Overview

Global Polypropylene Catalyst market reached US$ 2.09 billion in 2024 and is expected to reach US$ 3.12 billion by 2032, growing with a CAGR of 5.12% during the forecast period 2025-2032.

The global polypropylene catalyst market is experiencing significant expansion, driven by the rising demand for polypropylene (PP) in essential industries including packaging, automotive, construction, and consumer products. Polypropylene catalysts are vital to the polymerization of propylene monomers, affecting key characteristics such as molecular weight distribution, tacticity, and efficiency.

The demand for lightweight and durable materials in these sectors, particularly in packaging and automotive, is steadily increasing. The Indian textiles and apparel market is anticipated to expand at a CAGR of 10%, reaching US$ 350 billion by 2030, hence substantially increasing polypropylene utilization in textile applications.

The global drive for increased production efficiency at reduced costs is resulting in the widespread utilization of highly active catalysts, which enhance production by minimizing catalyst load and waste. The changing demand scenario establishes polypropylene catalysts as essential elements in contemporary commercial polymer production.

Market Trends

The polypropylene catalyst market is seeing substantial change due to advancements in catalyst technologies and a broader range of applications. The industry is adopting metallocene and single-site catalyst technologies to enhance polymer performance and processing efficiency. Advancements in catalyst design are allowing manufacturers to customize polypropylene characteristics more accurately for specific end-use applications.

The packaging industry maintains robust momentum owing to increasing customer demand for lightweight, economical, and high-strength materials. Furthermore, continuous investments in chemical and petrochemical infrastructure are bolstering the market's capacity for innovation. In the Asia-Pacific region, robust demand for automotive and packaging sectors, especially from China, is accelerating the use of novel catalyst technology. Industries are striving to reconcile performance with environmental accountability, resulting in increased incorporation of sustainable and performance-augmenting solutions in catalyst development, thereby transforming the competitive landscape.

Market Scope

| Metrics | Details |

| By Type | Ziegler-Natta Catalyst, Metallocene Catalyst, Others |

| By Manufacturing Process | Gas Phase, Bulk Phase, Others |

| By Application | Films, Fibers, Tubes, Injection-molded Products, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Industry Momentum in Lightweight Engineering Materials

A principal inducer for growth in the polypropylene market is the escalating need for lightweight and resilient materials in the automotive, packaging, textiles, and healthcare sectors. The versatility and cost-effectiveness of polypropylene render it suitable for various uses, including automobile bumpers and dashboards, as well as packaging containers.

The automotive industry is anticipated to continue being a major driver of catalyst demand owing to the persistent increase in global vehicle manufacturing. The packaging industry is also crucial, profiting from consumer demand for flexible and recyclable materials. The Indian Ministry of Commerce and Industry anticipates that textile and apparel exports will attain US$ 100 billion by 2030, hence immediately augmenting polypropylene use in synthetic textiles. These industry-wide changes are resulting in increased demand for catalysts that facilitate efficient, high-yield manufacturing of high-performance polypropylene products.

Environmental Pushback on Conventional Polypropylene

Although polypropylene catalysts enhance polymer production efficiency, increasing environmental concerns provide a significant limitation to the market. The growing public awareness of the ecological risks linked to traditional polypropylene, such as plastic pollution, chemical leaching, and persistent waste accumulation, is increasing the demand for biodegradable alternatives and environmentally sustainable catalyst systems.

In recent years, Europe produced 84 million tonnes of packaging waste, reflecting a 24% rise since 2010, underscoring the magnitude of the issue. Merely 10–12% of worldwide plastic garbage is burnt for energy recovery, whilst over 70% is deposited in landfills, intensifying environmental damage.

The obligation to adhere to regulatory standards and invest in sustainable catalyst technologies, all while ensuring cost efficiency, imposes a considerable strain on producers. Smaller entities may struggle to bear the expenses associated with innovation and regulatory compliance, thereby impeding their market involvement.

Segment Analysis

The global polypropylene catalyst market is segmented based on type, manufacturing process, application and region.

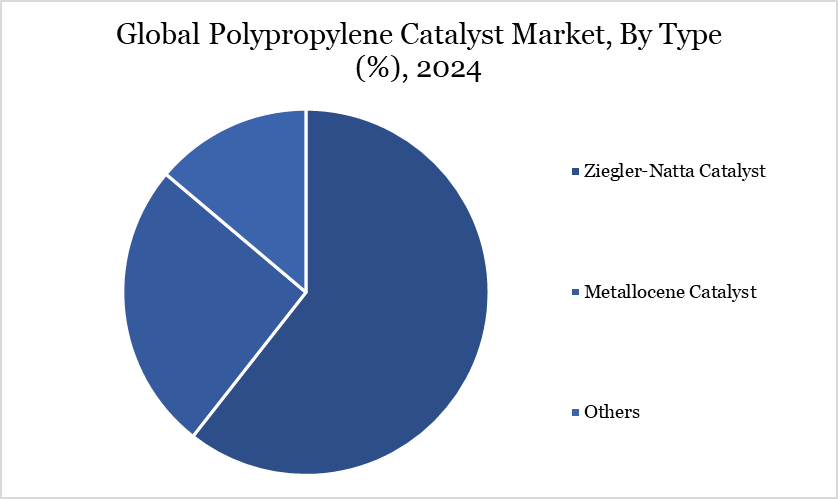

The Enduring Dominance of Ziegler-Natta Catalysts in Polypropylene Production

Ziegler-Natta catalysts remain predominant in the polypropylene catalyst market due to their established efficacy in generating isotactic polypropylene characterized by high crystallinity and rigidity—attributes that are highly valued in sectors such as automotive and construction. These catalysts generally comprise titanium halides as transition metal compounds and organoaluminum co-catalysts.

A primary characteristic of Ziegler-Natta catalysts is their multi-site activity, leading to a wide molecular weight dispersion and varied chemical composition. This is especially beneficial in situations necessitating enhanced processability and impact resistance. Their capacity to produce uniform polymer structures with enhanced mechanical properties renders them particularly advantageous in large-scale industrial production. The intrinsic versatility of these catalysts in altering polymer properties further enhances their sustained market appeal, especially in extensive operations that necessitate reliability, cost-effectiveness, and adaptability to evolving consumer requirements.

Geographical Penetration

Europe’s Regulatory Reforms and Sustainability Propel Growth

Europe is a substantial regional market for polypropylene catalysts, influenced by robust regulatory and environmental laws that dictate demand trends. In March 2024, the European Council achieved a tentative agreement to diminish packaging waste by enforcing recyclability and reducing dangerous compounds, thereby necessitating modern and ecologically compatible catalyst solutions.

The EU documented over 188 kg of packaging waste per capita, indicating increasing pressure on industry to implement sustainable materials. Consequently, polypropylene catalysts adhering to green chemistry principles are increasingly gaining prominence. Countries in the area are enhancing their petrochemical industries while emphasizing environmental stewardship, expediting the transition to sustainable catalytic systems. The region's dedication to minimizing environmental effect, along with a robust industrial foundation and research infrastructure, establishes Europe as a pivotal force in advancing sustainable innovation in the worldwide polypropylene catalyst market.

Sustainability Analysis

Sustainability has emerged as a pivotal factor in the growth and innovation of the polypropylene catalyst industry. Governments and companies are intensifying initiatives to reduce the environmental impact of plastic manufacturing. Catalytic pyrolysis of polypropylene waste is emerging as an effective way to upcycle polymers into biofuels and petrochemical feedstocks, providing an environmentally sustainable end-of-life solution.

This method, emphasized in contemporary literature, is more energy-efficient and less damaging than incineration, which emits detrimental substances such as CO₂, NOₓ, and dioxins. Catalyst producers are also investing in green chemical methods, creating environmentally friendly catalysts that necessitate reduced loadings and produce less waste.

Regulatory initiatives, such as those from the European Council requiring sustainable packaging practices, are propelling the adoption of recyclable and biodegradable polymers. Collectively, these initiatives represent a planned transition to a circular economy model that harmonizes material efficacy with enduring environmental stewardship.

Competitive Landscape

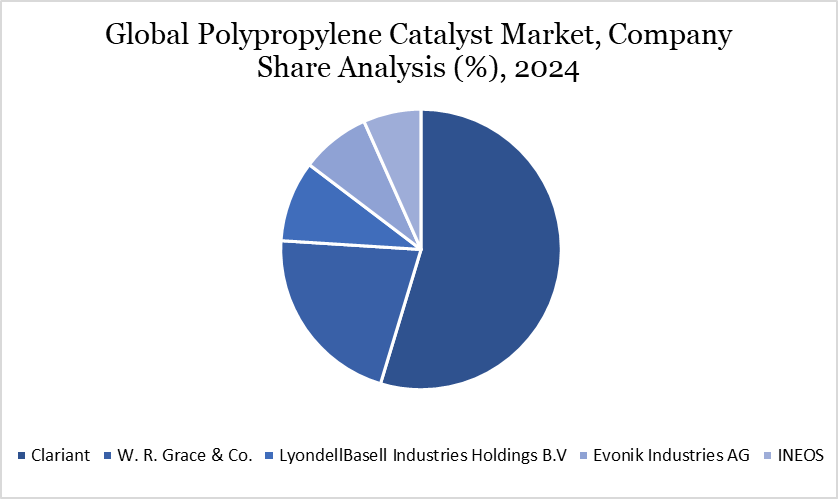

The major global players in the market include Clariant, W. R. Grace & Co., LyondellBasell Industries Holdings B.V, Evonik Industries AG, INEOS, Mitsui Chemicals, Inc., Sinopec Catalyst Co., Ltd., Reliance Industries Limited, Toho Titanium Co., Ltd., Renqiu Lihe Technology Co., Ltd. and among others.

Key Developments

In October 2023, Dow and Evonik Industries AG announced the startup of a pilot project utilizing the HYPROSYN method for the direct synthesis of Propylene Glycol from Propylene Oxide (PO) and Hydrogen Peroxide. The use of the HYPROSYN method indicates a focus on reducing environmental impact while optimizing the synthesis process for Propylene Glycol.

In July 2023, Advanced Refining Technologies LLC introduced ENDEAVOR, an innovative hydro-processing catalyst designed for the production of renewable diesel and sustainable aviation fuel using 100% renewable sources. The primary feedstocks for this catalyst include animal fats, refined oils, vegetable oils and greases.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies