Non-Oncology Biopharmaceuticals Market - Industry Outlook

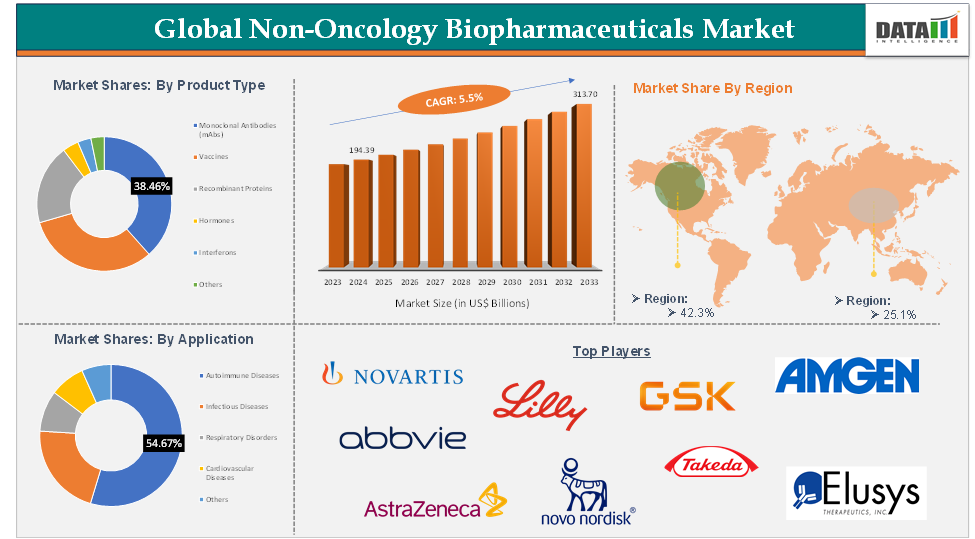

Non-Oncology Biopharmaceuticals Market reached US$ 194.39 Billion in 2024 and is expected to reach US$ 313.70 Billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025-2033.

The global non-oncology biopharmaceuticals market is growing due to the rising demand for advanced biologic therapies for chronic and non-cancerous conditions. Technological advancements in biologics, such as monoclonal antibodies, recombinant proteins, and gene therapies, are improving treatment outcomes and expanding therapeutic applications. The market is dominated by North America due to strong R&D infrastructure and favorable reimbursement policies, while Asia-Pacific is emerging as a high-growth region due to rapid healthcare modernization and expanding patient access. Despite challenges like high development costs and regulatory complexities, the market is poised for continued innovation and robust global growth.

For more details on this report – Request for Sample

Non-Oncology Biopharmaceuticals Market Dynamics: Drivers & Restraints

Driver: Increasing Prevalence of Chronic Diseases

Chronic diseases like diabetes, rheumatoid arthritis, and cardiovascular disorders are driving the global non-oncology biopharmaceuticals market growth. As aging demographics, sedentary lifestyles, and environmental factors increase, biopharmaceuticals offer advanced, targeted therapeutic solutions, driving research, investment, and market expansion in high-burden regions.

For instance, according to the Centers for Disease Control and Prevention, the US has 129 million people with at least one major chronic disease, including heart disease, cancer, diabetes, obesity, and hypertension. Five of the top 10 leading causes of death in the US are associated with preventable and treatable chronic diseases. Over the past two decades, prevalence has steadily increased, and this trend is expected to continue. An increasing proportion of Americans are dealing with multiple chronic conditions, with 42% having two or more and 12% having at least five. Chronic diseases also significantly impact the US healthcare system, accounting for 90% of the annual $4.1 trillion expenditure.

Hence, the rising burden of chronic diseases in the U.S., affecting 129 million people, underscores the urgent need for effective biopharmaceutical treatments. With 90% of the $4.1 trillion annual healthcare expenditure tied to these conditions, demand for advanced, non-oncology biologics is accelerating. This trend fuels growth in the global non-oncology biopharmaceuticals market.

Restraint: Stringent Regulatory Requirements

The global non-oncology biopharmaceuticals market faces significant challenges due to stringent regulatory requirements from bodies like the FDA and EMA, which often lead to prolonged approval timelines and increased development costs. These complex compliance frameworks can delay market entry, limit innovation, and pose significant hurdles for smaller biotech firms, impacting new product launches and market growth.

Non-Oncology Biopharmaceuticals Market Segment Analysis

The global non-oncology biopharmaceuticals market is segmented based on product type, application, route of administration, distribution channel, and region.

Product Type:

The monoclonal antibodies (mAbs) segment of the product type is expected to hold 38.4% of the non-oncology biopharmaceuticals market

Monoclonal antibodies (mAbs) are laboratory-produced molecules designed to mimic the immune system's ability to fight off pathogens. They target specific antigens and are effective in treating various diseases, including autoimmune disorders, chronic inflammatory conditions, and infectious diseases. Their precision, efficacy, and safety make them a cornerstone of modern biopharmaceutical therapies.

The monoclonal antibodies segment is driving growth in the global non-oncology biopharmaceuticals market due to their targeted action and expanding therapeutic applications. The increasing prevalence of chronic diseases, investments in biologics R&D, and antibody engineering advancements are driving demand. The availability of biosimilars and new mAb therapies further expands market access.

Non-Oncology Biopharmaceuticals Market - Geographical Analysis

North America dominated the global non-oncology biopharmaceuticals market with the highest share of 51.3% in 2024

North America, particularly the US, dominates the global non-oncology biopharmaceuticals market due to its advanced healthcare infrastructure, high healthcare spending, and presence of leading biopharmaceutical companies. The region also benefits from robust R&D activities, favorable regulatory pathways, and increasing prevalence of chronic diseases like diabetes and cardiovascular conditions, contributing to market growth. For instance, in 2024, diabetes affected 8.9% of the U.S. population, including 29.7 million people of all ages, and 352,000 children and adolescents under 20 years old, according to the CDC.

Hence, this rising burden drives the adoption of advanced biopharmaceuticals, such as insulin analogs and monoclonal antibodies targeting diabetes-related complications. As healthcare providers seek more precise and sustainable therapies, this trend directly supports the expansion of the non-oncology biopharmaceuticals market.

Non-Oncology Biopharmaceuticals Market Key Players

The major global players in the non-oncology biopharmaceuticals market include Novartis AG, Eli Lilly and Company, GlaxoSmithKline, Amgen Inc., AbbVie Inc., AstraZeneca, Novo Nordisk A/S, Takeda Pharmaceutical Company Ltd, Elusys Therapeutics, and Swedish Orphan Biovitrum, among others.

Scope

Metrics | Details | |

CAGR | 5.5% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Monoclonal Antibodies (mAbs), Vaccines, Recombinant Proteins, Hormones, Interferons, Others |

Application | Autoimmune Diseases, Infectious Diseases, Respiratory Disorders, Cardiovascular Diseases, Others | |

| Route of Administration | Injectable, Oral, Topical, Nasal, Others |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |