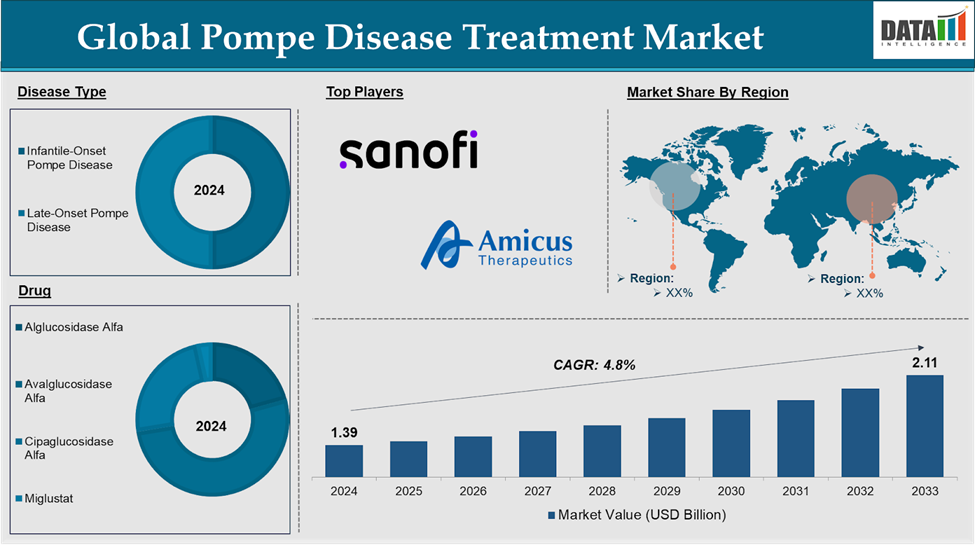

Market Size

The Global Pompe disease treatment market reached US$ 1.39 billion in 2024 and is expected to reach US$ 2.11 billion by 2033, growing at a CAGR of 4.8% during the forecast period of 2025-2033.

Pompe disease, also known as Glycogen Storage Disease Type II (GSDII) or Acid Maltase Deficiency, is a rare, inherited, and progressive metabolic disorder caused by a deficiency of the enzyme acid alpha-glucosidase (GAA). This enzyme is responsible for breaking down glycogen (a stored form of sugar) within lysosomes, a part of the cell that digests and recycles substances. When GAA is deficient or absent, glycogen accumulates abnormally within lysosomes, particularly in those present in skeletal muscles, heart muscles, and the liver, leading to progressive muscle weakness, respiratory issues, and organ dysfunction. There is no cure for Pompe disease, but treatments can slow its progression and improve the quality of life.

The Pompe disease treatment market is experiencing notable growth, driven by advancements in therapies, increased disease awareness, and strategic industry developments. For instance, the approval of second-generation ERTs, such as Nexviazyme (avalglucosidase alfa) in August 2021, has enhanced treatment efficacy for late-onset Pompe disease. Additionally, in September 2023, the FDA approved Pombiliti (cipaglucosidase alfa-atga) in combination with Opfolda (miglustat), offering a new therapeutic option for adults with late-onset Pompe disease.

Executive Summary

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Advancements in Enzyme Replacement Therapy (ERT)

The rising advancements in enzyme replacement therapy are significantly driving the growth of the Pompe disease treatment market and are expected to continuously drive the market over the forecast period. Nexviazyme (avalglucosidase alfa), approved in August 2021, represents a major advancement in Pompe disease treatment. This second-generation enzyme replacement therapy offers improved enzyme stability and better tissue penetration, resulting in more effective treatment, particularly for late-onset Pompe disease (LOPD). This efficacy boost is expected to significantly increase the uptake of Nexviazyme and similar therapies, driving market demand.

Additionally, the introduction of Pombiliti (cipaglucosidase alfa-atga) and Opfolda (miglustat) in September 2023 provides a two-component therapy for patients who have not responded well to conventional ERT. This combination therapy addresses immune responses (which often occur in ERT patients) and aims to improve treatment outcomes in adults with late-onset Pompe disease. With increasing approvals of novel ERTs, more patients can access specialized therapies suited to their condition, leading to wider market penetration and higher treatment adoption rates globally.

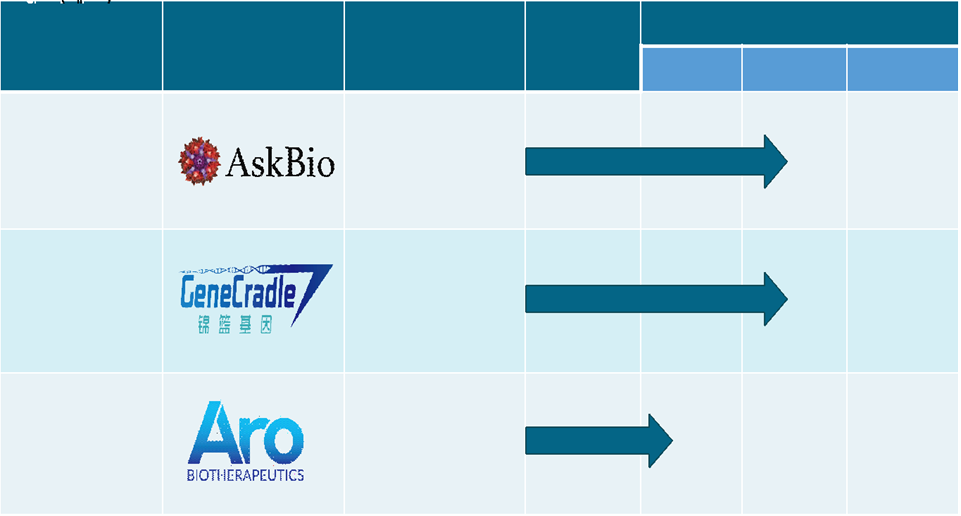

Major pharmaceutical companies are investing heavily in the development of next-generation ERTs for Pompe disease. Additionally, several companies are developing advanced therapies for Pompe disease. These continued research efforts are expected to boost the overall market growth.

Below are the key pipeline drugs and their current phase of clinical development.

Limited Availability of Approved Therapies May Restrain the Market Growth.

The limited availability of approved therapies is significantly hampering the growth of the Pompe disease treatment market, as it creates barriers to treatment access, increases unmet medical needs, and limits options for patients. As of now, there are only a few FDA-approved therapies for Pompe disease, primarily enzyme replacement therapies (ERT) like Myozyme, Lumizyme, Nexviazyme, and Pombiliti + Opfolda. While these treatments are life-saving, they are not curative. They help manage symptoms and slow disease progression, but they do not stop or reverse the damage caused by the disease, especially in late-onset cases.

The lack of curative options (like gene therapy, which is still in clinical trials) means patients are dependent on lifelong ERT, which doesn't always provide complete relief, especially for those who develop immune responses to the enzymes or for those who experience limited efficacy in tissue penetration. The limited availability of affordable therapies restricts access, particularly in regions with less robust healthcare infrastructure. In many developing countries, even if the therapies are approved, they are not widely available due to economic constraints and lack of reimbursement programs.

The regulatory process for new treatments is slow, and while there is ongoing research into potential therapies, very few new drugs have been approved in the last decade. As of 2023, while there are several promising treatments in the clinical trial phase, such as gene therapies and enzyme optimization strategies, most therapies are still not approved for widespread use. The market faces a lack of diversity in treatment options beyond ERT, which hampers growth because patients who do not respond well to ERTs are left with few alternative options. This slow pace of approval significantly limits the potential market size and adoption of new therapies.

Market Segment Analysis

The global Pompe disease treatment market is segmented based on disease type, Drug, route of administration, Age Group, and region.

Product Type:

The enzyme replacement therapy in the Drug segment is expected to dominate with a higher market share.

Myozyme (alglucosidase alfa), the first FDA-approved ERT for Pompe disease, was introduced in 2006 and quickly became the gold standard for treating infantile-onset Pompe disease (IOPD). Since its approval, it has been widely adopted and continues to be the primary treatment option. Later, Lumizyme, an alternative formulation of Myozyme, was introduced to treat late-onset Pompe disease (LOPD). Both drugs provide essential enzyme replacement for patients who lack the enzyme acid alpha-glucosidase (GAA), helping to manage symptoms and slow disease progression.

The approval of Nexviazyme (avalglucosidase alfa) in 2021 expanded the range of enzyme replacement therapies available to patients. Nexviazyme, specifically designed for late-onset Pompe disease, is considered more efficient at clearing glycogen from tissues compared to earlier treatments like Myozyme, improving clinical outcomes. Pombiliti (cipaglucosidase alfa) combined with Opfolda (miglustat) was approved in 2023, offering a new therapy for patients who don't respond well to standard ERT, particularly in adult LOPD patients. This combination therapy presents a broader solution within the ERT segment.

Enzyme replacement therapy has been shown to significantly improve the quality of life and clinical outcomes for patients, including reducing muscle weakness, improving cardiopulmonary function, and increasing mobility. Clinical trials of Nexviazyme have demonstrated a significant improvement in muscle strength, respiratory function, and motor skills, leading to its adoption as an alternative treatment for late-onset cases. Myozyme and Lumizyme have also helped patients with infantile-onset Pompe disease survive longer, with some infants living past their first year, where untreated Pompe disease would typically lead to early death due to heart and respiratory failure.

Market Geographical Analysis

North America is expected to hold a significant position in the Pompe disease treatment market share

North America, especially the United States, has one of the highest Pompe disease rates globally, significantly driving the demand for effective treatment solutions. For instance, according to the Cleveland Clinic Organization, in the United States, Pompe disease affects about 1 in every 40,000 people. North America is a leader in the approval and commercialization of Enzyme Replacement Therapies (ERTs), including Myozyme, Lumizyme, Nexviazyme, and Pombiliti. The U.S. Food and Drug Administration (FDA) is often the first regulatory body to approve new treatments for Pompe disease.

For instance, in September 2023, Amicus Therapeutics announced that the U.S. Food and Drug Administration (FDA) has approved Pombiliti (cipaglucosidase alfa-atga) + Opfolda (miglustat) 65mg capsules. This two-component therapy is indicated for adults living with late-onset Pompe disease (LOPD), weighing ≥40 kg, and who are not improving on their current enzyme replacement therapy (ERT).

North America, particularly the United States, is home to leading pharmaceutical companies and research institutions actively developing novel therapies for Pompe disease. Companies like Sanofi Genzyme, Amicus Therapeutics, and Aro Biotherapeutics have invested significantly in clinical trials, aiming to improve existing therapies or develop new treatment modalities like gene therapy and chaperone therapy.

For instance, in February 2025, Aro Biotherapeutics announced that it had received U.S. Food and Drug Administration (FDA) clearance of the Investigational New Drug Application (IND) for ABX1100, a novel therapy currently being investigated in a phase 1 study in late-onset Pompe disease (LOPD) patients.

Asia-Pacific is growing at the fastest pace in the Pompe disease treatment market

Asia-Pacific countries have been improving their regulatory frameworks to speed up the approval of innovative treatments. For instance, the China National Medical Products Administration (NMPA) and Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) are actively working to expedite the approval processes for new drugs, including those for rare diseases like Pompe disease.

For instance, according to the National Institute of Health, Alglucosidase alfa received marketing approval for the treatment of Pompe disease in Japan in 2007. Additionally, Japan has been at the forefront of accelerated approval processes for rare diseases, including Pompe disease treatments like Myozyme and Nexviazyme, which are now widely available in the country. Japan’s focus on rare diseases and its advanced regulatory processes have contributed to the high adoption of approved therapies in the region.

The Asia-Pacific region, particularly countries like China, India, Japan, and South Korea, are leading the charge in providing better access to enzyme replacement therapies (ERTs) and improving the overall healthcare framework for rare diseases. With a strong focus on early diagnosis, improving patient access, and growing R&D investments, the APAC region is poised for significant growth in the coming years.

Competitive Landscape

Market Scope

| Metrics | Details | |

| CAGR | 4.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Disease Type | Infantile-Onset Pompe Disease and Late-Onset Pompe Disease |

| Drug | Alglucosidase Alfa, Avalglucosidase Alfa, Cipaglucosidase Alfa and Miglustat | |

| Route of Administration | Parenteral and Oral | |

| Age Group | Pediatrics and Adults | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyze product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: This covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyze competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global Pompe disease treatment market report delivers a detailed analysis with 55 key tables, more than 61 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2025

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.