Global POS Terminal Market: Industry Outlook

The POS Terminal market is experiencing significant growth, driven by the rapid expansion of digital commerce and the rising adoption of cashless payment solutions. According to the International Energy Agency (IEA), the global B2C e-commerce market is projected to reach US$5.5 trillion by 2027, growing at a CAGR of 14.4%. This surge in online retail is increasing demand for advanced POS systems that can efficiently handle diverse payment methods and integrate seamlessly with digital platforms.

In the US, retail e-commerce sales reached US$304.2 billion in Q2 2025, marking a 1.4% increase from Q1 2025, as reported by the US Census Bureau. This steady growth highlights the expanding role of POS terminals in bridging online and offline sales channels, ensuring smoother transactions and enhanced customer experiences. Businesses are increasingly investing in modern POS technologies to meet evolving consumer expectations, including faster checkout, contactless payments, and integration with inventory and analytics systems.

Reflecting these trends, Posiflex Technology launched its GT-7100 Series POS Terminal in April 2025, combining sleek design with high performance for retail and hospitality environments. With 15- and 15.6-inch ultra-slim, fan-free displays, a 4mm ultra-narrow bezel, and a 400-nit multi-touch panel, the terminal enhances operational efficiency and customer engagement. Powered by Intel 11th Gen Tiger Lake and MediaTek Genio G700 processors, and featuring an IP-65 rated front panel, the GT-7100 Series ensures reliable performance in demanding environments. Innovations like these highlight the POS market’s growth trajectory as businesses adapt to increasing e-commerce activity and changing consumer behaviors globally.

Key Market Trends & Insights

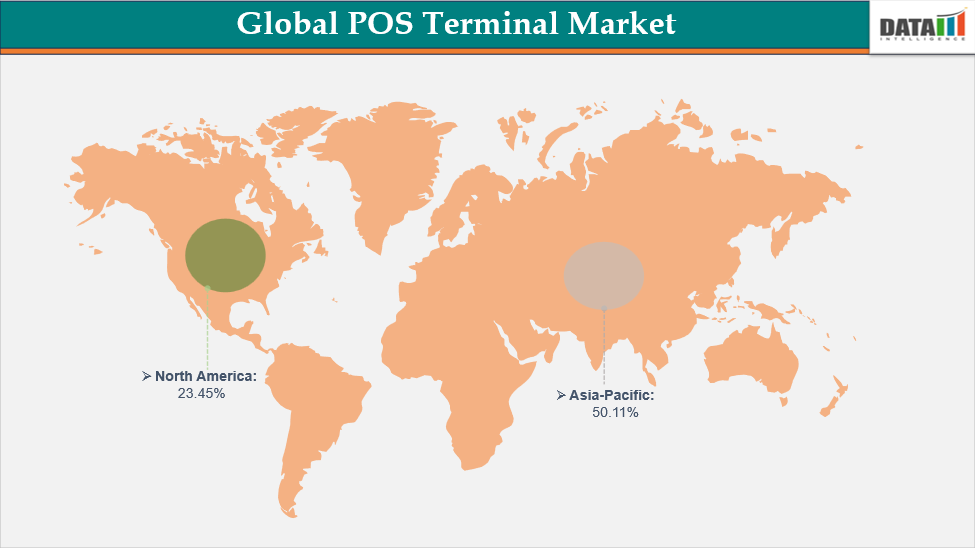

- The Asia-Pacific region holds the highest share in the global POS terminal market, accounting for around 50.11%, due to rapid digital adoption and the widespread use of mobile and contactless payments. Countries like China, India, and Southeast Asian nations are driving strong demand, fueled by the growth of e-commerce, m-commerce, and retail modernization.

- North America is emerging as one of the fastest-growing regions in the global POS terminal market, with a growth rate of 23.45%. This rapid expansion is driven by increasing adoption of contactless payments, digital wallets, and advanced POS solutions in retail, hospitality, and healthcare sectors.

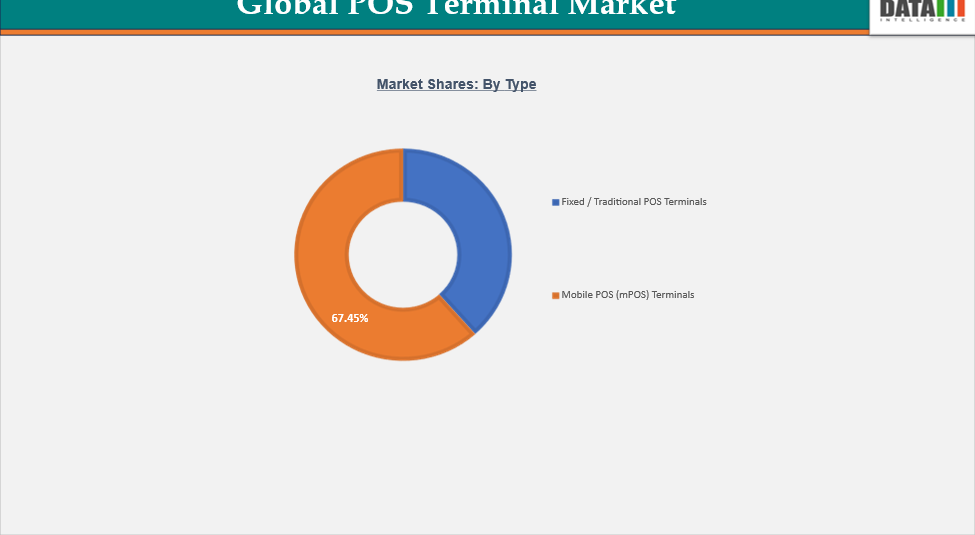

- Fixed / Traditional POS Terminals hold the highest share in the global POS terminal market, accounting for 67.45%, primarily due to their reliability, robust features, and widespread adoption in retail and hospitality sectors. These terminals offer stable hardware, support multiple payment methods, and integrate easily with existing point-of-sale systems, making them the preferred choice for businesses with high transaction volumes.

Market Size & Forecast

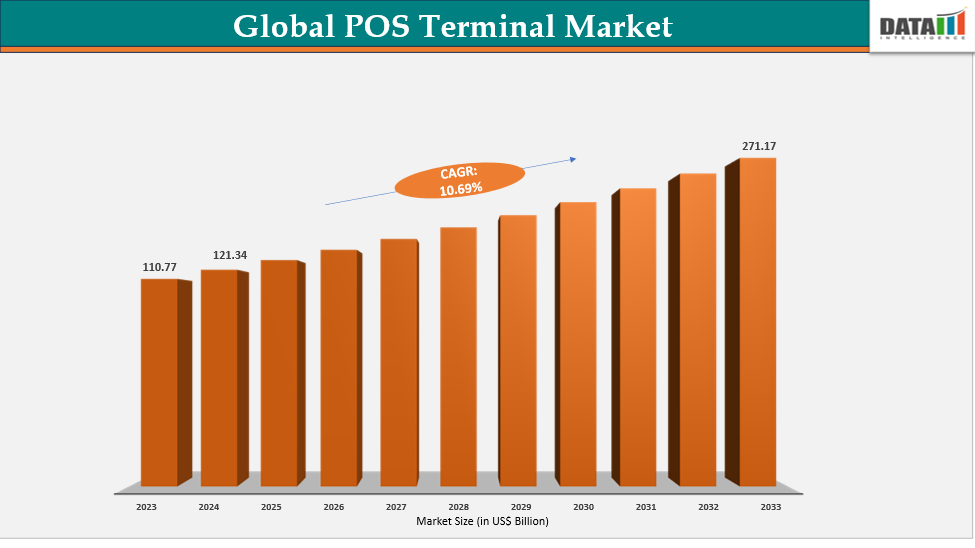

- 2024 Market Size: US$121.34 Billion

- 2033 Projected Market Size: US$271.17 Billion

- CAGR (2025–2033): 10.69%

- Asia-Pacific: Largest market in 2024

- North America: Fastest-growing market

Global POS Terminal Market: Executive Summary

Market Dynamics

Driver: Surge in Digital and Contactless Payments

The rapid adoption of digital and contactless payments is fueling strong growth in the POS terminal market. According to recent statistics, 82% of global consumers now use contactless payment methods, up from 74% in 2022, reflecting a clear shift toward faster and safer transactions. In the US, 65% of card transactions are contactless-enabled, marking a 20% increase over the past year, which is prompting merchants to upgrade their POS infrastructure to meet consumer expectations. As the global value of contactless payments is projected to reach US$15.3 trillion in 2024, businesses are increasingly investing in advanced POS terminals to handle the surge in digital transactions efficiently.

Small businesses are also driving adoption, with 78% of those that implemented contactless technology in 2023 reporting higher customer satisfaction. This demonstrates that integrating modern POS solutions directly impacts operational efficiency and enhances the customer experience. Retailers, hospitality providers, and service-oriented businesses are now seeking POS systems that support multiple payment modes, including chip, swipe, QR code, and NFC-based transactions, creating a robust market demand. The convergence of customer preference and business efficiency is thus a major driver for POS terminal innovations.

In response to this trend, J.P. Morgan Payments launched two new POS terminals in January 2025 — Paypad and Pinpad — designed to leverage touchless payments via palm and facial recognition. The Paypad, an all-in-one tablet terminal, supports chip, contactless, swipe, QR code, and biometric payments, while the compact Pinpad also enables touchless transactions using an infrared camera. These terminals are set to launch in the US later this year, with international rollout following, strengthening J.P. Morgan’s omnichannel commerce ecosystem. Such innovations illustrate how surging digital and contactless payments are directly shaping the POS terminal market, driving both technology upgrades and strategic investments globally.

Restraint: Cybersecurity and Data Breach Risks

Cybersecurity and data breach risks are emerging as major restraints for the POS terminal market, as increasing connectivity exposes systems to cyberattacks. Retailers and businesses face constant threats of card skimming, malware attacks, and unauthorized access to sensitive payment data. As POS terminals process large volumes of financial transactions, any security lapse can lead to significant financial and reputational losses. According to Cybercrime Magazine, cybercrime is projected to cost businesses US$10.5 trillion in 2025, highlighting the scale of the threat. This looming risk makes enterprises cautious about investing in advanced POS systems, particularly those connected to cloud networks or the internet.

The need for stringent security compliance, including PCI DSS certification and encryption measures, further adds to operational costs, restraining market growth. Businesses must continually upgrade software and maintain secure networks, creating an additional financial and logistical burden. Fear of potential data breaches also slows adoption among small and medium-sized enterprises (SMEs), which often lack dedicated IT security teams. These challenges compel POS vendors to invest heavily in cybersecurity solutions, sometimes at the expense of expansion or innovation. Consequently, cybersecurity concerns are intricately limiting the rapid penetration of POS terminals across global markets.

For more details on this report, Request for Sample

Global POS Terminal Market Segment Analysis

The global POS Terminal market is segmented based on type, component, payment mode, deployment, end-user, and region.

Type: Fixed/Traditional POS Terminals Lead with 67.45% Market Share, Due to their reliability, extensive deployment in retail and hospitality, and robust infrastructure support.

The fixed or traditional POS terminals dominate the global POS terminal market due to their reliability and robust functionality. These terminals are widely adopted in large retail stores, supermarkets, and hospitality sectors, where continuous high-volume transactions demand stable systems. Their comprehensive hardware and software integration ensures smooth operations, which is critical for businesses with complex payment and inventory needs. Additionally, fixed POS terminals offer advanced connectivity options, supporting multiple payment methods, loyalty programs, and back-office integrations. The hardware segment, which includes screens, printers, and cash drawers, contributes significantly to this dominance, accounting for a major portion of market revenue.

Another key factor is business preference for on-premise deployments, as fixed terminals allow greater control, customization, and data security. While mobile POS systems are growing in popularity for SMEs, fixed POS terminals remain essential for high-traffic establishments. Their ability to handle large transaction volumes without downtime gives them a competitive edge. Furthermore, the retail sector alone captures a substantial share of demand for these terminals, reinforcing their market leadership. Overall, the stability, functionality, and adaptability of fixed POS systems ensure they maintain the highest market share globally.

Geographical Analysis

Asia-Pacific Leads POS Terminal Market with 50.11% Share Due to Rapid Digitalization and Mobile Payment Adoption

The Asia-Pacific (APAC) region holds the highest share in the global POS terminal market, driven by rapid digital transformation, urbanization, and expanding retail sectors. Countries like China and India are at the forefront, with increasing adoption of mobile and contactless payment systems fueling demand for POS solutions. Fixed POS terminals currently dominate, particularly in retail, hospitality, and healthcare, while mobile POS systems are witnessing the fastest growth due to their portability and cost-effectiveness.

In India, the POS ecosystem has experienced remarkable expansion, with over 10.7 million terminals as of February 2025, up from 5.8 million in 2022, reflecting a 13% growth in just one year according to RBI data. This surge underscores the country’s accelerated move toward cashless transactions and growing consumer reliance on digital payment methods. The increasing presence of POS terminals is further supported by investments in digital infrastructure and government initiatives promoting financial inclusion, creating a favorable environment for market growth.

Meanwhile, in China, digital retail continues to strengthen, as exemplified by Alibaba’s US$7 billion subsidy initiative announced on September 18, 2025, aimed at stimulating consumption and supporting both consumers and merchants. Distributed through the Taobao platform over a 12-month period, this initiative reinforces online transaction growth and encourages the adoption of POS systems across the retail sector. Combined with regional investments and the rise of small and medium-sized enterprises leveraging mobile POS solutions, APAC’s leadership in the POS terminal market is set to remain strong, interconnected by robust digital payment adoption and supportive government policies.

North America POS Terminal Market Growing Fast at 23.45% Due to Rapid Adoption of Contactless and Mobile Payments

North America’s POS terminal market is witnessing rapid growth, driven primarily by the widespread adoption of mobile and flexible payment solutions. Mobile POS (mPOS) systems are leading this expansion, enabling businesses to accept payments anywhere with minimal setup costs. The market is particularly fueled by small and medium-sized enterprises (SMEs), which, according to the US Small Business Administration (SBA), represent 99.9% of all US businesses and employ 60.6 million people, or 47.1% of the private workforce. This massive SME presence creates a high demand for cost-effective and versatile payment systems.

Consumer behavior further supports this growth, with digital transactions and e-commerce adoption increasing rapidly. In Canada, over 27 million people—about 75% of the population—were eCommerce users in 2022, a figure expected to rise to 77.6% by 2025 according to the International Energy Agency (IEA). This shift toward online and hybrid shopping experiences encourages businesses to adopt advanced POS solutions that integrate both in-store and online payment capabilities, ensuring seamless customer transactions.

Innovations and strategic launches are also driving market momentum. In June 2023, US Bank and its subsidiary Elavon introduced the Talech Terminal POS solution to help small business owners avoid large upfront investments. This system supports a variety of hardware options, including mobile, fixed, and in-store terminals, offering flexibility and affordability. Coupled with rising SME activity and growing eCommerce penetration, such innovations solidify North America as the fastest-growing POS terminal market, where technology adoption aligns perfectly with business and consumer needs.

Competitive Landscape

The major players in the POS Terminal market include Ingenico Group, Verifone Systems Inc., Square Inc. (Block Inc.), PAX Technology, NCR Corporation, Diebold Nixdorf, Clover Network Inc., BBPOS Limited, Samsung Electronics, and Huawei Technologies.

Ingenico Group: Ingenico Group is a global leader in payment solutions, offering secure and innovative technologies for in-store, online, and mobile transactions. The company provides point-of-sale (POS) terminals, payment software, and related services to businesses of all sizes. Ingenico focuses on enabling seamless, fast, and secure payment experiences for merchants and consumers worldwide. With a strong presence across Europe, North America, and emerging markets, it supports both traditional and digital payment methods. Its solutions are widely used in retail, hospitality, banking, and e-commerce sectors.

Market Scope

| Metrics | Details | |

| CAGR | 20.78% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Type | Fixed / Traditional POS Terminals, Mobile POS (mPOS) Terminals |

| Component | Hardware, Software, Services | |

| Payment Mode | Contact-Based, Contactless Payments | |

| Deployment | Cloud-based, On-premises | |

| End-User | Retail, Hospitality & Foodservice, Healthcare, Transportation, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global POS Terminal market report delivers a detailed analysis with 78 key tables, more than 71 visually impactful figures, and 267 pages of expert insights, providing a complete view of the market landscape

Suggestions for Related Report

For more related reports, please click here