Polyols Market Overview

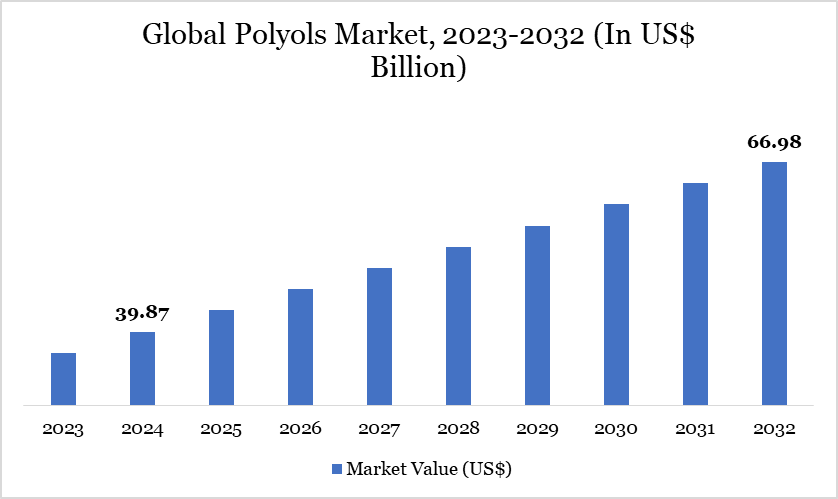

Polyols Market reached US$ 39.87 billion in 2024 and is expected to reach US$ 66.98 billion by 2032, growing with a CAGR of 6.70% during the forecast period 2025-2032.

The global polyols market is witnessing robust growth driven by increasing demand across diverse end-use industries such as construction, automotive, furniture, bedding, and packaging. In the construction sector, rigid polyurethane foams made using polyols are essential for thermal insulation in buildings and appliances. The push for energy-efficient and green buildings, especially across Europe under stringent EU building efficiency standards, has significantly boosted rigid foam consumption.

For instance, according to The European Commission has launched the Renovation Wave initiative aimed at enhancing the energy efficiency of buildings throughout the EU. The objective is to double the current renovation rates by 2030, ensuring each renovation contributes to improved energy and resource efficiency. As a result, up to 35 million buildings across Europe could be renovated by 2030 under this plan. Thus, the polyols market is driven by both regulatory shifts toward sustainability and industrial innovation, with companies investing in bio-based polyols to reduce environmental impact.

Polyols Market Trends

Environmental concerns and the push for sustainability have led to increased demand for bio-based polyols derived from renewable resources like vegetable oils and biomass. Companies such as Covestro and Kimpur have introduced bio-based polyether polyols to meet this demand. Advancements in polyol technology have led to the development of specialized polyols with enhanced properties, such as improved durability and thermal insulation.

Companies are investing in research and development to create polyols suitable for niche applications, including medical devices and electronics. Asia-Pacific dominates the polyols market due to rapid industrialization and urbanization, particularly in countries like China and India.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

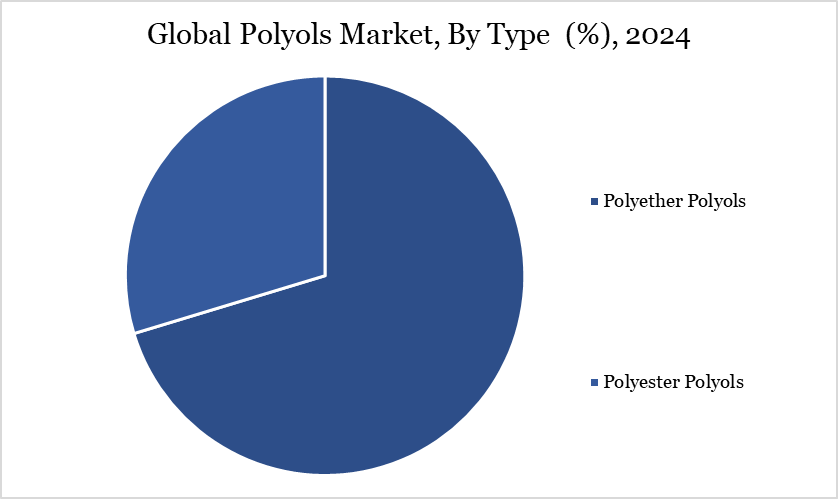

| By Type | Polyether Polyols, Polyester Polyols |

| By Application | Flexible Polyurethane Foam, Rigid Polyurethane Foam, CASE |

| By End-User | Packaging, Furniture, Automotive & Transportation, Building & Construction, Footwear, Electronics, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Polyols Market Dynamics

Growing Demand for Polyurethane Foams in End-Use Industries

The growing demand for polyurethane foams across various end-use industries is a major driver of the polyols market. Polyurethane foams, produced using polyols, are highly versatile materials valued for their lightweight, cushioning, insulation, and durability properties. For instance, in 2024, Automotive experts from Huntsman have added a series of new lightweight, durable polyurethane foam technologies to the company’s battery solutions portfolio that have been developed for the potting and fixation of cells mounted in electric vehicle (EV) batteries. The new range also includes products that can be used as a moldable encapsulant in battery modules or packs.

Additionally, in 2025, Swiss furniture brand Vitra announced the development of a world-first easily recyclable polyurethane foam, developed in partnership with chemicals company BASF. This expanding demand for polyurethane foams in diverse sectors directly boosts the consumption of polyols, thereby driving the overall growth of the polyols market globally.

Raw Material Price Volatility

Raw material price volatility is a significant factor restraining the growth of the polyols market. Polyols are primarily produced from petrochemical-based feedstocks such as propylene oxide and ethylene oxide, whose prices are closely tied to crude oil fluctuations. When crude oil prices surge unexpectedly due to geopolitical tensions, supply disruptions, or market speculation, the cost of these raw materials rises sharply.

For instance, during the 2020-2022 period, crude oil price volatility led to increased production costs for major polyols manufacturers like BASF and Covestro. This, in turn, resulted in higher prices for polyurethane foams and other downstream products, making them less affordable for price-sensitive sectors like construction and automotive. Therefore, raw material price volatility disrupts supply chain stability and dampens market demand, acting as a key restraint on the overall growth of the polyols market.

Polyols Market Segment Analysis

The global polyols market is segmented based on type, application, end-user, and region.

Polyether Polyols Lead Market Growth with Versatile Applications and Cost Advantage

The polyether polyols segment dominates the global polyols market due to its widespread use, cost-efficiency, and compatibility with a wide range of polyurethane foam applications. Polyether polyols are extensively utilized in the production of flexible polyurethane foams, which are in high demand in industries such as furniture, bedding, automotive interiors, and packaging.

For instance, in 2024, Dow announced the production of VORANOL WK5750, an advanced Polyether Polyol, at its Freeport plant. Designed for high-performance foam applications like mattresses and furniture, it offers superior softness, resilience, and purity. Additionally, leading furniture brands like IKEA, Tempur-Pedic, and Ashley Furniture utilize flexible foams made from polyether polyols to deliver ergonomic and comfortable mattresses, sofas, and cushions.

Thus, the dominance of the polyether polyols segment is driven by its technical advantages, broad applicability, and cost-effectiveness, supported by strong demand from key end-user industries and emerging markets worldwide.

Polyols Market Geographical Share

North America Leads Polyols Market with Strong Industrial Demand and Regulatory Support

North America dominates the polyols market due to its well-established industrial base, high consumption of polyurethane products, and strong presence of leading manufacturers. The region benefits from advanced infrastructure in automotive, construction, and furniture sectors, which are major end-users of polyols.

In the US, stringent building codes and energy-efficiency regulations have driven the adoption of rigid polyurethane foams for insulation in residential and commercial construction. Major construction projects across states like Texas, California, and Florida continue to fuel demand for insulation materials made from polyols.

Additionally, North America is home to several global polyol and polyurethane producers, including Dow Inc., Huntsman Corporation, and Carpenter Co., which provide consistent supply and invest heavily in R&D and sustainability. Robust supply chains, innovation, and regulatory support for energy-efficient materials collectively contribute to North America’s dominance in the global polyols market.

Sustainability Analysis

Sustainability is becoming a central focus in the polyols market as industries across the value chain aim to reduce their environmental footprint and align with global climate goals. Traditionally, polyols are derived from petroleum-based feedstocks, which contribute to carbon emissions and resource depletion. However, the market is witnessing a growing shift toward bio-based polyols made from renewable resources such as soybean oil, castor oil, and other vegetable oils.

These alternatives offer reduced greenhouse gas emissions and improved biodegradability, making them more environmentally friendly. Companies like Cargill, BASF, and Covestro are investing in the development of bio-based polyols to cater to the increasing demand for sustainable materials in applications such as green buildings, eco-friendly furniture, and low-emission automotive interiors.

Polyols Market Major Players

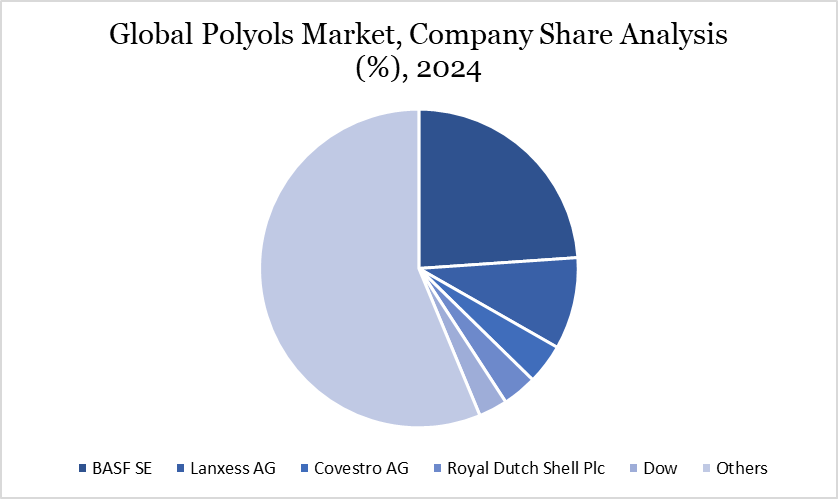

The major global players in the market include BASF SE, Lanxess AG, Covestro AG, Royal Dutch Shell Plc, Dow,Mitsui Chemicals, Inc, Wanhua, Huntsman International LLC, Stepan Company, Tosoh Corporation and among others.

Key Developments

In 2023, Specialty chemicals innovator Perstorp has launched new grades for two base polyols that are currently available with 100% renewable, mass-balanced carbon content.

In 2024, Econic Technologies and Chimcomplex have signed a memorandum of understanding to collaborate on exploring the production of CO₂-based polyols to improve the sustainability and performance of materials across industries and to bring sustainable polyol technology to the European market

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies