Oral Contraceptive Pills Market Size & Industry Outlook

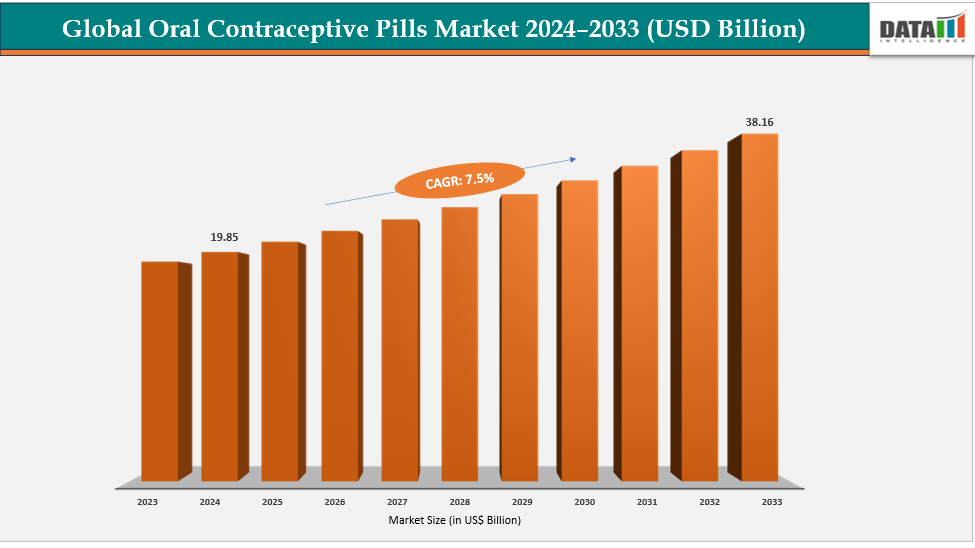

The global oral contraceptive pills market size reached US$ 18.55 Billion in 2023 with a rise of US$ 19.85 Billion in 2024 and is expected to reach US$ 38.16 Billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025-2033.

Rising awareness of reproductive health and the availability of over-the-counter oral contraceptive pills are significantly driving market growth. The need for easy-to-use, trustworthy contraception has increased as a result of greater public awareness of family planning, STI prevention, and women's health. When over-the-counter (OTC) is available, prescription obstacles are removed, facilitating quicker and simpler access, particularly in areas with weak healthcare systems. Among young adults and professional women, this accessibility promotes regular use and adoption.

Key Highlights

- North America dominates the oral contraceptive pills market with the largest revenue share of 46.5% in 2024

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 7.4% over the forecast period

- The generic pills segment from category type is dominating the oral contraceptive pills market with a 60.3% share in 2024

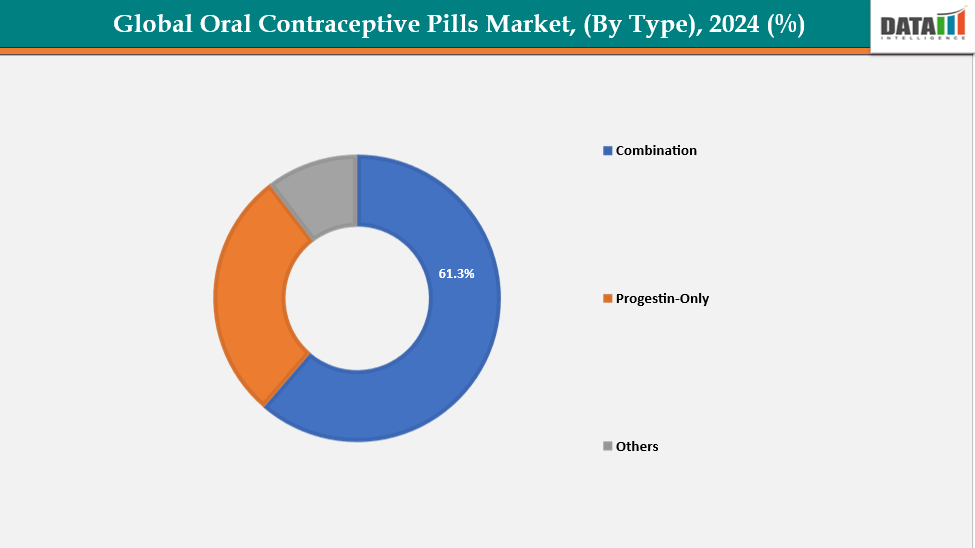

- The combination segment from type is dominating the oral contraceptive pills market with a 61.3% share in 2024

- Top companies in the oral contraceptive pills market include Bayer AG, Pfizer Inc., AbbVie, Teva Pharmaceuticals USA, Inc., Mylan N.V., Perrigo Company plc, Organon group of companies, Lupin Pharmaceuticals Inc., Afaxys, Inc., and Exeltis USA, Inc., among others.

Market Dynamics

Drivers: High incidence of unintended pregnancies is significantly driving the oral contraceptive pills market growth

The high incidence of unintended pregnancies is a major driver of the oral contraceptive pills (OCPs) market. Globally, nearly half of all pregnancies are unintended, leading to health risks, unsafe abortions, and socioeconomic burdens. This creates a strong need for reliable, affordable, and convenient contraceptive methods. For instance, according to the WHO report published in August 2024, an estimated 73 million induced abortions took place worldwide each year, with about 61% of unintended pregnancies and 29% of all pregnancies ending in abortion. Notably, nearly 45% of these abortions were unsafe, highlighting a significant global public health concern.

Moreover, oral contraceptive pills, with their high effectiveness, non-invasive nature, and widespread availability, are increasingly chosen by women worldwide. Government initiatives, NGO-led family planning programs, and awareness campaigns further promote their adoption.

Restraints: Side effects and health concerns are hampering the growth of the oral contraceptive pills market

Side effects and health concerns have hindered the growth of the oral contraceptive pills (OCPs) market. Hormonal components in OCPs, such as estrogen and progestin, can lead to risks like blood clots, stroke, and cardiovascular issues, particularly in older women and smokers. For instance, according to the Cleveland Clinic, a small percentage of individuals who used combination (estrogen-containing) birth control pills experienced rare but serious complications, including deep vein thrombosis, pulmonary embolism, high blood pressure, heart attack, and stroke.

Moreover, common side effects, including nausea, weight gain, mood swings, irregular bleeding, headaches, and decreased libido, often result in discontinuation or poor adherence. Negative perceptions, misinformation, and media coverage further amplify safety concerns.

For more details on this report, see Request for Sample

Segment Analysis

The global oral contraceptive pills market is segmented based on type, category, distribution channel and region

By Type: The combination segment from type is dominating the oral contraceptive pills market with a 61.3% share in 2024

The combination pill segment dominates the oral contraceptive pills (OCPs) market due to its high effectiveness, established safety, and additional health benefits. These pills, which include both progestin and estrogen, have a typical-use efficacy of 91–99% in preventing ovulation. They are more desirable than progestin-only alternatives since they also help control menstrual periods, lessen cramps, treat acne, and lower the risk of ovarian cysts. Combination tablets are widely available worldwide in both branded and generic forms. Adoption is further fueled by effective marketing and physician recommendations.

For instance, owing to factors like the combination pill, in July 2023, the FDA approved Femlyv, the first orally disintegrating tablet for pregnancy prevention, containing norethindrone acetate and ethinyl estradiol. These active ingredients had previously been approved in the U.S. as a conventional swallowable tablet for contraception since 1968, offering a new, convenient administration option.

By Category: The generic pills segment from category type is dominating the oral contraceptive pills market with a 60.3% share in 2024

The generic segment is dominating the oral contraceptive pills (OCPs) market. Generics are more widely adopted due to their affordability, accessibility, and proven efficacy, offering the same active ingredients as branded versions. For instance, in August 2023, Xiromed LLC announced that it had received FDA approval for Joyeaux, the first generic version of Balcoltra. Joyeaux combines levonorgestrel, ethinyl estradiol, and ferrous fumarate in a single-tablet regimen, offering a cost-effective, FDA-approved alternative to the branded contraceptive in the U.S. market. Joyeaux is an oral contraceptive. Xiromed will launch the product in the U.S. immediately.

Moreover, their market share is further increased, particularly in emerging nations, by pharmaceutical companies' extensive manufacturing as well as assistance from government initiatives and insurance policies. Although they continue to be available through marketing and brand loyalty, branded pills cater to a more upscale, niche market.

Geographical Analysis

North America is expected to dominate the global oral contraceptive pills market with a 46.5% in 2024

North America holds a dominant position in the oral contraceptive pill market due to advanced healthcare infrastructure, high awareness of reproductive health, supportive regulatory frameworks, and the presence of leading pharmaceutical companies. The region has widespread access to both branded and generic contraceptives through pharmacies, hospitals, and clinics. High adoption of innovative contraceptive options, including combination pills, progestin-only pills, and over-the-counter formulations. For instance, in July 2023, the FDA approved Opill (norgestrel) as the first daily oral contraceptive for nonprescription use in the U.S. This progestin-only pill allowed consumers to purchase oral contraceptives without a prescription from drugstores, convenience stores, grocery stores, and online platforms, increasing accessibility and convenience.

Moreover, America leads in research and development, with top pharmaceutical and biotech companies actively developing next-generation oral contraceptives, including advanced combination pills, progestin-only options, and novel delivery methods, enhancing effectiveness, safety, and accessibility for women.

Europe is the second region after North America which is expected to dominate the global oral contraceptive pills market with a 34.5% in 2024

Europe’s oral contraceptive pill market growth is supported by high awareness of reproductive health and well-established healthcare systems. Widespread access to pharmacies, clinics, and online platforms, along with cross-border collaborations and public health campaigns, is enhancing the adoption and availability of contraceptive options across the region. Favorable government policies promoting family planning and taking initiatives for women’s health. For instance, in September 2024, the European Union and the Bill & Melinda Gates Foundation partnered to develop new financing mechanisms aimed at expanding access to safe, effective, and affordable contraceptive and maternal health medicines. This initiative enabled women in low- and middle-income countries to better meet their reproductive health needs.

Germany’s oral contraceptive pill market is driven by advanced healthcare infrastructure, supportive regulations, and high awareness of reproductive health. Pharmacies, clinics, and digital platforms ensure widespread access, while public health initiatives, educational campaigns, and strong government and private support for family planning enhance adoption and market growth nationwide.

The Asia Pacific region is the fastest-growing region in the global oral contraceptive pills market, with a CAGR of 7.4% in 2024

The Asia-Pacific oral contraceptive pills market, including Japan, China, India, and South Korea, is growing due to rising awareness of reproductive health, urbanization, and increasing access to healthcare. Government initiatives, educational campaigns, and public health programs in countries like Japan promote family planning and encourage the use of oral contraceptives. For instance, in November 2023, Japan launched a trial program allowing emergency contraceptive pills to be sold without a prescription, moving the country closer to the more than 90 nations that already permit over-the-counter access to these medications at pharmacies.

China and India are experiencing rising demand for oral contraceptive pills due to increasing awareness of reproductive health, expanding healthcare infrastructure, and government-supported family planning programs. Greater access to pharmacies, clinics, and online platforms, along with educational campaigns, is driving adoption of both branded and generic contraceptive options, supporting market growth.

Competitive Landscape

Top companies in the oral contraceptive pills market include Bayer AG, Pfizer Inc., AbbVie, Teva Pharmaceuticals USA, Inc., Mylan N.V., Perrigo Company plc, Organon group of companies, Lupin Pharmaceuticals Inc., Afaxys, Inc., and Exeltis USA, Inc., among others.

Bayer AG: Bayer AG, a global pharmaceutical and life sciences company, is a leading player in the oral contraceptive market. With flagship brands like Yasmin, Yaz, and Microgynon, Bayer offers a wide range of combination and progestin-only pills. The company leverages extensive research and development, global distribution, and educational initiatives to drive contraceptive adoption worldwide.

Key Developments:

- In July 2025, Daré Bioscience announced positive interim Phase 3 results for Ovaprene, its investigational monthly, hormone-free intravaginal contraceptive. The trial demonstrated promising safety, efficacy, and acceptability, positioning Ovaprene as a potential first-in-category option, as no FDA-approved hormone-free monthly intravaginal contraceptives currently exist.

- In June 2024, YourChoice Therapeutics completed its first-in-human Phase 1a clinical study for YCT-529, designed to be the first hormone-free oral contraceptive pill for men, marking a significant advancement in male family planning and non-hormonal birth control options.

Market Scope

| Metrics | Details | |

| CAGR | 7.5% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Type | Combination, Progestin-Only, and Others |

| By Category | Branded, Generics | |

| By Distribution Channel | Hospital Pharmacy, Retail Pharmacy, Online Pharmacy and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The Global Oral Contraceptive Pills Market report delivers a detailed analysis with 62 key tables, more than 52 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here