Neurovascular Devices Market Size

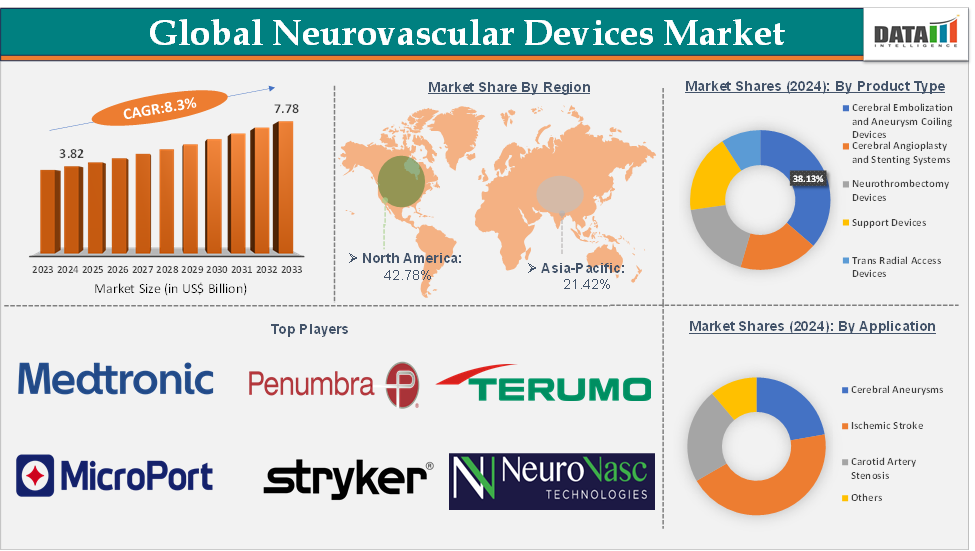

The global neurovascular devices market size reached US$ 3.82 Billion in 2024 from US$3.55 Billion in 2023 and is expected to reach US$ 7.78 Billion by 2033, growing at a CAGR of 8.3% during the forecast period 2025-2033.

Neurovascular Devices Market Overview

The neurovascular devices market is a rapidly evolving sector within the broader medical devices industry, focused on the development and commercialization of specialized products designed to diagnose, treat, and manage neurovascular diseases such as ischemic and hemorrhagic strokes, cerebral aneurysms, and arteriovenous malformations. These devices include stents, flow diverters, embolic coils, thrombectomy devices, catheters, and microcatheters, among others.

The neurovascular devices market is moderately consolidated, with major players such as Medtronic, Stryker Corporation, Penumbra, Inc., Johnson & Johnson, and Terumo Corporation leading product innovation and market penetration. Strategic acquisitions, partnerships, and ongoing R&D investments characterize the competitive dynamics, with smaller innovators contributing disruptive technologies.

Neurovascular Devices Market Executive Summary

Neurovascular Devices Market Dynamics

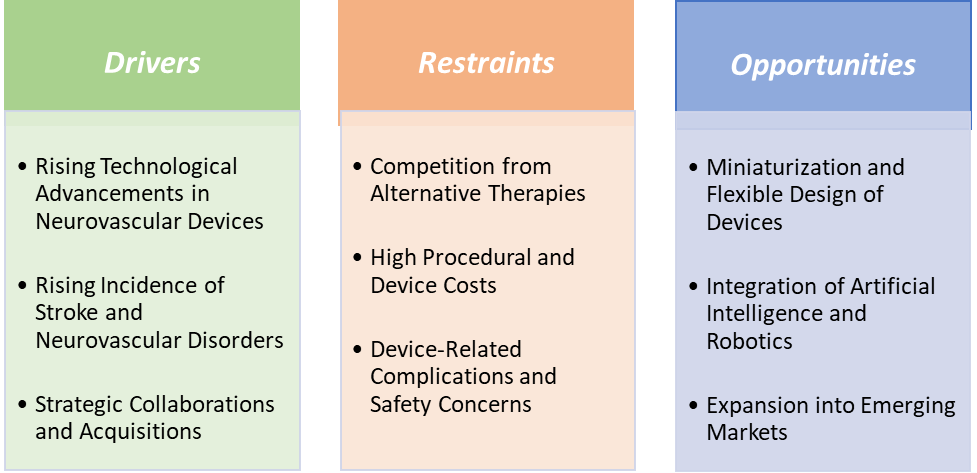

Drivers:

Technological innovation is a major growth driver in the neurovascular devices market, enhancing procedural efficacy, safety, and expanding the range of treatable conditions. Advances enable minimally invasive interventions that reduce recovery time and improve patient outcomes, fueling higher adoption rates globally. Newer neurovascular devices, such as flow diverters, stent retrievers, and embolic coils, are designed to be less invasive, reducing recovery times and complications for patients. Thus, major market players are focusing on innovations, which are driving the market growth.

For instance, in February 2025, Penumbra launched the Access25 delivery microcatheter. Access25 is a single-lumen device designed to aid physicians in accessing the neurovasculature for delivery of Penumbra’s 0.020-inch coil platform. Access25 is compatible with Penumbra’s Midway intermediate catheters and Benchmark/BMX guide catheters. It is designed to facilitate ease of trackability and stable support when delivering Penumbra’s 0.020-inch coils for neurovascular embolization, such as PC400, POD400, and PAC400.

Devices now integrate with enhanced 2D and 3D imaging technologies, providing real-time visualization to guide procedures. This technology helps neurosurgeons place devices more precisely, ensuring safer and more effective treatments.

For instance, in February 2024, Royal Philips announced major enhancements to its Image Guided Therapy System, Azurion, with the launch of its new Azurion neuro biplane system. Designed to improve productivity and help care teams make the right decisions faster, treat more patients, and achieve better outcomes, the new interventional system features enhanced 2D and 3D imaging and X-ray detector positioning flexibility. The new image-guided therapy system is a complete interventional solution for confident diagnosis, image guidance, and therapy assessment of patients with stroke or other neurovascular diseases.

The rising incidence of stroke and neurovascular disorders is also driving the neurovascular devices market growth

The increasing prevalence of neurovascular diseases, especially stroke, is a primary factor propelling the neurovascular devices market. Stroke is a leading cause of death and disability worldwide, creating a substantial demand for advanced diagnostic and therapeutic devices. According to the World Health Organization (WHO), over 15 million people suffer a stroke each year globally. Ischemic stroke, caused by blood clots blocking cerebral arteries, accounts for around 87% of all stroke cases. The increasing number of stroke cases directly correlates with the rising sales and adoption of these devices.

The rising global incidence of stroke and other neurovascular disorders is creating an urgent need for advanced, effective treatment options. This epidemiological trend directly drives the expansion of the neurovascular devices market by increasing patient numbers, encouraging technological innovation, and prompting healthcare system investments.

Restraints:

Competition from alternative therapies is hampering the growth of the neurovascular devices market

Many neurovascular disorders, such as ischemic stroke or cerebral aneurysms, can be treated using medications rather than interventional devices. Pharmacological treatments like antiplatelet drugs (e.g., aspirin) and anticoagulants (e.g., warfarin, rivaroxaban) can prevent clot formation and reduce the risk of stroke or aneurysm rupture. For instance, the use of thrombolytics (e.g., tissue plasminogen activator, tPA) for acute ischemic stroke can often reduce the need for thrombectomy or other device-based interventions, thus limiting demand for neurovascular devices.

In some situations, traditional open surgery remains the preferred option, especially for complex or large aneurysms and arteriovenous malformations (AVMs). Although less commonly used than minimally invasive methods, open surgery can be seen as a more established and reliable option. For instance, for patients with large or difficult-to-treat brain aneurysms, clipping surgery may be recommended over embolization or flow diversion, which can reduce the market share of neurovascular devices.

Alternatives like stereotactic radiosurgery or laser ablation are sometimes preferred for treating brain tumors, arteriovenous malformations, and other vascular lesions. These methods can offer less risk and are less invasive than traditional neurovascular procedures. For instance, Gamma Knife radiosurgery is frequently used as an alternative to embolization or surgical resection for AVMs, particularly for small lesions.

Opportunities:

Miniaturization and flexible design of devices create a market opportunity for the neurovascular devices market

Advancements in miniaturization and flexible device design are transforming neurovascular interventions by enabling access to increasingly complex and delicate cerebral vasculature. This innovation expands treatment possibilities, improves clinical outcomes, and opens new market segments. Smaller, more flexible microcatheters, stents, and coils can navigate narrow, winding blood vessels deep within the brain. This capability allows treatment of previously untreatable conditions like distal aneurysms, small arteriovenous malformations, and pediatric neurovascular disorders.

Miniaturized devices cater to smaller vessels in pediatric patients and fragile vessels in elderly patients. This niche is underserved but growing, offering manufacturers differentiation opportunities. Flexible devices reduce the risk of vessel injury, perforation, or dissection. Improved maneuverability shortens procedure duration, which is critical in acute stroke management where every minute counts. This increases physician confidence and broadens device adoption.

For more details on this report – Request for Sample

Neurovascular Devices Market, Segment Analysis

The global neurovascular devices market is segmented based on product type, application, end-user, and region.

The cerebral angioplasty and stenting systems from the product type segment are expected to hold 38.13% of the market share in 2024 in the neurovascular devices market

Over the years, technological advancements in angioplasty and stenting systems have improved treatment efficacy, safety, and patient outcomes. The development of self-expanding stents, drug-eluting stents, and balloon angioplasty systems has enhanced the precision and success rates of neurovascular procedures. Market players are developing advanced stenting systems, which are driving the segment growth.

For instance, in May 2025, Terumo Interventional Systems announced the early commercial availability of its FDA-approved Roadsaver carotid stent system. The Roadsaver carotid stent system, when used in conjunction with Terumo’s Nanoparasol embolic protection system, is indicated for the treatment of carotid artery stenosis in patients with elevated risk for adverse events after carotid endarterectomy.

Cerebral angioplasty and stenting are minimally invasive procedures, which are preferred by both patients and physicians because they involve smaller incisions, reduced recovery times, and fewer complications compared to traditional open surgeries. For instance, angioplasty with stenting for carotid artery disease is performed through a small incision in the groin, making it a less traumatic alternative to surgery. This less invasive nature drives higher adoption of stenting systems in treating neurovascular diseases.

Neurovascular Devices Market, Geographical Analysis

North America is expected to dominate the global neurovascular devices market with a 42.78% share in 2024

North America, especially the United States, is a hub for innovation in medical devices, with leading companies such as Medtronic, Stryker Corporation, Terumo Corporation, and other emerging market players developing new and improved neurovascular devices. This includes the development of stent retrievers, flow diverters, and clot removal devices that are highly effective in treating stroke and aneurysms.

For instance, in February 2024, CERENOVUS, Inc., part of Johnson & Johnson MedTech, launched CEREGLIDE 71 Intermediate Catheter, a next-generation intermediate catheter with TruCourse indicated for the revascularization of patients suffering from acute ischemic stroke. CEREGLIDE 71 Intermediate Catheter is the latest innovation in a planned CEREGLIDE Family of Catheters to join the CERENOVUS STROKE SOLUTIONS portfolio and is optimized for effective direct aspiration and the delivery of compatible stent retrievers, including the EMBOTRAP III Revascularization Device, into the neurovasculature.

Similarly, in June 2024, Terumo subsidiary MicroVention launched its LVIS EVO intraluminal support device to treat wide-neck intracranial aneurysms in the U.S. The device is indicated for use with neurovascular embolization coils in adults to treat saccular intracranial aneurysms with a neck width of 4 mm or greater or a dome-to-neck ratio of less than two that arise from a parent vessel with a diameter between 2 and 4.5 mm.

Asia-Pacific is growing at the fastest pace in the neurovascular devices market holding 21.42% of the market share

The APAC region has a growing incidence of stroke, aneurysms, and carotid artery diseases due to lifestyle factors, rising levels of hypertension, smoking, and diabetes, which are risk factors for neurovascular conditions. For instance, the World Health Organization (WHO) reports that Asia, particularly China and India, has a high incidence of ischemic stroke, with nearly 70% of all strokes occurring in low- and middle-income countries in Asia. This significantly boosts the demand for neurovascular devices such as stents, coils, and thrombectomy systems.

There is an increasing awareness of minimally invasive neurovascular procedures such as stenting, angioplasty, and thrombectomy in the Asia Pacific region. As healthcare professionals and patients become more informed about the benefits of these procedures, the demand for neurovascular devices increases. For instance, the use of thrombectomy systems like the Solitaire FR Stent Retriever is growing in countries like India and China as part of the initiative to improve stroke treatment outcomes.

Neurovascular Devices Market Competitive Landscape

Top companies in the neurovascular devices market include Medtronic, Stryker Corporation, Terumo Corporation, MicroPort Scientific Corporation, Johnson & Johnson, Penumbra, Inc., ASAHI INTECC USA, INC., Acandis GmbH, Rapid Medical, and NeuroVasc Technologies, Inc., among others.

Neurovascular Devices Market Scope

Metrics | Details | |

CAGR | 8.3% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Cerebral Embolization and Aneurysm Coiling Devices, Cerebral Angioplasty and Stenting Systems, Neurothrombectomy Devices, Support Devices, Trans Radial Access Devices |

Application | Cerebral Aneurysms, Ischemic Stroke, Carotid Artery Stenosis, Others | |

End-User | Hospitals, Specialty Clinics, Surgical Centers, Research Laboratories, and Academic Institutes, Ambulatory Surgical Centers | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global neurovascular devices market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 146 pages of expert insights, providing a complete view of the market landscape.