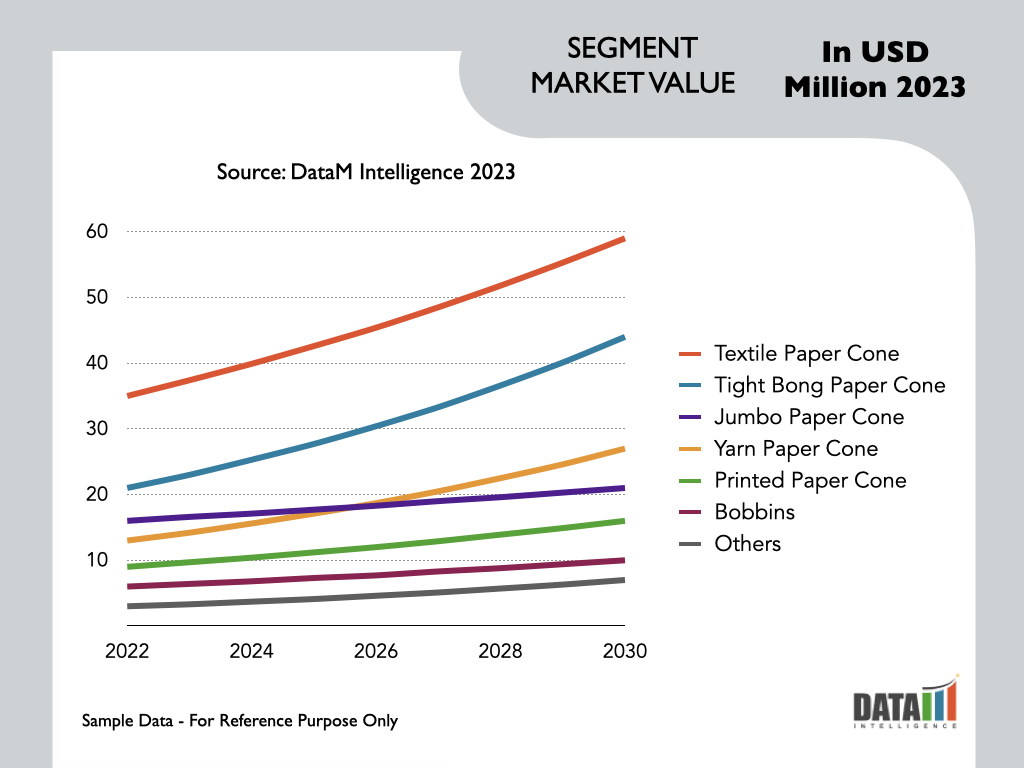

Global Paper Cone Market is segmented By Type (Textile Paper Cone, Tight Bong Paper Cone, Jumbo Paper Cone, Yarn Paper Cone, Printed Paper Cone, Bobbins, Others), By Taper of Cone (Up to 30 Taper, 30 to 50 Taper, Above 50 Taper), By Size (5-degree 57-minutes cone,1-degree 51-minutes cone, 3-degree 51-minutes cone, 3-degree 30-minutes cone, 6-degree 20-minutes cone, 9-degree 51-minutes cone, 9-degree 36-minutes cone, 7-degree 22-minutes cone, Others), By End-User (Textile Industry, Construction, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2023-2030

Paper Cone Market Size

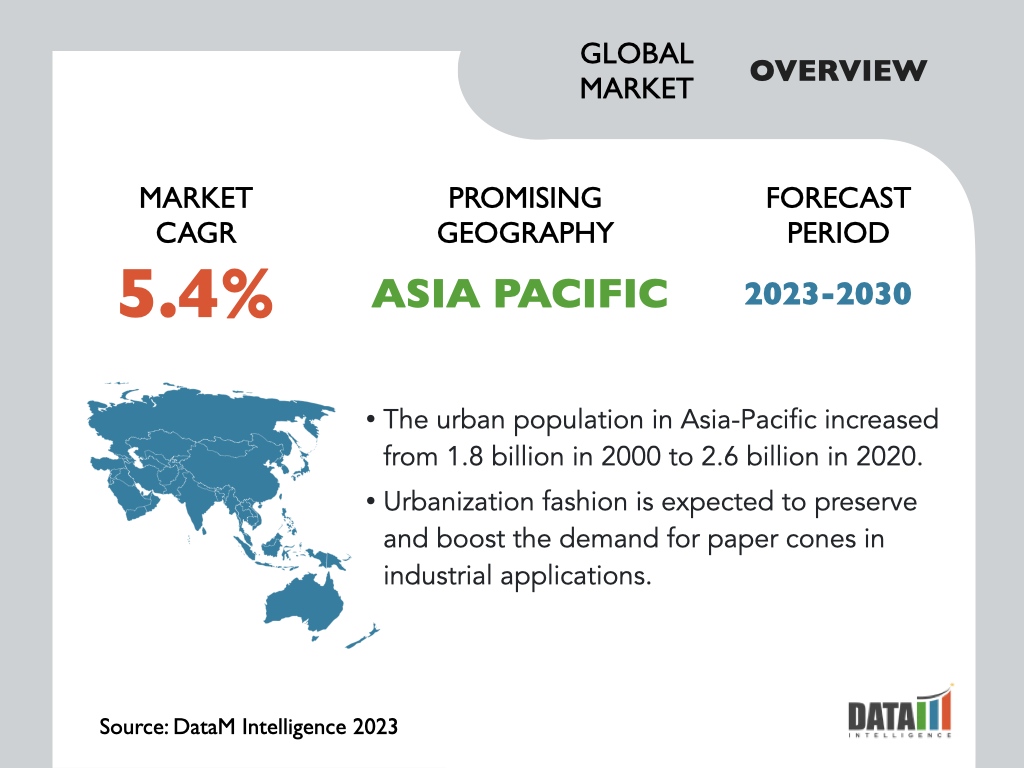

Emerging as a highly reliable market, the global paper cone industry experienced a leap from US$ 0.3 billion in 2022 to an anticipated value of US$ 0.4 billion by the milestone year of 2030. This healthy expansion, registering a CAGR of 5.4% in the period of 2023-2030, reflects the trajectory of the paper cone market growth. A multitude of factors, including the expanding fabric and packaging sectors, an increased demand for eco-friendly packaging options, and technological enhancements in the domain of paper cone production, have driven the robust growth of this market.

Paper cones have emerged as an indispensable asset in the textile industry, especially in the yarn winding process during production. The upsurge in global population, expansion of disposable income, and alterations in fashion trends have contributed significantly to the rise in the demand for textiles, paving the way for market opportunities for paper cones. Recent years have seen a remarkable shift towards sustainable packaging solutions across various sectors. Paper cones, given their renewable and biodegradable properties, are a preferable alternative to plastics, and other non-recyclable packaging options, further boosting the paper cone market size.

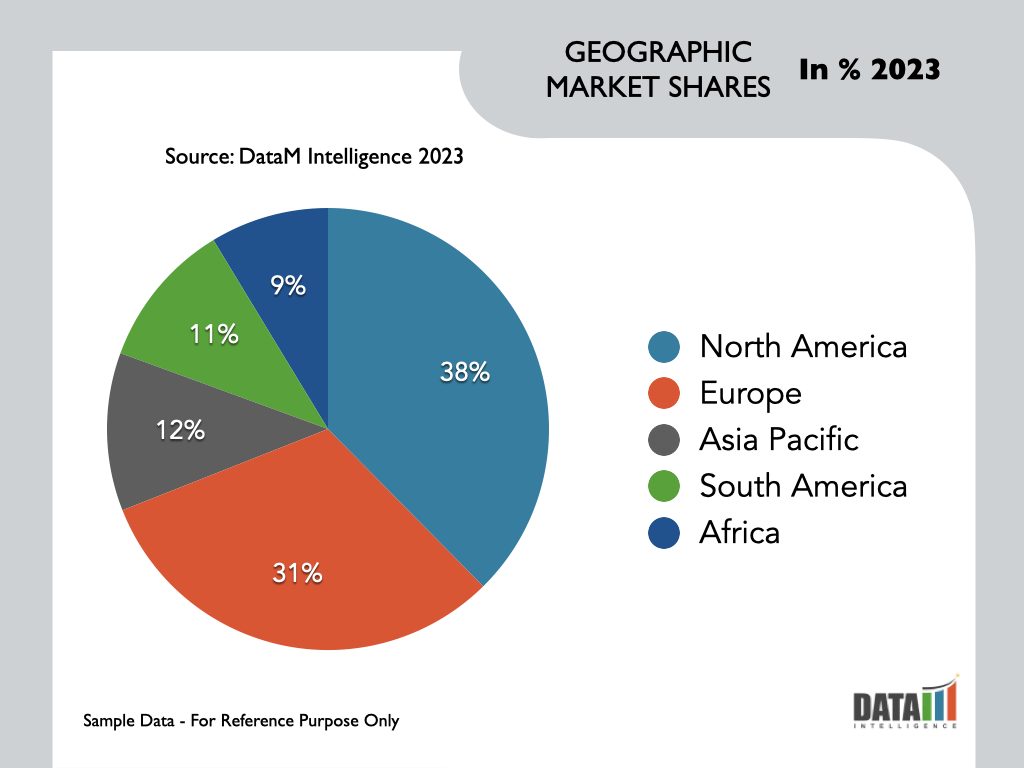

The Asia-Pacific region dominates the paper cone market share with about a quarter of the market under its belt. This dominance is powered by attributes such as population growth, urbanisation, rapid expansion of consumer goods industries, and the widespread adoption of green packaging practices. Simultaneously, the focus on sustainable packaging and governmental initiatives are impelling wider acceptance of paper cones within this territory. Adding to this, textile paper cones hold a quarter of the paper cone market share within the product type segment. The rise in global population and disposable income has led to a surge in the demand for textiles and clothing items. This trend has cementified the dominance of the textile paper cone sector.

Paper Cone Market Scope

|

Metrics |

Details |

|

CAGR |

5.4% |

|

Size Available for Years |

2021-2030 |

|

Forecast Period |

2023-2030 |

|

Data Availability |

Value (USD ) |

|

Segments Covered |

Type, Taper of Cone, Size, End-User and Region |

|

Regions Covered |

North America, Latin America, Europe, Asia Pacific, Middle East, and Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

Largest Market Share |

North America |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis, and Other key Insights. |

To Know More Insights - Download Sample

Paper Cone Market Dynamics

Increasing Popularity of Green Packaging Solutions & Transition from Plastic to Paper Cones

The mounting focus on global sustainability and its implementation has spurred the demand for packaging like paper cones. Governments and regulatory bodies globally are enforcing stricter environmental policies, encouraging industries to adopt sustainable practices. Given their biodegradable and recyclable nature, paper cones comply perfectly with these sustainability objectives. The United Nations Environment Programme (UNEP) reports that the global market for sustainable packaging is projected to hit US$ 440 billion by 2025. This rise in demand for sustainable packaging solutions is fueling the adoption of paper cones across various sectors, thereby contributing to the overall paper cone market growth.

Furthermore, the global movement towards minimising plastic usage has significantly impacted the paper cone market. Plastic cones, previously extensively used in the textile industry, are being replaced with paper cones due to their eco-friendly properties. Government projects and regulations aimed at reducing plastic waste have amplified this transition. The European Union's Single-Use Plastics Directive for instance, aspires to restrict the use of certain single-use plastic products, including plastic cones. This shift from plastic to paper cones presents a massive growth opportunity for the paper cone market forecast.

Rising Demand in Emerging Economies and Technological Advancements

The paper cone market is experiencing remarkable growth in emerging economies, propelled by the expansion of the textile and yarn industries in these regions. The fact that countries such as India, China, Bangladesh, and Vietnam are critical textile and garment producers contributes to the high demand for paper cones. This, combined with rapid industrialisation, urbanisation, and population growth fuels the paper cone market forecast.

Moreover, technological innovations in paper cone manufacturing have enhanced the quality, durability, and functionality of paper cones. Advancements, like superior adhesives, improved winding techniques, and precision cutting, have resulted in the production of paper cones that comply with the stringent requirements of different industries. These advancements heighten their competitiveness against other packaging options. Enterprises are investing in research and development to further optimise the performance, and eco-friendliness of paper cones, thereby propelling the paper cone market growth.

Challenges of the Global Paper Cone Market - Fluctuating Raw Material Prices

A significant impediment within the global paper cone market is the fluctuation in raw material prices. Paper cones are predominantly manufactured using paperboard, which is susceptible to price fluctuations based on factors like availability and production costs. This volatility in raw material costs can impact the profitability of manufacturers and eventually affect market growth. For instance, an increase in the price of paperboard can result in higher production costs for paper cone manufacturers, which might result in inflated prices for the end-users. Simultaneously, the paper cone market faces competition from alternative packaging solutions, like plastic cones, metallic cones, and composite materials.

Paper Cone Market Segment Analysis

The global paper cone market is segmented based on type, taper of cone, size, end-user and region.

Expansion Sustainable Packaging Solutions in Textile Industry

The textile enterprise performs a vital role in the boom of the fabric paper cone segment. With the growing international populace and disposable incomes, there has been a growth in demand for textiles and clothes. Consistent with statistics from the International Trade Centre (ITC), international fabric and apparel exports reached US$ 305 billion in 2020, reflecting a steady increase.The respective increase inside the fabric enterprise interprets into higher demand for packaging substances, inclusive of paper cones, to facilitate the efficient storage and transportation of yarns and threads. Further, the growing recognition on sustainability practices has propelled the growth of the fabric paper cone segment within the textile market.

Paper cones are taken into consideration greater environmentally pleasant as compared to plastic or metallic options. Governments and regulatory bodies across the globe have implemented measures to encourage using sustainable packaging substances. The adoption of sustainable practices by fabric producers and the choice for packaging contribute to the growth of the fabric paper cone segment.

Paper Cone Market Geographical Share

Urbanization and Sustainable Packaging Practices

Urbanization in Asia-Pacific has brought improvements in industries that include textiles, food processing, and yarn winding. The respective industries heavily rely on paper cones for packaging, garage, and transportation of their merchandise. The growth of urban regions and the status quo of manufacturing facilities in countries such as China, India, and Bangladesh have created a vast market for paper cones.

Governments and regulatory bodies in the region have carried out rules and projects to promote environmentally friendly packaging materials. Paper cones, being biodegradable and recyclable, align with these sustainability dreams. For instance, in India, the Ministry of Environment, Forest and climate change has introduced measures to encourage using packaging materials, driving the call for paper cones in Asia-Pacific. The respective cognizance of sustainable packaging practices contributes to the boom of the paper cone marketplace in Asia-Pacific.

Paper Cone Market Companies

The sphere of global stakeholders includes Conitex Sonoco, Tubettificio Senese S.r.L, Sunnytexcone India (P) Ltd, Jaalouk & Co, Savio Texcone Private Limited, FAVRETTO, Bharath Paper Conversions, Saroja Texcone, Pacific Cones, and JTS GROUP OF COMPANIES.

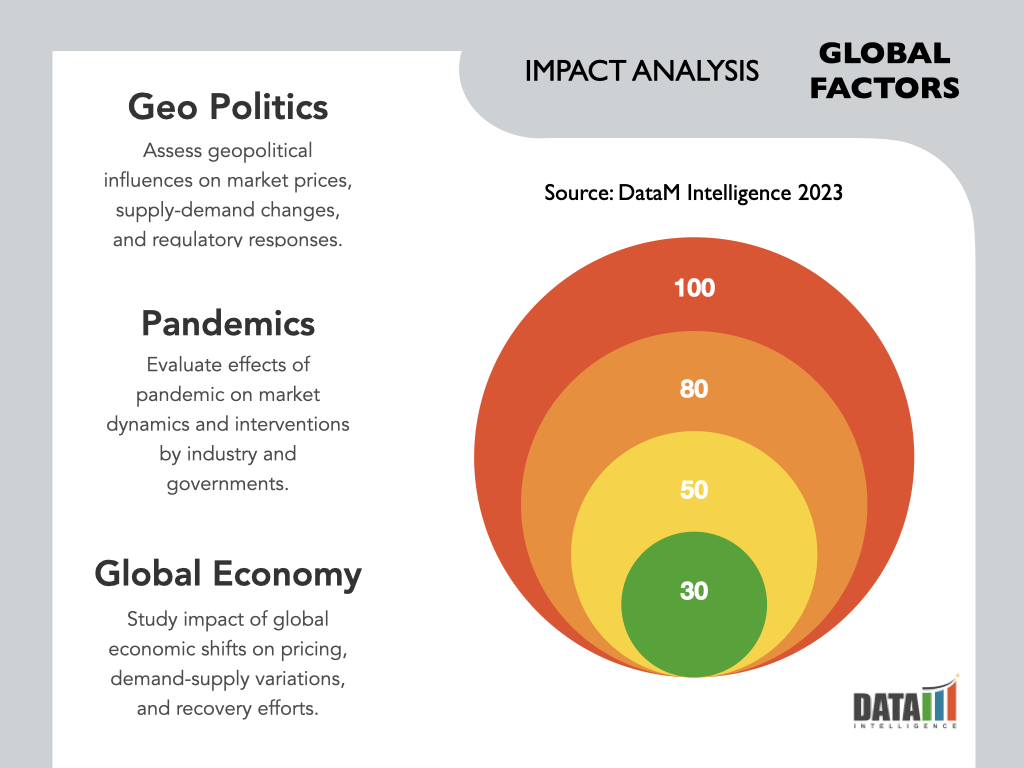

Global Factor Impact Analysis

The outbreak of the COVID-19 pandemic had some major implications throughout numerous industries including the paper cone marketplace. Paper cones are broadly used in industries inclusive of textiles, yarn winding, and ice cream, offering structural support and facilitating green packaging. The COVID-19 pandemic disrupted global supply chains, which include those in the paper cone industry. Restrictions on global trade, lockdown measures, and the closure of manufacturing facilities led to disruptions in the supply of raw substances and components required for paper cone manufacturing. According to the statistics from the International Trade Centre (ITC), global trade in paper and paperboard declined by 6.4% in 2020 compared to the preceding year.

The disruption in the supply chain impacted on the production ability of paper cone players and created delays in assembling as per the demand of end-customers. The paper cone market closely relies on give-up-use industries consisting of textiles, yarn winding, and ice cream. But the COVID-19 pandemic resulted in a huge decline in sales from these sectors. Lockdown measures and decreased consumer spending on non-crucial gadgets directly impacted the textile enterprise, leading to a decline in yarn production and the next call for paper cones. Further, the closure of ice cream parlors and disruptions in the meals provider industry affected the demand for paper cones used in ice cream packaging.

Global Paper Cone Market Report Coverage

By Type

- Textile Paper Cone

- Tight Bong Paper Cone

- Jumbo Paper Cone

- Yarn Paper Cone

- Printed Paper Cone

- Bobbins

- Others

By Taper of Cone

- Up to 30 Taper

- 30 to 50 Taper

- Above 50 Taper

By Size

- 5-degree 57-minutes cone

- 1-degree 51-minutes cone

- 3-degree 51-minutes cone

- 3-degree 30-minutes cone

- 6-degree 20-minutes cone

- 9-degree 51-minutes cone

- 9-degree 36-minutes cone

- 7-degree 22-minutes cone

- Others

By End-User

- Textile Industry

- Construction

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On June 8, 2023, K. U. Sodalamuthu and Co. (P) Ltd. announced the launch of the company’s new automatic paper cone plant. The new plant is capable of producing 55 cones every minute and is expected to significantly boost the company’s position in the paper cone market.

- On November 15, 2022, Subam Papers Pvt. Ltd, a leading recycled paper products manufacturing company announced that it is expanding its paper cone manufacturing capacity to 1000TPD.

Why Purchase the Report?

- To visualize the global paper cone market segmentation based on type, taper of cone, size, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of paper cone market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping is available as excel consisting of key products of all the major players.

The global paper cone market report would provide approximately 69 tables, 77 figures and 198 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies