Orthopedic Regenerative Surgical Products Market: Industry Outlook

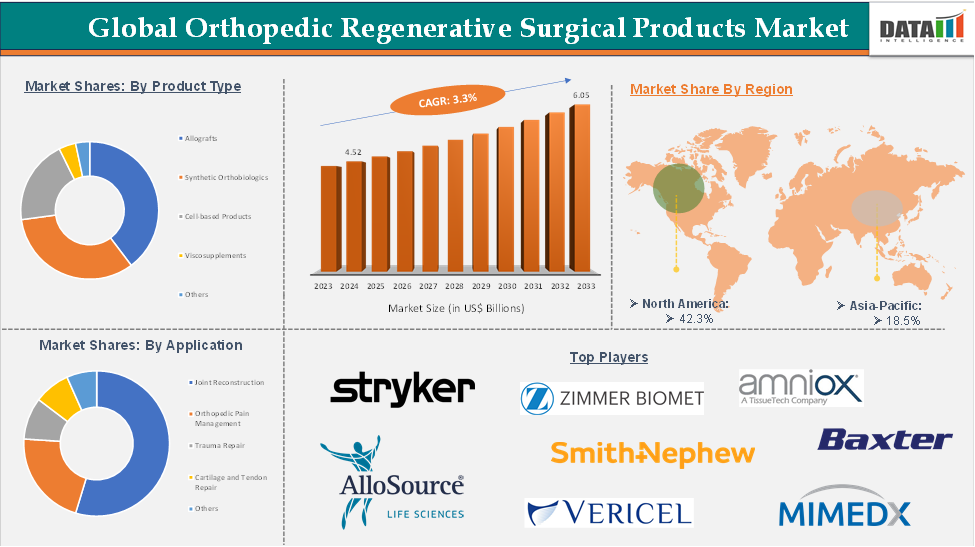

Orthopedic Regenerative Surgical Products Market reached US$ 4.52 Billion in 2024 and is expected to reach US$ 6.05 Billion by 2033, growing at a CAGR of 3.3% during the forecast period 2025-2033.

The global orthopedic regenerative surgical products market is experiencing lucrative growth due to advancements in regenerative medicine, musculoskeletal disorders, and the demand for minimally invasive surgical procedures. The market includes biologically derived products like bone grafts, stem cell therapies, and synthetic substitutes. With the aging population and increasing incidence of conditions like osteoarthritis and traumatic injuries, the need for long-lasting orthopedic solutions is increasing.

Technological innovations and increased healthcare spending in developed regions are driving market expansion. However, challenges like high treatment costs, limited reimbursement policies, and regulatory complexities may hinder adoption in emerging economies.

For more details on this report, Request for Sample

Orthopedic Regenerative Surgical Products Market Dynamics: Drivers & Restraints

Driver: Rising incidence of orthopedic disorders

The global orthopedic regenerative surgical products market is fueled by the aging population, who are more susceptible to degenerative bone diseases, joint disorders, and fractures. The increasing number of sports-related injuries and road accidents has also increased demand for advanced orthopedic regenerative solutions, further fueling market growth.

For instance, according to NCBI studies, the global prevalence of orthopedic disorders is increasing due to aging populations and rising obesity. The market for orthopedic devices is projected to continue growing, with osteoarthritis being a leading cause of disability in older adults, particularly after age 70.

Hence, this instance highlights key factors aging populations and rising obesity that directly contribute to increased orthopedic disorders, thereby boosting demand for orthopedic devices. The growing burden of osteoarthritis, especially in individuals over 70, necessitates advanced surgical and regenerative solutions. These demographic and health trends drive consistent market growth by expanding the patient base and creating ongoing clinical need for innovative orthopedic products.

Restraint: High cost of regenerative surgical products and procedures

The market for regenerative surgical products and procedures is hindered by high costs, requiring expensive materials, specialized equipment, and skilled personnel, making them less accessible in cost-sensitive regions. Limited reimbursement coverage in many countries further discourages widespread adoption of these advanced orthopedic solutions, especially in developing economies.

Orthopedic Regenerative Surgical Products Market Segment Analysis

The global orthopedic regenerative surgical products market is segmented based on product type, application, end user, and region.

Product Type:

The allografts segment of the product type is expected to hold 41.1% of the orthopedic regenerative surgical products market

Allografts are tissues transplanted from one individual to another with a different genetic makeup, used in orthopedic surgery to repair or replace damaged bones, ligaments, tendons, or cartilage. They are sourced from cadaveric donors and processed for biocompatibility and sterility. Allografts offer a viable alternative to autografts, avoiding additional surgical sites and reducing donor site morbidity, making them a valuable option in regenerative orthopedic procedures.

The global orthopedic regenerative surgical products market is experiencing steady growth in the allografts segment due to product launches and its effectiveness in treating complex musculoskeletal injuries without autograft harvesting complications. The increasing incidence of sports injuries, trauma cases, and joint reconstruction surgeries is boosting demand for allografts, especially in spine and knee procedures.

For instance, in April 2025, Xtant Medical Holdings, a global medical technology company, launched Trivium, a premium demineralized bone matrix allograft designed to improve bone grafting procedures. Engineered with PureLoc Fiber Technology, Trivium combines three synergistic elements for exceptional performance in structure, handling, and biological activity.

Orthopedic Regenerative Surgical Products Market Geographical Analysis

North America dominated the global Orthopedic Regenerative Surgical Products market with the highest share of 42.3% in 2024

North America dominates the global orthopedic regenerative surgical products market due to its strong healthcare infrastructure, high healthcare expenditure, and early adoption of advanced medical technologies. The region has leading biotechnology and medical device companies investing in regenerative research and product development. The high prevalence of orthopedic and musculoskeletal conditions, particularly among the aging population, drives demand for innovative, minimally invasive solutions. Favorable reimbursement policies and regulatory support further accelerate market growth.

For instance, musculoskeletal conditions, including orthopedic problems, are prevalent in the U.S., affecting 126.6 million people, posing a significant healthcare system and individual life burden. Hence, The US's high prevalence of musculoskeletal conditions drives demand for effective treatment options, driving innovation in orthopedic regenerative surgical products. This demand encourages investment in advanced biologics and minimally invasive therapies, setting a precedent for global adoption and growth.

Asia-Pacific region in the global orthopedic regenerative surgical products market is expected to grow with the highest CAGR of 18.5% in the forecast period of 2025 to 2033

The Asia Pacific market for orthopedic regenerative surgical products is rapidly growing due to factors such as an aging population, increased bone-related disorders, and increased awareness of advanced treatment options. Countries like China, India, and Japan are investing in healthcare infrastructure and regenerative medicine research. Economic development and expanding middle-class populations are driving increased healthcare spending and demand for quality orthopedic care. Government initiatives and improved access to medical technologies contribute to market growth.

For instance, in March 2024, Intellijoint Surgical received regulatory approval for its Intellijoint KNEE product in Japan, marking the company's second product in the world's largest computer-assisted surgical navigation market. The device offers real-time measurements of surgical cutting guides during total knee replacement and is compatible with all implant vendors.

Orthopedic Regenerative Surgical Products Market Key Players

The major global players in the orthopedic regenerative surgical products market include Stryker, Zimmer Biomet, AlloSource, Amniox Medical, Inc., Smith & Nephew, Baxter, Vericel Corporation, and MIMEDX, among others.

Industry Key Developments

In November 2024, OSSIO, Inc., a medical technology company, introduced the OSSIOfiber Threaded Trimmable Fixation Nail, a new addition to its product portfolio, which is suitable for various orthopedic surgeries, including hand and wrist, foot and ankle, sports medicine, and pediatrics.

In September 2024, Temple OrthoBiologics, a new venture from Temple Therapeutics, launched a breakthrough in orthopedic sports medicine, transforming the belief that scar tissue prevention was impossible for years.

Scope

Metrics | Details | |

CAGR | 3.3% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Allografts, Synthetic Orthobiologics, Cell-based Products, Viscosupplements, Others |

Application | Joint Reconstruction, Orthopedic Pain Management, Trauma Repair, Cartilage and Tendon Repair, Others | |

End User | Hospitals, Ambulatory Surgical Centers, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |