Polymerase Chain Reaction Market Size & Industry Outlook

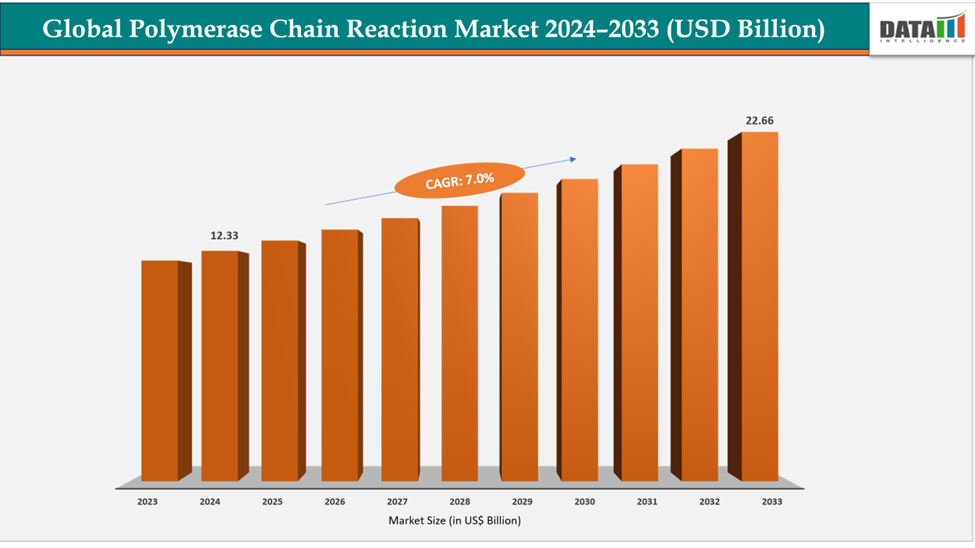

The global polymerase chain reaction market size reached US$ 11.58 Billion in 2023 with a rise of US$ 12.33 Billion in 2024 and is expected to reach US$ 22.66 Billion by 2033, growing at a CAGR of 7.0% during the forecast period 2025-2033.

The polymerase chain reaction (PCR) market is being driven by technological advancements and the growth of genetic and oncology testing. Innovations such as digital PCR, real-time PCR, multiplexing, and microfluidics enable highly sensitive, accurate, and high-throughput testing. Expansion in genetic testing supports personalized medicine, prenatal screening, and hereditary disease detection, while oncology applications use PCR for biomarker detection, liquid biopsies, and early cancer diagnosis. Rising disease prevalence, regulatory approvals, and increasing adoption in research and clinical labs further boost demand.

Key Highlights

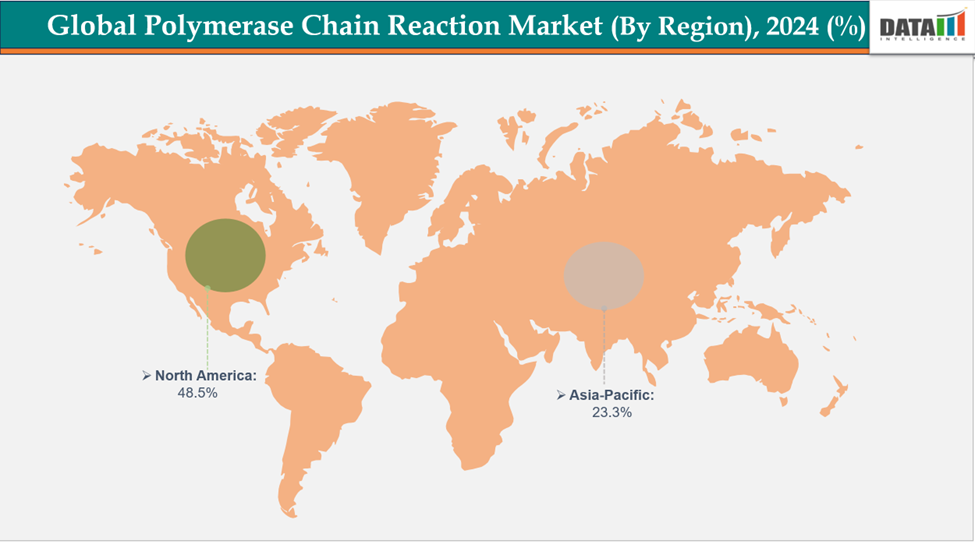

- North America is dominating the global polymerase chain reaction market with the largest revenue share of a 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global polymerase chain reaction market, with a CAGR of 7.5% in 2024

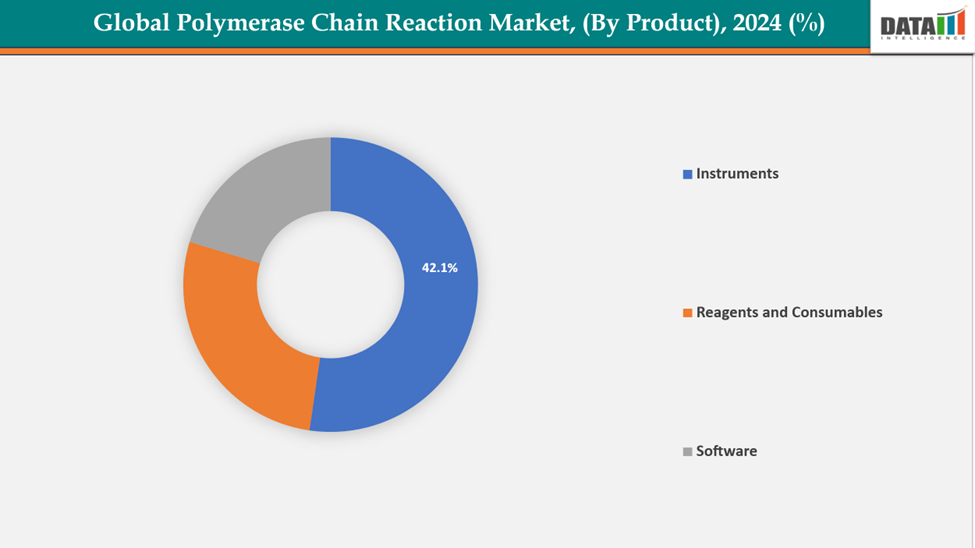

- The instruments from product type is dominating the polymerase chain reaction market with 42.1% share in 2024.

- The real-time PCR systems from type is dominating the polymerase chain reaction market with a 42.5% share in 2024

- Top companies in the polymerase chain reaction market include Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd, Abbott, QIAGEN, Bio-Rad Laboratories, Inc., Cepheid, Illumina, Inc., Takara Bio Inc., Standard BioTools, BD, and others.

Market Dynamics

Drivers: Rising prevalence of infectious diseases is significantly driving the polymerase chain reaction market growth

The rising prevalence of infectious diseases is a major driver of polymerase chain reaction (PCR) market growth because PCR remains the most accurate, rapid, and sensitive method for detecting pathogens at the molecular level. Outbreaks of infectious diseases such as COVID-19, influenza, tuberculosis, HIV, and emerging viral threats have highlighted the need for timely and reliable diagnostics to control transmission and improve patient outcomes. For instance, according to WHO, in 2023 an estimated 1.3 million people acquired HIV, which has caused about 42.3 million deaths globally to date, with a case-fatality ratio of 0.91%. The Eastern Mediterranean Region reported 23,406,897 cases, accounting for 3.03% of the worldwide burden, underscoring its ongoing impact.

Moreover, PCR enables early-stage detection by amplifying even minute quantities of viral or bacterial genetic material, making it indispensable for both clinical and public health applications. Governments and healthcare systems worldwide are investing heavily in molecular diagnostic infrastructure to enhance disease surveillance and pandemic preparedness.

Restraints: Technical limitations are hampering the growth of the polymerase chain reaction market

Technical limitations are hampering the growth of the polymerase chain reaction (PCR) market due to challenges in accuracy, complexity, and cost. Due to their great sensitivity, PCR assays are vulnerable to contamination, which can result in false positives or negatives that jeopardize the reliability of the test. The method's broad application in decentralized or low-resource environments is further limited by the need for accurate sample preparation, knowledgeable staff, and well-equipped labs. For instance, changing the amount of DNA template or changing the conditions that influence Taq polymerase activity, such as MgCl₂ concentration, can affect both the quantity and quality of DNA bands produced. Some studies have shown that even the brand of Taq polymerase can affect results.

Additionally, conventional PCR methods can be time-consuming and labor-intensive, especially when handling large sample volumes, limiting scalability. Moreover, PCR cannot always distinguish between live and dead organisms, reducing its clinical relevance in some contexts.

For more details on this report, see Request for Sample

Polymerase Chain Reaction Market, Segment Analysis

The global polymerase chain reaction market is segmented based on type, application, product, end user and region.

By Product: The instruments segment from product is dominating the polymerase chain reaction market with a 42.1% share in 2024

The instruments segment of the PCR market is witnessing robust growth, primarily driven by technological advancements and increasing demand for accurate diagnostic solutions. Innovations such as real-time PCR (RT-PCR) and digital PCR (dPCR) have significantly improved the sensitivity, precision, and throughput of testing, enabling rapid and reliable detection of genetic material. The surge in infectious diseases, including the COVID-19 pandemic, has further accelerated the adoption of PCR instruments in clinical diagnostics.

Additionally, the integration of automation and multiplexing capabilities allows laboratories to perform multiple analyses simultaneously with minimal manual intervention, enhancing efficiency and cost-effectiveness. These factors collectively position the instruments segment as a key driver in the expanding PCR market.

The real-time PCR systems segment from type is dominating the polymerase chain reaction market with a 42.5% share in 2024

The Real-Time PCR (qPCR) systems segment is dominating the Polymerase Chain Reaction (PCR) market due to its speed, accuracy, and versatility. In contrast to traditional PCR, qPCR yields quantitative data instantly, allowing for accurate nucleic acid measurement without the need for post-amplification processing. This makes it perfect for gene expression analysis, genetic mutation detection, viral load monitoring, and infectious disease diagnosis. qPCR is preferred by hospitals, diagnostic labs, and research organizations due to its ability to allow high-throughput testing, limit contamination risk, and shorten turnaround times.

Additionally, technological advancements, automation and multiplexing capabilities, and new launches and approvals have expanded its applications, reinforcing its market leadership over standard and digital PCR systems. For instance, in November 2023, Roche launched the LightCycler PRO System, a next-generation qPCR platform that enhanced performance and usability. Building on its proven LightCycler technology, the system bridged translational research and in vitro diagnostics, supporting molecular testing for cancer, infectious diseases, and broader public health challenges across research and clinical settings.

Geographical Analysis

North America is dominating the global polymerase chain reaction market with a 48.5% in 2024

North America dominates the global PCR market due to a combination of technological leadership, strong healthcare infrastructure, and high R&D investment. The region hosts major PCR manufacturers like Thermo Fisher and Bio-Rad, driving innovation and quality. Advanced hospitals and molecular diagnostic labs support widespread PCR adoption, while government funding and regulatory clarity accelerate research and commercialization. Early adoption of advanced techniques such as real-time and digital PCR, coupled with rising demand for infectious disease, cancer, and genetic disorder diagnostics, further strengthens its position.

The dominance of the U.S. is further reinforced by recent major PCR manufacturer, regulatory, and market development. For instance, in December 2024, Thermo Fisher Scientific received FDA 510(k) clearance for the Applied BioSystems TaqPath COVID-19 Diagnostic PCR Kit. Previously under EUA, this approval allowed laboratories to adopt an IVD workflow. Built on the same chemistry, the kit had tested over one billion samples during the COVID-19 pandemic.

Europe is the second region after North America which is expected to dominate the global polymerase chain reaction market with a 34.5% in 2024

The European polymerase chain reaction (PCR) market is expected to be among the largest globally, with significant contributions from countries such as Germany, the UK, the Netherlands, and France. Europe’s strong position is supported by robust regulatory frameworks, a strong presence of companies, and active research collaborations, promoting innovative PCR applications. For instance, QIAGEN, a Netherlands-based company, In September 2024, QIAGEN launched the QIAcuityDx Digital PCR System for clinical oncology testing, expanding its successful digital PCR portfolio into North America and Europe. The system is 510(k) exempt in the U.S. and IVDR-certified in Europe, marking a significant step in advancing clinical diagnostics with versatile, high-precision PCR technology.

Germany’s PCR market is driven by advanced healthcare infrastructure, strong regulatory support, and high public and clinical awareness. Market growth is driven by increasing demand for molecular diagnostics, advanced healthcare infrastructure, rapid adoption of real-time and digital PCR technologies, and rising prevalence of infectious and genetic diseases.

The Asia Pacific region is the fastest-growing region in the global polymerase chain reaction market, with a CAGR of 7.5% in 2024

The Asia-Pacific polymerase chain reaction market, including Japan, China, India, and South Korea, is growing due to increasing health awareness, urbanization, and improved healthcare access. Advancements in molecular diagnostics, government initiatives, public health programs, and research by biotech companies are driving PCR adoption for infectious disease detection, genetic testing, and clinical diagnostics, strengthening early diagnosis and overall disease management across the region.

China is witnessing growing demand for PCR testing due to rising health awareness, expanding healthcare infrastructure, and government initiatives promoting molecular diagnostics. Moreover, regulatory approvals from the National Medical Products Administration (NMPA) and the strong presence of top companies are further boosting the market in China. For instance, in September 2024, AmoyDx announced that its Pan Lung Cancer PCR Panel had received China NMPA approval for detecting EGFR, ALK, ROS1, and METex14 skipping mutations in non-small cell lung cancer patients, advancing molecular diagnostics in oncology.

Competitive Landscape

Top companies in the polymerase chain reaction market include Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd, Abbott, QIAGEN, Bio-Rad Laboratories, Inc., Cepheid, Illumina, Inc., Takara Bio Inc., Standard BioTools, BD, and others.

Thermo Fisher Scientific Inc.: Thermo Fisher Scientific Inc. is a global leader in the PCR market, offering thermal cyclers, reagents, and consumables under brands like Applied Biosystems and Invitrogen. The company drives innovation in gene expression, genotyping, and diagnostics, supported by strategic investments and acquisitions, expanding its capabilities in molecular biology and clinical testing worldwide.

Key Developments:

- In September 2024, QIAGEN expanded its QIAcuity digital PCR platform by launching 100 new assays for cancer research, inherited genetic disorders, infectious disease surveillance, and food and environmental monitoring. These assays were made available through the GeneGlobe platform, integrating pre-designed assays with a database of over 10,000 biological entities.

Market Scope

| Metrics | Details | |

| CAGR | 7.0% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| By-Product | Instruments, Reagents and Consumables, Software | |

| Segments Covered | By Type | Real-time PCR Systems, Standard PCR Systems, Digital PCR Systems |

| By Application | Medical Applications, Non-Medical Applications, and Others | |

| By End User | Hospitals and Clinics, Diagnostic Centers, Pharmaceutical and Biotechnology Industries, Academic and Research Organizations and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global polymerase chain reaction market report delivers a detailed analysis with 70 key tables, more than 64 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more clinical diagnostic-related reports, please click here