Overview

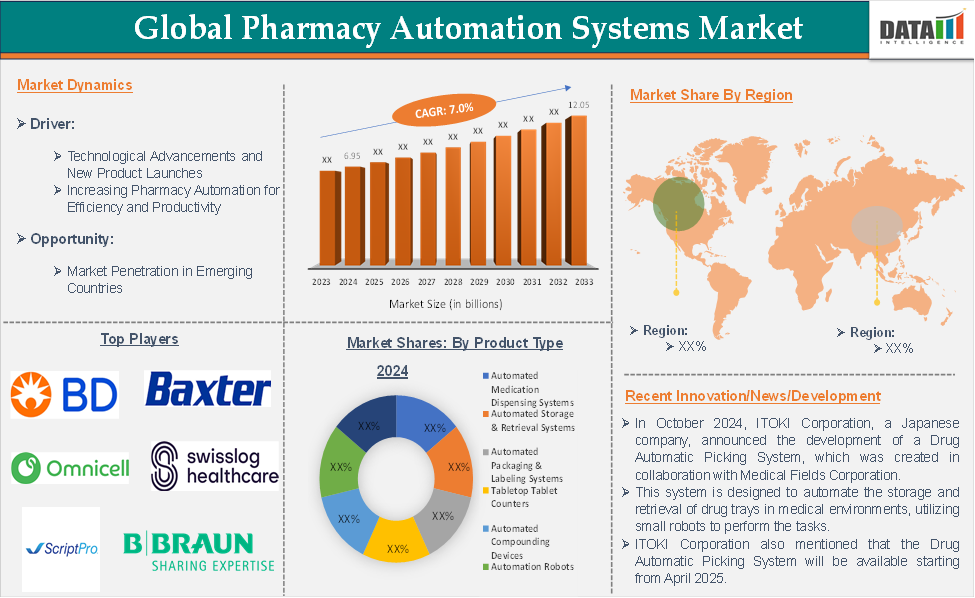

The global pharmacy automation systems market reached US$ 6.95 billion in 2024 and is expected to reach US$ 12.05 billion by 2033, growing at a CAGR of 7.0 % during the forecast period of 2025-2033.

Pharmacy automation systems are advanced technological solutions that enhance efficiency in pharmaceutical operations by automating key processes such as medication dispensing, storage, labeling, and inventory management. These systems use robotics, software, and artificial intelligence (AI) to ensure precision in medication handling, reducing the risk of human errors in dispensing and packaging.

By integrating automated workflows, pharmacies can optimize their supply chain, improve medication tracking, and enhance compliance with regulatory standards. The technology is particularly beneficial in high-volume settings such as hospitals and retail pharmacies, where accuracy and efficiency are critical to patient safety and operational effectiveness.

Executive Summary

Market Dynamics: Drivers & Restraints

Technological Advancements and New Product Launches

The technological advancements and new product launches are key drivers for market growth in the forecast period. The key companies in the market landscape, such as BD, Omnicell, Swisslog Healthcare, and other regional manufacturers, constantly invest in launching technologically advanced pharmacy automation systems.

For instance, in October 2024, ITOKI CORPORATION in Japan announced the launch of the Drug Automatic Picking system with MediMonitor, jointly developed with Medical Fields Corporation. This system uses small robots to store and retrieve drug trays and audits the whole process. ITOKI said that these systems would be available starting in April 2025.

Moreover, in April 2024, Swisslog Healthcare, one of the global market players in hospital automation systems, launched the ezCUT Automated Tablet Cutter in the North American market in collaboration with JVM Manufacturing. This machine automates the cutting of solid oral formulations to fulfill the half-strength prescriptions. This system can significantly reduce the time and manual labor. All these factors demand the global pharmacy automation systems market.

High Cost of Pharmacy Automation Systems

High initial investment costs represent a major challenge in the global pharmacy automation systems market, particularly affecting the adoption of these technologies among smaller pharmacies. Pharmacy automation systems, which include automated dispensing machines, robotic systems, and software solutions, come with significant upfront costs. These systems can range from $64,571.54 to over $6,45,715.35, depending on their complexity and scale.

The largest portion of the initial investment is typically spent on acquiring advanced automation equipment. High-quality robotic dispensers and automated storage systems are especially costly. Additionally, the installation of these systems requires specialized knowledge, leading to further costs related to infrastructure modifications or upgrades.

Staff training is also essential to ensure the proper operation and maintenance of these technologies, and training programs contribute to the overall expenditure. This financial burden can be a significant barrier, particularly for smaller pharmacies that may have limited budgets for such investments. Thus, the above factors could be limiting the global pharmacy automation systems market's potential growth.

Segment Analysis

The global pharmacy automation systems market is segmented based on product type, end-user, and region.

Product Type:

The automated medication dispensing systems segment in product type is expected to dominate the global pharmacy automation systems market with the highest market share

Automated dispensing systems are tools that are currently being widely adopted in pharmacies across the world to automate the process of drug dispensing. These systems are incorporated with advanced software to improve the accuracy, speed, and efficiency of medication dispensing. Moreover, these systems play a crucial role in reducing human errors that can occur during dispensing, which may lead to medication errors and often fatalities.

The key players manufacturing automated medication-dispensing systems include BD, Omnicell, Inc., and ScriptPro, among others. The market for automated medication-dispensing systems is mainly driven by technological advancements, product approval and launches, mergers, rising collaborations between manufacturers and end-users, and increasing automation of pharmacies across the world.

For instance, in October 2024, the first Automated Dispensing Medication System, i-Pharmabot, was launched in Malaysia by the National Heart Institute (IJN). The system can dispense up to 180 medications per minute and drastically reduce dispensing errors. With this new system in action, IJN plans to improve the safety and experience for outpatients along with the inpatient population.

Moreover, in October 2023, JVM, an affiliate of Hanmi Science, launched the next-generation automated drug dispensing machine “MENITH,” featuring a robotic arm, in the European market. Through this launch, JVM also entered a supply contract in the Netherlands with Brocacef, a company that operates large, factory-type dispensing pharmacies in Europe. These factors have solidified the segment's position in the global pharmacy automation systems market.

Geographical Analysis

North America is expected to hold a significant position in the global pharmacy automation systems market with the highest market share

The North America pharmacy automation systems market refers to the adoption and use of automation technologies in pharmacies across North America, which includes solutions for dispensing, storing, tracking, and managing medications. Increasing concerns about medication errors and patient safety have pushed healthcare providers to adopt automated systems. These systems, such as robotic dispensing units and barcode scanning, help reduce the risk of human error and improve medication accuracy, directly benefiting patient safety.

The aging population in North America, particularly in the U.S. and Canada, is driving the demand for medication management solutions. Older adults often take multiple medications, which increases the risk of medication errors and the complexity of dispensing. Automation helps to ensure these medications are dispensed correctly and on time, which is crucial for elderly patients' health management.

Continuous advancements in technology, such as robotic systems, artificial intelligence, and machine learning, have made pharmacy automation more accessible and affordable. These innovations provide advanced features like real-time inventory tracking, automated prescription refills, and medication management, making it easier for pharmacies to integrate these systems into their operations.

For instance, in August 2024, Omnicell launched a new service called Central Med Automation, designed to optimize medication dispensing across entire health system enterprises using robotics and smart devices. The goal of this service is to streamline the entire process of medication management from a centralized fulfillment area, enabling more efficient and accurate dispensing throughout the healthcare system. Thus, the above factors are consolidating the region's position as a dominant force in the global pharmacy automation systems market.

Competitive Landscape

The major global players in the pharmacy automation systems market include BD, Omnicell, Swisslog Healthcare, ScriptPro, ARxIUM, B. Braun Medical Inc., Baxter, ICU Medical, Inc., Capsa Healthcare, Pearson Medical Technologies, and Willach Group among others.

Key Developments

- In October 2024, Integrated Inspection and PV2 innovations in multi-dose card pharmacy automation represent advancements in the way pharmacies manage medication dispensing and packaging, helping reduce operational costs. This refers to automated systems that are built into pharmacy automation solutions to monitor and verify the accuracy and quality of the dispensing process.

Scope

| Metrics | Details | |

| CAGR | 7.0% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Automated Medication Dispensing Systems, Automated Storage & Retrieval Systems, Automated Packaging & Labeling Systems, Tabletop Tablet Counters, Automated Compounding Devices, Automation Robots, Others |

| End-User | Hospital & Central Pharmacy, Retail Pharmacy, Specialty Pharmacy | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials and product pipelines and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzed product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: This covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyze competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global pharmacy automation systems market report delivers a detailed analysis with 57 key tables, more than 47 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.