Global Nut Ingredients Marke is segmented By Type (Peanut, Almond, Walnut, Cashew, Hazelnut and Others), By Form (Roasted, Chopped, Raw, Powdered and Others), By Application (Bakery & Confectionary, Snacks and Bars, Desserts, Cereals, Dairy Products, Beverages and Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2023-2030

Nut Ingredients Market Size

Global Nut Ingredients Market reached USD 21.2 billion in 2022 and is expected to reach USD 32.0 billion by 2030 growing with a CAGR of 5.3% during the forecast period 2023-2030. The nut ingredients market trend is driven by the rise of plant-based milk alternatives.

Consumers are increasingly opting for dairy-free options, and almond milk is a prime example. Almond milk, made from almond nut ingredients, has gained popularity as a nutritious and environmentally-friendly choice, driving its market growth.

The nut ingredients market is experiencing steady growth, driven by rising health consciousness and the popularity of natural, nutritious foods. Nuts, including almonds, walnuts, and peanuts, are in high demand because of their wealthy nutrients, minerals, and healthy fat. Consumers' preference for plant-based diets and dairy alternatives further boosts the market. Additionally, the versatility of nut ingredients in various food applications, including nut-based products like nut butters and nut flours, contributes to the market's expansion.

The nut ingredients market is substantially pushed by the rising demand for gluten-free products in the food industry. For example, almond flour, which is made from almonds, is becoming increasingly popular as a gluten-free substitute in baking. The market for nut ingredients like almond flour is rapidly expanding as more people look for gluten-free goods owing to dietary constraints or personal preferences.

Nut Ingredients Market Scope

|

Metrics |

Details |

|

CAGR |

5.3% |

|

Size Available for Years |

2021-2030 |

|

Forecast Period |

2023-2030 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Type, Form, Application, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, and Middle East & Africa |

|

Fastest Growing Region |

Asia Pacific |

|

Largest Region |

Europe |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To Know More Insights - Download Sample

Nut Ingredients Market Dynamics

Rising Health Awareness Boosts Nut Ingredients Market Size and Share

As humans turn out to be more fitness-aware, they're choosing healthier and herbal meals. Nuts are full of vitamins, minerals, and healthy fat, making them popular for a balanced food plan. This developing interest in healthier options has led to better demand for nut-based products like nut butter, nut flours, and nut milk options.

As a result, the nut substances market is expanding, and so many people are using these products for snacking and cooking. Nuts offer benefits like better heart health and weight management, which make them even more appealing to consumers. With these advantages driving their popularity, the market size and share of nut ingredients are expected to keep growing.

The surge in Vegan Diets Propels Nut Ingredients Market Growth

The surge in vegan and plant-based diets is another major driver of the nut ingredients market. Nuts serve as a valuable protein source for individuals following these dietary preferences. The demand for vegan and plant-based food alternatives continues to upward thrust, and the usage of nut ingredients in diverse food applications, which includes bakery, confectionery, and drinks, is anticipated to grow substantially.

This nutritional shift is anticipated to fuel the market growth, increasing its market share and overall market size in the coming years. Nuts' versatility and ability to cater to diverse dietary needs make them a preferred choice among vegans, flexitarians, and health-conscious consumers, driving the adoption of nut-based products across various food industries.

Supply Chain Vulnerability Emerges as a Restraint of Nut Ingredients Market

One significant restraint facing the nut ingredients market is the vulnerability of its supply chain. Factors such as climate change, natural disasters, and geopolitical issues can impact the cultivation, harvesting, and transportation of nuts, leading to potential fluctuations in supply and prices. Additionally, labor shortages and logistical challenges can disrupt production and distribution, affecting the availability of nut-based products.

Despite these hurdles, the nut ingredients market size is projected to continue its growth trajectory due to the increasing demand for healthy and natural ingredients in various food and beverage applications. Market players are actively seeking innovative solutions to strengthen the supply chain resilience and mitigate potential disruptions, ensuring steady growth in the nut ingredients market.

Nut Ingredients Market Segment Analysis

The global nut ingredients market is segmented based on type, form, application, and region.

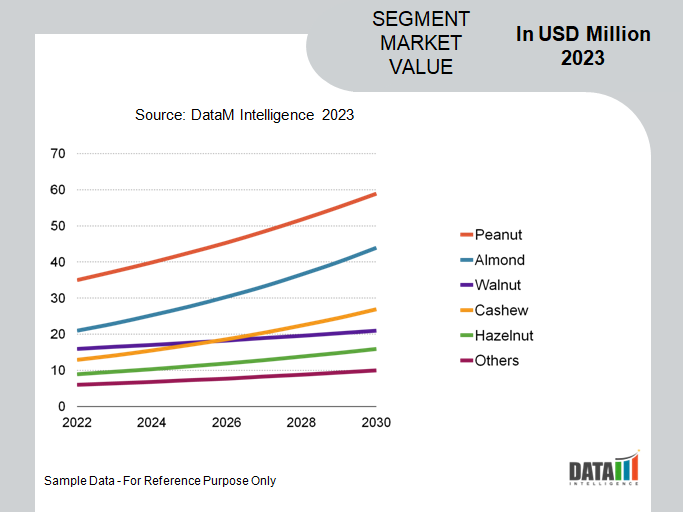

Almond Segment Emerges as the Fastest Growing Segment in the Nut Ingredients Market

The global nut ingredients market has been segmented by type into almond, peanut, walnut, cashew, hazelnut, and others.

The almond segment is a crucial part of the nut ingredients market, known for its versatility and nutritional benefits. Almond-based nut ingredients encompass a wide range of products, including nut-based products like almond milk, almond butter, and almond oil. Moreover, almond flour is gaining popularity as a gluten-free alternative in baking. The almond segment's market share is estimated to be around 30% of the overall nut ingredients market.

This significant market share is due to almonds' widespread use in both commercial and household applications. Almonds' appeal as a healthy snack and their incorporation into various culinary creations has contributed to the segment's growth. As the nut ingredients market continues to expand, almond-based products are expected to maintain their position as a preferred choice among consumers seeking nutritious and delicious options.

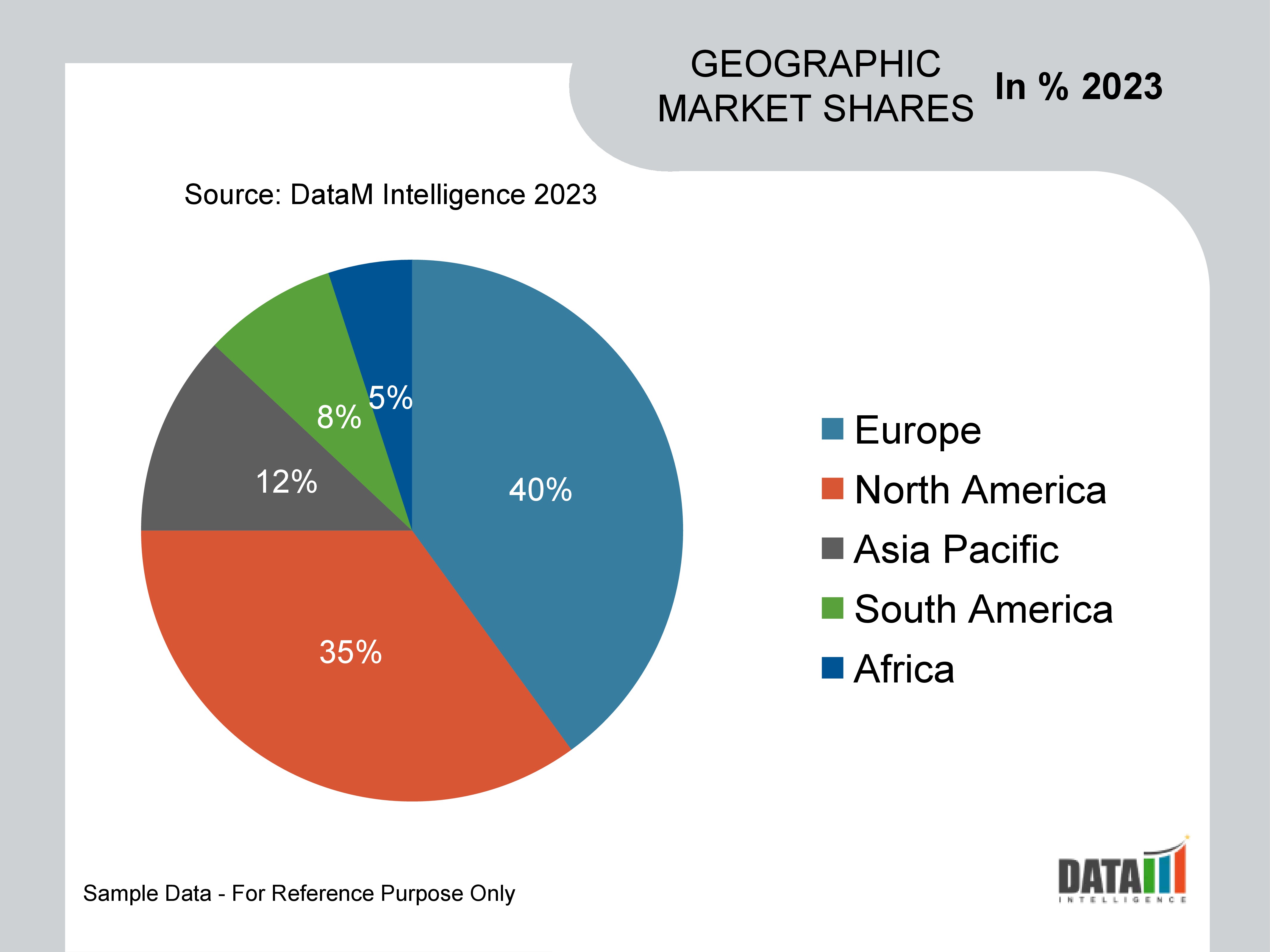

Global Nut Ingredients Market Geographical Share

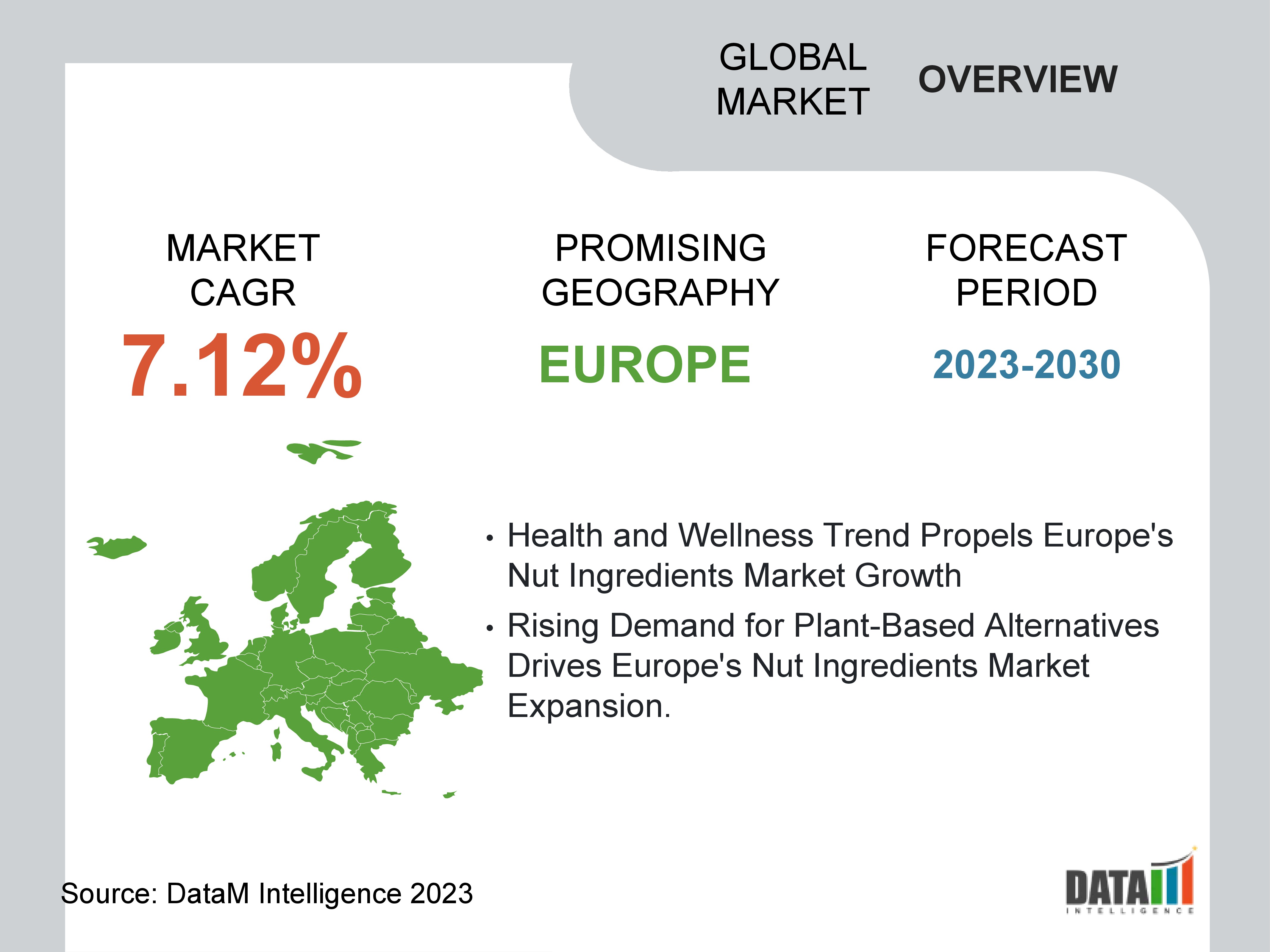

Europe is Leading the Nut Ingredients Market with a 40% Market Share

The nut ingredients market in Europe witnessed significant changes due to the Covid-19 pandemic. With an ever-increasing emphasis on health-conscious choices during lockdowns, demand surged for nut products like nut pastes, nut oils, nut extracts, nut powders, nut meals, and nut fillings as consumers sought nutritious options for cooking and snacking at home. This trend propelled growth in the nut ingredients market size.

However, the closure of hospitality establishments negatively affected industrial consumption and distribution. Despite the challenges, certain European regions managed to maintain their dominant position, holding a 40% market share. The post-pandemic era is expected to bring further opportunities and challenges, shaping the future of the nut ingredients market in Europe.

Nut Ingredients Market Companies

The major global players in the market include ADM, Olam International Limited, Barry Callebaut, Sran Family Orchards, Inc., John B. Sanfilippo & Son, Kanegrade, Borges Agriculture & Industrial Nuts, Dohler GmbH, Nestlé, and Harris Woolf California Almonds.

COVID-19 Impact on Nut Ingredients Market

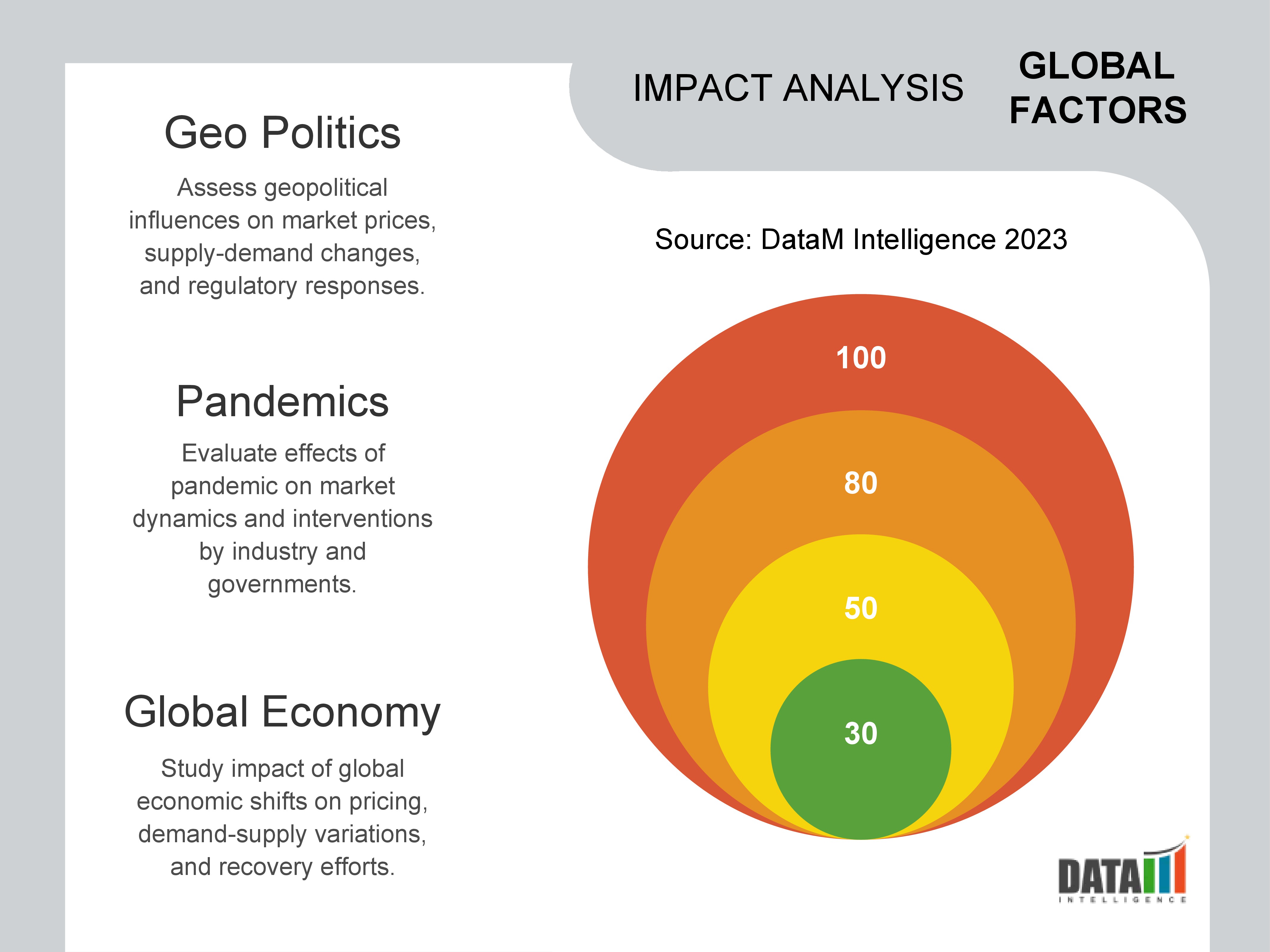

Global Recession/Ukraine-Russia War/COVID-19, and Artificial Intelligence Impact Analysis:

Covid-19 Impact:

The Covid-19 pandemic had a mixed impact on the nut ingredients market. Initially, panic buying and supply chain disruptions boosted demand for nuts as a healthy snacking option. However, the closure of restaurants, cafes, and bakeries led to a decline in industrial consumption. Additionally, export limitations and labor shortages affected production and distribution.

As the pandemic receded, a shift towards healthier eating habits and increased home cooking positively influenced nut ingredient sales. Nevertheless, ongoing uncertainties in the post-pandemic era and economic challenges may continue to shape the market's dynamics in the coming years.

Key Developments

- On September 01, 2020, Harris Woolf Almonds has launched GMO-free roasted almond protein powder that packs an unmatched level of flavor and almond oil that is made from 100% food-grade almonds to meet the growing demand for sustainable plant-based proteins and to deliver novel value to the customers.

- On February 11, 2021, Hormel Foods Corporation, a global branded food company, announced that it has entered into a definitive agreement to acquire the Planters snack nut portfolio from the Kraft Heinz Company. The acquisition includes the Planters, NUT-rition, Planters Cheez Balls, and Corn Nuts brands.

- On May 04, 2022, VKC Nuts, one of India’s leading fully integrated farm-to-fork nuts dried fruits company announced the launch of ‘Bactopure’, India’s first and only range of pasteurized nuts and dried fruits, under its signature brand Nutraj.

Why Purchase the Report?

- To visualize the global nut ingredients market segmentation based on type, form, application, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities in the market by analyzing trends and co-development.

- Excel data sheet with numerous data points of nut ingredients market-level with all segments.

- The PDF report consists of a cogently put-together market analysis after exhaustive qualitative interviews and an in-depth market study.

- Product mapping is available as Excel consists of key products of all the major market players.

The global nut ingredients market report would provide approximately 61 tables, 63 figures, and 190 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies