Overview

Global Mycelium-Based Meat Alternatives Market reached US$ 971.25 million in 2024 and is expected to reach US$ 2,592.78 million by 2032, growing with a CAGR of 13.20% during the forecast period 2025-2032.

The global mycelium-based meat alternatives market is evolving beyond niche applications as governments integrate it into national food innovation strategies. In 2023, the US Department of Energy’s Bioenergy Technologies Office (BETO) began funding fungal biomass R&D as part of its Alternative Protein Initiative, reflecting federal interest in integrating fungi into future food and fuel systems. Meanwhile, companies like Prime Roots have partnered with public school programs to pilot mycelium-based deli meats in institutional food services, signaling a move toward mainstream adoption beyond retail.

In Europe, support for fungi-derived proteins has been reinforced through the EU-funded Smart Protein project, which is exploring large-scale applications of mycelium as a circular economy ingredient. Trials in Denmark and the Netherlands are integrating mycelium into existing bakery and foodservice infrastructure to test feasibility at scale. These developments underscore a shift from startup-driven innovation to publicly supported integration into national supply chains and food security frameworks.

Mycelium-Based Meat Alternatives Market Trend

One of the most unique trends in the market is the use of vertical fermentation systems—such as the “AirMycelium” technology employed by MyForest Foods—which mimics natural forest growth conditions to achieve high yield on minimal land. In parallel, USDA’s move to define organic certification requirements for mycelium will simplify entry for producers into clean-label and organic retail categories.

Public funding has not only enabled infrastructure scale-up but also job creation in regions hosting such facilities. Sustainability data backed by USDA shows these methods dramatically outperform conventional meat in resource efficiency. Continued government support and technological maturity are fostering a robust innovation ecosystem around mycelium-based proteins.

Market Scope

Metrics | Details |

By Product Type | Burger Patties, Nuggets, Sausages, Fillets, Ground Meat, Others |

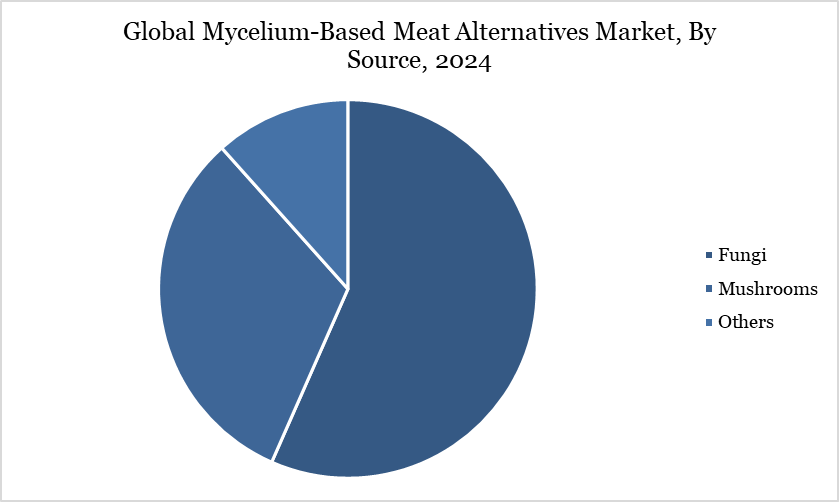

By Source | Fungi, Mushrooms, Others |

By Category | Frozen, Fresh, Ready-to-eat |

By Application | Meat Substitutes, Food Additives, Pharmaceuticals, Biomaterials, Others |

By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Consumer Demand for Sustainable and Clean-Label Protein Sources

Consumers are increasingly favoring sustainably produced, clean-label protein options, prompting companies and governments to respond. A USDA‑funded research initiative highlights that cultivated meat systems can reduce greenhouse gas emissions by 78–96%, use 82–96% less water, and require 99% less land than traditional meat production. Meanwhile, MyForest Foods reports that its mycelium “MyBacon” is now stocked in over 1,200 retailers across 45 US states plus Puerto Rico and the US Virgin Islands—an expansion driven by consumer appetite for natural, minimally processed protein alternatives.

Limited Production Scalability and High Manufacturing Costs

Limited production scalability and high manufacturing costs are restraining the global market for mycelium-based meat alternatives. According to a USDA-supported report, current production costs for cultured proteins remain “an order of magnitude higher” than conventional proteins—ranging between US$ 2 to 15 per kg—requiring approximately US$ 250 billion in investments by 2050 to reach cost parity. Until economies of scale are achieved and centralized production systems mature, high capital expenditure and limited scalability will continue to restrain the market’s momentum.

Segment Analysis

The global mycelium-based meat alternatives market is segmented based on product type, source, category, application and region.

Fungi Segment Driving Mycelium-Based Meat Alternatives Market

The fungi-source segment records around 30% of the market share is rapidly advancing the development of mycelium-based meat alternatives, driven by growing institutional support and innovation in fungal fermentation. In the US, the Department of Agriculture (USDA) has played a pivotal role by awarding a US$ 681,000 Sustainable Technology and Green Energy grant and a US$ 1 million low-interest loan to MyForest Foods—a company specializing in fungal bacon made from mycelium. This funding allowed the company to scale up production capacity from 35,000 to 180,000 square feet. These expansions reflect increasing confidence in fungi-derived proteins as sustainable, scalable solutions for meat replacement.

Government action is also helping standardize the production of mycelium-based foods. In January 2025, the USDA revised its National Organic Program regulations to include definitions for organic mushroom and mycelium production. This regulatory clarification, with full compliance expected by February 2027, addresses the sourcing of substrates and spawn—easing certification hurdles for producers. MyForest Foods, using a vertical fermentation process, now produces around 20,000 pounds of mycelium weekly for its “MyBacon” product. Their partnership with regional development authorities is projected to create 160 new jobs, underscoring how fungi-based innovations are aligning with public goals for sustainable food systems.

Geographical Penetration

North America Drives the Global Mycelium-Based Meat Alternatives Market

North America’s market value holds 28% of the global value, which is US$ 271.95 million. The appetite for mycelium-based meat alternatives is growing alongside rising interest in sustainable protein sources and fungal foods. In the US, the value of mushroom production—a proxy for consumer acceptance of fungal-based foods—reached US$ 1.02 billion for the 2021–22 season, with 702 million pounds sold.

Additionally, USDA projections indicate stable-to-increasing interest in non-traditional protein sources through 2033, reflecting long-term demand potential. Together, these government-led indicators highlight a supportive environment for mycelium-based meat alternatives in North America, driven by both consumer acceptance and strategic investments.

Sustainability Analysis

Mycelium-based meat alternatives offer a highly sustainable protein source, emitting as little as 0.307 kg CO₂-eq per kg of biomass, far below traditional meat emissions (2–30 kg CO₂-eq) according to peer-reviewed life cycle data. These products can grow on agricultural by-products, minimizing land and water use. The UN recognizes mycoprotein as a key solution under SDG 2 for food security. MyForest Foods received over USD 1.6 million in public funding for scaling sustainable mycelium production. This market aligns with global efforts to reduce emissions and support eco-friendly food innovation.

Competitive Landscape

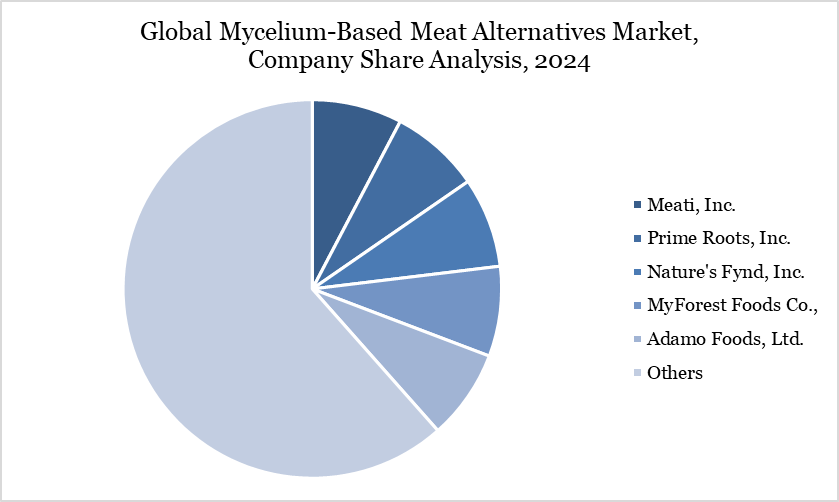

The major global players in the market include Meati, Inc., Prime Roots, Inc., Nature’s Fynd, Inc., MyForest Foods Co., Adamo Foods Ltd., ENOUGH Foods Inc., Mycorena AB, The Better Meat Co., Inc., Bosque Foods, Inc., and Quorn Foods Ltd.

Key Developments

In September 2024, Meati, a producer of mycelium-based meat alternatives, is setting its sights on a Series D funding round in 2025, according to an exclusive interview with CEO Phil Graves. This strategic move comes as the company continues to attract significant capital in a market where many alternative protein startups have faced challenges.

In September 2024, Beyond Meat has plans to launch a mycelium-based whole-cut steak alternative, responding to growing consumer demand for clean-label alternatives, reports CNBC. President and CEO Ethan Brown stated that the new filet would roll out in a healthy restaurant chain instead of McDonald’s, Dunkin’, or KFC;

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies

Suggestions for Related Report