Neurostimulation Devices Market Size

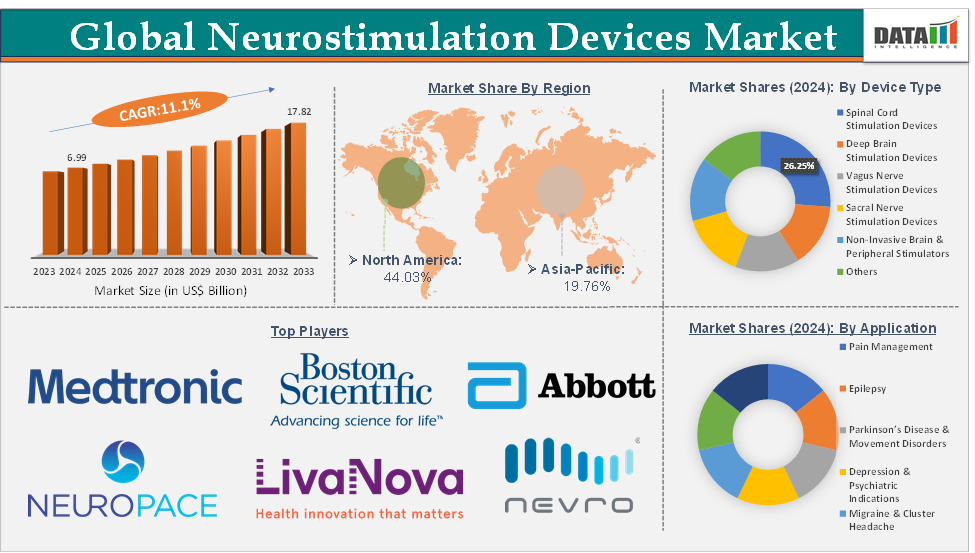

The global neurostimulation devices market size reached US$ 6.99 billion in 2024 from US$ 6.36 billion in 2023 and is expected to reach US$ 17.82 Billion by 2033, growing at a CAGR of 11.1% during the forecast period 2025-2033.

Overview

The neurostimulation devices market encompasses implantable and external devices designed to modulate neural activity for therapeutic purposes, addressing a range of conditions from chronic pain and movement disorders to epilepsy, and depression. The market is experiencing robust growth, driven by the rising prevalence of neurological diseases, an aging population, increasing demand for minimally invasive therapies, and technological innovations such as closed-loop systems and high-frequency stimulation.

Implantable neurostimulation devices, including spinal cord stimulators, deep brain stimulators, vagus nerve stimulators, and sacral nerve stimulators, dominate revenue share. North America holds the largest market share due to advanced healthcare infrastructure and high treatment adoption rates, whereas Asia-Pacific is projected to witness the fastest growth, supported by healthcare modernization and rising patient awareness.

Executive Summary

Dynamics

Drivers:

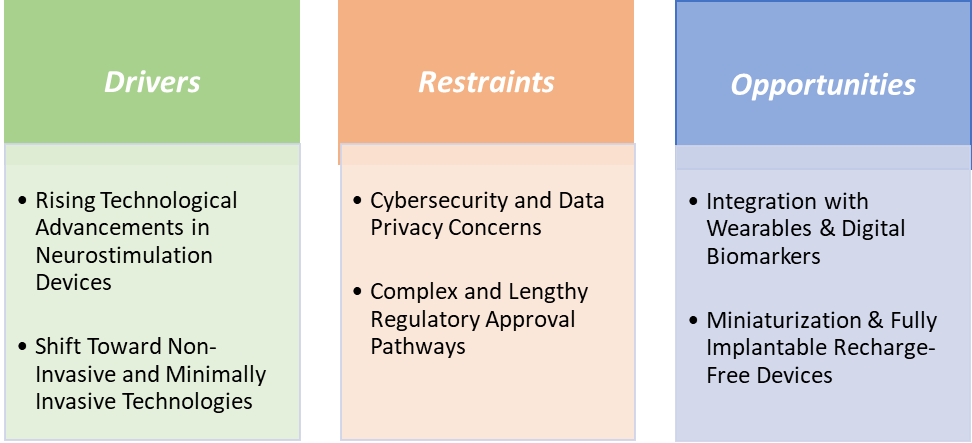

Rising technological advancements in neurostimulation devices is significantly driving the neurostimulation devices market growth

Rising technological advancements in neurostimulation devices are a major catalyst for market growth, as innovations are enhancing therapeutic outcomes, expanding indications, and improving patient experience. Modern devices now feature closed-loop stimulation systems that automatically adjust electrical impulses based on real-time neural feedback, as seen in Medtronic’s Percept PC DBS with BrainSense technology, which optimizes therapy for Parkinson’s patients.

For instance, in February 2025, Medtronic plc announced the U.S. Food and Drug Administration (FDA) approval of BrainSense Adaptive deep brain stimulation (aDBS) and BrainSense Electrode Identifier (EI). Medtronic enhanced its Percept DBS neurostimulators with exclusive BrainSense Adaptive technology, introducing aDBS for people living with Parkinson's. This feature personalizes therapy based on a patient's brain activity in real time both in clinical settings and in daily life.

Advances in miniaturization and battery technology have enabled rechargeable implantable pulse generators lasting up to 10–15 years, reducing revision surgeries and lifetime costs. Wireless and Bluetooth-enabled programming now allows remote device adjustment, improving convenience for patients and clinicians. On the non-invasive side, compact, home-use devices like gammaCore’s nVNS are expanding neurostimulation access beyond hospital settings. Integration with AI-driven algorithms and wearable biosensors is paving the way for personalized neuromodulation, while research into brain-computer interfaces suggests even broader future applications. Together, these advancements are not only improving clinical efficacy but also lowering barriers to adoption, making neurostimulation a more attractive option for patients, providers, and payers worldwide.

Restraints:

Cybersecurity and data privacy concerns is hampering the growth of the neurostimulation devices market

Cybersecurity and data privacy concerns are increasingly hampering the growth of the neurostimulation devices market as modern systems adopt wireless programming, cloud-based data storage, and remote patient monitoring. Implantable neurostimulators often communicate via Bluetooth or proprietary RF protocols with clinician programmers and patient controllers, creating potential entry points for unauthorized access. For instance, the FDA has issued cybersecurity safety communications for implantable medical devices, warning about vulnerabilities that could allow hackers to alter therapy parameters, drain batteries, or access patient data.

Furthermore, compliance with stringent regulations like HIPAA in the U.S. and GDPR in Europe adds complexity and cost to device design and data management. For instance, according to the HIPAA Journal, in August 2023, 23 million breached healthcare records are noticed. Over the past 12 months, an average of 9,989,003 healthcare records were breached each month. In the year to August 31, 2024, there have been 491 data breaches of 500 or more records, and at least 58,668,002 records are known to have been breached. The average breach size in 2024 is currently 119,487 records and the median breach size is 4,109 records.

For more details on this report – Request for Sample

Segmentation Analysis

The global neurostimulation devices market is segmented based on device type, application, end-user, and region.

The spinal cord stimulation devices segment from the device type is dominating the neurostimulation devices market with a 26.25% share in 2024

The spinal cord stimulation devices segment is dominating the neurostimulation devices market due to its well-established clinical efficacy, broad range of approved indications, and continuous technology enhancements. Spinal cord stimulation is a proven therapy for chronic pain conditions such as failed back surgery syndrome, complex regional pain syndrome, and neuropathic pain, which together represent a large and growing patient population. Leading players like Medtronic, Boston Scientific, and Nevro have developed advanced systems offering high-frequency stimulation (Nevro’s 10 kHz therapy) and burst stimulation (Abbott’s BurstDR), which provide superior pain relief and eliminate or reduce paresthesia, improving patient satisfaction.

The introduction of dorsal root ganglion stimulation has further expanded spinal cord stimulation applications to highly localized pain areas where conventional spinal cord stimulation may be less effective. Moreover, modern spinal cord stimulation devices feature rechargeable IPGs with extended battery life, wireless programming, and MRI compatibility, making them more convenient and versatile. With chronic pain cases rising globally and alternative treatment options often delivering suboptimal results, spinal cord stimulation remains the backbone of the neurostimulation devices market, accounting for the largest revenue share and maintaining its leadership position.

Geographical Share Analysis

North America is expected to dominate the global neurostimulation devices market with a 44.03% in 2024

North America dominates the neurostimulation devices market owing to its advanced healthcare infrastructure, high adoption of innovative therapies, and favorable reimbursement environment. The U.S. accounts for the largest share, driven by a high prevalence of chronic pain, impacting over 50 million adults along with neurological conditions like Parkinson’s disease, epilepsy, and depression that are treatable with neurostimulation.

The region is home to major global players like Medtronic, Boston Scientific, Abbott, and Nevro, enabling rapid commercialization of advanced technologies, including high-frequency spinal cord stimulation, burst stimulation, and closed-loop systems. Regulatory bodies like the U.S. FDA also actively facilitate device innovation through expedited review pathways for breakthrough neurostimulation technologies. In addition, well-trained neurosurgeons and pain specialists, combined with a strong network of specialty clinics, ensure high procedural volumes.

Competitive Landscape

Top companies in the neurostimulation devices market include Medtronic, Boston Scientific Corporation, Abbott, Aleva Neurotherapeutics, NeuroPace, Inc., LivaNova PLC, Nevro Corp, Nalu Medical, Curonix LLC, and Phagenesis Limited, among others.

Report Scope

Metrics | Details | |

CAGR | 11.1% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Device Type | Spinal Cord Stimulation Devices, Deep Brain Stimulation Devices, Vagus Nerve Stimulation Devices, Sacral Nerve Stimulation Devices, Non-Invasive Brain & Peripheral Stimulators and Others |

Application | Pain Management, Epilepsy, Parkinson’s Disease & Movement Disorders, Depression & Psychiatric Indications, Migraine & Cluster Headache, Sleep Disorders and Others | |

End-User | Hospitals, Specialty/Neurology Clinics, Ambulatory Surgical Centers, Rehabilitation Centers, Academic and Research Institutes and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global neurostimulation devices market report delivers a detailed analysis with 62 key tables, more than 62 visually impactful figures, and 167 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here