Overview

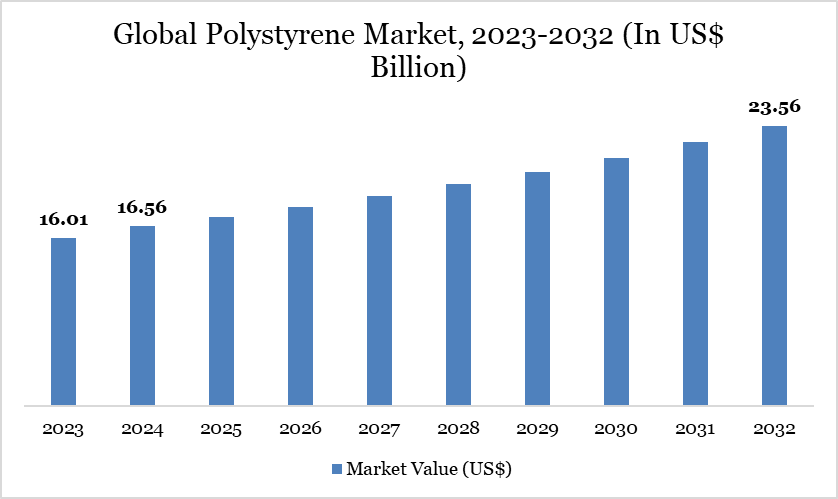

The global polystyrene (PS) market reached US$16.56 billion in 2024 and is expected to reach US$23.56 billion by 2032, growing at a CAGR of 4.63% during the forecast period 2025-2032.

The global polystyrene market is experiencing strong growth, driven by its versatile applications in packaging, electronics, construction, and healthcare, thanks to its lightweight, durable, and insulating qualities. With the world generating around 141 million tonnes of plastic packaging each year, according to the UK government, the need for high-performance and scalable packaging materials like polystyrene remains high. Companies are responding to evolving market needs by developing innovative and high-performance products.

For instance, in April 2023, Epsilyte launched its new expanded polystyrene (EPS) product, 124LR, which includes a minimum of 50% post-consumer recycled content and holds certification from SCS Global. This product is specially designed for molded packaging parts that require a smooth and premium finish. Such advancements showcase how manufacturers are enhancing the value and sustainability of polystyrene. As more industries seek reliable and cost-efficient materials, polystyrene’s market outlook remains bright with continuous product development paving the way for future growth.

Polystyrene (PS) Market Trend

One of the most significant trends shaping the Polystyrene market is the push for innovations in recycling and the circular economy, as companies aim to reduce waste and create sustainable value chains. For instance, in January 2025, Trinseo made headlines by launching Europe’s first transparent recycled polystyrene (rPS) specifically approved for direct food contact, a breakthrough fully compliant with EU Regulation 2022/1616 from February 2025. The company, with the Fraunhofer Institute, validated its proprietary dissolution recycling process through an EFSA Novel Technology Dossier and a successful “Challenge Test” proving decontamination efficiency. This milestone supports safer, circular solutions for food packaging applications.

Such milestones highlight how advanced recycling technologies can transform polystyrene waste into high-quality, safe materials for sensitive applications like food packaging. By closing the loop, companies like Trinseo are pioneering safer, circular solutions that align with global sustainability goals. This momentum is inspiring other industry players to invest in innovative recycling methods, positioning the circular economy as a driving force for the polystyrene market’s future growth.

Market Scope

Metrics | Details |

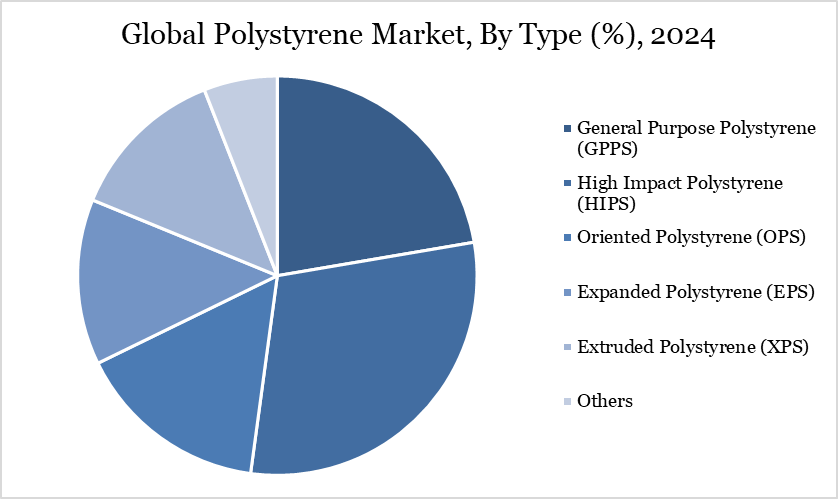

By Type | General Purpose Polystyrene (GPPS), High Impact Polystyrene (HIPS), Oriented Polystyrene (OPS), Expanded Polystyrene (EPS), Extruded Polystyrene (XPS), Others |

By Form | Foams, Films and Sheets, Injection-Molded Parts, Others |

By Application | Packaging, Building & Construction, Electrical & Electronics, Automotive, Agriculture, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Packaging Boom Keeps Polystyrene (PS) in Demand

The global packaging boom is fueling the demand for polystyrene (PS), creating ripples across industries and opening new frontiers in material innovation. With the packaging industry generating a massive turnover of around US$500 billion—according to the World Packaging Organization (WPO)—PS remains a preferred choice due to its light weight, rigidity, and cost-efficiency. A major share of this comes from packaging containers, while machinery sales contribute an estimated US$25 billion, indicating the scale of infrastructure supporting this demand. In this dynamic environment, polystyrene stands resilient, especially in food packaging where hygiene and form retention are crucial.

A breakthrough came in January 2025, when INEOS Styrolution, the global styrenics leader, announced a pioneering initiative—launching yogurt cups made from mechanically recycled PS in partnership with Unternehmensgruppe Theo Müller. This collaboration showcases a significant milestone in circular packaging, involving advanced steps such as deep NIR sorting, hot washing, and pelletizing. Such developments not only align with sustainability goals but also reinforce polystyrene's relevance in modern packaging. As consumer demand shifts toward convenience, shelf appeal, and recyclability, PS continues to evolve with it. With innovation at its core, the material is redefining packaging possibilities, ensuring it remains a vital component of this fast-growing global industry.

Environmental & Regulatory Pressure

Environmental and regulatory pressures are tightening their grip on the polystyrene market as governments and communities wake up to the plastic waste crisis. Expanded polystyrene (EPS), known for its cheap and convenient use in takeout packaging, has become a prime target for bans because of its non-biodegradable nature.

According to the 2022 Toxics Release Inventory data, US styrene facilities alone released a staggering 32 million pounds of styrene into the environment, raising health and contamination concerns. Once discarded, polystyrene can leach into waterways and slowly choke animals, highlighting its threat to marine life. Around 30 countries have now passed laws to prohibit or limit the use of EPS, pushing companies to find alternative materials. The EU and China have gone a step further, enforcing sweeping bans on single-use plastics like cutlery and food containers, cutting off key markets for polystyrene producers.

In the US, local measures are also ramping up — for example, Virginia’s new law threatens US$50 daily fines for food chains and stores that ignore the ban on EPS containers from July 1, 2025. Such moves are forcing restaurants and retailers to switch to biodegradable packaging despite higher costs. With communities demanding action, these tough regulations send a clear signal that the cheap convenience of EPS comes at too high an environmental price. This mounting global crackdown is steadily squeezing demand and creating costly compliance burdens, restraining the market’s growth like never before.

Segment Analysis

The global polystyrene (PS) market is segmented based on type, form, application, and region.

EPS Leads Polystyrene Market for Its Versatility and Cost-Effective Insulation

Expanded Polystyrene (EPS) continues to secure a significant share in the global polystyrene market by evolving with the needs of sustainability and performance-driven industries. In January 2024, HIRSCH Isolation, a member of EUMEPS, showcased the circular potential of EPS by launching an insulation range made entirely without virgin material, strengthening its position in eco-conscious construction. This initiative, paired with their REuse service, reinforced EPS’s role in promoting climate-neutral and resource-efficient building solutions across Europe.

Building on this momentum, in April 2025, ThermoSafe introduced the ChillTherm Bio—a biodegradable EPS pallet shipper designed to support life sciences and healthcare logistics with consistent 120-hour thermal protection for temperature-sensitive pharmaceuticals and biologics. The shipper’s flat-packed format also offered space-saving advantages and operational flexibility, aligning with global supply chain efficiency needs. These efforts reveal how EPS, once viewed solely as a packaging or insulation material, is now being reimagined through innovation and circular design.

Geographical Penetration

Asia-Pacific Leads Global EPS Market Due to Rapid Urbanization, Booming Construction, and Strong Packaging Demand

Asia-Pacific holds a significant share in the global Expanded Polystyrene (EPS) market, driven by rapid urbanization, booming construction, and thriving packaging industries. China, being the world’s largest construction market, fuels immense demand for EPS in insulation and building materials. Likewise, India’s packaging sector is expanding rapidly, according to IBEF, it is the 5th largest sector of the Indian economy and is expected to reach US$204.81 billion by 2025, pushing the need for lightweight, protective materials like EPS.

In line with this, companies are investing heavily; for example, in August 2022, Steelbird Hi-Tech India announced a new EPS plant in Baddi, Himachal Pradesh. This facility, spread over 60,000 square feet, aims to produce 22,000 EPS units daily, mainly for helmet production. Such initiatives not only strengthen local supply chains but also generate employment, highlighting Asia-Pacific’s role as a manufacturing hub. Together, these factors make the region a powerhouse in the global EPS landscape.

Sustainability Analysis

The polystyrene market is steadily evolving towards sustainability, weaving together innovation and circularity to tackle environmental pressures. In a landmark move, Trinseo launched Europe’s first transparent recycled polystyrene (rPS) in April 2024, designed specifically for direct food contact, and available from February 2025 — a breakthrough that aligns with the stringent EU Regulation 2022/1616 for food-safe recycled plastics. This step not only sets a new benchmark for sustainable packaging but also keeps valuable polystyrene in the loop, supporting circular economy ambitions.

Meanwhile, in April 2024, Japan made headlines with its first PS chemical recycling plant at Denka’s Chiba Factory, developed by Denka and Toyo Styrene in partnership with Agilyx’s advanced pyrolysis technology. These ¥4 billion (US$28 million) investments enable the facility to process 3,000 tonnes of PS waste annually, showcasing a practical path to divert plastic waste from landfills. Together, these initiatives illustrate how technological advancements and regulatory alignment are reshaping polystyrene’s future, transforming it from a single-use plastic to a key player in the global circular economy.

Competitive Landscape

The major global players in the market include INEOS Styrolution Group GmbH, TotalEnergies, SABIC, BASF SE, LG Chem., Trinseo PLC, Formosa Chemicals & Fibre Corp., CHIMEI, Synthos, Kumho Petrochemical Co., Ltd. and others.

Key Developments

In December 2023, CD Bioparticles launched a new range of Functional Polystyrene Particles sized from 25 nm to 750 µm, supporting pharmaceutical and life science research needs. These particles enable diverse applications like protein adsorption, immunoassays, and drug delivery. They are synthesized via emulsion or emulsion-free processes and can be further enhanced through coating or conjugation.

In June 2023, Sulzer unveiled its EcoStyrene technology, an advanced chemical recycling solution designed to handle heavily contaminated polystyrene waste. This innovative process can recycle polystyrene with complex contaminants like flame retardants and food residues, which traditional methods struggle to process.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies