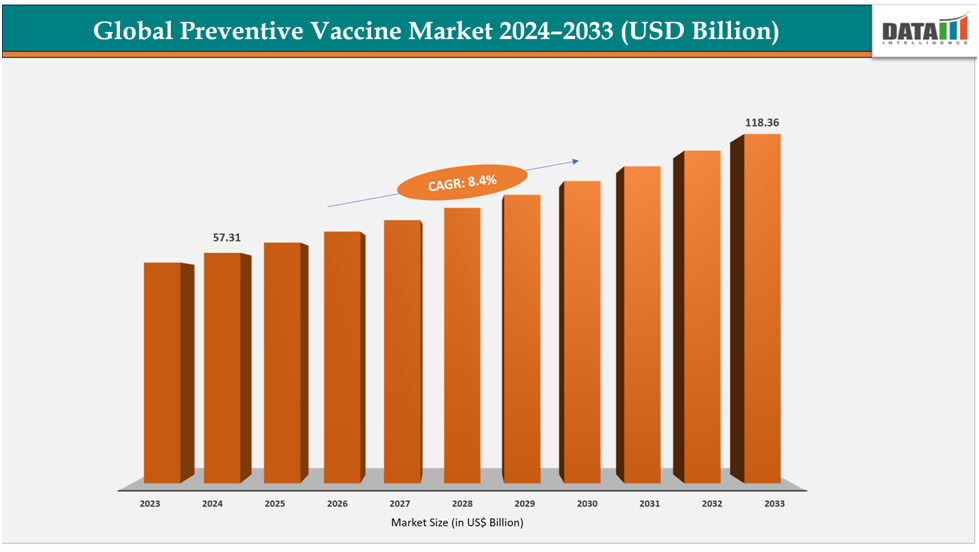

The global preventive vaccine market size reached US$ 53.15Billionin 2023 with a rise of US$57.31Billion in 2024 and is expected to reach US$118.36Billion by 2033, growing at a CAGR of8.4%during the forecast period 2025-2033.

Innovations in vaccine research and development, including mRNA, protein subunit, and conjugate technologies, are speeding up the creation of safer, more efficient, and quicker-to-produce vaccinations. New developments make it possible to target newly developing infectious diseases and enhance immune responses across all age groups. Around the world, robust government vaccination programs are increasing vaccine accessibility at the same time by providing financing, launching awareness campaigns, and enforcing vaccination laws. When combined, these elements raise demand, lower the burden of disease, and boost vaccine coverage.

Key Highlights

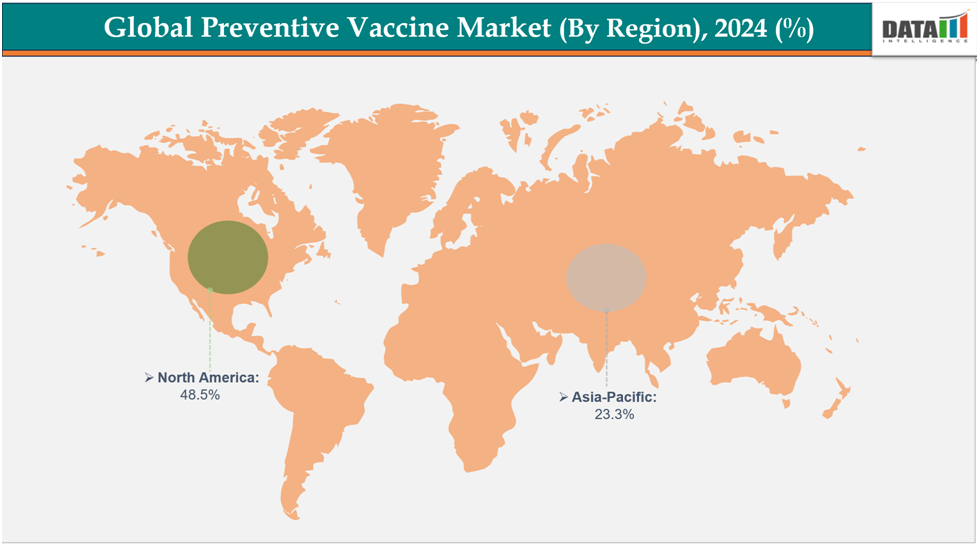

- North America is dominating the global preventive vaccine market with the largest revenue share of a 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global preventive vaccine market, with a CAGR of 7.5% in 2024

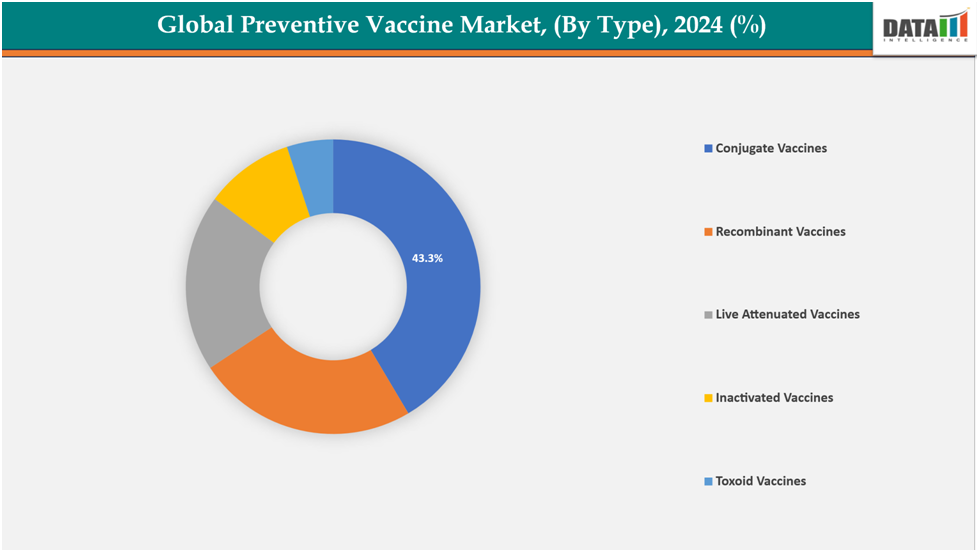

- The conjugate vaccines segment from type is dominating the preventive vaccine market with a 43.3% share in 2024

- The pneumococcal disease segment disease indication is dominating the preventive vaccine market with a 25.5% share in 2024

- Top companies in the preventive vaccine market include GSK plc, Biological E Limited, HIPRA, Bharat Biotech, GSK plc, Sanofi, Bavarian Nordic, Merck Inc., Valneva SE, Pfizer Inc., and Takeda Pharmaceutical Company Limited, among others.

Market Dynamics

Drivers: Rising prevalence of infectious diseases is significantly driving the preventive vaccine market growth

The rising prevalence of infectious diseases is a major driver of the preventive vaccine market. The need for effective vaccination has grown as a result of rising incidences of influenza, dengue, HPV, and pneumococcal disease worldwide, as well as new dangers including COVID-19 and mpox. With the help of WHO, Gavi, and CEPI, governments throughout the world are giving vaccination programs top priority since they continue to be the most economical way to lower morbidity, mortality, and medical expenses. The use of vaccines has spread from children to adults and the elderly due to increased public awareness following COVID-19. Market expansion is being further accelerated by pharmaceutical innovation in mRNA, recombinant, and conjugate platforms as well as growing coverage in emerging nations.

Owing to the rising prevalence of infectious diseases, for instance, dengue significantly drove the preventive vaccine market. According to WHO, from January to July 2025, over 4 million cases were reported across 97 countries, with the disease spreading into new regions such as Europe and the Eastern Mediterranean. In 2024, dengue reached a historic high of 14.6 million cases, with the Americas contributing over 13 million, reflecting a dramatic global surge since 2000.

Restraints: The side effects associated with preventive vaccines are hampering the growth of the preventive vaccine market

The growth of the preventive vaccine market is significantly influenced by concerns over side effects. Reports of adverse reactions, ranging from mild symptoms like fever and fatigue to rare but severe complications, contribute to vaccine hesitancy and lower uptake rates. For instance, the Haemophilus influenzae type B (Hib) vaccine, recommended by the CDC starting at two months of age, protects against serious infections such as meningitis, pneumonia, epiglottitis, and sepsis, yet concerns about reactions can affect parental acceptance.

Moreover, the smallpox vaccine may rarely cause serious issues, including widespread rash, severe eye infections leading to vision loss, exacerbation in people with eczema, and encephalitis, which can result in permanent brain damage. These potential risks, whether perceived or actual, create caution among the public, slowing adoption and limiting the overall expansion of the preventive vaccine market.

For more details on this report, see Request for Sample

Segmentation Analysis

The global preventive vaccine market is segmented based ontype, disease indication, route of administration, distribution channel, and region

By Disease Indication:

By Type:

The conjugate vaccines segment from type is dominating the preventive vaccine market with a 43.3% share in 2024

Conjugate vaccines dominate the preventive vaccine market primarily because they effectively protect infants and young children, the most vulnerable populations. Unlike plain polysaccharide vaccines, conjugate vaccine links the bacterial sugar coat to a carrier protein, powerfully engaging the immature immune system to trigger a robust, long-lasting response with immunological memory.

Moreover, scientific advantage, continuousinvestments in research and development, and higher-valent vaccines expand coverage, allowing protection against multiple strains, reducing severe diseases like invasive pneumococcal and meningococcalinfections. For instance, in July 2025, the FDA approved MenQuadfi, a meningococcal conjugate vaccine developed by Sanofi Pasteur, for active immunization against invasive disease caused by Neisseria meningitidis serogroups A, C, W, and Y. It was authorized for use in individuals six weeks of age and older, marking a significant advancement in pediatric and adult protection.

The Pneumococcal disease segment disease indication is dominating the preventive vaccine market with a 25.5% share in 2024

The pneumococcal vaccine segment dominates the preventive vaccine market due to the high global burden of pneumococcal disease, which causes pneumonia, meningitis, and bloodstream infections, particularly in children under five and the elderly. The broad acceptance of effective vaccinations, such as PCV and PPSV, is fueled by their inclusion in numerous national immunization programs. Vaccines become more accessible through government programs and international partnerships that fund them. Additionally, the cost-effectiveness of immunization over therapy and growing awareness of preventative healthcare are driving demand.

Moreover, innovation in vaccines covering more serotypes strengthens their appeal.In June 2024, the U.S. FDA approved Merck’s CAPVAXIVE (Pneumococcal 21-valent Conjugate Vaccine) for adults aged 18 and older. The vaccine was designed to provide active immunization against 21 Streptococcus pneumoniae serotypes, targeting those responsible for the majority of invasive pneumococcal disease and pneumonia cases in adults.

Geographical Analysis

North America is dominating the global preventive vaccine market with a 48.5% in 2024

North America has a well-developed market for preventive vaccines because of its high immunization rate and robust public health programs that target at-risk groups, adults, and children. Conjugate and mRNA vaccines are the most popular preventative vaccinations in North America because of their great efficacy, safety, and wide range of protection against many infectious disease strains. According to CDC guidelines, vaccinations against influenza, COVID-19, meningococcal disease, and pneumococcal disease are frequently given to people of all ages. Strong intellectual property protection, high vaccination costs, and FDA regulations that promote significant R&D investment are the main drivers of the region's market supremacy.

The dominance of the U.S. is further reinforced by recent regulatory and market development. For instance, in September 2024, the FDA approved FluMist, AstraZeneca’s needle-free influenza vaccine, for self- or caregiver-administration at home. Adults up to 49 years old could self-administer, while parents or caregivers could vaccinate children aged 2–17. Approval was supported by usability studies demonstrating safe and effective administration across eligible age groups.

Europe's the second region after North America which is expected to dominate the global preventive vaccine market with a 34.5% in 2024

Europe’s preventive vaccine market growth is driven by high public awareness of immunization and well-established healthcare systems. Widespread access to hospitals, clinics, pharmacies, and online platforms, combined with cross-border collaborations and public health campaigns, has increased vaccine adoption across the region. Favorable government policies and national immunization programs promote routine and seasonal vaccination for children, adults, and at-risk populations. For example, in October 2024, the European Union promoted the European Immunization Agenda 2030 (EIA2030) across all 53 member states, aiming to strengthen immunization systems, improve vaccine coverage, and combat vaccine hesitancy through public health campaigns.

Germany’s preventive vaccine market is driven by advanced healthcare infrastructure, supportive regulations, and high public awareness. Hospitals, clinics, pharmacies, and digital platforms provide widespread access, while national immunization programs, public health campaigns, and strong government and private support promote vaccine adoption, ensuring robust coverage and sustained market growth nationwide.

The Asia Pacific region is the fastest-growing region in the global preventive vaccine market, with a CAGR of 7.5% in 2024

The Asia-Pacific preventive vaccine market, including Japan, China, India, and South Korea, is expanding due to rising health awareness, urbanization, and improved healthcare access. Advancement in research and developments by biological companies, government initiatives, public health programs, and educational campaigns promote immunization, encourage vaccine adoption, and strengthen disease prevention efforts across the region.

For instance, in October 2024, SK bioscience’s SkyCellflu Quadrivalent, the first Korean-developed cell-cultured influenza vaccine, received final market authorization from Indonesia’s BPOM. This approval marked a significant milestone as the first Korean flu vaccine approved for use in Indonesia, expanding access to advanced influenza prevention in Southeast Asia’s largest pharmaceutical market.

China and India are witnessing growing demand for preventive vaccines due to increased health awareness, expanding healthcare infrastructure, and government immunization programs. Enhanced access through hospitals, clinics, pharmacies, and online platforms, combined with educational campaigns, is driving vaccine adoption, supporting the growth of both routine and new preventive immunization options.

Competitive Landscape

Top companies in the preventive vaccine marketincludeGSK plc, Biological E Limited,HIPRA, Bharat Biotech, GSK plc, Sanofi, Bavarian Nordic, Merck Inc., Valneva SE, Pfizer Inc., andTakeda Pharmaceutical Company Limited,among others.

GSK plc: GlaxoSmithKline (GSK), a UK-based pharmaceutical leader, holds one of the world’s largest preventive vaccine portfolios. Its offerings include vaccines for influenza, HPV, shingles, and meningococcal diseases. GSK focuses on global immunization, with strong R&D in next-generation vaccines, targeting both developed and emerging markets to address public health needs worldwide.

Key Developments:

- In September 2025, the FDA approved ModernaTX, Inc.’s MNEXSPIKE COVID-19 vaccine, an mRNA-based vaccine designed for active immunization against COVID-19 caused by SARS-CoV-2. It was authorized for individuals aged 65 and older and for those aged 12–64 with at least one underlying condition increasing their risk of severe disease.

- In April 2025, Valneva received its first marketing authorization for IXCHIQ in a chikungunya-endemic country. Brazil’s ANVISA approved the single-dose vaccine for individuals aged 18 and older, marking the world’s first chikungunya vaccine approval in an endemic region. The initiative was supported by the Coalition for Epidemic Preparedness Innovations, the EU, and Instituto Butantan to expand access in low- and middle-income countries.

Market Scope

| Metrics | Details | |

| CAGR | 8.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Type | Conjugate Vaccines, Recombinant Vaccines, Live Attenuated Vaccines, Inactivated Vaccines, Toxoid Vaccines |

| By Disease Indication | Pneumococcal Disease, DTP (Diphtheria, Tetanus, Pertussis), Meningococcal Disease, MMR (Measles, Mumps, Rubella), Varicella, Influenza, Rotavirus, Polio, Human Papilloma Virus, Hepatitis, Dengue and Others | |

| By Route of Administration | Oral, Intramuscular, Subcutaneous and Others | |

| By Distribution Channel | Hospital Pharmacies, Retail Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The Global Preventive Vaccine Market report delivers a detailed analysis with 62 key tables, more than 52visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more biotechnology-related reports, please click here