Market Size

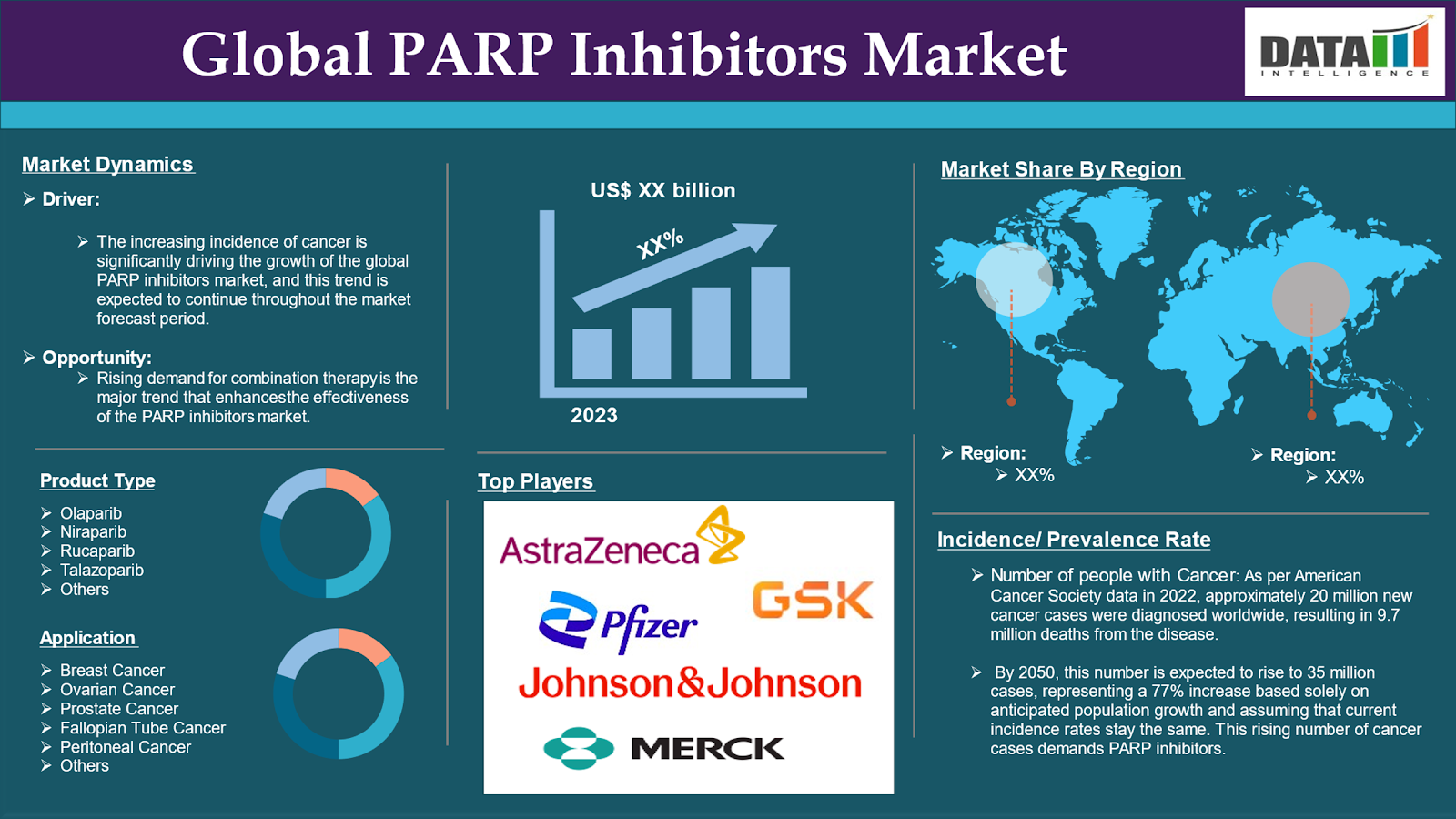

The Global PARP Inhibitors Market reached US$ 3.53 billion in 2023 and is expected to reach US$ 6.64 billion by 2031, growing at a CAGR of 8.3% during the forecast period 2024-2031.

PARP (poly ADP-ribose polymerase) proteins are responsible for binding to broken DNA strands and recruiting additional proteins to facilitate the repair of damaged DNA. Various pathways, governed by different genes, play a role in DNA damage repair. The PARP protein family specifically regulates the response to single-strand breaks in DNA. By inhibiting this pathway, cells are compelled to rely on alternative mechanisms to address DNA damage.

PARP inhibitors drugs are designed to interfere with the function of the PARP enzyme, which plays a crucial role in repairing DNA damage within cells. The PARP enzyme is essential for the repair of single-strand breaks in DNA, which can occur due to various factors, including environmental stressors and normal cellular processes. PARP is an enzyme that detects and repairs damaged DNA. When DNA is damaged, PARP binds to the site of the break and facilitates repair by recruiting other proteins involved in the repair process. This is particularly important for maintaining genomic stability. These factors have driven the global PARP inhibitors market expansion.

Market Summary

| Metrics | Details |

| CAGR | 8.3% |

| Market Size Available for Years | 2022-2031 |

| Estimation Forecast Period | 2024-2031 |

| Revenue Units | Value (US$ Mn) |

| Segments Covered | Product Type |

| Application | |

| Distribution Channel | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa |

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Increasing incidence of cancer

The increasing incidence of cancer is significantly driving the growth of the global PARP inhibitors market, and this trend is expected to continue throughout the market forecast period.

The rising incidence of cancer is a key factor propelling the global PARP inhibitors market. This growth is fueled by an increase in patient numbers, improvements in genetic testing, a growing demand for targeted therapies, and greater awareness of available treatment options. As more individuals are diagnosed with cancers that can be effectively managed with PARP inhibitors, the market is anticipated to grow significantly, towards personalized medicine in the field of oncology.

As per American Cancer Society data in 2022, approximately 20 million new cancer cases were diagnosed worldwide, resulting in 9.7 million deaths from the disease. By 2050, this number is expected to rise to 35 million cases, representing a 77% increase based solely on anticipated population growth and assuming that current incidence rates stay the same. This rising number of cancer cases demands PARP inhibitors.

Endometrial cancer is a highly diverse disease that begins in the tissue lining of the uterus and is most commonly diagnosed in postmenopausal women, with an average diagnosis age exceeding 60 years. In Europe, endometrial cancer ranks as the fourth most prevalent cancer among women, with nearly 125,000 new cases and over 30,000 fatalities reported in 2022. Patients diagnosed at an early stage typically have a five-year survival rate of about 80-90%, but this rate drops to under 20% for those with advanced disease. There is a pressing need for new treatment options, particularly for the 70-80% of patients who have proficient mismatch repair (pMMR) disease.

Most patients are diagnosed at an early stage when the cancer is confined to the uterus, and they typically undergo surgery and/or radiation therapy, resulting in a high five-year survival rate of approximately 80-90%. However, those with advanced-stage (Stage III-IV) endometrial cancer face a significantly poorer prognosis, with a five-year survival rate falling to less than 20%. All these factors demand the global PARP inhibitors market.

Moreover, the rising demand for combination therapy contributes to the expansion of the global PARP inhibitors market.

Resistance of Drugs

The resistance of drugs will hinder the growth of global PARP inhibitors. PARP inhibitors are effective cancer treatments, but they come with certain limitations, including the specific types of cancer they can address and the potential for resistance to develop over time. For instance, as per MD Anderson Cancer Center research publication in April 2024, according to Litton, there are multiple ongoing studies exploring combinations of PARP inhibitors with other therapies, aiming to extend their use to a broader range of tumors and various DNA repair defects, thereby addressing resistance and enhancing treatment responses.

A common challenge with PARP inhibitors is that patients may eventually develop resistance, which reduces the long-term effectiveness of these drugs. Researchers are investigating patient samples to understand how cancer cells gain this resistance and to identify new biomarkers that could indicate a patient's likelihood of developing resistance.

Additionally, researchers are exploring other targeted therapies that could be combined with PARP inhibitors to help overcome resistance and improve treatment outcomes. One promising approach involves using PRMT inhibitors, which interact with DNA and have shown encouraging results in preliminary studies when paired with PARP inhibitors. Thus, the above factors could be limiting the global PARP inhibitors market's potential growth.

Market Segment Analysis

The global PARP inhibitors market is segmented based on product type, application, distribution channel, and region.

Product Type:

Olaparib segment is expected to dominate the global PARP inhibitors market share

The olaparib segment holds a major portion of the global PARP inhibitors market share and is expected to continue to hold a significant portion of the global PARP inhibitors market share during the forecast period.

LYNPARZA (olaparib) is a pioneering, first-in-class PARP inhibitor and the initial targeted therapy designed to obstruct the DNA damage response (DDR) in cells or tumors that exhibit deficiencies in homologous recombination repair (HRR), particularly those with mutations in the BRCA1 or BRCA2 genes (BRCAm). Mutations in these genes lead to homologous recombination deficiency (HRD), which has been linked to a heightened risk of developing certain cancers and may result in more aggressive disease progression.

According to the MJH Life Sciences article in July 2024, as the first PARP inhibitor approved by the FDA for treating specific cancers, LYNPARZA (olaparib) has been prescribed to approximately 45,500 patients over the past decade, offering a targeted therapeutic option for individuals with significant unmet medical needs. To gain insights into the impact of LYNPARZA on personalized oncology medicine. These factors have solidified the segment's position in the global PARP inhibitors market.

Niraparib segment is the fastest-growing segment in the global PARP inhibitors market share

The niraparib segment is the fastest-growing segment in the global PARP inhibitors market share and is expected to hold the market share over the forecast period.

Niraparib is an orally administered PARP inhibitor currently being explored for the treatment of patients with metastatic castration-resistant prostate cancer (mCRPC), particularly those with defects in the BRCA1 or BRCA2 DNA repair genes.

Niraparib works by inhibiting the activity of poly(ADP-ribose) polymerase (PARP), a protein involved in the repair of DNA damage. By blocking PARP, niraparib prevents cancer cells from effectively repairing their DNA, leading to increased DNA damage and ultimately cell death. This mechanism is particularly effective in tumors with homologous recombination deficiencies (HRD), such as those caused by BRCA mutations, which are common in certain cancers, including prostate cancer.

Furthermore, key players in the industry product launches and approvals would propel this segment's growth in the PARP inhibitors market. For instance, In August 2023, the U.S. Food and Drug Administration (FDA) has approved AKEEGA, a dual-action tablet that combines niraparib and abiraterone acetate, for the treatment of patients with BRCA-positive metastatic castration-resistant prostate cancer (mCRPC). This approval marks AKEEGA as the first and only medication of its kind, designed to address the specific needs of patients whose cancers are associated with BRCA mutations. These factors have solidified the segment's position in the global PARP inhibitors market.

Application :

Ovarian cancer segment is expected to dominate the global PARP inhibitors market share

The ovarian cancer segment holds a major portion of the global PARP inhibitors market share and is expected to continue to hold a significant portion of the global PARP inhibitors market share during the forecast period.

Ovarian cancer is one of the most prevalent and deadly gynecologic cancers in the United States, with a five-year relative survival rate of 51%. For patients diagnosed with advanced ovarian cancer, this survival rate is even lower, estimated at around 31%, as more than two-thirds of women with ovarian cancer are diagnosed at an advanced stage.

Approximately 20% of women with advanced ovarian cancer carry a BRCA mutation, while about half have tumors that are positive for homologous recombination deficiency (HRD), which includes those with BRCA mutations. Given the poor prognosis associated with advanced ovarian cancer, there is a significant unmet need for new and improved treatment options. Clinical trials have shown that LYNPARZA (olaparib) can effectively increase progression-free survival in patients with advanced ovarian cancer who are selected based on specific biomarkers.

According to the Journal of Ovarian Research publication in January 2023, the use of patient-derived organoids (PDOs) has emerged as a promising tumor model for selecting PARP inhibitors and addressing drug resistance in patients with ovarian cancer. PDOs allow for functional testing of biomarkers that can predict responses to PARP inhibitors in epithelial ovarian cancer (EOC). Research indicates that this model system is effective for evaluating ovarian cancer characterized by DNA repair deficiencies. By integrating PDOs with next-generation sequencing genome analysis, clinicians can identify patients who are suitable candidates for PARP inhibitor therapies. This approach aids in clinical decision-making and has the potential to extend patient survival times. These factors have solidified the segment's position in the global PARP inhibitors market.

Breast cancer segment is the fastest-growing segment in the global PARP inhibitors market share

The breast cancer segment is the fastest-growing segment in the global PARP inhibitors market share and is expected to hold the market share over the forecast period.

PARP inhibitors are a class of targeted cancer therapies that are used to treat various types of cancer, including breast, ovarian, and prostate cancers. Additionally, they are currently undergoing clinical trials for potential use in other cancer types.

PARP inhibitors are particularly promising for individuals with inherited mutations in the BRCA1 or BRCA2 genes. Cancers associated with these mutations often struggle to repair their DNA effectively, making them sensitive to the DNA damage induced by PARP inhibitors. When BRCA1/2-related breast cancers are treated with a PARP inhibitor, the cancer cells find it increasingly difficult to repair themselves, ultimately leading to their death.

Olaparib (Lynparza) has received FDA approval for treating HER2-negative early breast cancer in patients at high risk of recurrence who possess a BRCA1 or BRCA2 (BRCA1/2) inherited gene mutation and have undergone chemotherapy. Research findings indicate that individuals with a BRCA1/2 mutation and HER2-negative breast cancer, who were treated with olaparib, experienced a reduced risk of cancer recurrence and improved survival rates compared to those who did not receive the drug. Olaparib is administered after the completion of chemotherapy. These factors have solidified the segment's global position in the PARP inhibitors market.

Market Geographical Share

North America is expected to hold a significant position in the global PARP inhibitors market share

North America holds a substantial position in the global PARP inhibitors market and is expected to hold most of the market share.

The prevalence of cancers, particularly those associated with BRCA mutations such as breast and ovarian cancers and prostate cancer, is a major contributor to the growth of the PARP inhibitors market. As per Johnson & Johnson news in August 2023, prostate cancer is one of the most prevalent cancers in the United States, with an estimated 288,300 new cases and nearly 35,000 deaths expected in 2023.

Among patients with metastatic castration-resistant prostate cancer (mCRPC), approximately 10 to 15 percent have alterations in the BRCA1 or BRCA2 genes. These mutations are significant because they are associated with a more aggressive form of the disease, leading to poorer outcomes and shorter survival times for affected patients.

Furthermore, in this region, a major number of key players' presence, well-advanced healthcare infrastructure, government initiatives & regulatory support, technological advancements, & investments, and product launches & approvals would propel this PARP inhibitors market growth. For instance, in March 2023, AstraZeneca and Merck announced that the U.S. Food and Drug Administration (FDA) will hold a meeting of the Oncologic Drugs Advisory Committee (ODAC) to discuss the supplemental new drug application (sNDA) for LYNPARZA (olaparib).

This application seeks approval for the use of LYNPARZA in combination with abiraterone and prednisone or prednisolone for treating adult patients with metastatic castration-resistant prostate cancer (mCRPC). Thus, the above factors are consolidating the region's position as a dominant force in the global PARP inhibitors market.

Asia Pacific is growing at the fastest pace in the global PARP inhibitors market

Asia Pacific holds the fastest pace in the global PARP inhibitors market and is expected to hold most of the market share.

The Asia-Pacific region is witnessing a significant increase in cancer diagnoses, particularly in ovarian and breast cancers, which are frequently treated with PARP inhibitors. This growing prevalence of these cancers results in a larger patient population that requires effective treatment options. The number of cancer cases in the Asia-Pacific region is expected to demand for PARP inhibitors.

The Asia-Pacific parp inhibitors market is driven by factors such as the increasing prevalence of cancer, growing investments in research and developments related to cancer, increasing innovative and targeted treatment options, and advancements in technologies. Japan holds a major portion of the market share owing to the rising prevalence of cancer in Japan is a significant driver for PARP inhibitors, as these therapies offer targeted treatment options that can be more effective and less toxic than traditional chemotherapies.

In Japan, breast cancer is the most frequently diagnosed cancer overall and the most common among women. More than 90% of breast cancer patients in Japan are diagnosed at an early stage. In 2022, there were approximately 2.3 million new cases of breast cancer globally, resulting in around 700,000 deaths. Prostate cancer is the second most commonly diagnosed cancer in men and ranks as the fifth leading cause of cancer-related deaths among men globally. In Japan, it is estimated that there will be 96,400 new cases and 13,300 deaths in 2022. This rising number of cancer cases demands PARP inhibitors.

Furthermore, key players in this region, research & developments, and a rising number of clinical trials drive this PARP inhibitor growth in the market. For instance, in August 2023, AstraZeneca and Merck announced that Lynparza (olaparib), in combination with abiraterone and prednisolone, has been approved in Japan for the treatment of adult patients with BRCA-mutated (BRCAm) metastatic castration-resistant prostate cancer (mCRPC). Thus, the above factors are consolidating the region's position as the fastest-growing force in the global PARP inhibitors market.

Market Companies

The major global players in the PARP inhibitors market include AstraZeneca, Pfizer Inc., GSK plc, Pharmaand GmbH., Globela Pharma, Johnson & Johnson Services, Inc., Merck & Co., Inc., Beacon Pharmaceuticals PLC, and EVEREST among others.

Emerging Players

The emerging players in the global PARP inhibitors market include Artios Pharma, Repare Therapeutics, Jiangsu Hengrui Pharmaceuticals Co., Ltd., and ONO PHARMACEUTICAL CO., LTD. among others.

Key Developments

- In July 2024, AstraZeneca announced the DUO-O Phase III trial investigated the combination of Lynparza (olaparib) and Imfinzi (durvalumab) with chemotherapy and bevacizumab in newly diagnosed patients with advanced high-grade epithelial ovarian cancer who do not have tumor BRCA mutations.

- In June 2023, AstraZeneca and Merck announced that the U.S. Food and Drug Administration (FDA) has approved LYNPARZA (olaparib) in combination with abiraterone and prednisone or prednisolone for the treatment of adult patients with deleterious or suspected deleterious BRCA-mutated (BRCAm) metastatic castration-resistant prostate cancer (mCRPC).

Why Purchase the Report?

- To visualize the global PARP inhibitors market segmentation based on product type, application, distribution channel, and region and understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of the PARP inhibitors market with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping is available in excel consisting of key products of all the major players.

The global PARP inhibitors market report would provide approximately 59 tables, 56 figures, and 182 pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies