Global Plasma-Derived Therapeutics Market – Industry Trends & Outlook

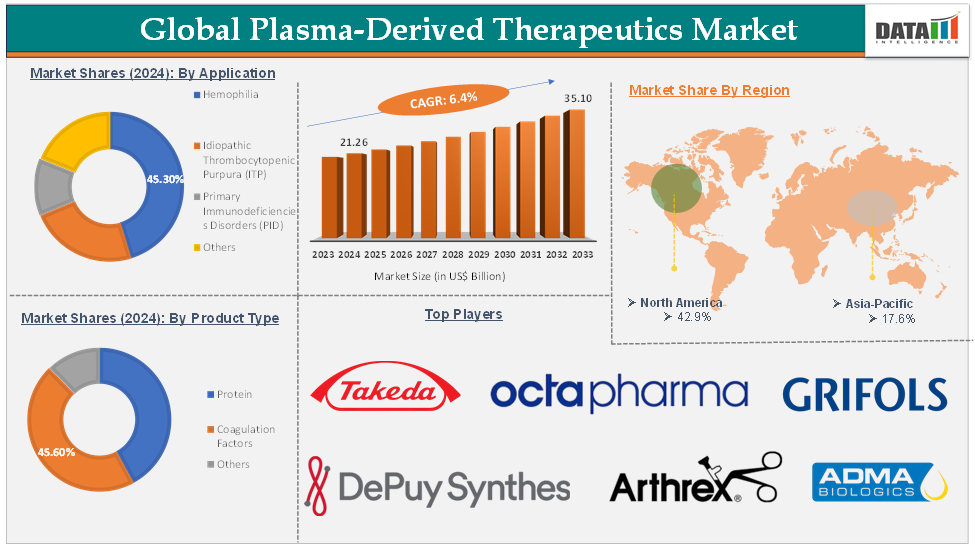

The global plasma-derived therapeutics market was valued at US$ 20.16 Billion in 2023. The market size reached US$ 21.26 Billion in 2024 and is expected to reach US$ 35.10 Billion by 2033, growing at a CAGR of 6.4% during the forecast period 2025-2033.

The global plasma-derived therapeutics market encompasses the development and use of therapeutic products derived from human plasma, such as immunoglobulins, clotting factors, and albumin, to treat a wide range of medical conditions, including primary immunodeficiency, hemophilia, autoimmune disorders, and chronic liver disease.

Market growth is primarily driven by the rising prevalence of rare and chronic diseases, increased diagnosis rates, and greater awareness of the clinical benefits of plasma-derived medicines. The growing incidence of life-threatening conditions like hemophilia and immunodeficiencies, as well as an aging global population more susceptible to immune disorders, further fuels demand.

Technological advancements in plasma collection, fractionation, and purification have improved the safety, efficacy, and availability of these therapies, while regulatory support and streamlined approval processes have accelerated their market penetration. Additionally, ongoing R&D and collaborative efforts within the biopharmaceutical sector are expanding the therapeutic scope of plasma-derived products, with next-generation immunoglobulins and recombinant plasma alternatives on the horizon.

Global Plasma-Derived Therapeutics Market – Executive Summary

Global Plasma-Derived Therapeutics Market Dynamics: Drivers

Increasing prevalence of rare diseases

The global plasma-derived therapeutics market is experiencing significant growth, largely driven by the increasing prevalence of rare diseases. Many of these conditions, including primary immunodeficiency disorders, hemophilia, and various autoimmune diseases, require specialized treatments that are often provided through plasma-derived therapies.

According to a news release by Pfizer in 2024, there are over 7,000 recognized rare diseases affecting approximately 400 million people worldwide. Notably, about 80% of these rare diseases have genetic origins, and half of those affected are children. Despite the large number of individuals impacted, rare diseases remain one of the most underserved patient populations, with approved treatments available for only about 5% of these conditions.

For instance, in March 2025, Kedrion Biopharma Inc. expanded the U.S. distribution network for Ryplazim, the only FDA-approved plasma-derived human plasminogen therapy for patients with plasminogen deficiency type 1 (PLGD-1), a rare, serious disorder that causes abnormal fibrin-rich lesions on mucosal surfaces. These lesions can result in severe complications, including vision and hearing loss, airway obstruction, and infertility if left untreated.

The growing aging population

The growing aging population is a significant driver for the global plasma-derived therapeutics market. As people age, they become more susceptible to a range of conditions that require plasma-derived therapies, such as immune deficiencies, chronic liver diseases, neurological disorders, and bleeding disorders like hemophilia.

According to the World Health Organization, the number of people aged 60 and older is projected to rise from 1.1 billion in 2023 to 1.4 billion by 2030, with the fastest increases occurring in developing regions due to improvements in healthcare and living standards. As people live longer, they are more likely to develop chronic and noncommunicable diseases such as immune deficiencies, liver conditions, and neurological disorders that frequently require plasma-derived therapies for effective management and improved quality of life.

This demographic shift is not confined to high-income countries; low- and middle-income nations are experiencing even more rapid increases in their elderly populations, further expanding the potential patient pool for these therapies. The growing proportion of older adults worldwide is therefore creating sustained demand for plasma-derived medicines, making the aging population a key factor in the market’s ongoing expansion.

Global Plasma-Derived Therapeutics Market Dynamics: Restraints

High cost of plasma-derived therapies

The high cost of plasma-derived therapies is a major restraint on the growth and accessibility of the global plasma-derived therapeutics market. Producing these therapies, such as immunoglobulins, clotting factors, and albumin, requires complex, labor-intensive, and capital-intensive processes, including the collection of large volumes of human plasma, advanced fractionation and purification techniques, and stringent quality control measures.

Specialized facilities and compliance with rigorous regulatory requirements further add to manufacturing expenses, making these therapies expensive and often unaffordable, especially in low- and middle-income countries. The high price limits patient access and can result in delayed or inadequate treatment for those who need these lifesaving medicines. Additionally, the cost barrier discourages broader adoption and can hinder the expansion of plasma-derived therapies into new markets, ultimately constraining the market's overall growth potential.

Global Plasma-Derived Therapeutics Market Dynamics: Opportunities

Development of novel plasma-derived products

The development of novel plasma-derived products presents a significant opportunity for the global plasma-derived therapeutics market. Advances in biotechnology, improved fractionation techniques, and the integration of artificial intelligence are enabling the creation of new and more effective plasma-based therapies to address a wider range of diseases, including those with unmet medical needs. This innovation is expanding the therapeutic scope beyond traditional indications like hemophilia and immunodeficiencies to include rare and complex conditions, as well as personalized medicine applications.

The introduction of novel products such as next-generation immunoglobulins, hyperimmune globulins, and specialized clotting factors can improve patient outcomes, offer better safety profiles, and reduce treatment burdens. Additionally, regulatory agencies are increasingly supporting accelerated approval pathways for innovative therapies targeting serious or rare diseases, further incentivizing research and development in this sector.

For instance, in April 2025, InVitria, a prominent company specializing in recombinant and chemically defined components for biomanufacturing, launched Optibumin 25, the first and only recombinant human serum albumin (rHSA) available as a 25% solution. Optibumin 25 is a lab-produced version of human serum albumin, a protein commonly used in biomanufacturing and therapeutic formulations.

Unlike traditional albumin sourced from human plasma, this product is made using recombinant DNA technology, ensuring high purity and eliminating risks associated with plasma-derived products (e.g., pathogen transmission).

For more details on this report, Request for Sample

Global Plasma-Derived Therapeutics Market - Segment Analysis

The global plasma-derived therapeutics market is segmented based on product type, application, end-user, and region.

Application:

The hemophilia application segment is expected to hold 45.3% of the global plasma-derived therapeutics market in 2024

Hemophilia is a rare, inherited bleeding disorder characterized by the inability of blood to clot normally due to a deficiency in one of several clotting factors. The condition primarily affects males. Individuals with hemophilia are at risk for excessive and recurrent bleeding, which can occur spontaneously or after injury. This bleeding can be life-threatening, especially in those with severe hemophilia, as it may involve muscles, joints, or, in rare cases, critical areas such as the brain (intracranial space), where it can be fatal.

According to the World Federation of Hemophilia, more than 38,000 people worldwide are living with hemophilia B. This form of hemophilia is caused by a deficiency of clotting factor IX (FIX) and is also known as congenital FIX deficiency or Christmas disease. The current standard treatment involves regular intravenous infusions of either plasma-derived or recombinant FIX to control and prevent bleeding episodes.

For instance, in October 2024, SteinCares, a leading specialty healthcare company in Latin America, announces a new distribution agreement with Biotest AG, a multinational company specializing in biological therapies derived from human plasma, for the commercialization and distribution of Haemoctin throughout selected Latin American countries (Chile, Colombia, Costa Rica, Ecuador, Mexico and Peru).

The addition of this plasma-derived factor VIII treatment for hemophilia marks SteinCares’ entry into the plasma-derived therapy segment, expanding its current portfolio of innovative pharmaceuticals, biosimilars, and complex generics. These factors have solidified the segment's position in the global plasma-derived therapeutics market.

Global Plasma-Derived Therapeutics Market – Geographical Analysis

North America is expected to hold 42.9% of the global plasma-derived therapeutics market in 2024

North America has a significant population affected by rare and chronic diseases such as haemophilia, primary immunodeficiency disorders, and various autoimmune conditions. These diseases often require continuous and specialized treatment with plasma-derived products like immunoglobulins, clotting factors, and albumin.

The high disease burden increases the demand for these therapies, making North America one of the largest and most important markets for plasma-derived therapeutics. Early diagnosis and greater disease awareness in the region further contribute to a growing patient pool that relies on these lifesaving treatments.

The United States and Canada boast some of the world’s most advanced healthcare systems and a robust biopharmaceutical industry. This infrastructure supports the efficient collection, processing, and distribution of plasma, ensuring that therapies reach patients quickly and safely.

North America has a vast network of plasma collection centers, particularly in the United States, which is the world’s largest supplier of source plasma. Well-established donor recruitment and retention programs encourage regular plasma donations, ensuring a steady and sufficient supply of raw material for manufacturing plasma-derived therapies.

The region is at the forefront of technological innovation in plasma collection, separation, and purification processes. Advances such as automated plasmapheresis, improved fractionation techniques, and enhanced pathogen inactivation methods have significantly increased the safety, efficiency, and scalability of plasma-derived products. These technological improvements not only reduce manufacturing costs but also minimize the risk of disease transmission, ensuring high-quality therapies for patients.

For instance, in November 2024, Kedrion Biopharma Inc. announced that the U.S. Food and Drug Administration (FDA) had approved its manufacturing facility in Bolognana, Italy, to produce RYPLAZIM, a plasma-derived human plasminogen therapy indicated for treating plasminogen deficiency type 1 (PLGD-1), a rare and chronic genetic disorder. Thus, the above factors are consolidating the region's position as a dominant force in the global plasma-derived therapeutics market.

Asia Pacific is expected to hold 17.6% of the global plasma-derived therapeutics market in 2024

The Asia-Pacific plasma-derived therapeutics market is experiencing the fastest growth globally, driven by several key factors. A major driver is the region’s large and aging population, which is increasingly affected by chronic and rare diseases such as hemophilia, primary immunodeficiencies, autoimmune disorders, and neurological conditions.

This growing patient base is fueling demand for effective plasma-based therapies. Additionally, many countries in Asia-Pacific are investing heavily in plasma collection and processing infrastructure, enhancing their capacity to meet rising therapeutic needs.

Healthcare system improvements and strengthened regulatory frameworks across the region are facilitating faster approvals and better access to plasma-derived medicines. Governments are also promoting plasma donation initiatives to secure a stable supply of plasma, which is critical for manufacturing these therapies. Rising awareness about rare diseases and the benefits of plasma-derived treatments among healthcare providers and patients further supports market expansion.

Technological advancements in plasma fractionation, purification, and safety measures are also being adopted in the Asia-Pacific region, improving the quality and availability of plasma-derived products. Countries such as China, Japan, Australia, and India are key contributors to market growth, with increasing healthcare expenditure and collaborations with global plasma fractionators enhancing their market presence.

For instance, in September 2024, Takeda Pharmaceutical launched Ceprotin (lyophilized human protein C concentrate) in Japan for the treatment of blood-clotting complications associated with congenital protein C deficiency. This rare genetic disorder leads to a lack of protein C, an essential component for regulating blood clot formation. Without enough protein C, patients are at risk for life-threatening blood clots. Thus, the above factors are consolidating the region's position as a dominant force in the global plasma-derived therapeutics market.

Global Plasma-Derived Therapeutics Market – Competitive Landscape

The major global players in the plasma-derived therapeutics market include Takeda Pharmaceutical Company Limited, Johnson and Johnson (DePuy Synthes), Octapharma AG, Arthrex, Inc., Grifols, S.A., ADMA Biologics, Inc., CSL, Evolve Biologics Inc., Kamada Pharmaceuticals, and Bio Products Laboratory Ltd, among others.

Global Plasma-Derived Therapeutics Market – Key Developments

In May 2025, BioRewards Plasma Services and Alpha-1 Plasma Holdings launched a $100 million expansion plan aimed at transforming the plasma collection industry to meet the surging global demand for plasma-derived therapies. The initiative involves deploying over $100 million in capital to open more than 20 state-of-the-art plasma collection centers across the U.S. over the next three years, with additional centers planned internationally in key countries.

In September 2024, Grifols, a global leader in plasma-derived medicines, is collaborating with French telecom giant Orange to establish a sustainable supply of essential therapeutics for life-threatening diseases in Egypt. This partnership centers on building advanced digital infrastructure to support Egypt’s ambitious national project for plasma self-sufficiency.

In August 2024, Nanoform, a Helsinki-based medicine performance-enhancing company, announced a pre-clinical development partnership with Takeda Pharmaceuticals’ Plasma-derived Therapies Business Unit to create innovative formulations of plasma-derived therapies for rare diseases.

In June 2024, Grifols revealed that its subsidiary, Biotest, secured its first FDA approval for Yimmugo, an innovative intravenous immunoglobulin (IVIg) therapy for primary immunodeficiencies (PID). This milestone marks Yimmugo as the first Biotest product to receive FDA clearance, expanding treatment options for patients with PID.

In May 2024, LFB announced the acquisition of Amber Plasma through its affiliate, Europlasma. Amber Plasma operates 12 plasma collection centers in the Czech Republic. This strategic acquisition significantly strengthens LFB’s plasma collection network in Central Europe, increasing Europlasma’s total number of centers to 24 15 in the Czech Republic and 9 in Austria.

In April 2024, Pfizer Inc. announced that the U.S. Food and Drug Administration (FDA) approved BEQVEZ (fidanacogene elaparvovec-dzkt), a one-time gene therapy for adults with moderate to severe hemophilia B (congenital factor IX deficiency). This therapy is intended for patients who are currently on factor IX (FIX) prophylaxis, have a history of life-threatening hemorrhages, or experience frequent, serious, spontaneous bleeding episodes.

In February 2024, South Korea’s GC Biopharma Corp. announced ambitious plans to boost sales of its immunoglobulin product, Alyglo, which recently received FDA approval. The company aims to increase Alyglo’s sales sixfold over the next five years, targeting $300 million in revenue by 2028, up from an anticipated $50 million in 2024. Alyglo, indicated for the treatment of primary humoral immunodeficiency, is set to launch in the U.S. market.

Global Plasma-Derived Therapeutics Market – Scope

Metrics | Details | |

CAGR | 6.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Protein, Coagulation Factors, Others |

Application | Hemophilia, Idiopathic Thrombocytopenic Purpura (ITP), Primary Immunodeficiency Disorders (PID), Others | |

End-User | Hospitals & Specialty Clinics, Ambulatory Surgical Centers, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global plasma-derived therapeutics market report delivers a detailed analysis with 62 key tables, more than 53 visually impactful figures, and 173 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here