Parkinson’s Disease Therapeutics Market Size

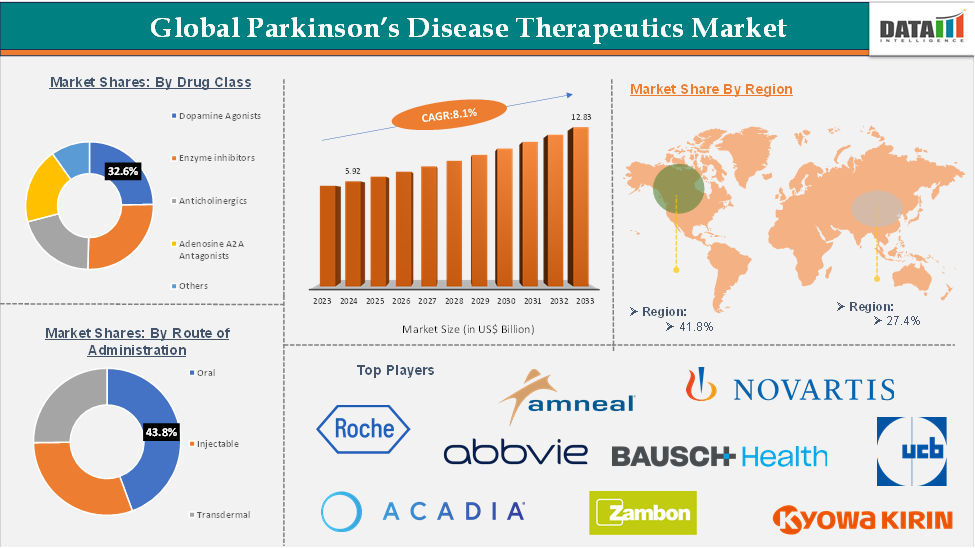

Global Parkinson’s Disease Therapeutics Market size reached US$ 5.92 Billion in 2024 and is expected to reach US$ 12.83 Billion by 2033, growing at a CAGR of 8.1% during the forecast period 2025-2033.

The Parkinson’s disease treatment market continues to grow as the prevalence of the condition rises, the global population ages, and medical research advances. This progressive neurological disorder affects millions, increasing the demand for effective therapeutic options. Present treatment strategies focus on symptom management rather than a cure, aiming to improve patients’ quality of life.

These include dopamine agonists that replicate dopamine activity in the brain, enzyme inhibitors such as MAO-B and COMT inhibitors that help slow dopamine degradation, anticholinergic medications to control tremors, and adenosine A2a antagonists, which offer alternative mechanisms for symptom relief. In addition to these, levodopa-based treatments and emerging approaches such as gene therapy, stem cell therapy, and precision medicine are expanding the therapeutic landscape.

Several factors are driving the growth of this market, including greater public awareness, increased funding for neurological research, and rising healthcare investments, particularly in emerging economies. Opportunities are emerging in the development of disease-modifying therapies, more effective drug delivery systems (like inhalable and extended-release formulations), and the application of digital technologies for real-time disease monitoring and personalized treatment plans.

Executive Summary

For more details on this report – Request for Sample

Market Scope

| Metrics | Details | |

| CAGR | 8.1% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Disease Type | Familial Parkinson’s Disease, Idiopathic Parkinson’s Disease, Early-Onset Parkinson's Disease |

| Drug Class | Dopamine Agonists, Enzyme inhibitors, Anticholinergics, Adenosine A2A Antagonists, Others | |

| Route of Administration | Oral, Injectable, Transdermal | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

Parkinson’s Disease Therapeutics Market Dynamics: Drivers & Restraints

The growing prevalence of parkinson’s disease is expected to drive the parkinson’s disease therapeutics market

A major driver of the expansion of the therapeutics market is the rising incidence of Parkinson's disease. The need for efficient treatment options stays strong as diagnoses retain expanding. Emphasizing the urgent requirement for new therapeutics, a 2024 report from the National Institute of Neurological Disorders and Stroke forecasts that between 500,000 and 1 million Americans are affected by the disorder.

In response, pharmaceutical companies have increased their efforts to create innovative medicines. For instance, Neuron23 Inc. started its worldwide Phase 2 NEULARK trial to evaluate NEU-411, a brain-penetrant LRRK2 inhibitor, in people with early-stage Parkinson's disease in November 2024. Using digital biomarkers and patient-specific targeting to improve therapy efficacy, this work marks a significant advance in precision medicine.

The need for new treatment approaches is more crucial as the patient population increases. This growing need is changing the therapeutic landscape for Parkinson's disease and generating major developments in clinical research. Market growth in the forthcoming years is going to be driven by the focus on disease-modifying medicines, individualized medication, regulatory support, and higher neurological R&D funding.

The presence of alternative treatment options is expected to hamper the parkinson’s disease therapeutics market

The presence of alternative treatment options is a significant factor restraining the growth of the Parkinson’s disease therapeutics market. While pharmaceutical therapies remain central to symptom management, a growing number of patients and healthcare providers are exploring non-pharmacological approaches, such as deep brain stimulation (DBS), physical therapy, occupational therapy, and lifestyle interventions like specialized exercise programs and dietary modifications. These alternatives are often seen as complementary or, in some cases, preferable to drug-based treatments, particularly when patients experience intolerable side effects or limited efficacy from medications.

For instance, according to a study published by the National Institute of Health (NIH) in 2024, of 367 people with PD, 36% reported having used natural health products to alleviate PD-related symptoms, with coffee, cannabis, and turmeric being the most popular. Furthermore, 71% of people with PD were interested in learning more about natural health products.

Parkinson’s Disease Therapeutics Market Segment Analysis

The global parkinson’s disease therapeutics market is segmented based on disease type, drug class, route of administration, and region.

Drug Class:

The dopamine agonists segment is expected to hold approximately 32.6% of the global Parkinson’s disease therapeutics market

The dopamine agonist segment maintains its leadership in the parkinson’s disease treatment market due to its proven effectiveness in managing motor symptoms, especially during the early stages of the disease. These medications function by directly stimulating dopamine receptors in the brain, aiding in symptom control and often postponing the need for levodopa, which can cause long-term side effects. As a result, dopamine agonists are commonly used as first-line treatments or in combination with other medications, solidifying their position as a key component in the management of Parkinson’s disease.

This segment’s strong position is supported by ongoing innovation, increased investment in research and development, and regular regulatory approvals of new and improved treatments. For example, in February 2025, Supernus Pharmaceuticals, Inc. received FDA approval for ONAPGO (apomorphine hydrochloride) injection. It is the first and only subcutaneous apomorphine infusion device for adults with advanced Parkinson’s experiencing motor fluctuations. This marks a significant step forward in delivering more convenient and continuous symptom relief.

Similarly, in September 2024, Amneal Pharmaceuticals, Inc. received FDA approval for CREXONT, an extended-release oral formulation of carbidopa and levodopa that combines immediate- and extended-release components to offer more consistent symptom control throughout the day.

These advancements reflect the industry’s focus on improving treatment outcomes and quality of life for patients. With ongoing clinical developments, better drug delivery systems, and a focus on patient-centric therapies, the dopamine agonists segment is expected to maintain its dominant role in the Parkinson’s disease therapeutics market.

Parkinson’s Disease Therapeutics Market Geographical Analysis

North America was valued at US$ 2.36 billion in 2024 and is estimated to reach US$ 5.11 billion by 2033, growing at a CAGR of 8.2%.

North America continues to dominate the Parkinson’s disease therapeutics market, driven by a combination of advanced healthcare infrastructure, a high prevalence of the disease, strong pharmaceutical innovation, and substantial investment in research and development. The region has several major pharmaceutical companies that are actively developing new therapies and enhancing existing treatments to address the evolving needs of Parkinson’s patients.

For instance, in October 2024, AbbVie received FDA approval for VYALEV (foscarbidopa and foslevodopa), the first and only 24-hour subcutaneous infusion of a levodopa-based therapy for adults with advanced Parkinson’s disease. This approval represents a major advancement in treatment, offering continuous symptom control and greater convenience for patients. Similarly, companies like Supernus Pharmaceuticals and Amneal Pharmaceuticals have also made notable contributions with approvals for ONAPGO and CREXONT.

In addition to pharmaceutical innovation, increased investment in research is playing a crucial role in driving market growth. For example, in fiscal year 2022, the National Institute of Neurological Disorders and Stroke (NINDS) funded approximately $125 million out of the $259 million in NIH-supported Parkinson’s disease research, reflecting strong government support for advancing therapeutic development.

These factors are creating a robust environment for continued innovation in North America, solidifying its leadership in the global Parkinson’s disease therapeutics market.

Asia-Pacific is expected to hold 26.8% of the global Parkinson’s disease therapeutics market

The Asia-Pacific (APAC) is rapidly becoming the fastest-growing region in the global Parkinson’s disease therapeutics market, driven by factors such as an aging population, increased disease awareness, and significant investments in healthcare infrastructure and research.

In Japan, the prevalence of Parkinson’s disease is notably high. In 2022, Japan accounted for nearly 8% of the diagnosed prevalent cases of Parkinson’s disease among the seven major markets (7MM), with approximately 105,583 male cases and 96,053 female cases. This trend is expected to continue, with cases projected to increase during the forecast period.

The aging population in Japan, with a significant proportion of individuals aged 75 years and older, contributes to the rising incidence of Parkinson’s disease, highlighting the urgent need for effective therapeutic solutions in the region.

Parkinson’s Disease Therapeutics Market Top Companies

The top companies in the Parkinson’s disease therapeutics market include AbbVie Inc., Acadia Pharmaceuticals Inc., ZAMBON COMPANY S.P.A., Eisai Co., Ltd., Merz Pharmaceuticals, LLC., Teva Pharmaceutical Industries Ltd., Kyowa Kirin Co., Ltd., Novartis AG, Boehringer Ingelheim International GmbH, Bausch Health Companies Inc., Amneal Pharmaceuticals LLC., F. Hoffmann-La Roche Ltd, UCB S.A., and Rusan Pharma, among others.

Key Developments

- In July 2024, Merz Therapeutics announced the completion of its acquisition of INBRIJA (levodopa inhalation powder) and (F)AMPYRA (fampridine), along with associated assets, from Acorda Therapeutics, Inc. AMPYRA (dalfampridine) holds FDA approval in the U.S. and is marketed as FAMPYRA across the European Union and other global regions.

The global Parkinson’s disease therapeutics market report delivers a detailed analysis with 57 key tables, more than 46 visually impactful figures, and 168 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.