Optical Coherence Tomography Market Size& Industry Outlook

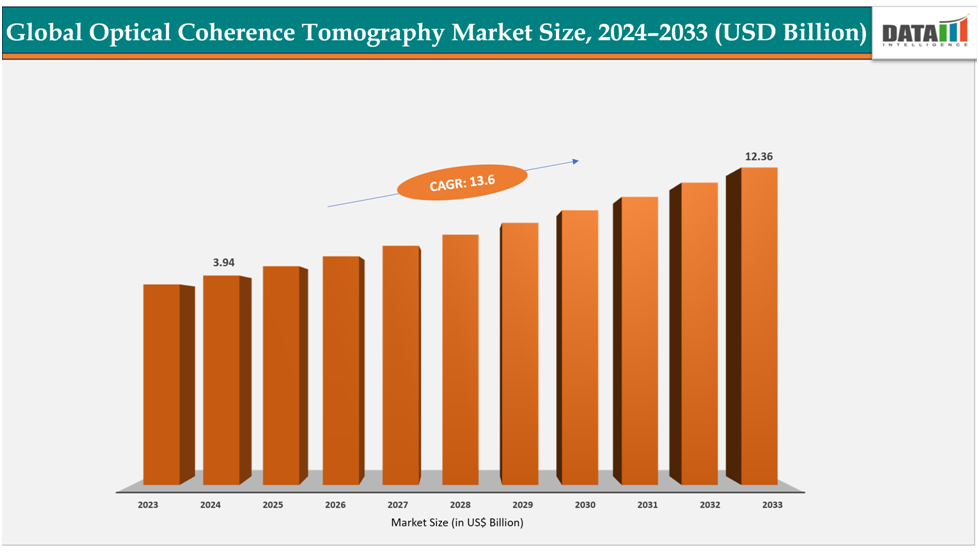

The global optical coherence tomography market size reached US$3.94billion in 2024 is expected to reach US$ 12.36billion by 2033, growing at a CAGR of 13.6%during the forecast period 2025-2033.

One of the key driver in the global optical coherence tomography (OCT) market is the growing adoption of minimally invasive diagnostic procedures. OCT provides real-time, detailed cross-sectional imaging without the need for biopsies or surgical intervention, reducing patient risk and recovery time. This shift toward non-invasive diagnostics is particularly important in ophthalmology, cardiology, and oncology, where early and precise detection is critical. The preference for safer, faster, and more cost-effective diagnostic approaches is significantly boosting the uptake of OCT systems across healthcare settings worldwide.

Key Highlights

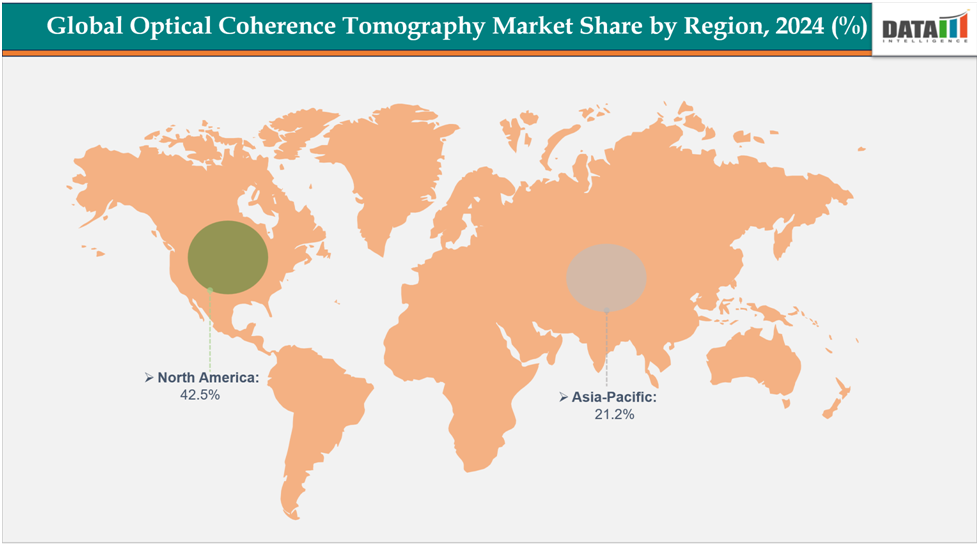

- North Americadominatesthe optical coherence tomography market with the largest revenue share of 42.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of8.1% over the forecast period.

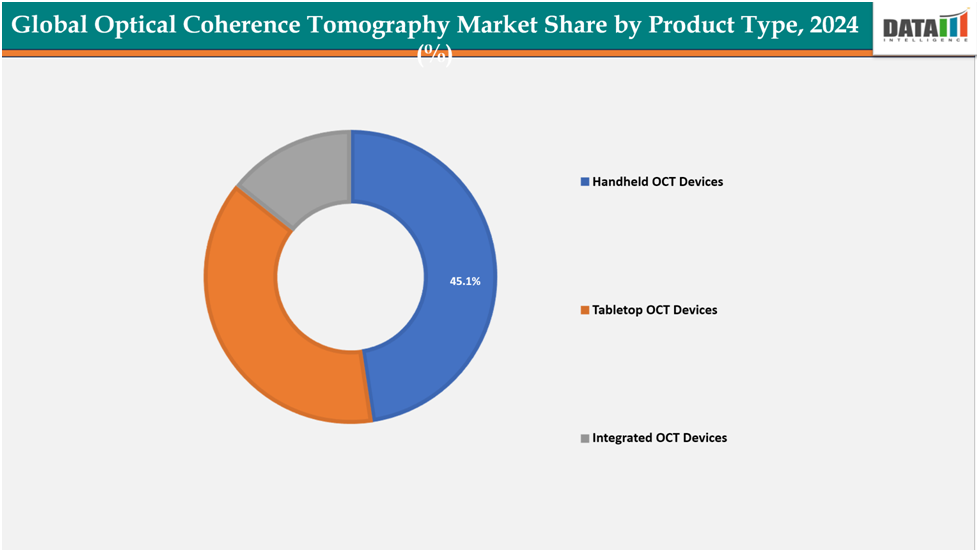

- Based on product type, handheld OCT devices segmented the market with the largest revenue share of 45.1% in 2024.

- The major market players in the optical coherence tomography market includes Carl Zeiss Meditec, Heidelberg Engineering, Topcon Healthcare, Canon Medical Systems, NIDEK, Visionix USA Inc., Haag-Streit, Leica Microsystems / Leica Ophthalmic, Thorlabs, Santecand among others.

Market Dynamics

Drivers: Rising prevalence of retinal diseases is significantly driving the optical coherence tomography market growth

The rising prevalence of retinal diseases is a key driver of the global optical coherence tomography (OCT) market, as conditions like diabetic retinopathy, age-related macular degeneration, and glaucoma require early detection and continuous monitoring to prevent vision loss. With an increasing aging population and a growing number of diabetes patients worldwide, the demand for precise, non-invasive imaging solutions has surged. OCT systems enable ophthalmologists to capture high-resolution, cross-sectional images of the retina, allowing for timely diagnosis, treatment planning, and monitoring of disease progression. This heightened clinical need is prompting hospitals, eye care clinics, and research centers to invest in advanced OCT technologies, significantly boosting market growth.

For instance, the prevalence of retinal disorders was reported at 52.37% among individuals aged 60 years and above. The most common conditions included age-related macular degeneration (AMD), hypertensive retinopathy, epiretinal membrane (ERM), branch retinal vein occlusion (BRVO), and diabetic retinopathy (DR). The occurrence of retinal disorders showed a clear increase with advancing age and was significantly associated with hypertension and previous cataract surgery.

Restraints: Strict regulatory frameworks are hampering the growth of the optical coherence tomography market

The capital cost of Optical Coherence Tomography (OCT) systems varies widely depending on the model and capabilities. Basic or lower-end commercial OCT machines typically cost between USD 6,500 and 20,000, while mid-range systems are priced around USD 20,000 to 40,000. High-end or premium systems, which may include multi-mode imaging and angiography capabilities, can exceed USD 50,000 to 120,000. Research-oriented or low-cost prototype OCT systems are available for approximately USD 5,000 to 10,000. These high upfront costs, combined with limited reimbursement in many regions, pose significant challenges to widespread adoption.

For more details on this report – Request for Sample

Segmentation Analysis

The global optical coherence tomography market is segmented based on product type, technology, application, end user, and region.

Product Type:

The handheld OCT devices from product type segment to dominate the optical coherence tomography market with a 45.1% share in 2024

The adoption of handheld optical coherence tomography (OCT) devices is being driven by their portability, ease of use, and ability to perform imaging in patients who cannot access conventional tabletop systems, such as children, bedridden individuals, or those in remote locations. Additionally, the growing demand for point-of-care diagnostics, rising prevalence of retinal disorders, and increasing focus on early detection and monitoring of ocular diseases are further boosting the use of handheld OCT devices in clinical and community settings.

For instance, in August 2025, Optomed USA has announced the launch of the Optomed Lumo, a handheld fundus camera designed to enable high-quality retinal imaging in primary care and other healthcare settings beyond traditional ophthalmology and optometry clinics.

Application: The oncology segment is estimated to have a 41.1% of the optical coherence tomography market share in 2024

The oncology application segment plays a crucial role in the healthcare market, primarily driven by the increasing global incidence of cancer and a heightened focus on early detection, precise diagnosis, and tailored treatment strategies. The adoption of advanced imaging and diagnostic technologies is on the rise in oncology, facilitating the monitoring of tumor advancement, assessment of treatment effectiveness, and the support of precision medicine methodologies. Moreover, the growth of this segment is bolstered by expanding research initiatives, increased healthcare investments, and a growing public awareness regarding the advantages of early cancer screening.

For instance, in October 2024, Perimeter Medical Imaging AI, Inc, identified as "Perimeter" or the "Company," has announced the successful completion of patient enrollment in a pivotal study. This study is focused on evaluating its advanced Perimeter B-Series OCT system, a technology that integrates proprietary artificial intelligence (AI) with optical coherence tomography (OCT). The application of this system is primarily during breast-conserving surgeries (BCS), highlighting its importance in enhancing surgical procedures and patient outcomes within the medical technology sector.

Geographical Analysis

North America dominates the global optical coherence tomography market with a 42.5% in 2024

North America is a major growth driver in this market due to the rising prevalence of chronic diseases, increasing geriatric population, and high adoption of advanced healthcare technologies. Favorable reimbursement policies, strong healthcare infrastructure, and growing investments in research and development further support market expansion.

In the USA, the market is driven by widespread awareness of early disease detection, strong regulatory support for innovative diagnostic devices, and high patient demand for advanced imaging solutions. The presence of leading medical device manufacturers and ongoing technological innovations also boost market growth.

For instance, in September 2025, Conavi Medical has submitted its Novasight Hybrid IVUS/OCT intravascular imaging system to the U.S. Food and Drug Administration (FDA) for 510(k) clearance, targeting coronary applications.

Europe is the second region after North America which is expected to dominate the global optical coherence tomography market with a 34.5% in 2024

Europe’s market growth is supported by increasing prevalence of chronic and age-related diseases, well-established healthcare systems, and favorable government initiatives for preventive healthcare. Growing adoption of advanced diagnostic technologies and focus on early intervention are also key drivers.

Germany drives the market through its robust healthcare infrastructure, high healthcare spending, and emphasis on precision medicine. The country’s proactive screening programs and increasing adoption of advanced diagnostic tools contribute to the growth of the market.

For instance, in May 2024, ZEISS Medical Technology has announced that the CIRRU 6000 currently offers ophthalmologists a highly efficient, data-driven workflow, supported by the largest OCT (optical coherence tomography) reference database in the U.S. market and enhanced cybersecurity features. As part of the ZEISS Medical Ecosystem, this latest OCT device, recently cleared by the U.S. Food and Drug Administration (FDA), facilitates informed patient care decisions across ophthalmic workflows, from disease diagnosis to treatment and ongoing management.

The Asia Pacific region is the fastest-growing region in the global optical coherence tomography market, with a CAGR of 8.1% in 2024

Asia’s market expansion is fueled by a large patient population, rising incidence of chronic and lifestyle-related diseases, and improving healthcare infrastructure. Growing awareness about early diagnosis and increasing adoption of advanced medical technologies are also driving factors.

Japan is witnessing growth due to its aging population, high prevalence of chronic diseases, and strong emphasis on preventive healthcare. Advanced healthcare facilities, supportive government policies, and technological innovation in diagnostics further drive the market.

For instance, in June 2024, NIDEK CO., LTD., a global leader in ophthalmic, optometric, and lens edging equipment, has announced the launch of the RS-1 Glauvas Optical Coherence Tomography (OCT) system.

The RS-1 Glauvas features an impressive scan speed of up to 250 kHz, high-quality wide and deep area imaging, user-friendly operability, and deep learning-based analytics. These capabilities enable streamlined workflows and enhanced diagnostic confidence for managing glaucoma and retinal vascular diseases, particularly in high-volume clinical settings.

Competitive Landscape

Top companies in the optical coherence tomography market includeCarl Zeiss Meditec, Heidelberg Engineering, Topcon Healthcare, Canon Medical Systems, NIDEK, Visionix USA Inc, Haag-Streit, Leica Microsystems / Leica Ophthalmic, Thorlabs, Santecand among others.

Carl Zeiss Meditec:-Carl Zeiss Meditec plays a significant role in the ophthalmic imaging market by providing advanced diagnostic solutions, including cutting-edge Optical Coherence Tomography (OCT) systems such as the CIRRUS series. The company leverages large reference databases, data-driven workflows, and enhanced cybersecurity features to support accurate disease diagnosis, treatment planning, and ongoing patient management. As part of its comprehensive ZEISS Medical Ecosystem, Carl Zeiss Meditec contributes to improving clinical efficiency and diagnostic confidence in both glaucoma and retinal disease management, strengthening its position as a key player in the global ophthalmic diagnostics market.

Market Scope

| Metrics | Details | |

| CAGR | 13.6% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Handheld OCT Devices, Tabletop OCT Devices, Integrated OCT Devices |

| Technology | Time-Domain OCT (TD-OCT), Spectral-Domain OCT (SD-OCT), Swept-Source OCT (SS-OCT), Others | |

| Application | Oncology, Ophthalmology, Cardiovascular, Dermatology Others | |

| End User | Hospitals, Clinics, Ambulatory Surgical Centers, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global optical coherence tomography market report delivers a detailed analysis with 62 key tables, more than 57visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here