Global Personal Watercraft Market is Segmented By Seating Capacity (Standing, One Seat Capacity, Two Seat Capacity, Three Seat Capacity), By Watercraft Type (Recreational Watercraft, Muscle Watercraft, Luxury Watercraft, Performance Watercraft, Sports Watercraft), By Hull (Plastics, Composites), and By Region (North America, Europe, South America, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

Personal Watercraft Market Size

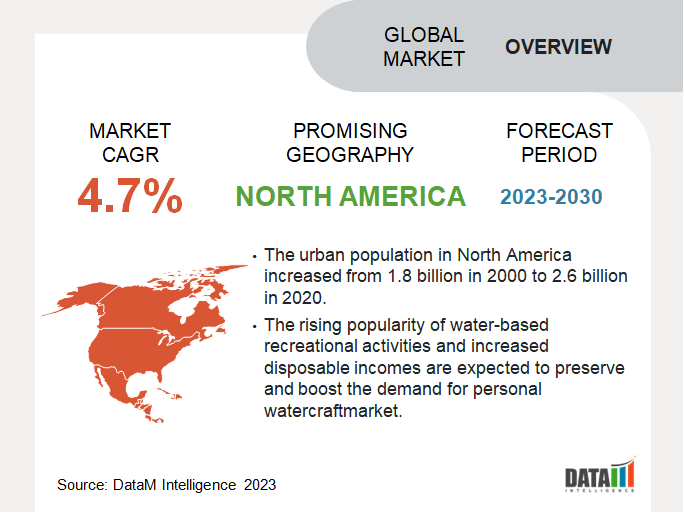

Global Personal Watercraft Market reached USD 1.6 billion in 2022 and is expected to reach USD 2.4 billion by 2031, growing with a CAGR of 4.7% during the forecast period 2024-2031. The global personal watercraft market has been experiencing robust growth in recent years, driven by increasing leisure activities, rising disposable incomes, and a growing interest in water sports.

The surge in water-based leisure activities has been a key driver behind the growth of the personal watercraft market.

People across the globe are increasingly seeking adrenaline-pumping experiences and adventure, which has led to the popularity of personal watercraft. Governments, especially in coastal regions and popular tourist destinations, are investing in water sports infrastructure, providing easy access to lakes, rivers, and oceans, further promoting the growth of the market.

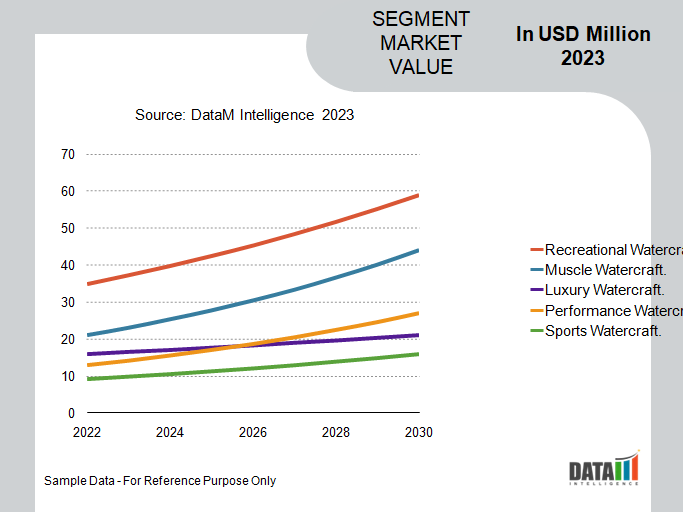

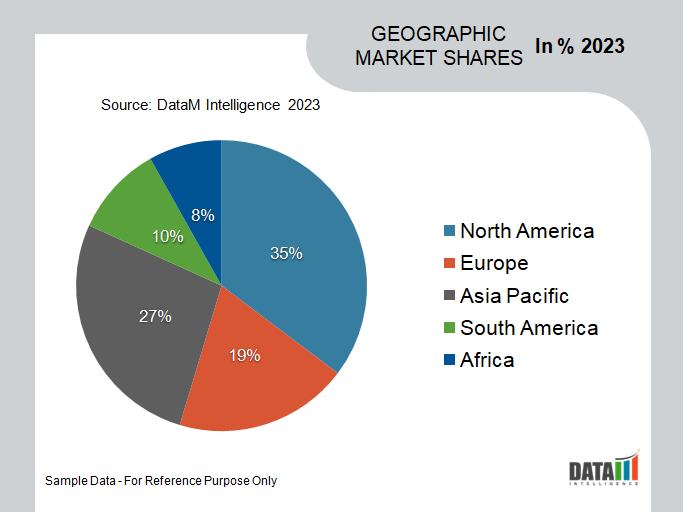

The recreational watercraft segment takes the lead in the watercraft type segment, showcasing rapid growth and capturing more than 1/4th of the market share. The remarkable expansion can be attributed to rising popularity of recreational watercraft and its ability to offer a unique and exhilarating experience for water enthusiasts. Similarly, North America dominates the personal watercraft system market, holding the largest market share of over 1/4th. The region presents significant potential in this market, driven by the rising popularity of water-based recreational activities and increased disposable incomes.

Personal Watercraft Market Scope

|

Metrics |

Details |

|

CAGR |

4.7% |

|

Size Available for Years |

2022-2031 |

|

Forecast Period |

2024-2031 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Seating Capacity, Watercraft Type, Hull and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Largest Region |

North America |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To Know More Insights - Download Sample

Personal Watercraft Market Dynamics

Expanding Water-based Infrastructure, Tourism and Water-based Adventure

The development of water-based infrastructure has also contributed to the expansion of the personal watercraft market. The increasing availability of marinas, docking facilities, and water sports centers has made it easier for consumers to access and enjoy watercraft activities. Government records on infrastructure projects and marine development plans illustrate the focus on building and upgrading water sports facilities globally. Such developments not only benefit the personal watercraft industry but also promote water-based tourism and recreational activities.

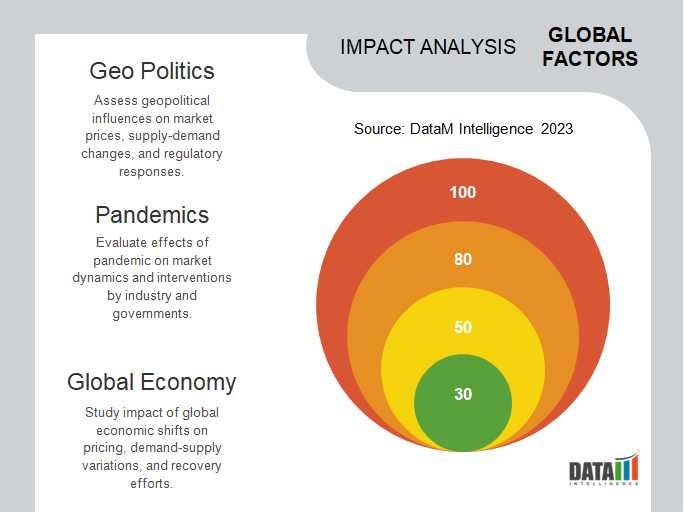

The growing tourism industry and the development of water-based adventure destinations have significantly boosted the global personal watercraft market. Governments around the world are investing in promoting water sports and adventure tourism, creating a favorable environment for the growth of personal watercraft sales and rentals. Statistics from tourism boards in countries like Thailand, Mexico and UAE demonstrate a considerable increase in water sports tourism. These destinations offer an array of water-based activities, including jet skiing, which has attracted both domestic and international tourists, fueling the demand for personal watercraft.

Rising Disposable Income and Leisure Spending Combined with Growing Popularity of Water Sports and Recreational Activities

The growth of the global personal watercraft market is closely linked to the rise in disposable income and increased leisure spending among consumers. As economies thrive, individuals have more disposable income to spend on leisure and recreational activities. Personal watercraft offer an affordable option for individuals seeking thrilling water adventures, thus witnessing increased demand. According to data from the World Bank, the global per capita income increased by 4.5% from 2018 to 2019, indicating improved financial stability and higher disposable incomes. The respective upward trend in income levels has contributed to the expanding customer base for personal watercraft, especially in emerging markets.

Further, the increasing popularity of water sports and recreational activities has been a significant driver for the personal watercraft market. As people seek adventurous experiences and leisure activities, water sports have emerged as a preferred choice. Government statistics from tourism departments and recreational organizations globally indicate a rise in water sports participation, directly contributing to the demand for personal watercraft.

For instance, the U.S. Coast Guard's annual recreational boating statistics report highlighted a surge in the number of personal watercraft registrations. In the United States alone, there were over 1.2 million registered personal watercraft in 2020, showcasing the growing preference for these vessels among water enthusiasts.

Noise Pollution Concerns and Stringent Environmental Regulations

Personal watercraft are often associated with high noise levels, which can disturb marine life, disrupt wildlife habitats, and cause inconvenience to nearby residents and tourists. As a result, many countries are enforcing noise pollution limits for watercraft. For example, the Environmental Protection Agency (EPA) in U.S. has set specific noise emission standards for recreational watercraft, included in personal watercraft. Failure to comply with these standards may result in significant fines and penalties for manufacturers and users alike.

Similalry, the increasing focus on environmental conservation and sustainable practices also restricts the market. Governments across the globe are implementing stringent regulations to protect marine ecosystems, limit noise pollution, and reduce emissions. Such regulations often lead to stricter emission standards for personal watercraft, which can raise manufacturing costs and limit the availability of certain models in the market.

According to the United Nations Environmental Programme (UNEP), marine pollution has become a pressing concern around the globe, with plastic waste and oil spills significantly impacting marine life. Governments are taking proactive measures to protect coastal areas, lakes, and rivers, resulting in the implementation of restrictions on personal watercraft operations in ecologically sensitive areas.

Personal Watercraft Market Segment Analysis

The global personal watercraft market is segmented based on seating capacity, watercraft type, hull and region.

Versatility and Excitement that Recreational Watercrafts Offer

The recreational watercraft segment has experienced a plethora of market trends and opportunities in recent years. Recreational watercraft, such as jet skis, has become an emblem of adventure and fun in the water. The respective compact and powerful vessels are designed to accommodate one to three passengers, offering a high-speed and agile ride on lakes, rivers, and coastal waters. The ease of use and the adrenaline rush provided by personal watercraft have contributed significantly to their surging popularity.

The rise of water sports and outdoor activities has spurred the demand for personal watercraft, especially among millennials and Generation Z. Water sports enthusiasts are drawn to the versatility and excitement that recreational watercraft offer, contributing to the segment's growth. Additionally, the increasing disposable income and growing tourism industry have further fueled the demand for recreational watercraft. With higher disposable incomes, more people are willing to invest in watercraft for leisure activities and weekend getaways.

Global Personal Watercraft Market Geographical Share

Thriving Tourism Industry and Rising Disposable Incomes

Personal watercrafts were first introduced in the 1960s and have since evolved into a mainstream water sports segment. The compact, motorized watercrafts are designed to be ridden by one to three individuals and offer a fun and exciting way to explore water bodies. According to the U.S. Coast Guard's Boating Statistics, the number of registered personal watercraft in U.S. has been steadily increasing over the years. As of the latest statistics, there were over 1.1 million registered personal watercrafts in the U.S. in 2020, reflecting a significant rise in consumer interest and demand.

North America is home to numerous picturesque lakes, rivers, and coastal regions, making it an ideal destination for water-based tourism. Tourists and locals alike seek thrilling water sports experiences, contributing to the growing demand for personal watercraft. Moreover, increasing disposable incomes in North America have allowed consumers to indulge in recreational activities. Personal watercraft are viewed as an attractive investment for water enthusiasts looking to elevate their leisure experiences.

Personal Watercraft Market Companies

The major global players in the market include Honda Motors Co. Ltd., BRP Inc., Yamaha Motors Co. Ltd., Kawasaki Motors Corp., Lampuga, Jiujiang Poseidon Motorboat Manufacturing Co. Ltd., BRO Inc, Arctic cat Inc, Polaris Industries and SLVH s.r.o.

COVID-19 Impact on Personal Watercraft Market

The outbreak of the COVID-19 pandemic in late 2019 and its subsequent spread across the globe in 2020 has had a profound impact on various industries, including the personal watercraft market. Personal watercraft, also known as PWC or jet skis, have been a popular choice for recreational water activities. However, the pandemic led to significant disruptions in the market due to various factors such as travel restrictions, economic uncertainty, and changes in consumer behavior. As governments globally implemented strict travel restrictions and lockdown measures to curb the spread of the virus, the personal watercraft market faced unprecedented challenges.

Many popular tourist destinations, where PWC rentals and sales thrive, experienced a sharp decline in visitors and leisure activities. Countries dependent on tourism, such as the Maldives, Thailand, and the Caribbean nations, were significantly impacted. According to the United Nations World Tourism Organization (UNWTO), international tourist arrivals fell by 73% globally in 2020 compared to the previous year. Such restrictions negatively impacted the global personal watercraft market, leading to a decline in rental and sales revenue during the pandemic.

Key Developments

- In 2021, BRP (Bombardier Recreational Products) launched Sea-Doo Switch, a watercraft that features a modular design, allowing users to easily switch between a stand-up and sit-down configuration. The product’s innovative design caters to a broader range of riders, offering versatility and adaptability for different water sports preferences..

- In 2022, Yamaha launched Yamaha VX Limited HO. The VX Limited HO is equipped with advanced safety features and a spacious storage system, enhancing the overall user experience and convenience.

- In 2021, Kawasaki Jet Ski introduced the Ultra 310LX in 2021, a top-of-the-line personal watercraft model designed for thrill-seekers and water sports enthusiasts. The Ultra 310LX boasts a powerful engine, providing impressive acceleration and top speeds. Additionally, it features a comfortable and luxurious seating arrangement, ensuring riders can enjoy extended water adventures without discomfort.

Why Purchase the Report?

- To visualize the global personal watercraft market segmentation based on seating capacity, watercraft type, hull and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of personal watercraft market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global personal watercraft market report would provide approximately 61 tables, 59 figures and 187 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies